Showing 822 results for:

Venture Capital

Popular topics

All results

The Black-owned water bottle brand SUPLMNT welcomes NBA player Gary Payton II as its latest investor. The brand was founded in 2020 by South Philadelphia, PA, native Jairus Morris, who aims to improve hydration in Black and brown communities. His journey as a founder was inspired by his mother, who took on multiple jobs to support the household of five children. “I grew up in a South Philly single-mother household with four siblings. My mother was my first inspiration and motivation to want to be an entrepreneur,” he said in an interview shared on Medium. “She always tried side hustles to bring in extra income for my family; whether it was selling Mary Kay or braiding hair, she did it. Moving us out of the ghetto in South Philly to a suburb in New Jersey was the best thing she could have done. It exposed me to see that there was so much more to life outside of the hood.” As an adult, he also mentioned recognizing disparities around health and wellness, which further inspired his...

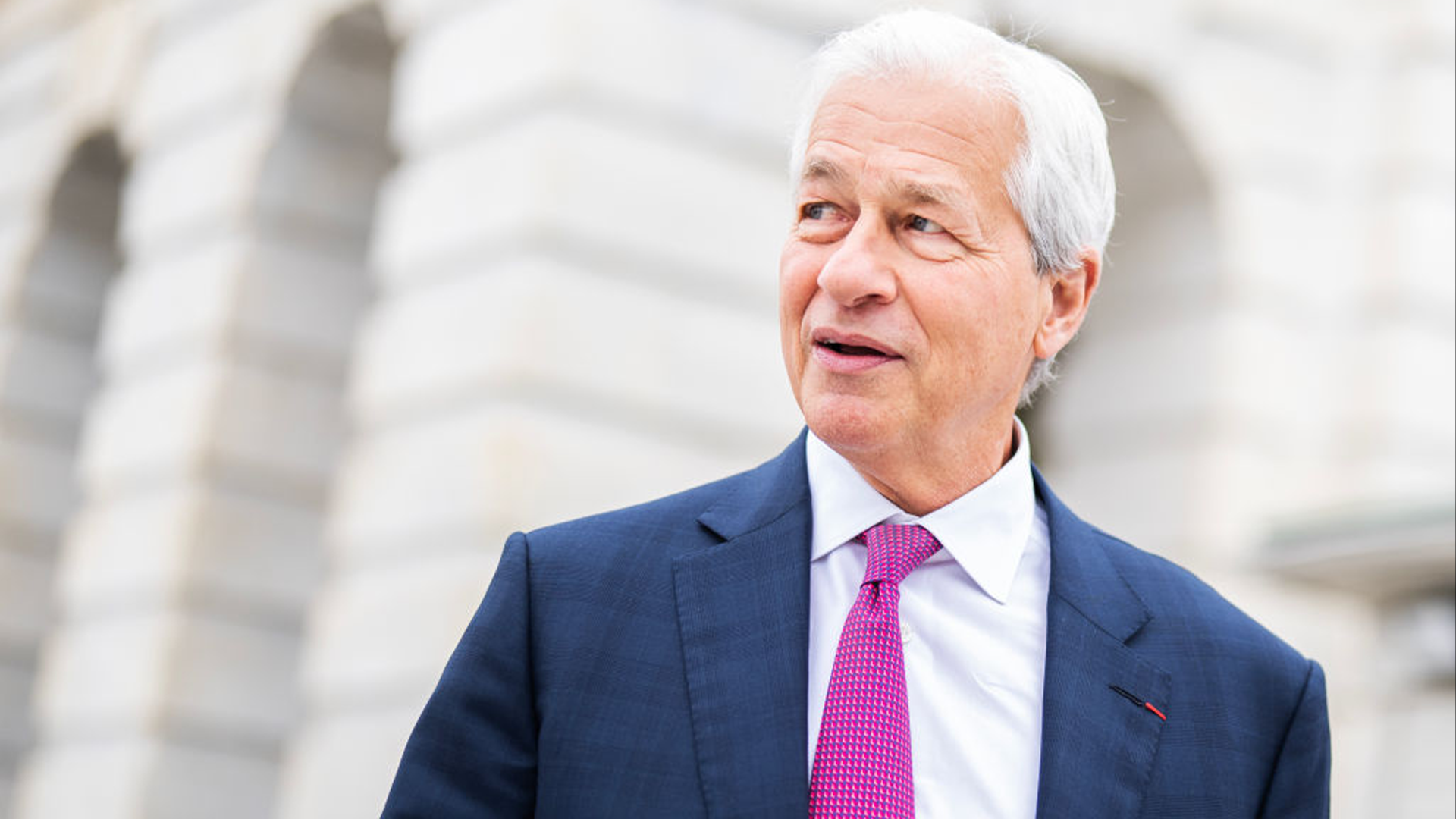

JPMorgan Chase has begun removing any mention of its DEI efforts from its website, according to The Wall Street Journal. As AFROTECH™ previously mentioned, the bank’s CEO, Jamie Dimon, had vowed to maintain its commitment to diversity, equity, and inclusion (DEI) as well as environmental, social, and corporate governance (ESG) policies, despite pushback from the conservative National Legal and Policy Center (NLPC). The center had also suggested that JPMorgan Chase, which employs 300,000 people globally, reexamine executive compensation tied to DEI goals — an initiative it introduced in 2020 through its “accountability framework.” That same year, the company had launched a $30 billion program to promote racial equity in personal finance as well. In response to the recent pushback, Dimon said at the World Economic Forum in Davos, Switzerland, last month, “Bring them on. We are going to continue to reach out to the Black community, the Hispanic community, the LGBT community, the...

Breakr continues to find new ways to improve the creator economy. As AFROTECH™ previously reported, the platform was created by Historically Black College and University (HBCU) alums and brothers Anthony and Ameer Brown to ensure artists can connect with brands and agencies and establish creative campaigns they are compensated for. With an early focus on music, Breakr partnered with BMG and Sony Music and built a roster of clients that included Ye (formerly Kanye West), Young Thug, Megan Thee Stallion, Rick Ross, Future, and Gunna. Additionally, Nas is involved not only as an artist on the platform but also as an investor. He participated in a $4.2 million seed round led by Slow Ventures in 2021. Breakr has expanded its scope beyond the music industry, adding partners such as Hershey, Billboard, Celsius, Samsung, and UMG, information shared with AFROTECH™ notes. In 2022, 30,000 creators had onboarded onto its platform. In 2025, that number has more than doubled, reaching a community...

Venture firm Ulu Ventures has raised $208 million to support diverse founders. WSJ Pro reports that the VC firm founded by Miriam Rivera and her husband, Clint Korver, has invested in companies where 80% have a white co-founder. However, an equal 80% share also has at least one founder who is an immigrant, a woman, or from a minority group. Since its inception in 2008, this initiative has supported 250 startups , leveraging a data-driven approach to minimize cognitive bias and foster inclusive investment across all demographics. “Venture capital has so many decision-making problems when it comes to bias, diversity, disdain for data and analytics, hubris, misapplication of pattern-matching, and so on, that we feel like the one-eyed VCs in the land of the blind,” Korver told the outlet. The couple acknowledges a shift due to the changing diversity, equity, and inclusion (DEI) landscape. Major companies are throwing in the towel and dismantling DEI commitments, with some erasing...

Giannis Antetokounmpo is expanding his portfolio with a new investment tied to sports. Sportico reports the Milwaukee Bucks superstar is an investor in ScorePlay, an artificial intelligence -powered sports media management platform launched by Victorien Tixier (CEO) and Xavier Green (CTO) in 2021. Its solutions streamline sports organizations’ essential digital workflows by automating the management of photos and short video clips, its website mentions. Features among all its tiers include: Automated ingestion of photos and short videos Unlimitied AI tagging Usage analytics “The idea is to maximize the distribution, both on your own social channel, but also distributing the content to your athletes, who are your best storytellers,” Tixier told CNBC. ScorePlay had already attracted the attention of Kevin Durant and Rich Kleiman’s 35V family office, as well as Eli Manning, notes the outlet. Most recently, it has closed a $13 million Series A round led by Harry Stebbings’ 20VC, which...

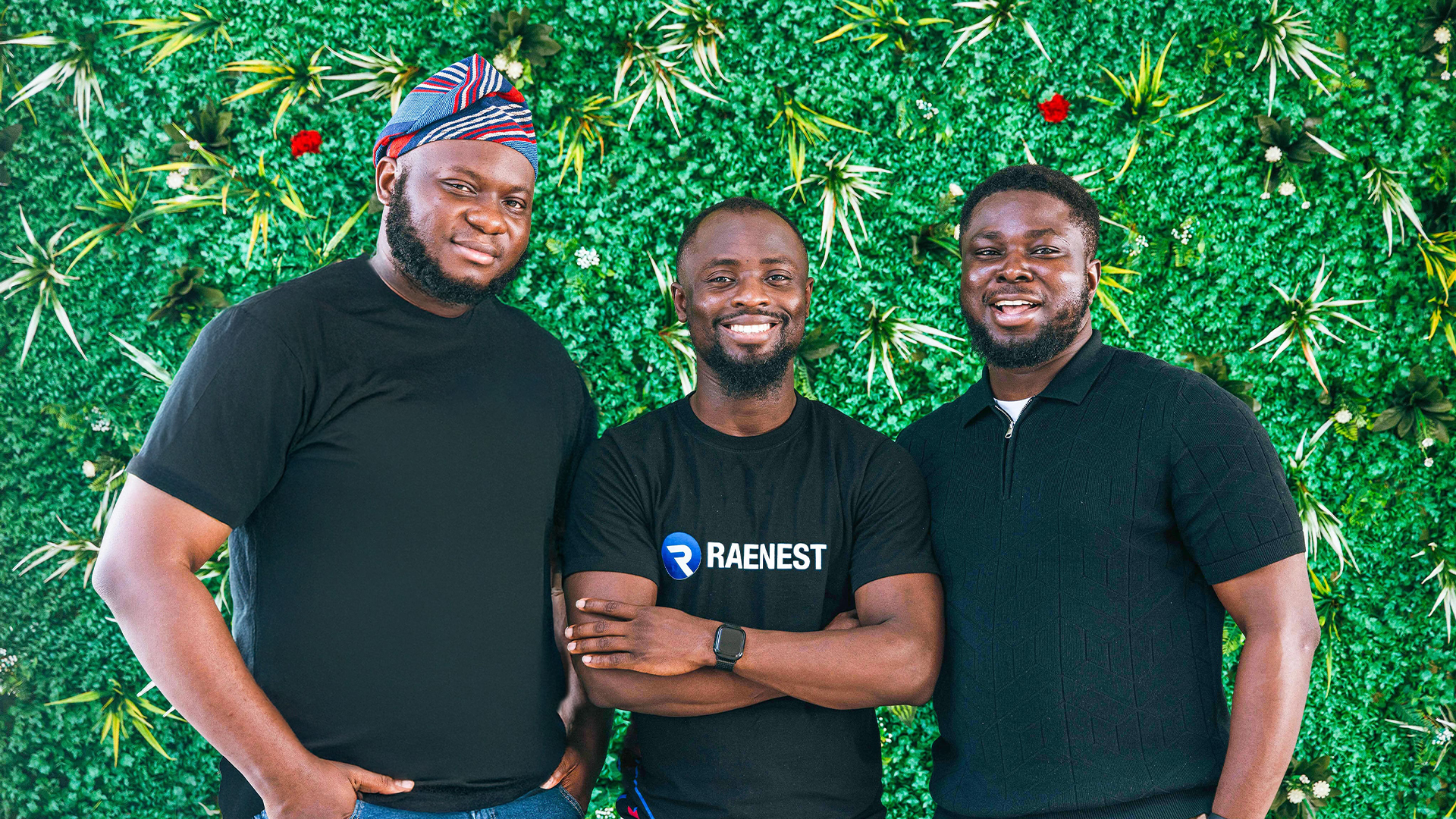

Fintech platform Raenest has raised new funding to support African businesses. The company, founded in 2022 by Victor Alade, Sodruldeen Mustapha, and Richard Oyome, offers a range of services, including virtual and physical dollar cards, international transfers, invoicing for global payments, the ability to create USD, GBP, and EUR bank accounts, and currency conversion, among other features listed on its website. Raenest’s original platform was structured as an Employer of Record (EOR), helping foreign companies pay employees on the continent while remaining compliant, TechCrunch reports. The founders recognized a deeper-rooted issue, leading them to update Raenest to assist the continent’s gig economy and businesses directly. “A U.S. company might not care if a payment is delayed by five days, but for someone in Nigeria or Kenya, that’s a big deal — especially when converting to local currency becomes another hurdle,” Alade told TechCrunch. Looking ahead, Raenest intends to secure...

Saquon Barkley has expanded his portfolio ahead of Super Bowl LIX, set for Feb. 9, 2025. The running back, wearing a No. 26 Philadelphia Eagles jersey, is heading to New Orleans, LA, to face the Kansas City Chiefs — a rematch of the 2022 Super Bowl matchup, ESNP reports. Barkley has combined his passion for sports and business and will be featured in a Super Bowl ad for Ramp, a financial operations platform that provides exclusive perks to over 30,000 customers. These perks include smart accounts payable, which processes bills in seconds, corporate cards, vendor management, procurement, travel booking, and automated bookkeeping. Customers have saved upwards of $2 billion through Ramp, CEO and Co-Founder Eric Glyman mentioned in a press release. For these reasons, Barkley is not only endorsing the company through the commercial but is now an investor in the platform, the press release reported. “I’ve always believed a winning mindset applies to every part of life. If you want to...

Gmail users may have been confused when they opened their email accounts and saw pop-ups about Gemini . Instead of Google sending out big “coming soon” announcements about their next-gen flagship artificial intelligence (AI) model, Gmail users just saw a subtle star in the right-hand corner of their screens. With Gemini, ChatGPT and China’s DeepSeek, along with plenty of other programs, it’s clear that AI is sticking around for the long haul. So is it worth newbie investors investing in AI, and how is this possible to do anyway? African-American Investors Are Getting Younger A new report from Financial Industry Regulatory Authority’s (FINRA) confirmed that African-Americans tend to be much younger than white investors, with 49% of African-American investors between the ages of 18-34 while 51% of white investors were ages 55 and older. Growing up in a tech-dominant age, African-American investors are using social media to get their investment education and to learn about trading...

WNBA legend Candace Parker wants to invest in the league. The Tennessean reports the WNBA intends to add a 16th team in 2028. A group of investors, including Former Governor Bill Haslam, Crissy Haslam, Pro Football Hall of Fame quarterback Peyton Manning, and entertainers Tim McGraw, Faith Hill, and Parker, have bid for a WNBA team in Nashville, TN, per AP News. The team, named the Tennessee Summitt, would launch by the 2028 timeline and play at Bridgestone Arena. “We believe a WNBA team, based in Nashville, could serve as a beacon for girls and women, young and old, across Tennessee, while also creating more opportunities for sports fans as our community continues to grow,” Haslam explained, according to AP News. As for Parker’s interest in bidding for WNBA ownership, it comes full circle. Her earlier career days include her time as an athlete representing the University of Tennessee women’s basketball team Lady Vols. She attended the school between 2004 and 2008 under the guidance...

Managing your finances effectively is more important than ever, and the right budget app can make all the difference. Whether you’re trying to track your spending, grow your net worth , or make smarter investing decisions, using a well-designed budgeting tool can help you stay on top of your financial goals. With so many options available, we’ve rounded up the best budget apps for 2025 to help you find the one that fits your needs. 1. Monarch Money Rating: 4.9/5 (App Store), 4.8/5 (Google Play) Platforms: iOS, Android, Web Cost: Free trial, then $14.99/month or $99/year Monarch Money is a rising star in the budgeting space, offering powerful financial planning tools for individuals and families. It allows users to track spending, set financial goals, and even monitor investments, making it an excellent choice for those looking to grow their net worth. Unlike many free apps , Monarch provides a premium experience with a clean interface, collaboration features for partners, and...

African fintech company Moniepoint has received strategic funding from Visa. As AFROTECH™ previously reported, Moniepoint was reportedly the fastest-growing fintech company in 2023 and 2024. Launched by Tosin Eniolorunda (CEO) and Felix Ike (chief technology officer), the fintech company has a banking app that connects customers to a “debit card that always works,” Eniolorunda said in a YouTube video. Moniepoint’s offerings include: Banking accounts Loans Expense cards Instant payouts Accounting and bookkeeping solutions Moniepoint’s business model has been an overwhelming success. In fact, it processes over 1 billion transactions monthly, with total payments volume exceeding $22 billion, according to a press release shared with AFROTECH™. As it looks to expand its efforts, the company has received a strategic investment from Visa. “We are thrilled to announce Visa’s investment in Moniepoint,” Eniolorunda said, per the press release. “Visa’s backing is a strong endorsement of our...

If you’ve been keeping up with Donald Trump’s moves since the end of the 2024 election , you likely already know that the newly inaugurated president has taken numerous meetings with CEOs and industry leaders in the world of tech, including those from OpenAI, Softbank and Oracle. According to the latest White House press briefing, Trump has united the forces of the aforementioned corporations under the umbrella of “Stargate,” in an effort to create a massive push for artificial intelligence infrastructure. For now, there are still plenty of questions regarding Stargate, and even a few critiques from high-ranking Trump cabinet picks arguing that the respective parties simply don’t have the funds to pull it off. Still, the New York Stock Exchange seems to be brimming with the news, as shown by the latest returns of each of the parties involved. The Stargate venture is poised to cost more than $500 billion when it’s all said and done, so many people in the world of tech and government...

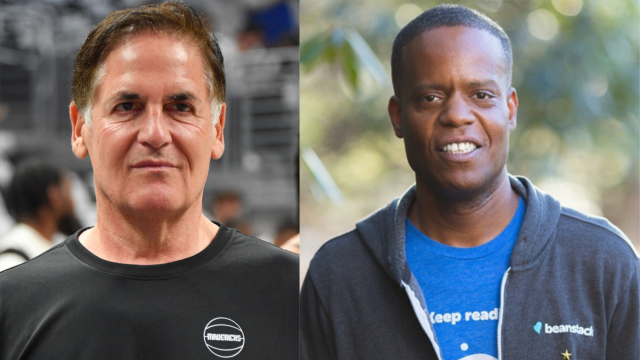

Black-owned edtech company Beanstack has secured another investment from Mark Cuban. The platform was launched in 2013 by Felix Brandon Lloyd (CEO) and Jordan Lloyd Booke, a husband-and-wife duo with extensive backgrounds in education. Booke served as Google’s head of K-12 education outreach from 2011 to 2013, while Lloyd worked as a teacher and dean at the SEED Public Charter School for seven years. The idea for Beanstack was sparked while they were reading to their 2-year-old son, inspiring them to focus on increasing literacy rates. “The early idea for our company came one night when [me and Jordan] were reading a book to our 2-year-old son and soon-to-be big brother,” Lloyd told AFROTECH™ in a previous interview. “He pointed to biracial characters on the page that looked like him and said, ‘That’s me, and that’s little sister.’ The power of reading was so clear. We immediately decided to put our backgrounds in education to work on a new business idea.” Beanstack initially...

JPMorgan Chase CEO Jamie Dimon is not backing down from diversity, equity, and inclusion (DEI) commitments. According to Business Insider, Dimon confirmed that the financial services firm will continue to advance its DEI efforts and environmental, social, and corporate governance (ESG) policies despite pressure from the National Legal and Policy Center (NLPC), a conservative nonprofit organization. The NLPC has proposed that JPMorgan reevaluate how executive compensation is linked to the company’s racial equity goal. “Bring them on,” Dimon told CNBC at the World Economic Forum in Davos, Switzerland. “We are going to continue to reach out to the Black community, the Hispanic community, the LGBT community , the veterans community.” In 2020, JPMorgan launched a $30 billion program to promote racial equity in personal finance, which included mortgage refinancing and partnerships with Historically Black Colleges and Universities . The bank also launched an “accountability framework” to...

Pryce Yebesi has raised new funding in his next era as a founder. Yebesi co-founded Utopia Labs at the age of 21 alongside Kaito Cunningham (CEO), Jason Chong, and Alexander Wu. The venture offered crypto payments and crypto treasury management, and was “trusted by leading DAOs (decentralized autonomous organizations) and crypto companies to streamline operations, manage payroll, and consolidate financial reporting,” as AFROTECH™ previously reported. Yebesi also dropped out of college to focus on Utopia Labs, which had been supported by a $1.5 million raise in 2021 and was later acquired by Coinbase in November 2024. According to information shared with AFROTECH™, Yebesi then began working as an entrepreneur-in-residence at Washington University in St. Louis, MO, and through his observations he recognized small business owners were challenged by accounting software. This prompted the launch of a new brainchild in the fintech space, Open Ledger, which was established with the help of...