“Just answer yes or no,” California Rep. Maxine Waters repeatedly said in a recent hearing, “I’m reclaiming my time.”

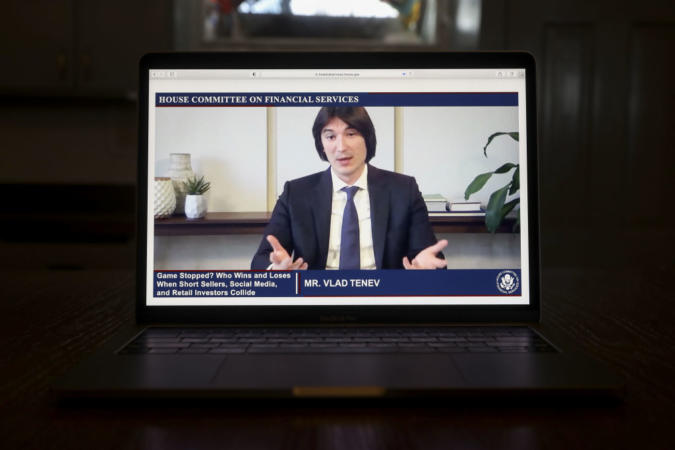

This was Waters’ mood the entire time she questioned Robinhood CEO Vlad Tenev during the “Game Stopped? Who Wins and Loses When Short Sellers, Social Media, and Retail Investors Collide,” virtual hearing on Thursday, Feb. 18. Tenev and a group of other CEOs and financial experts were called to testify before the U.S. House Committee on Financial Services following the events of the stock market frenzy on Jan. 25.

That frenzy came after the Reddit group of young day-to-day traders called WallStreetBets caught wind of hedge fund short sellers in GameStop last month. When WallStreetBets shared its findings on Reddit, retail investors began grabbing GameStop stock up, driving its share price through the rough, and ultimately costing some hedge funds millions of dollars.

Check out what Black millennials had to say about this debacle.

Despite this being absolutely legal, Tenev decided to shut down the trading of GameStop stock and a list of other stock on Robinhood for a few days. He said this was to avoid a stock market crash, but House Representatives questioned that motive. New York Rep. Alexandria Ocasio-Cortez especially pressured Tenev after he said clearinghouses — financial institutions that facilitate payments — demanded Robinhood come up with more capital, which it did the day after shutting some trading down.

“Given Robinhood’s track record, isn’t it possible that the issue is not clearinghouses, but the fact that you simply didn’t manage your own book, or failed to appropriately manage your own margin rules, or failed to manage your own internal risks?,” Ocasio-Cortez said to Tenev during the hearing.

Tenev wasn’t the only one under fire. The other CEOs and experts called to testify included:

- Kenneth C. Griffin, CEO of Citadel

- Gabriel Plotkin, CEO of Melvin Capital Management

- Steve Huffman, Chief Executive Officer, Co-Founder, Reddit

- Keith Gill, former anonymous investor who used to go by “Roaring Kitty” online

- Jennifer Schulp, Director of Financial Regulation Studies, Cato Institute

Now, we knew this hearing would be intense, but I don’t think we’ve gotten enough clarity for the five and half hours these CEOs spent answering questions from representatives. To be quite frank, we’ve been left with more questions than answers, but there were still some key things Tenev mentioned.

For one, he said Robinhood doesn’t survey social media because his company “doesn’t have the capacity” or team to do that. This came as a rep asked him why he didn’t see the fallout from GameStop coming. He also referred to the events of Jan. 25 as a “black swan” event, meaning it was once in a lifetime, when often questioned if he would ever limit trading on Robinhood again. However, he can’t predict the future. We don’t yet know if some young investors will get smart again and shake the stock market (I’d put my bets on “yes” every time).

During the hearing, Griffin often defended Tenev’s points when it came to this being a one-off event. While I do agree the events of Jan. 25 are unique, I don’t think we can assume it won’t happen again. Griffin also weirdly supported no legislation being raised on how much hedge funds can short sell and to my surprise, not many representatives even raised question to talk about legislation, which is honestly where the action would be following events like this.

One thing Tenev did do is apologize more than once throughout the hearing for the unexpected trading restrictions he imposed on Robinhood last month, and the effects it had on retail investors. Interestingly, he also tried to push the blame of the events on Jan. 25 on a broken financial system, and called for real-time trading to avoid these kind of issues.

“The industry, Congress, regulators, and other stakeholders need to come together to deploy our intellectual capital and engineering resources to move to real-time settlement of U.S. equities,” he said during his opening statement. “Accomplishing this won’t be without its well-documented challenges, but it is the right thing to do and Robinhood is eager to drive this critical effort on behalf of all investors.”

But how much of what Tenev said can we really believe? When we spoke to Black millennials earlier this month, they all mentioned Robinhood’s lack of customer service and a help line to call when in need. During the hearing, Tenev claimed that Robinhood does have a robust customer support team, but he stuttered through explaining how when Rep. James French Hill pressed him on it.

Though he wasn’t asked many questions, Huffman was adamant about his support of WallStreetBets’ actions on his platform. He said Reddit will continue to protect its users and not limit their posts, as he was asked.

“I would like to reiterate why it is important to protect online communities like WallStreetBets,” Huffman said during the hearing. “WallStreetBets may look sophomoric or chaotic from the outside, but the fact that we are here today means they’ve managed to raise important issues about fairness and opportunity in our financial system. I’m proud they used Reddit to do so.”

Ultimately outside of being grilled for hours, it doesn’t seem like Tenev will get in much trouble for his actions.

If you have the time, dig into this hearing and take note, not all of these apps have your best interest in mind:

You can also read the written testimonies here.