Buying a home can be an overwhelming and expensive purchase. On Friday, August 30, 2024, the current national average interest rate for a 30-year, fixed-rate mortgage was 6.38%.

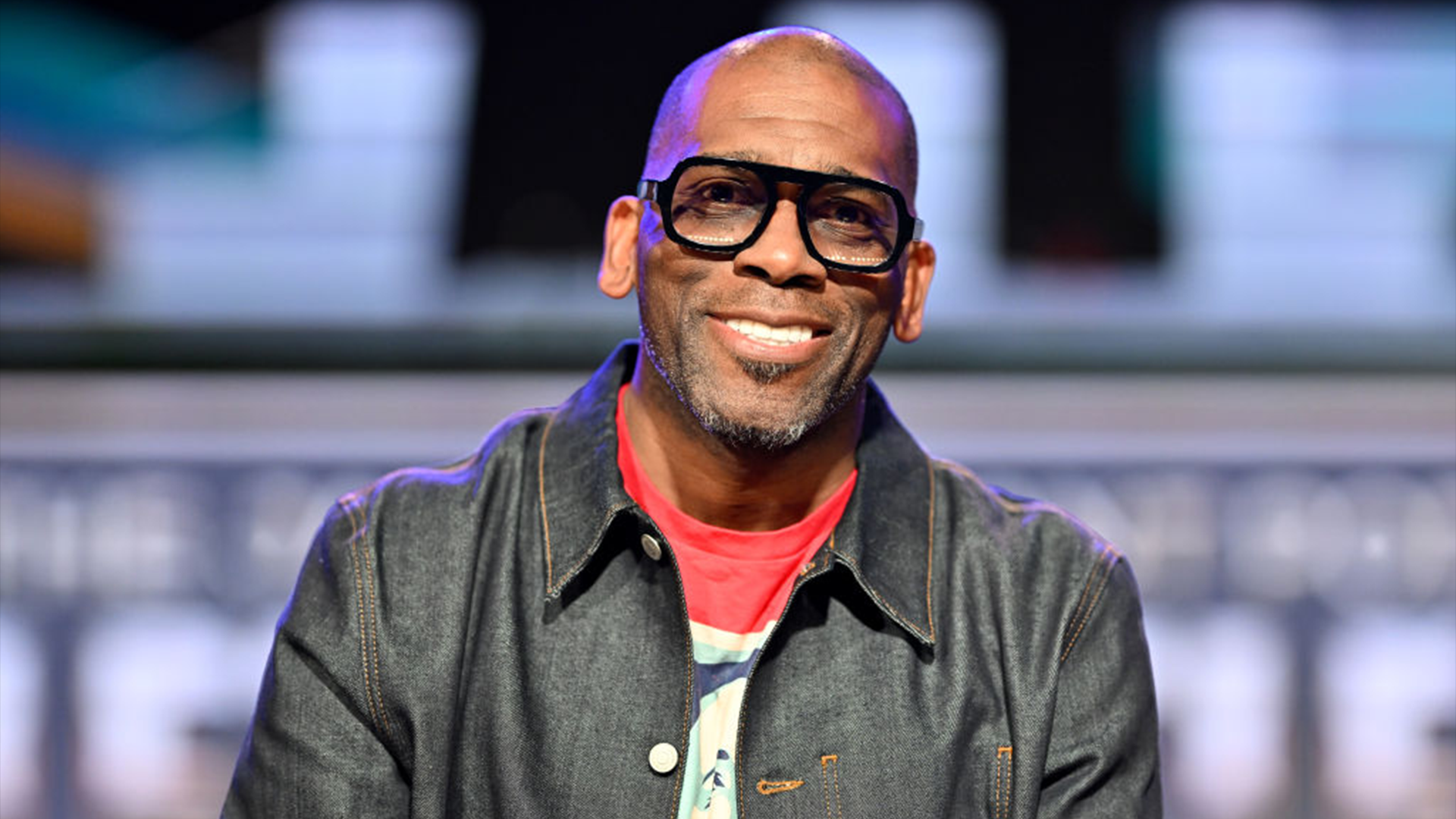

The interest rates have gotten so high that John Hope Bryant, the founder of Operation HOPE, is trying to convince people that a 40-year mortgage plan is more fair.

But when first-time homeowners and first-time investors are listening to Realtors, real estate attorneys and mortgage lenders discuss percentage rates, it may not seem as clear. That is, until new homeowners see property and interest (P&Is) really affect their monthly budget. (Varying property taxes can make budgeting even more complicated.)

Using Chicago as an example, if you bought a home in the Windy City right now (with very good credit between 700-739) for the city’s average home value of $305K, you’d pay about $1,729 per month for P&I. If that sounds high, the average rent in Chicago is $1,836 per month for a one-bedroom apartment. That’s only about $100 difference.

Although a homeowner and a tenant are paying about the same rate, the Home Mortgage Interest Deduction helps homeowners get some of those funds back each year. Tenants don’t get anything in return (besides possibly home office deductibles for work-from-home employees).

For aspiring real estate investors who just cannot afford the price of a single-family home right now, redirecting your gaze from a single-family home to a condominium unit may be an easier business decision. Here’s why.

Condo Prices Cheaper Than Single-Family Homes

The best real estate investing for beginners includes being able to find property that you can afford without putting your primary home’s mortgage and/or rent at risk. Shopping around is mandatory to make this real estate investment make sense.

Plus, there are a considerable amount of condominiums to choose from (depending on the state). Even in the third-largest city in the U.S., Homes.com has found condos with total prices as low as $29,900.

Which one is more likely to not hurt your checking account — approximately $30K or $305K?

Of course, there are high-end condos that can be hundreds of thousands all the way to millions, but the average condo rarely costs this much.

Once you get past pricing, there’s another popular hurdle with condominium associations (COAs): becoming co-owners or investors with a group of other homeowners.

Investors Must Partner With Condo Boards

First-time real estate investors may hesitate at all the stereotypes about COAs: power-hungry condo boards, overzealous bylaws and unreasonable Rules & Regulations. When you buy a single-family home to rent out, you make all the rules. With a COA, that’s not the case.

Nitpicky rules aside, homeowners associations (HOAs) and COAs have been around since World War II veterans from the 1940s. Clearly, they’ve worked out for a specific type of homeowner.

Besides longevity, there are multiple other perks for real estate investors who opt for purchasing a condo unit instead of a single-family home.

Underestimated Perks Of Condo Investments

First, as long as you (and your real estate attorney) have carefully reviewed meeting minutes and annual budgets for the past few years by your potential COA, you’ll have an idea of what’s been fixed and what hasn’t. If you’re seeing a considerable amount of owners complaining about a faulty roof, deck repairs, city violations and pest infestation, this probably won’t be the best buy.

COAs who have already had these high-cost maintenance needs handled are a largely good option. Plus, you, the investor, have been able to bypass special assessments. You may be paying more for the condo because the last condo owner wants to recoup those funds, but at least you’ll know you’re investing in a COA that cares about repairs.

Second, you’ll have an easier time getting repairs resolved. Unlike a single-family home investor who is responsible for everything, COAs can be self-run or hire a property manager to handle the day-to-day. Either way, there’s a group of people who are invested in getting that pesky tuckpointing job completed and can guide the exterminator to that one unit with the mouse infestation.

Having hands-on homeowners is also a major relief for out-of-state investors, who physically just cannot come back and forth every single time something happens with the building. For common-area problems, that condo real estate investor can reach out to the condo board or COA’s property manager to handle the rest.

(Of note, if the repair is not “behind the walls,” condo boards and property managers don’t handle those issues. For example, a deteriorated flush valve [flapper] in a toilet is not an “association expense”; it only affects your condo unit’s toilet so you’ll be responsible for funding this instead of COA monthly assessments for communal repairs.)

Third, COAs are always invested in the safety of the building. Unlike a single-family home, which may or may not have a communal neighborhood block, COAs are required to know what’s going on in their building. Whether it’s a mail thief, someone trashing the laundry room or dead batteries in a carbon monoxide/smoke detectors, if one owner doesn’t notice, the next one will. Investors can get up to speed with what’s going on in the building, and maybe even consider joining the condo association to improve on the turnaround times.

And after investing in a condo, first-time real estate investors with a COA usually have first dibs on investing in more units in the same building. Or, use that COA experience to move on to single-family homes and more responsibility later.