Showing 9 results for:

financial education

Popular topics

All results

Some Harvard University students will soon be able to attend the institution free of charge, thanks to a new initiative aimed at making education “affordable to more students than ever,” particularly for those from middle-class families. On Monday, March 17, 2025, the Boston, MA-based Ivy League institution announced that starting in the 2025-2026 academic year, students from families with annual incomes of $100,000 or less will receive free tuition, food, housing, health insurance, and travel costs. They will also get a $2,000 start-up grant in their first year and a $2,000 launch grant during their junior year to “help support their transition beyond Harvard .” Additionally, Harvard will be tuition-free for students from families with annual incomes up to $200,000. “Putting Harvard within financial reach for more individuals widens the array of backgrounds, experiences, and perspectives that all of our students encounter, fostering their intellectual and personal growth,” said...

Raleigh, NC -based St. Augustine University (SAU) has lost its appeal for accreditation and will enter a 90-day arbitration process. According to WTVD-11, SAU has been on probation with the Southern Association of Colleges and Schools Commission on Colleges (SACSCOC) for two years. In December 2023, the SACSCOC Board of Trustees voted to remove SAU from membership due to financial and governance issues. After a successful appeal, it was reinstated in July 2024 and remained effective through the end of the year. However, on Thursday, March 6, 2025, the Historically Black College and University announced that the appeal to keep its accreditation had ultimately been denied, per WDTV-11. The university stated that the 90-day arbitration process would ensure that all students graduating by May 2025 receive degrees from an accredited institution. “We have made substantial progress and are confident that our strengthened financial position and governance will ensure a positive outcome,”...

If you’ve grown up in the digital age , you likely have some understanding of how unreliable information spreads across the net. Millennials far and wide have been inundated with enough YouTube troll comments, Nigerian prince emails and “free iPhone” pop-ups to build a healthy skepticism of internet browsing. Now, it seems that this learning curve has become a perennial part of growing up, as Gen Z and Gen Alpha are surmising that social media apps like TikTok are rife with terrible financial advice. New studies from researchers at Intuit Credit Karma estimate that over 77 percent of Gen Z kids are looking to influencers on the short-form video app for money management, while roughly 61 percent of millennials are doing the same on YouTube and Facebook . In order to understand just how damaging these financial words of wisdom can be to a growing audience of youngsters, lets take a moment to briefly run through the data, and see exactly where young people are being led astray. After...

The Zone and Morgan Stanley are partnering to ensure member athletes can obtain total wellness. Founded by two former student-athletes, Ivan T chatchouwo and Erik Poldroo, The Zone was birthed to create a home for athletes to seek support for their mental health as they would for other areas of concern such as physical injury or academic conflicts. The founders recognize finances are a leading source of stress and constraints can permeate into other areas of productivity and performance. “Evidence highlights that stress related to personal finance overwhelmingly yields poor individual results, directly tied to how one feels and ultimately how one produces and performs in a given area – whether in sports, the classroom or in the workplace,“ Ivan T chatchouwo told AfroTech. He continued: “As a former student-athlete myself, along with Erik, and in speaking to several other fellow current or former student-athletes, we could all relate at some point or another to feeling some form of...

Cryptocurrency is still on the rise, especially the most notable of them all: Bitcoin. AfroTech previously reported on the basics of digital currency and debunked some myths about the growing market, and we’ll even explore this topic further at AfroTech 2021. View this post on Instagram A post shared by AfroTech (@afro.tech) Cryptocurrency expert Isaiah Jackson, author of “Bitcoin & Black America” and co-host of “The Gentlemen of Crypto,” is a huge advocate for bitcoin education, especially in the Black community. With nearly 19,000 subscribers, his YouTube show is a daily live stream that discusses Bitcoin and the cryptocurrency market from the lens of two Black men who are Certified Bitcoin Professionals. One of “The Gentlemen of Crypto’s” core values is bridging cryptocurrency and the community, its website reads. “We cannot miss, in my opinion, the biggest financial revolution of our lifetime,” Jackson told AT about Black people getting educated on bitcoin. “And we can’t be left...

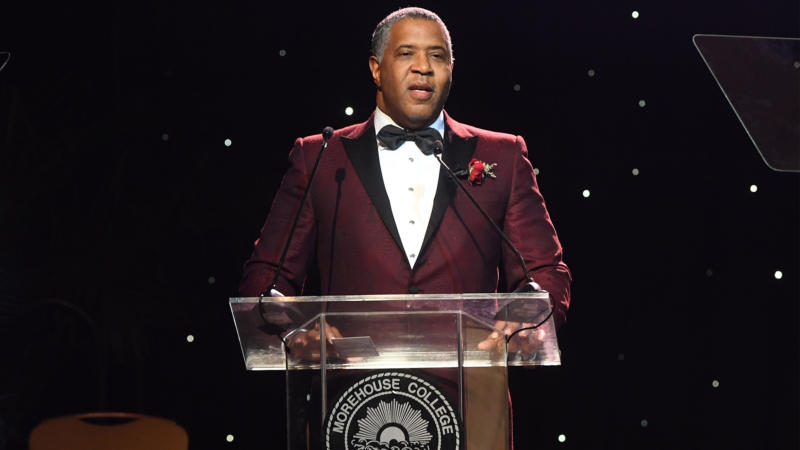

When underserved communities lack access to resources for financial education, their ability to focus on the idea of generational wealth is stunted before they even have a chance to take a step on its path. With the mission to give such communities a fighting opportunity to learn about smart investing and building wealth early on, Robert F. Smith and Goalsetter, a financial literacy platform founded by Tanya Van Court, announced today the launch of “One Stock. One Future.” — an initiative to spearhead financial freedom for the next generation of Black and LatinX Americans.

Black Americans own 2.2 percent of the nation’s 5.7 million employer businesses, according to U.S. Census data. Yet, many lack the proper financial tools, guidance, and resources to succeed. States like Georgia saw a big jump in business growth last year with a 57 percent increase in new business formations. While this may seem exciting, Black businesses historically bring in less revenue because they face challenges related to funding, business models, financial understanding, and leadership. McKinsey & Company reported that while approximately 15 percent of white Americans hold some business equity, only five percent of Black Americans do. Octavia Conner, a virtual CFO and founder of Say Yes to Profits, told AfroTech that for Black business owners to succeed, they’ll also need more support from corporate America. She said corporate America needs to stop limiting opportunities for entrepreneurs based on the color of their skin, offer more programs and financial resources, and grant...

The global neobanking market is expected to reach an estimated $723 billion by 2028, according to Grand View Research. As more people handle their finances online, the neobanking industry has been getting a lot of love, but what are neobanks anyway? Neobanks are digital-only financial institutions that operate similarly to traditional banks, but without physical branches, The Balance explains. You typically access neobanks through mobile applications and online platforms. While neobanking can be convenient, have lower costs and are more easily accessible, they don’t have the same accreditation as traditional banks and are regulated much less. Above all, neobanking requires access to technology and internet, a luxury that not everyone has. Another thing to think about with neobanking is that even with access to technology and internet, consumers have to be comfortable and trust tech in order to invest in using online-only banking systems. Some neobanks like N26, Atom Bank and Monzo...

According to a 2015 report from PwC , millennials lack the financial education that they need to thrive in today’s world. The report found that over 40 percent of millennials relied heavily on costly payday loans and rent-to-own financing alternatives, and more than 20 percent made withdrawals from their retirement accounts. While parents may shake their heads at these figures, Kevon L. Chisolm, Esq. is one parent who believes the solution is simple — start early. Chisolm, who is president of Umoja Investments, LLC, began teaching his 11-year-old son , Kamari Chisolm, about finances at an early age. The need to share this knowledge with other young people led the father-and-son duo to establish Black Wallstreeter Consultation Services in 2019. The company works with schools to increase youth knowledge of building and retaining wealth through investments and other means. “It is important for youth to learn about how to build financial wealth and investing, because the sooner...