Showing 49 results for:

black startups

Popular topics

All results

Launching a business is no easy feat. For as much as social media gurus love to talk about how everyone should have a hustle or launch their own business, the reality is often far different. While coming up with an idea can be hard enough, the truth is that most businesses will fail long before they reach the five-year operation milestone. Real barriers like funding a startup business as one tries to shift it from a labor of love to a profitable venture make that grim statistic a reality. In the beginning, most business owners are entirely self-funded. And while this can give one a sense of accomplishment, it also means that there can be lean times. Eventually, startups are going to need a cash infusion which is where the business loans come in. Understanding The Basics Of Startup Business Loans While business loans might seem like mysterious products, they are not much different than any other kind of financial loan offering. Simply put, a financial institution fronts a business...

Career Karma is still on a mission to help more people break into the tech industry . The company — founded by Ruben Harris — seeks to provide those wanting to launch careers in tech by equipping them with the right job training programs and support as they progress throughout their careers. Today, the company has even announced a $40 million Series B funding round that was led by Top Tier Capital Partners, a San Francisco-based global venture capital firm. With the latest funding round, the company will expand into higher education as well as lock in new key roles at Career Karma. “There is currently not one company that dominates the reskilling space. Whichever player aggregates demand will become the category leader in the $2.2 trillion post-secondary education market ,” said Credit Karma CEO Ruben Harris in an official news release shared with AfroTech. “With over 10 million job openings in the United States and more than 4 million people who have recently quit their jobs,...

Navigating the tech space as a Black entrepreneur requires a certain level of perseverance to ultimately see their innovative ideas turn into reality. It’s this relentless determination that took Kelauni Jasmyn’s paper napkin idea to recently closing in on $25 million for her national technology venture fund — Black Tech Nation Ventures (BTN.vc) — in under a year.

Black Ops Ventures, a Black-owned VC fund, has announced that it has closed its first fund with investments totaling $13 million. And, thanks to this fund closing, the company has announced its intent to exclusively back outstanding Black tech founders in the United States and Canada. According to a press release, “In securing investments for this initial close, Black Ops relied upon long-standing relationships with some of the most respected names in the tech industry.” Some of those names include Blavity, Inc. CEO Morgan DeBaun, Drew Houston, Jacob Gibson, Ben Horowitz, Union Square Ventures and Jeff Bussgang. Bank of America and Northwestern Mutual led the fundraising round, according to the press release. “We are part of this community of Black founders, with better access to deal flow than other venture investors, regardless of their cultural background,” said James Norman , partner, in the press release. Norman is also the founder of Pilotly and co-founder of Transparent...

If you do any type of freelance or contract work, this millennial just made your life a whole lot easier! As a football star turned tech guru, Blake Stanton is the visionary behind the Quiktract app, designed to give his peers a safe space while they’re sitting among corporate tables. The enterprise venture app was created specifically with entrepreneurs in mind as it allows freelancers the opportunity to connect, create amenable contracts, and secure payments all in one place. Since 2019, the app has combined the ease of a marketplace with the lead, contract, and payment tools that entrepreneurs need to easily manage their work. It offers a layer of protection for both freelancers and service providers as they work together on various projects.

Chipper Cash, an African cross-border payments company, has announced its new $2 billion valuation after its recent Series C extension. According to NairaMetrics, this new Series C extension raised an additional $150 million for the company. The funding was led by Sam Bankman-Fried’s cryptocurrency exchange platform FTX. SVB Capital, as well as other previous investors such as Deciens Capital, Ribbit Capital, Bezos Expeditions (owned by Amazon founder Jeff Bezos), One Way Ventures, and Tribe Capital, reinvested in this extension round. Chipper Cash, which was founded in 2018 by Ham Serunjogi and Maijid Moujaled, is a no-fee peer-to-peer cross-border payment service in Africa. Through their app, users can accept payments in Ghana, Uganda, Nigeria, Tanzania, Rwanda, South Africa and Kenya — to name but a few places that use the app. In 2021, the company expanded again — this time, into the United Kingdom. By using Chipper Cash, users can send money from the United Kingdom to their...

The COVID-19 pandemic made it clear that as essential workers help keep the world afloat startups like Vitable Health are simply vital. Hourly workers are what keep businesses rolling, yet they’re often left uninsured or have to fend for their health out-of-pocket. Vitable Health aims to change this misfortune by giving employers a more cost-effective way to give their employees and their families healthcare, Forbes reports. Now, the Pennsylvania-based startup has raised $7.2 million in funding to ensure that hourly workers’ health is as much of a priority as salaried employees. Participants of the round included First Round Capital, and angel investors such as the CEO of Lattice, Jack Altman; managing director at Y Combinator, Michael Seibel; senior vice president of business at GoPuff, Daniel Folkman; co-founder of Cityblock Health, Toyin Ajayi; and others, according to Forbes. With their latest funding, Vitable Health plans to improve its app as it launches its mental health...

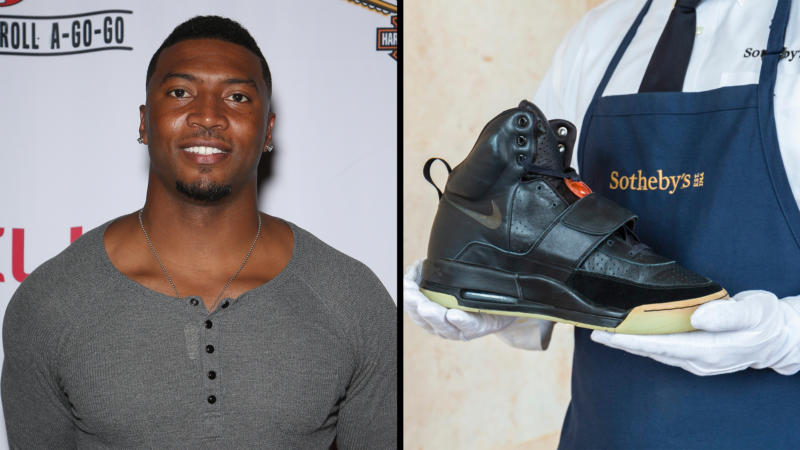

For former NFL player Gerome Sapp, transitioning from the world of professional sports to the world of business came with ease once he found the right concept. After retiring from the league in 2008, he was inspired to start a new career as a tech founder, and his latest conquest in the industry is proving to be quite a force in the investment space. With his driven mindset and finance background, the athlete-turned entrepreneur came up with an innovative concept to educate his community on what it means to make smart investments in assets that especially resonate with them — sneakers. This simple yet revolutionary idea is what paved the way for his new fintech startup Rares — a product of the Techstars Los Angeles Accelerator program — to launch as a platform to help people to invest in shares of particularly notable sneakers. The business, which launched earlier this year, was born amid the pandemic and gave Sapp the opportunity to combine his two passions — the Stock Market and...

Tennis superstar and philanthropist Serena Williams is giving back to underserved communities by backing leading rent reporter fintech company Esusu. According to a press release, Williams participated in the company’s $10 million Series A funding round — led by Motley Fool Ventures — with an undisclosed “significant investment” through her venture capital firm, Serena Ventures. In speaking with CNBC, Williams shared that she started her company to “invest in diverse founders and early-stage companies that outperform and generate impact, while at the same time empowering others and creating opportunities” — thus identifying Esusu as one of those very companies. “Esusu is really focused on credit building and creating pathways to financial inclusion for not only working families but for individuals as well,” she shared in a press statement. “Their services also make rent reporting seamless – finally giving renters credit for what often is their largest expense every month. Last year,...

Don’t just talk about it, be about it! Managing Director of venture capital (VC) firm Insight Partners knows exactly how to use his privilege to level the playing field when it comes to funding for Black founders. Richard Wells is the son of an Ecuadorian immigrant mother but carries the name and appearance of his white father which he notes has helped his career tremendously. “When I sit on a panel of folks that do what we do, I have joked that I have the same haircut and look very similar to everyone else, all the white guys,” said Wells in an interview with Forbes. “And I recognize that’s an advantage for me. No one knows that I had a grandmother that didn’t speak a word of English.” As veterans in the industry, Wells and his partners have continuously been informed about the hardships that fund managers, specifically, women and people of color, face when it comes to raising money. It was this that motivated both him and his partners to put $15 million of their own capital into a...

A lot of companies talk a good game about diversity, equity and inclusion (DEI) initiatives, but are these companies actually following through? Thanks to Black-owned tech startup Blendoor, this company is using data to score other companies on how diverse they really are. Blendoor , founded in 2014, is described as the “standard for corporate DEI ratings. The startup’s ratings are what help impact investors, diverse executives, and corporate boards align their company’s business strategy with fairness and equity. According to TechCrunch, Blendoor founder and CEO Stephanie Lampkin launched her company with a mission to focus on finding qualified diverse candidates by minimizing the bias that exists within companies’ hiring processes. As a natural starting point, the startup chose to target companies that have already made public DEI pledges. “We decided to create an index, a credit score, and we pulled in a ton of data from their diversity reports, their EEO One forms if they...

It’s time to change the conversation around mental health being too taboo of a subject for men to talk about. With resources like social network platform MentalHappy, it’s quite possible to reimagine what safe spaces look like for men to achieve a healthy mental state. MentalHappy — a first-of-its-kind safe, online mental health platform that provides positive peer support groups led by health and wellness professionals — is actively working to support the mental health needs of all – particularly for people of color and men. According to a poll conducted by researchers at the National Center for Health Statistics (NCHS), nearly one in ten American men reported experiencing some form of depression or anxiety, but less than half of those men actually sought out treatment for their conditions. For Black men in this country those numbers are even lower, which is why mental health remains an under-recognized and under-treated problem among them. “The most common misconception about...

They’ve called him Big L’why, Big Silly, Big Money, Big Billy in Hip-Hop for years — and now, Silicon Valley can call LL COOL J that, too. In a press release announcement, it was revealed that Rock The Bells — a direct-to-consumer online store for Hip-Hop culture merchandise, which has mushroomed into a multimedia brand name that includes LL COOL J’s Rock The Bells Radio on SiriusXM Channel 43 — acquired $8 million in a Series A funding round. The funding round was led by Raine Ventures — who has invested in Barn2Door, Knock Knock, and IRL in the past. “It’s an honor to be supported by such a distinguished group of investors,” said LL COOL J, CEO and co-founder of Rock The Bells, in the press release announcement. “This funding will help us accelerate our growth and team-building efforts to make sure we can further uplift the people and culture at the forefront of Hip-Hop through exciting e-commerce collaborations, storytelling, and experiences.” M13, Willoughby Capital Holdings,...

For the first time ever, a U.S. state is developing a fund strictly dedicated to supporting Black and Latinx-led companies. An exclusive from TechCrunch reports that New Jersey Governor Phil Murphy announced this week a proposal to direct funds from the state budget to form a $10 million seed fund for Black and Latinx startups. Based on research conducted by New Jersey, The Black and Latinx Seed Fund is the first-of-its-kind for any state in the nation and will be administered by the New Jersey Economic Development Authority (NJEDA). NJEDA CEO Tim Sullivan told TechCrunch that the new development is a “direct response to the systemic racial inequities in access to capital for Black and brown entrepreneurs” and aims to provide a solution for “the racial wealth gap.” “I think two of the centerpieces of Gov. Murphy’s strategy overall for the economy is to build a stronger and fairer New Jersey and a stronger and fairer economy,” Sullivan added. He also shares that the new seed fund is...

Back in the early 1900s Parrish Street’s four-block district in Durham, North Carolina used to be home to a plethora of Black-owned businesses. Though those businesses do not exist today, this venture capital fund is working to keep the district’s legacy alive. Resilient Ventures — a fund comprised of local angel investors — is a capital fund that was created to mirror the mission of Durham’s Black Wall Street in an effort to provide more opportunities for Black-led startups all across the country. According to its website, Resilient Ventures was founded on principles and values that aim to “disrupt systemic economic injustice by expanding access to capital, networks, and opportunity to companies.” As of this week, Hypepotamus reports that just two years after its launch and amid the pandemic, Resilient Ventures has closed on a $3.45 million fund from 24 investors total described as “mostly accredited individual investors from their network,” who contributed to the fund. Though the...