All results

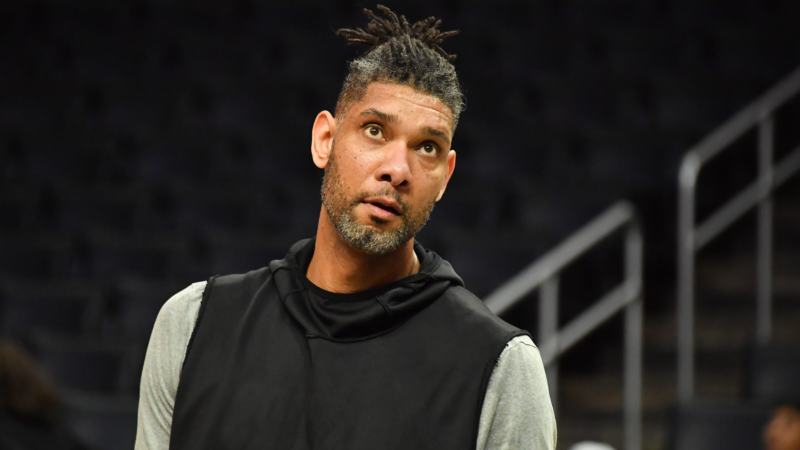

Tim Duncan was one of the biggest NBA superstars in the early 2010s. But in 2013, he enlisted a financial advisor. And according to Bleacher Report, that’s when all the problems began. The outlet confirms that thanks to a series of bad investments by his financial advisor, Charles Banks IV of Atlanta, Duncan was defrauded out of more than $20 million. What’s more, thanks to his role in the fraud, Banks was sentenced to a four-year prison sentence for wire fraud in 2017, per the San Antonio Current. Despite the loss, Tim Duncan is completely unfazed. “Luckily I had a long career and made good money. This is a big chunk, but it’s not going to change my life in any way. It’s not going to make any decisions for me,” he said to Bleacher Report. That said, Duncan still felt the sting of betrayal by Banks, whom he counted on to follow through on an investment that would help him “make a living that would last [him] for the rest of [his] life.” Instead, Duncan and his attorneys said there...

In 2016, Spike Lee called Chance the Rapper a fraud, according to XXL Magazine . Today, there’s someone out there that uses his name — and there’s no question that it’s a fraud. A new report released by CBS News revealed that a Chicago-area man has been using the rapper’s name to defraud unsuspecting women out of tens of thousands of dollars. The man, who is going by the pseudonym Jeffrey Washington, has been claiming that he’s working with CEDA (Community and Economic Development Association), together with Chance the Rapper, to help people “pay off financial obligations.” These financial obligations include mortgages, utility bills, and car insurance. But there’s just one problem with the scam: CEDA doesn’t cover what the scammer claims it covers. Instead, according to its official website, CEDA provides “heating and cooling assistance” to low-income residents of Chicago. And while the not-for-profit doesn’t provide mortgage assistance, it does provide assistance with affordable...

An Illinois based car-dealership has found itself on the paying end of a $10 million settlement with the Federal Trade Commission (FTC) and the state attorney’s office. The settlement comes after numerous claims that the car dealer was charging illegal fees and adding additional finance charges to its Black customers. As reported by the Chicago Tribune, Ed Napleton Automotive, headquartered in Oakbrook, IL was among nine other dealerships in Illinois, Florida, Pennsylvania, and Missouri with complaints filed for similar discriminatory practices. According to the local news outlet, the joint settlement was filed in Chicago federal court alleging the dealerships across multiple states charged up to thousands in additional products like paint without any prior consent. The complaint against the dealership also alleges that Black customers were charged an estimated $190 more in interest and paid about $99 more for similar add-ons than white customers, the FTC released in a statement....

A Texas man will reportedly be facing more than nine years behind bars for a fraudulent Paycheck Protection Program (PPP) loan application filed, CBS News reports. To help small businesses stay afloat amidst the pandemic, the Coronavirus Aid, Relief and Economic Security (CARES) offered PPP funds until May to remediate the financial turmoil many entrepreneurs faced. According to authorities, 30-year-old Lee Price III applied to two different financial institutions to obtain $1.6 million in funding, KHOU11 reports. In September, Price pleaded guilty to wire fraud and money laundering. Prices’ plan was carried out by falsely representing the number of employees and payroll expenses of three businesses, CBS News reports. O ne of the applications claimed a small business had 50 employees with a monthly salary of $375,000. After further investigation from authorities, it was revealed the business had neither employees nor payroll or any evidence that the individuals had been hired.

Nearly 20 former NBA players have been arrested by the Feds for their alleged role in a healthcare scam. NBC 4 New York was the first to break the story. According to the local NBC affiliate, the scheme involved plans to rip off the insurance provided by the league to NBA players both past and present. The charges were filed in the Southern District of New York on Thursday, Oct. 7. A full list of NBA players who were arrested in the scheme can be found below. Some of the players charged include: – Milt Palacio – Sebastian Telfair – Antoine Wright – Darius Miles – Ruben Patterson – Eddie Robinson – Gregory Smith – Glen Davis – Jamario Moon (1/2) — Tom Winter (@Tom_Winter) October 7, 2021 More former players: – Terrence Williams – Alan Anderson – Tony Allen – Shannon Brown – William Bynum – Melvin Ely – Christopher Douglas-Roberts – Tony Wroten (2/2) — Tom Winter (@Tom_Winter) October 7, 2021 “According to the grand jury indictment, the defendants allegedly engaged in a widespread...