All results

His inauguration is still weeks away, but since championing the 2024 election , Donald Trump has been making his presence felt across America. The East Coast native has big plans to implement changes across the nation, from teaming up with Robert F. Kennedy on health initiatives to making cryptocurrency more accessible. On Monday, Nov. 18, it was revealed that Trump Media & Technology Group (DJT) is in “advanced talks” to acquire Bakkt (BKKT), a well-established crypto exchange company not long after the president-elect launched his World Liberty Financial initiative. The former is majority-owned by NYSE parent company Intercontinental Exchange (ICE) which is led by CEO Jeff Sprecher, husband of former Georgia Senator Kelly Loeffler, who was also co-chair of Trump’s inaugural committee . Neither Bakkt nor its future potential owners have confirmed the Financial Times ‘ reports just yet, but there have been notable jumps in both stocks since the rumor mill began turning this week....

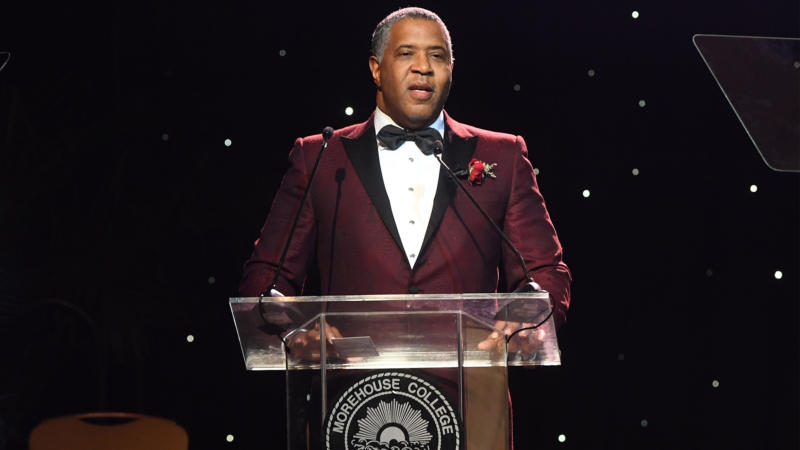

When underserved communities lack access to resources for financial education, their ability to focus on the idea of generational wealth is stunted before they even have a chance to take a step on its path. With the mission to give such communities a fighting opportunity to learn about smart investing and building wealth early on, Robert F. Smith and Goalsetter, a financial literacy platform founded by Tanya Van Court, announced today the launch of “One Stock. One Future.” — an initiative to spearhead financial freedom for the next generation of Black and LatinX Americans.

Ryan Leslie could teach us a thing or two about investing in stocks! The iconic singer/songwriter/producer, responsible for hits like Cassie’s “Me & U,” is also quite the entrepreneur and businessman with an eye for investments. Leslie must’ve known that Apple would become the tech giant that it is today, having first invested in the company back in 2009. In 2018, Apple became the first trillion-dollar company. According to Complex, the “Addicted” singer’s initial stake of $100,000 reached millions of dollars thanks to a wise lesson from his mentor. View this post on Instagram A post shared by Earn Your Leisure (@earnyourleisure) Leslie detailed exactly how during an episode of the “Earn Your Leisure” podcast stating: “I remember a conversation I had with my mentor. I said, ‘Hey look, man. I took your advice and man, $100,000 to $350,000. I’mma cash out and get something nice for my mom.’ And he gave me the ultimatum at that time– he said, ‘Ryan,listen. You can go ahead and cash...

The spurious offspring of Twitch and Slack, Trading.TV recently announced the closing of a $6.1 million seed. The round was led by Tribe Capital, Navy Capital, L Catterton Growth, and Activant, Benzinga previously reported. A portion of the revenue will open a $1 million creator fund which will prioritize the monetization and growth of creative platforms before the fall projections for public availability. Founder and CEO Tobias Heaslip recognized a shift in lucrative revenue for the emerging creative economy during his decade tenure as a trader and analyst. His previous roles involved contributions for Morgan Stanley, Goldman Sachs, and Barclays. “It was sort of the golden age of investment banking as it relates to TMT deals and social media was just becoming an investable asset class,” Heaslip revealed in a statement.

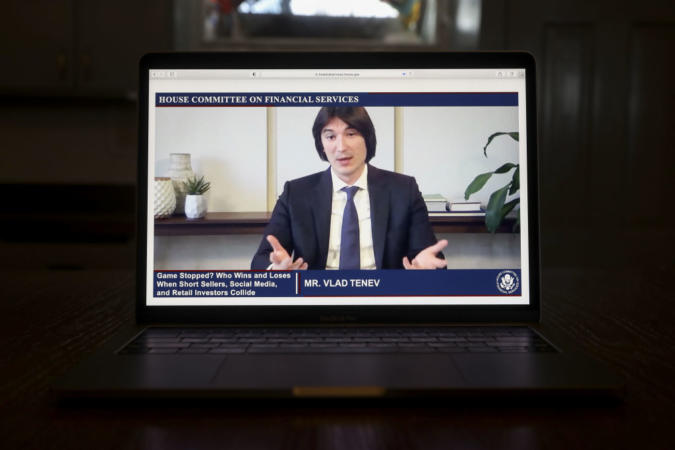

“Just answer yes or no,” California Rep. Maxine Waters repeatedly said in a recent hearing, “I’m reclaiming my time.” This was Waters’ mood the entire time she questioned Robinhood CEO Vlad Tenev during the “Game Stopped? Who Wins and Loses When Short Sellers, Social Media, and Retail Investors Collide,” virtual hearing on Thursday, Feb. 18. Tenev and a group of other CEOs and financial experts were called to testify before the U.S. House Committee on Financial Services following the events of the stock market frenzy on Jan. 25. That frenzy came after the Reddit group of young day-to-day traders called WallStreetBets caught wind of hedge fund short sellers in GameStop last month. When WallStreetBets shared its findings on Reddit, retail investors began grabbing GameStop stock up, driving its share price through the rough, and ultimately costing some hedge funds millions of dollars. Check out what Black millennials had to say about this debacle. Despite this being absolutely legal,...

Free-trading app Robinhood has been under fire for over a week now after it halted purchases of GameStop stock last week. Though the creators behind the app pride themselves on making a platform for “investing for everyone,” Robinhood brings in a big community of Black millennial investors that may take their money elsewhere following recent antics. As a quick refresher, a group of young day-to-day traders called WallStreetBets caught wind of hedge fund short sellers in GameStop last month. WallStreetsBetts shared its findings on Reddit and ultimately promoted young investors in its group to invest in GameStop stock, driving the share price up by 134% at one point, CNN reports. This uptick in GameStop’s stock price costs those hedge funds up to $70 billion in losses , according to Reuters. As a response to this frenzy with GameStop, Robinhood temporarily halted purchases of GameStop stock and a list of other stock on its app last week to manage the risk of a stock market crash. As a...

According to the Selig Center for Economic Growth , the Black buying power was $1.4 trillion in 2019. However, that figure doesn’t translate into dollars that are put back or stay circulating continuously within Black communities versus others–causing a true generational economic crisis. But many are finding more ways to teach Black people financial literacy, investing, and for Tiffany James , her prized bull is the stock market and helping Black girls and women get their generational coins up. The global stock market is $85 trillion , which the United States market represents 40% of the overall figure. Unfortunately, the Federal Reserve reported that only 33.5% of Black households, hold any stocks versus white households which are at 61%. However, ModernBlkGirl was created to be a catalyst in shrinking the wealth gap by teaching stock market literacy–disproving that it was made for white men in wrinkly suits. James sat down with AfroTech to explain why now is the best time to learn...

NBA legend Michael Jordan is expanding his business prowess as a newly tapped “special advisor” on the board of directors for DraftKings , the fantasy sports and sports betting company. Also, he’s set to receive an undisclosed equity stake, according to USA Today . CNN reports DraftKings adding Jordan’s name to the company’s stake raised their stocks significantly, sending shares around 6 percent higher in early trading. “Michael Jordan is among the most important figures in sports and culture, who forever redefined the modern athlete and entrepreneur,” said Jason Robins — DraftKings co-founder and CEO — in a press statement . “The strategic counsel and business acumen Michael brings to our board is invaluable, and I am excited to have him join our team.” Forbes reports that effective immediately, Jordan will step into his new role to provide “guidance and strategic advice to the board of directors on key business initiatives undertaken by the sports technology and entertainment...

Teaching kids about investing is a great way to encourage life-long money management and wealth-building habits. But given how complicated investing can be, how do you get started? Well, forget about all the complex technical jargon (for now). Instead, help them identify brands they like, explain briefly what stock ownership is, and then buy a couple of shares of the companies behind those brands for them. Periodically show them how those stocks are performing and what the different financial statements mean. Leverage their excitement for the brands and products they like to teach them about stock investing! Get started by talking with them about the companies behind the brands they love: Entertainment and Gaming Companies If your children enjoy Disney, Star Wars, or Marvel movies and toys, buy a share or two of Disney stock (DIS). You can also choose from popular toy companies like Mattel (MAT) and Hasbro (HAS). Mattel’s toys include Barbie, Matchbox, Fisher Price, and Thomas &...

One of the most time tested methods of building and growing wealth is with stock investments. When we invest in a stock, we are buying a piece of a company, the value of which rises and falls with market demand. While stock market returns can vary greatly from year-to-year, stock market returns have averaged 10 percent a year over the long-term. And when we add to our initial investment by buying more stocks over time, the returns can truly be substantial. Buying stock starts with: Educating yourself Identifying your goals Researching your options Selecting a brokerage Educate Yourself Stock market investing is not as simple as buying a banking product, like a certificate of deposit. A banking product typically provides a guaranteed return if you buy it and hold it for a certain period of time. However, when you buy a stock for a period, there’s no guarantee that its value will have increased. In fact, you may lose some — or even, in extreme cases, all of your money. It’s therefore,...

The legendary investor Warren Buffet has long shared that he only invests in companies he understands. For that reason, he’s long avoided tech stocks. However, since Buffet began investing, many technology firms have developed products that are part of our everyday lives. Growing up in the digital era, we understand how some of these companies make their money, and we can effectively assess their prospects. You should definitely invest in companies you understand. Chances are you’re more than familiar with at least a few of the following companies: Google (GOOGL) A company so ubiquitous it’s become a verb, Google is the world’s pre-eminent search engine. The firm makes most of its money through its extensive advertising platform. However, computing products like Chromebooks and SaaS products also contribute to its revenue. Overall, the firm is flush with cash, with a minimal amount of debt. Facebook (FB) The world’s biggest social media platform, Facebook’s sprawling reach has...