Most Popular VC and Investing

Discover more of what matters to you

Latest Articles

Carmelo Anthony’s intro into solo investing paid off big time. In 2006, Daniel Huang and Shawn Dougherty bootstrapped mStation with a $250,000 investment, developing speakers and cases for iPods and MP3 players, according to Forbes. Within their first year, they generated $1 million in revenue, most of the earnings coming from North America. The founders went on to make some power moves with the help of Carmelo Anthony, who was an active NBA player at the time. Here’s how. The Carmelo Anthony Effect In 2007, Huang and Dougherty acquired Mophie, which was responsible for creating the OG portable battery for iPhones. Forbes notes the pair created a battery-powered case, and Mophie’s revenue scaled from $2.6 million in 2008 to $200 million by 2013. Mophie’s revenue was predicted to reach $1 billion within the next five years. “What we got from them that we didn’t have was a global Apple retail presence, customers in 60 plus countries, and a diversification into the case business,”...

New funding has been raised for an online learning platform helping students avoid the debt of college. Campus was created by Tade Oyerinde, also its chancellor, to provide quality education to students through accredited, career-focused degree programs led by professors from top higher learning institutions such as Stanford University, University of California – Los Angeles , and Howard University. According to its website, Campus offers online associates degrees in business administration and business administration with applied artificial intelligence (AI) concentration to participants nationally. For its Sacramento, CA, campus, it has specific offerings for students in-state such as an associate’s degree in paralegal studies as well as one in AWS cloud administration. This campus also provides certification in medical assisting, medical billing and coding, phlebotomy, technical support, barbering and cosmetology, and other programs for California residents. Furthermore, to...

Megan Holston-Alexander and Andreessen Horowitz’s Cultural Leadership Fund is shifting the investment mindset of cultural leaders. The Montgomery, AL, native is a partner at Andreessen Horowitz’s Cultural Leadership Fund, which connects global leaders such as athletes, entertainers, musicians, and C-level executives with emerging technology companies and champions the next generation of Blacks in technology. According to TechCrunch, Andreessen Horowitz (a16z) has a stake in at least 300 companies in sectors that include crypto, consumer, enterprise, fintech, healthcare, and biotech. It is also “Silicon Valley’s first venture capital fund consisting exclusively of Black cultural leaders and organizations,” its website mentions. Holston-Alexander is dedicated explicitly to wealth generation in technology for the Black community and is tasked with finding and sourcing deals. She has remained in her role at Andreessen Horowitz since 2020. “When you think about companies that have grown...

Kylian Mbappé has added a team to his growing investment portfolio. Forbes named the French and Real Madrid soccer player among the richest athletes in 2024, with an estimated total earnings of $110 million. It appears he is putting his earnings to good use by investing in the luxury watch-shopping platform Wristcheck, which Jay-Z also backs. According to Robb Report, Mbappé’s interest in the company stemmed from their innovation in technology and creativity. “I’m thrilled to join Wristcheck as an investor through Coalition Capital,” Mbappé said in a press statement, according to the outlet. “As a Hublot ambassador and someone passionate about watches and innovation, I see Wristcheck as a platform that truly understands the next generation of collectors. They’re reshaping the watch industry with a forward-thinking approach that blends technology, transparency, and creativity.” More recently, Mbappé became a team owner. He secured a stake in the France SailGP Team, which is owned by...

Founder Erica Plybeah responded to an inconvenience with an innovative solution that improves the quality of life for patients needing medical transport. Established in 2017, she launched MedHaul to provide safe and reliable non-emergency medical transportation to individuals, regardless of their needs, per her LinkedIn. The company was inspired by her personal challenges in finding dependable transportation for her grandmother’s medical appointments in Memphis, TN, according to its website. Her grandmother has type-2 diabetes with a double-leg amputation. Living in an underserved area also limited access to transportation, and Plybeah wanted to lower this barrier for others, which motivated her to establish MedHaul, a company that works alongside healthcare facilities, research facilities, and community organizations to ensure people have access to medical transportation. Its technology is also helpful for healthcare providers to book medical transportation appointments that can...

Tru Skye Ventures, co-founded by Metta World Peace, has invested in a new sports technology company. According to its website, Tru Skye Ventures is a $100 million fund for sport-tech innovation, fan engagement, health, and wellness companies established in partnership with Stephen Stokols. On March 4, 2025, it was announced that FanUp, a fantasy sports and pop culture platform that has 2.3 million global fans, largely Gen Z (86%) and women (55%), closed a strategic financing round led by Tru Skye Ventures and 9.58 Ventures, co-founded by Fred Toney and Omar Sillah. American tennis star Frances Tiafoe and general partners—NFL safety Jalen Mills, NFL linebacker Deion Jones, and NBA assistant coach David Vanterpool—also participated in the round, according to a news release shared with AFROTECH™. “I’m thrilled to welcome powerhouse partners like Tru Skye Ventures and 9.58 Ventures to our strategic round,” FanUp Founder and CEO Tejas Bodiwala said in a news release. “Collectively, we’ll...

Former NFL player Marques Colston is making it easier for other athletes to enter the investment space. Drafted into the NFL in 2006 by the New Orleans Saints, Colston had a playing career that spanned more than 10 seasons and included securing a Super Bowl ring in 2010. He earned over $40 million throughout his time in the NFL, per Spotrac. Colston’s NFL career ended in 2015 when he was released by the Saints due to injury, according to the team’s webpage. Champion Venture Partners Today, Colston is still involved with athletes but in a new light. He is the founding partner in Champion Venture Partners, alongside former professional mixed martial arts (MMA) athlete Nick Edwards. The North Dakota-based private equity firm, established in 2024, is making “growth alternative asset investments” accessible to all, according to the firm’s website. “A lot of our team are former athletes, and what you see is there’s a really short time horizon on your athletic career where you have your...

After her first business failed, Carolyn Rodz is now making it her mission to help other entrepreneurs succeed. Rodz was an investment banker for JPMorgan Chase between 2001 and 2005, per her LinkedIn. After exiting her job, she ventured into entrepreneurship , but that did not fare well, leading her to reenter the workforce. Although this was a trying time, it did not deter her from entrepreneurship altogether — she launched Cake, a digital media company, in 2009 and exited in 2015 — and it paved a pathway of opportunity for a wider community. “I knew very little about starting a company and my first business failed,” Rodz said in an interview with the “Black Tech Green Money” podcast. “I went back to work, paid off debts, licked my wounds for a bit, started a second company that I ultimately sold, ran it very differently with the lessons that I learned and feel very fortunate that I got to start over again because many people don’t have that opportunity. I was young and single and...

Cherryrock Capital has raised $172 million to support diverse founders. The venture capital firm, founded in 2023 by Stacy Brown-Philpot (Managing Partner) — head of Alphabet Inc.’s online sales and operations in India and board member at HP Inc., StockX, and Noom Inc. — provides Series A and B funding to underrepresented founders of software companies driving innovation, according to its website. The VC firm, backed by a team with over 60 years of operating experience, has closed its first fund at $172 million, Bloomberg reports. “Today, I’m thrilled to announce the launch of Cherryrock Capital, the first fund focused on investing at the Series A & B stages in underinvested entrepreneurs …Cherryrock Capital is about being the foundation of success for the next generation of entrepreneurs…We’re on a mission to change the face of wealth creation and build an enduring institution. We are looking for founders who have the courage to be audacious in their vision, accountable to their...

Black Unicorn Factory has set a historic precedent in equity crowdfunding. Black Unicorn Factory (BUF) is a business development accelerator and equity crowdsourcing platform established by Johnny Stewart in 2012. Through BUF’s Follow Me for Equity app, it uniquely allows individuals to secure stock in pre-IPO companies by simply becoming a follower of a company through the app. “Stop following for free and earn equity,” actor Anthony Anderson said in a promotional video for the company. BUF’s target audience is underserved communities who are being left out of opportunities in the venture capital space. “It is disheartening to observe that the venture capital industry only allocates funds to a mere 1% of businesses led by individuals from underrepresented communities. At BUF, we firmly believe that this disparity cannot persist, and we are committed to providing an alternative to the discriminatory practices prevalent in the traditional venture capital landscape,” a statement on...

The Black-owned water bottle brand SUPLMNT welcomes NBA player Gary Payton II as its latest investor. The brand was founded in 2020 by South Philadelphia, PA, native Jairus Morris, who aims to improve hydration in Black and brown communities. His journey as a founder was inspired by his mother, who took on multiple jobs to support the household of five children. “I grew up in a South Philly single-mother household with four siblings. My mother was my first inspiration and motivation to want to be an entrepreneur,” he said in an interview shared on Medium. “She always tried side hustles to bring in extra income for my family; whether it was selling Mary Kay or braiding hair, she did it. Moving us out of the ghetto in South Philly to a suburb in New Jersey was the best thing she could have done. It exposed me to see that there was so much more to life outside of the hood.” As an adult, he also mentioned recognizing disparities around health and wellness, which further inspired his...

Breakr continues to find new ways to improve the creator economy. As AFROTECH™ previously reported, the platform was created by Historically Black College and University (HBCU) alums and brothers Anthony and Ameer Brown to ensure artists can connect with brands and agencies and establish creative campaigns they are compensated for. With an early focus on music, Breakr partnered with BMG and Sony Music and built a roster of clients that included Ye (formerly Kanye West), Young Thug, Megan Thee Stallion, Rick Ross, Future, and Gunna. Additionally, Nas is involved not only as an artist on the platform but also as an investor. He participated in a $4.2 million seed round led by Slow Ventures in 2021. Breakr has expanded its scope beyond the music industry, adding partners such as Hershey, Billboard, Celsius, Samsung, and UMG, information shared with AFROTECH™ notes. In 2022, 30,000 creators had onboarded onto its platform. In 2025, that number has more than doubled, reaching a community...

Venture firm Ulu Ventures has raised $208 million to support diverse founders. WSJ Pro reports that the VC firm founded by Miriam Rivera and her husband, Clint Korver, has invested in companies where 80% have a white co-founder. However, an equal 80% share also has at least one founder who is an immigrant, a woman, or from a minority group. Since its inception in 2008, this initiative has supported 250 startups , leveraging a data-driven approach to minimize cognitive bias and foster inclusive investment across all demographics. “Venture capital has so many decision-making problems when it comes to bias, diversity, disdain for data and analytics, hubris, misapplication of pattern-matching, and so on, that we feel like the one-eyed VCs in the land of the blind,” Korver told the outlet. The couple acknowledges a shift due to the changing diversity, equity, and inclusion (DEI) landscape. Major companies are throwing in the towel and dismantling DEI commitments, with some erasing...

Giannis Antetokounmpo is expanding his portfolio with a new investment tied to sports. Sportico reports the Milwaukee Bucks superstar is an investor in ScorePlay, an artificial intelligence -powered sports media management platform launched by Victorien Tixier (CEO) and Xavier Green (CTO) in 2021. Its solutions streamline sports organizations’ essential digital workflows by automating the management of photos and short video clips, its website mentions. Features among all its tiers include: Automated ingestion of photos and short videos Unlimitied AI tagging Usage analytics “The idea is to maximize the distribution, both on your own social channel, but also distributing the content to your athletes, who are your best storytellers,” Tixier told CNBC. ScorePlay had already attracted the attention of Kevin Durant and Rich Kleiman’s 35V family office, as well as Eli Manning, notes the outlet. Most recently, it has closed a $13 million Series A round led by Harry Stebbings’ 20VC, which...

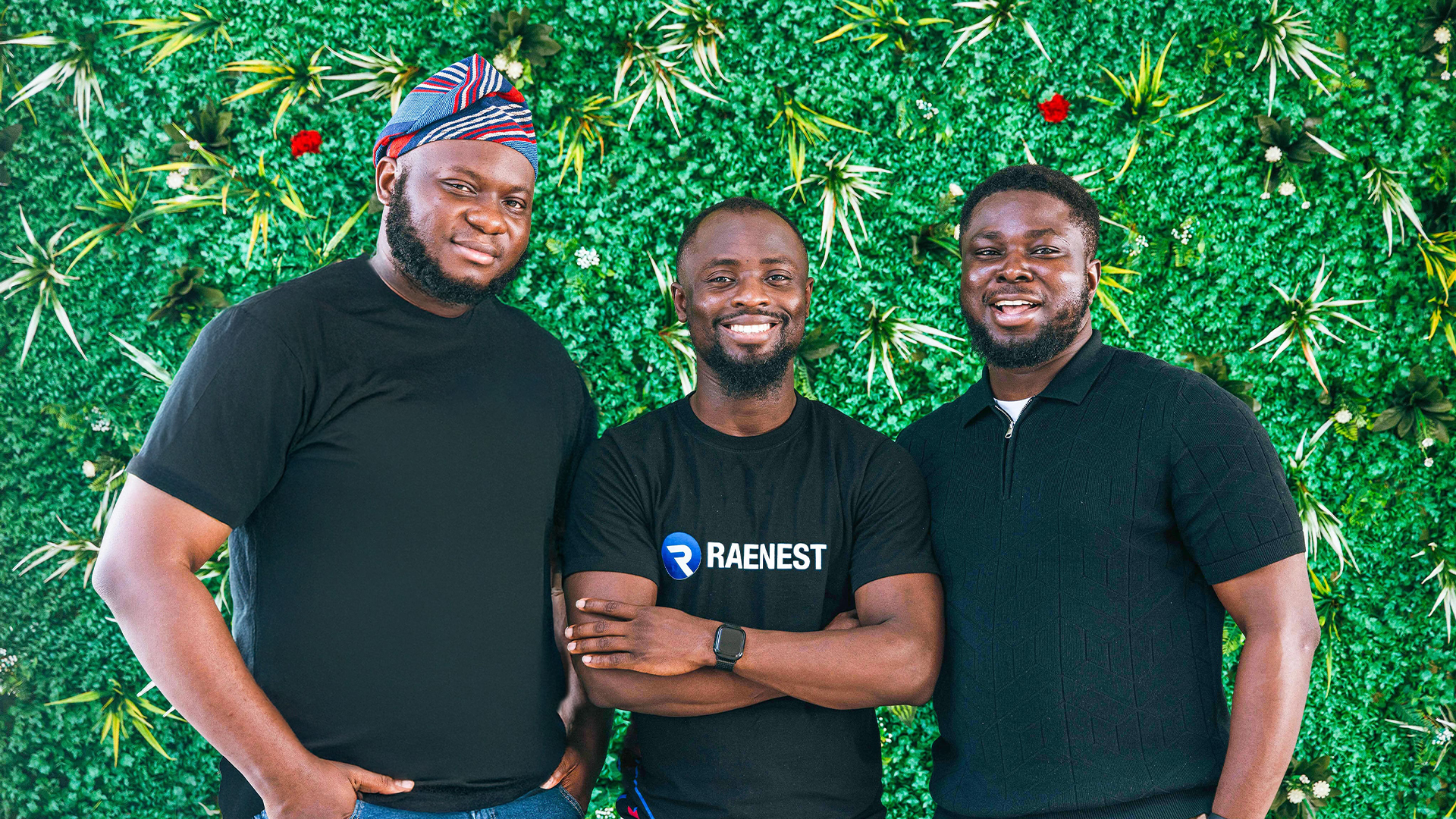

Fintech platform Raenest has raised new funding to support African businesses. The company, founded in 2022 by Victor Alade, Sodruldeen Mustapha, and Richard Oyome, offers a range of services, including virtual and physical dollar cards, international transfers, invoicing for global payments, the ability to create USD, GBP, and EUR bank accounts, and currency conversion, among other features listed on its website. Raenest’s original platform was structured as an Employer of Record (EOR), helping foreign companies pay employees on the continent while remaining compliant, TechCrunch reports. The founders recognized a deeper-rooted issue, leading them to update Raenest to assist the continent’s gig economy and businesses directly. “A U.S. company might not care if a payment is delayed by five days, but for someone in Nigeria or Kenya, that’s a big deal — especially when converting to local currency becomes another hurdle,” Alade told TechCrunch. Looking ahead, Raenest intends to secure...