Most Popular Finance

Discover more of what matters to you

Latest Articles

In an era of rising costs and increasing financial awareness , many people are turning to the “ no-buy year ” as a strategy to take control of their spending habits. This trend challenges individuals to commit to purchasing only essentials for an entire year. By eliminating non-essential spending, participants aim to build savings, reduce waste and cultivate a more mindful approach to consumption. However, the specific rules of a no-buy year vary from person to person, making it a flexible yet disciplined approach to financial wellness. A no-buy year is not about deprivation—it’s about intentional spending. The goal is to break the cycle of impulse purchases, reassess financial priorities and learn to appreciate what you already own. Whether you’re looking to save for a major goal, minimize clutter or simply gain a deeper understanding of your relationship with money, setting clear guidelines is essential for success. How A No-Buy Year Works At its core, a no-buy year revolves...

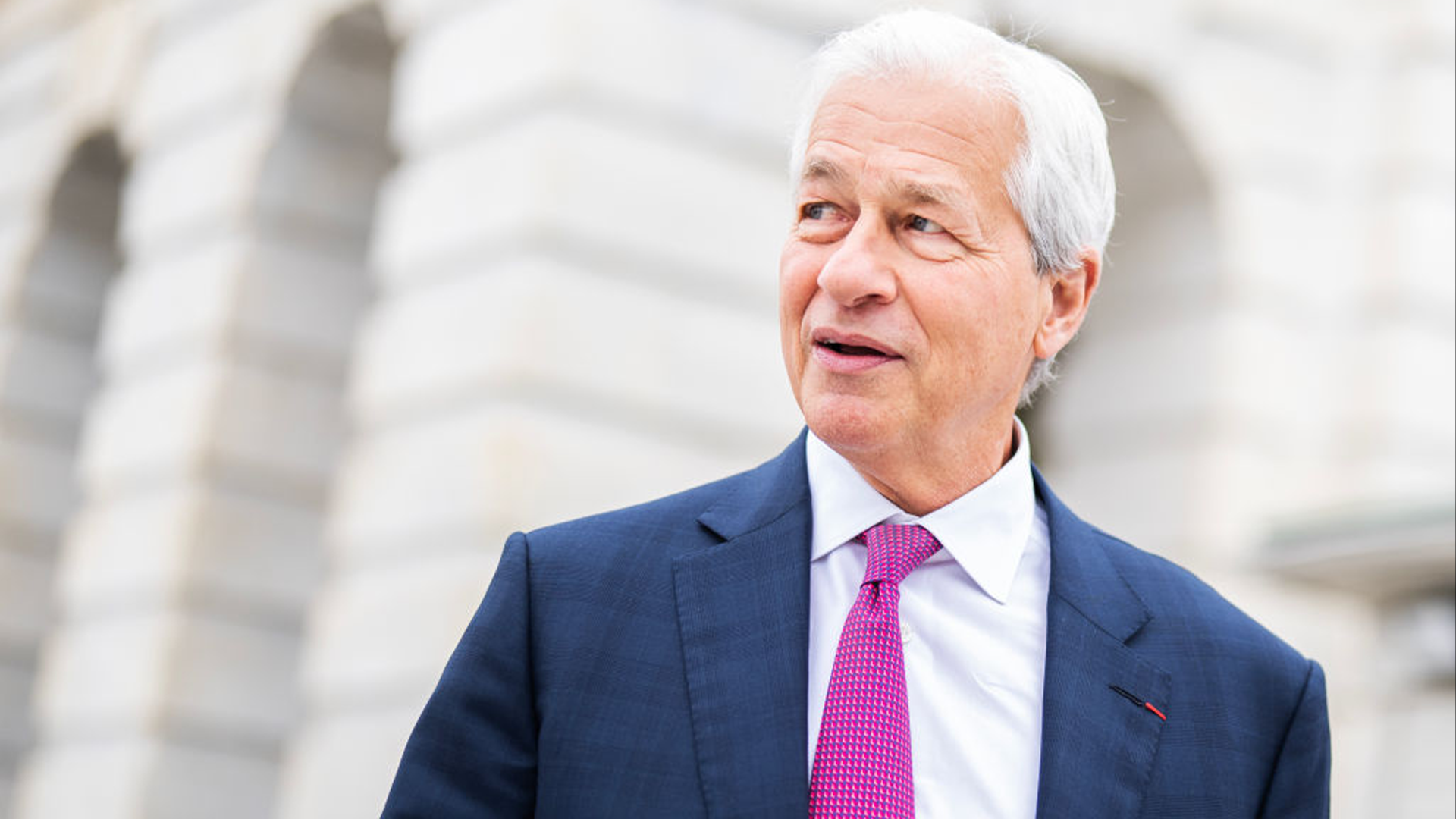

JPMorgan Chase has begun removing any mention of its DEI efforts from its website, according to The Wall Street Journal. As AFROTECH™ previously mentioned, the bank’s CEO, Jamie Dimon, had vowed to maintain its commitment to diversity, equity, and inclusion (DEI) as well as environmental, social, and corporate governance (ESG) policies, despite pushback from the conservative National Legal and Policy Center (NLPC). The center had also suggested that JPMorgan Chase, which employs 300,000 people globally, reexamine executive compensation tied to DEI goals — an initiative it introduced in 2020 through its “accountability framework.” That same year, the company had launched a $30 billion program to promote racial equity in personal finance as well. In response to the recent pushback, Dimon said at the World Economic Forum in Davos, Switzerland, last month, “Bring them on. We are going to continue to reach out to the Black community, the Hispanic community, the LGBT community, the...

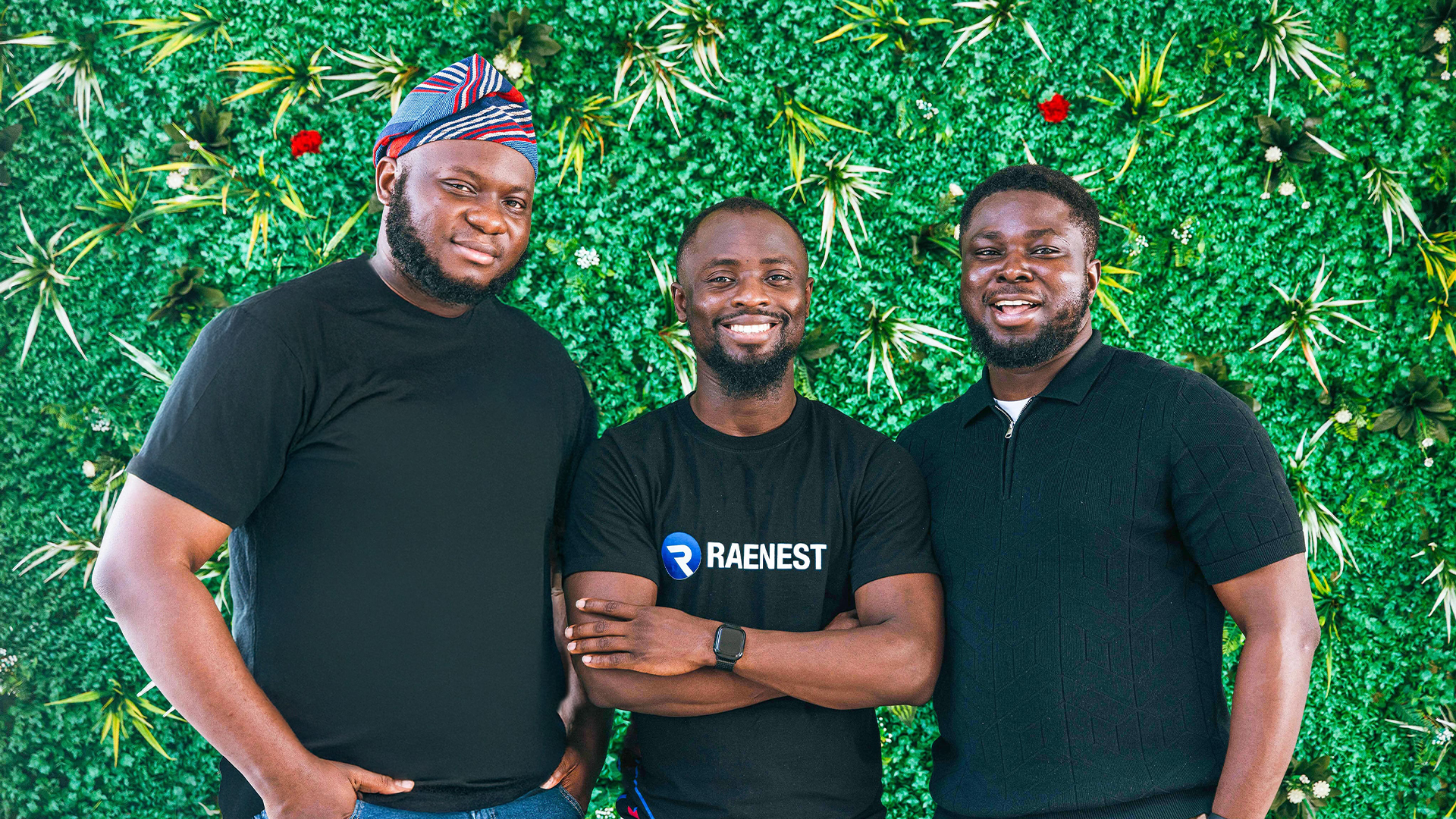

Fintech platform Raenest has raised new funding to support African businesses. The company, founded in 2022 by Victor Alade, Sodruldeen Mustapha, and Richard Oyome, offers a range of services, including virtual and physical dollar cards, international transfers, invoicing for global payments, the ability to create USD, GBP, and EUR bank accounts, and currency conversion, among other features listed on its website. Raenest’s original platform was structured as an Employer of Record (EOR), helping foreign companies pay employees on the continent while remaining compliant, TechCrunch reports. The founders recognized a deeper-rooted issue, leading them to update Raenest to assist the continent’s gig economy and businesses directly. “A U.S. company might not care if a payment is delayed by five days, but for someone in Nigeria or Kenya, that’s a big deal — especially when converting to local currency becomes another hurdle,” Alade told TechCrunch. Looking ahead, Raenest intends to secure...

Ohio’s only Black-owned bank — and the first established and approved in the U.S. since 2000 — has tripled its assets since inception. Columbus Business Journal reports Adelphi Bank was founded in January 2023 and is led by Chairman and CEO Jordan Miller, who had spent over three decades in business and initially retired in 2019 as Central Ohio president for Cincinnati’s Fifth Third Bank. He returned to the industry to get Adelphi up and running with a mission of dismantling financial inequities and helping customers create streams of income without bias. He is joined by Kevin Boyce, co-founder and vice chairman. Upon its launch, Adelphi received local support from large corporations in central Ohio. “It feels like family,” Miller expressed, according to the outlet. “Banks can be intimidating places.” Columbus-based Adelphi Bank currently offers certificates of deposit, checking and savings accounts, and loans for personal use. It plans to provide home mortgages in 2025. For...

Saquon Barkley has expanded his portfolio ahead of Super Bowl LIX, set for Feb. 9, 2025. The running back, wearing a No. 26 Philadelphia Eagles jersey, is heading to New Orleans, LA, to face the Kansas City Chiefs — a rematch of the 2022 Super Bowl matchup, ESNP reports. Barkley has combined his passion for sports and business and will be featured in a Super Bowl ad for Ramp, a financial operations platform that provides exclusive perks to over 30,000 customers. These perks include smart accounts payable, which processes bills in seconds, corporate cards, vendor management, procurement, travel booking, and automated bookkeeping. Customers have saved upwards of $2 billion through Ramp, CEO and Co-Founder Eric Glyman mentioned in a press release. For these reasons, Barkley is not only endorsing the company through the commercial but is now an investor in the platform, the press release reported. “I’ve always believed a winning mindset applies to every part of life. If you want to...

Gmail users may have been confused when they opened their email accounts and saw pop-ups about Gemini . Instead of Google sending out big “coming soon” announcements about their next-gen flagship artificial intelligence (AI) model, Gmail users just saw a subtle star in the right-hand corner of their screens. With Gemini, ChatGPT and China’s DeepSeek, along with plenty of other programs, it’s clear that AI is sticking around for the long haul. So is it worth newbie investors investing in AI, and how is this possible to do anyway? African-American Investors Are Getting Younger A new report from Financial Industry Regulatory Authority’s (FINRA) confirmed that African-Americans tend to be much younger than white investors, with 49% of African-American investors between the ages of 18-34 while 51% of white investors were ages 55 and older. Growing up in a tech-dominant age, African-American investors are using social media to get their investment education and to learn about trading...

Mastercard has agreed to settle a discrimination lawsuit impacting its minority employees. According to a press release, the fintech company had allegedly been underpaying its female, Black, and Hispanic employees. T he class-action lawsuit — which was filed in the U.S. District Court for the Southern District of New York — claims 7,500 employees in job levels 4-10 across the United States dating back to September 2016 were impacted. Details in the lawsuit share that the women and people of color received less compensation for conducting equivalent work to their male and white counterparts, the New York Times reports. The major fintech company had agreed to pay a $26 million settlement prior to the lawsuits filing on Jan. 14, 2025. The settlement now awaits approval from the court. “We are very pleased to have reached this nationwide settlement with Mastercard, which we believe represents a fair compromise,” Cara E. Greene, partner at Outten & Golden LLP and lead counsel for the...

Moove, marketed as an “African-born, global mobility fintech,” has announced an acquisition. The company, founded in Nigeria by Ladi Delano and Jide Odunsi, enables delivery drivers to finance vehicles and start driving with partners like Uber in three simple steps: apply, get verified, and drive. TechCrunch notes that Moove launched with 76 cars in Lagos in 2020 and has expanded to 36,000 cars. Per the company’s website, over 52,787,109 trips have been completed. Additionally, it is available in 19 cities across six continents. Over the years, Moove has secured significant funding. In 2023, $8 million had been by Absa Corporate and Investment Banking to reach Ghana, bringing its total investment from the bank to $28 million, Fintech Global reports. In March 2024, $100 million had been raised in a Series B round led by Uber to further its expansion, TechCrunch mentioned. The company has also attached a sustainability mission to its business model, seeking to create “the largest and...

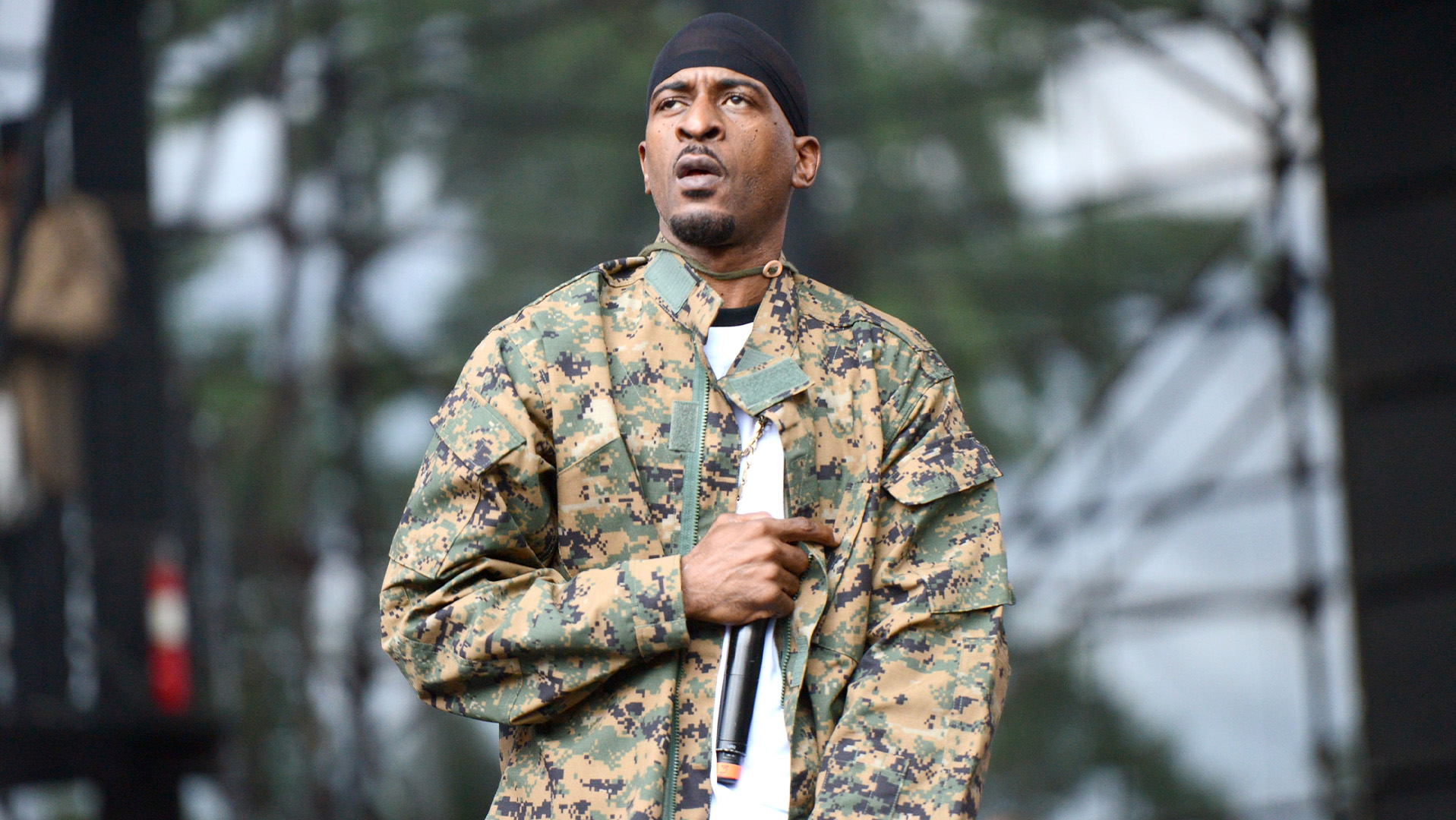

Hip-Hop icon RAKIM is aligning himself with artificial intelligence (AI). According to a news release, the rapper, who released the studio album “G.O.D.’s Network” in 2024, is now the founder of the fintech platform Notes Technology, which will benefit artists by providing them access to loan and credit providers to fund creative projects, AI-powered education around financial literacy and entrepreneurship, and fintech tools to manage capital and income. By merging music, finance, and technology, Notes seeks to empower artists with the tools they need to succeed and maintain control over their careers. “With Notes, getting ‘paid in full’ is beyond just the money, it’s also about the knowledge and understanding of the urban music game from a position of being conscious of how it all works as a business, and how to leverage that to thrive and succeed as independent urban music artists and creators,” RAKIM said in a statement shared on the company website. Notes Technology’s other...

African fintech company Moniepoint has received strategic funding from Visa. As AFROTECH™ previously reported, Moniepoint was reportedly the fastest-growing fintech company in 2023 and 2024. Launched by Tosin Eniolorunda (CEO) and Felix Ike (chief technology officer), the fintech company has a banking app that connects customers to a “debit card that always works,” Eniolorunda said in a YouTube video. Moniepoint’s offerings include: Banking accounts Loans Expense cards Instant payouts Accounting and bookkeeping solutions Moniepoint’s business model has been an overwhelming success. In fact, it processes over 1 billion transactions monthly, with total payments volume exceeding $22 billion, according to a press release shared with AFROTECH™. As it looks to expand its efforts, the company has received a strategic investment from Visa. “We are thrilled to announce Visa’s investment in Moniepoint,” Eniolorunda said, per the press release. “Visa’s backing is a strong endorsement of our...

Jay-Z will be launching a groundbreaking partnership, marking a first in the United States. Billboard reports that Jay-Z’s Roc Nation, a full-service entertainment company, has partnered with South Korean fintech company Musicow to introduce “the first Music Equity Service Provider in the United States.” This will give U.S.-based music fans a rare opportunity to obtain partial ownership of songs created by their favorite artists, while also earning a share of the revenue generated from sales. This will be made possible by giving artists the ability to fractionalize their royalty revenue and sell shares of their tracks to individual investors, creating an all-around win for everyone involved. “The music industry is evolving into a shared ecosystem where fans and creators can earn together,” Roc Nation Vice Chairman Jay Brown said in an interview with Billboard. “Our mission is not only to support and empower artists by providing the tools and services they need to build a better...

JPMorgan Chase CEO Jamie Dimon is not backing down from diversity, equity, and inclusion (DEI) commitments. According to Business Insider, Dimon confirmed that the financial services firm will continue to advance its DEI efforts and environmental, social, and corporate governance (ESG) policies despite pressure from the National Legal and Policy Center (NLPC), a conservative nonprofit organization. The NLPC has proposed that JPMorgan reevaluate how executive compensation is linked to the company’s racial equity goal. “Bring them on,” Dimon told CNBC at the World Economic Forum in Davos, Switzerland. “We are going to continue to reach out to the Black community, the Hispanic community, the LGBT community , the veterans community.” In 2020, JPMorgan launched a $30 billion program to promote racial equity in personal finance, which included mortgage refinancing and partnerships with Historically Black Colleges and Universities . The bank also launched an “accountability framework” to...

Pryce Yebesi has raised new funding in his next era as a founder. Yebesi co-founded Utopia Labs at the age of 21 alongside Kaito Cunningham (CEO), Jason Chong, and Alexander Wu. The venture offered crypto payments and crypto treasury management, and was “trusted by leading DAOs (decentralized autonomous organizations) and crypto companies to streamline operations, manage payroll, and consolidate financial reporting,” as AFROTECH™ previously reported. Yebesi also dropped out of college to focus on Utopia Labs, which had been supported by a $1.5 million raise in 2021 and was later acquired by Coinbase in November 2024. According to information shared with AFROTECH™, Yebesi then began working as an entrepreneur-in-residence at Washington University in St. Louis, MO, and through his observations he recognized small business owners were challenged by accounting software. This prompted the launch of a new brainchild in the fintech space, Open Ledger, which was established with the help of...

South Africa’s first Black-owned bank has hit unicorn status, POCIT reports. Tyme Group, founded in 2019, is majority-owned by billionaire Patrice Motsepe, notes Bloomberg. The platform was designed to make digital banking more affordable and accessible, and it has been an overwhelming success with online and physical banks throughout South Africa and the Philippines. According to TechCrunch, it has attracted 10 million users since its inception and reached an additional 5 million users through its Philippine brand, GoTyme. GoTyme allows users to create an account via its bank app. Customers can then receive an ATM debit card instantly and retrieve it at a kiosk. Tyme Group says it has allocated $600 million in financing to support small businesses and has raised $400 million in customer deposits. Now it is seeking to extend its reach in new markets, which include Vietnam and Indonesia by 2025. This will be made possible in light of a $250 million round led by digital bank Nu...

Google continues to build on its commitment to invest $1 billion in Africa’s digital economy. As AFROTECH™ previously reported, Google announced on Oct. 6, 2021, that it would focus on supporting the continent’s tech sector over the next five years to make the internet more accessible. “Today I’m excited to reaffirm our commitment to the continent through an investment of $1 billion over five years to support Africa’s digital transformation to cover a range of initiatives from improved connectivity to investment in startups,” Google CEO Sundar Pichai said during a virtual event held in 2021, per TechCrunch. Fast forward to 2024, and the tech giant has already invested over $900 million since the announcement and expects to reach its goal by 2026, according to information shared on its platform. Its most recent investment includes participation in a $90 million funding round for telecom solutions provider Cassava Technologies, one of Google’s partners in building the first subsea...