Investment firms are a necessary part of the business world. But did you know that these celebrities helm up their own?

From a tennis legend to several rappers, these twelve celebs are redefining what the names and faces of investment firms look like. No longer tied to “old-money white wealth” like Goldman Sachs, JPMorgan Chase, and Bank Of New York Mellon, these celebrities have proven that investments made back into the Black community pay off in much larger dividends…and cultivate goodwill in the long run.

For example, Karan Wadhera — the managing partner for Snoop Dogg’s Casa Verde — even left his position in the “traditional” investment firm world to work with the legendary Doggfather on his venture. He told TechCrunch that he was driven to do so to shift people’s focus onto things that weren’t getting enough attention at the time (in Casa Verde’s case, Black ownership and cannabis investment).

“We have a decent-size checkbook and a fairly high profile in this space, so we see a fair amount of inbound. We also have a strong network among cultivators and retailers and brands in the industry, and we’re constantly leveraging them to find new opportunities. They’re often customers for our portfolio companies, and they’re looking for solutions,” he said to the outlet.

Let’s take a look at how these celebrities are making a difference with their own investment firms.

Serena Williams — Serena Ventures

As AfroTech previously reported, tennis legend Serena Williams founded Serena Ventures in 2014. The goal, according to Williams, was to invest in companies that featured women and under-represented founders in prominent roles. She revealed the existence of the company in 2019.

“I launched Serena Ventures with the mission of giving opportunities to founders across an array of industries,” Williams said in an Instagram post. “Serena Ventures invests in companies that embrace diverse leadership, individual empowerment, creativity, and opportunity.”

Since then, Serena Ventures has invested in 43 companies, according to CrunchBase. Twenty-five of those companies were considered “diversity investments,” including Lolli, Kira Health, and Nude Barre.

Jay-Z — Marcy Venture Partners

As AfroTech previously reported, Jay-Z founded Marcy Venture Partners in 2019. In October 2021, Marcy Venture Partners closed its second fund for a whopping $325 million.

In total, the company manages more than $600 million in assets.

One of Marcy’s most prominent investments was in Rihanna’s Savage x Fenty brand, for which the firm led a $70 million funding round. CrunchBase, meanwhile, reports that Marcy has made 30 investments in total — of which 15 of them were considered “diversity investments” including Partake Foods, Perch Credit, and Wyze Labs.

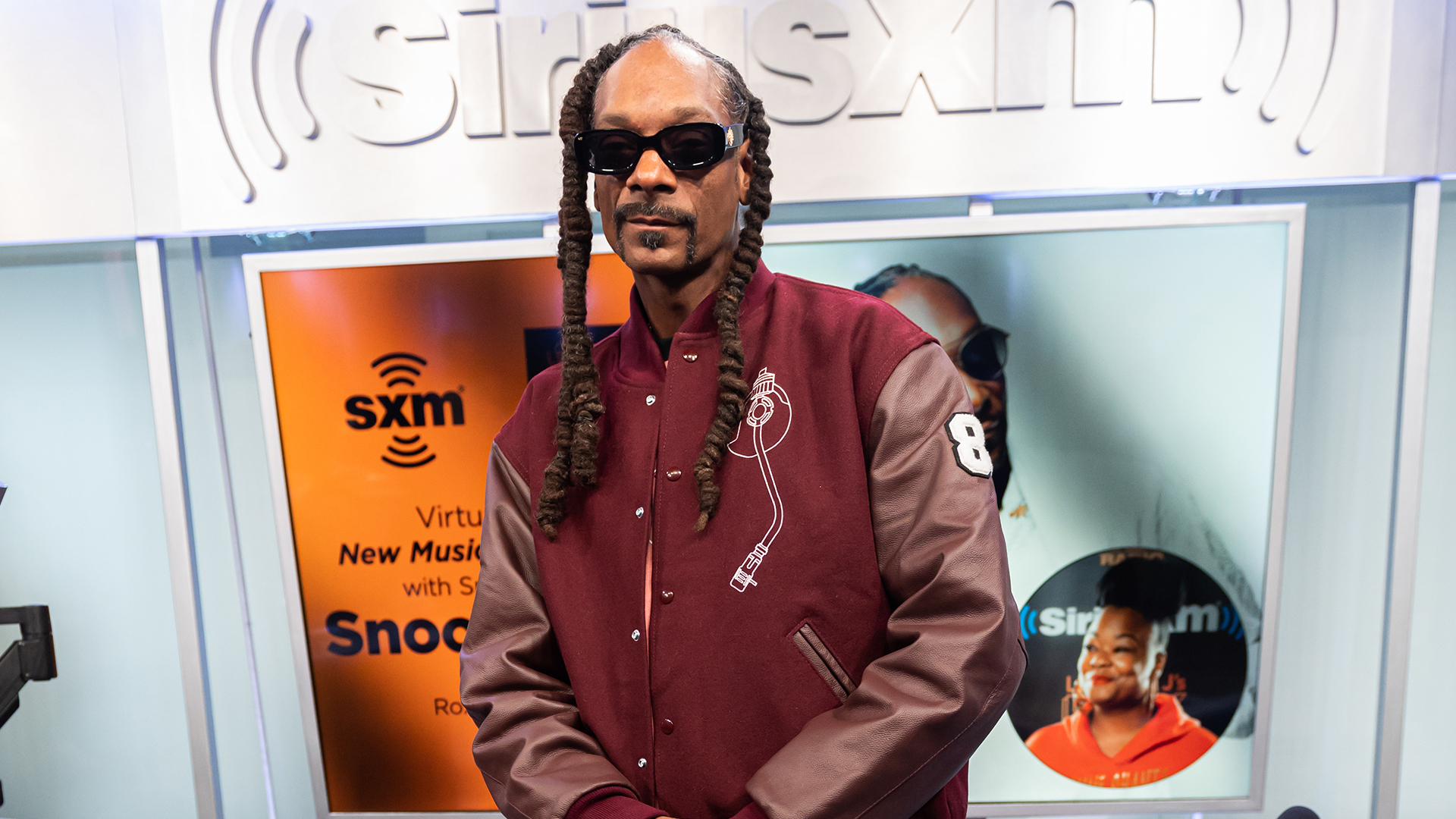

Snoop Dogg — Casa Verde Capital

As AfroTech previously reported, Snoop Dogg founded Casa Verde Capital in 2014. In December 2020, Casa Verde Capital closed its second fund for $100 million.

The fund, according to our report, specializes in seed capital and is especially known for investing in startup cannabis brands.

CrunchBase reports that Casa Verde has made 30 investments. Only four of those investments were considered “diversity investments,” which includes companies like Proper and Miss Grass.

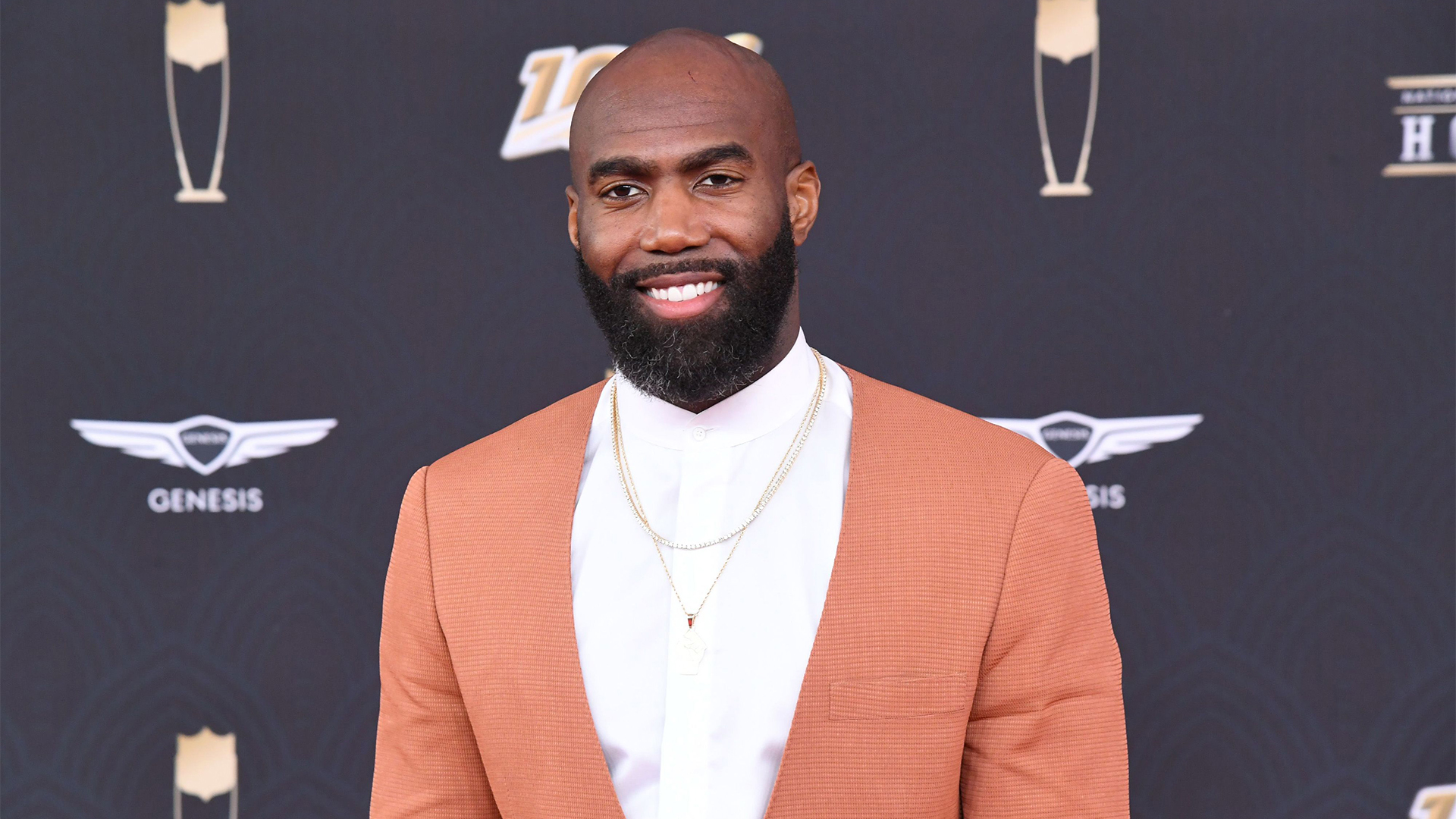

Malcolm Jenkins — Broad Street Ventures

Though the NFL star-turned-investor and entrepreneur has been getting a lot of press for his NFTs, Malcolm Jenkins has also gotten a lot of accolades for his founding of Broad Street Ventures.

The goal of the fund, he said, was to help Black and Latinx investors build their wealth.

“We have more power and leverage when we do this together,” he told CBS News.

Kevin Durant — Thirty Five Ventures

Another sports star that has been making his way into the venture capital world is none other than Kevin Durant. The NBA powerhouse has turned Thirty Five Ventures into a monstrous entity all on its own. As AfroTech previously reported, the firm has invested in several “unicorn” companies, including NBA Top Shot and WHOOP.

Founded in 2016, Thirty Five Ventures has made 44 investments overall and five “diversity investments,” according to CrunchBase.

Steph Curry — SC30 & Penny Jar Capital

Another NBA star that has been breaking into the venture capital world is Steph Curry. As AfroTech previously reported, his first firm is Penny Jar Capital, which has invested in early-stage companies like Syndio.

CrunchBase has also revealed that Curry is the founder of SC30, which has made 13 investments including in such companies as Step, Literati, and Tonal.

Diddy — Combs Enterprises

Diddy has been known for his business prowess for many years. But, as AfroTech previously reported, he entered into a whole different dimension when he founded Combs Enterprises. The company’s most prominent investment is, of course, in CÎROC, but Diddy has committed to using his newfound prominence with Combs Enterprises to highlight Black-owned businesses year-round.

AfroTech also reported that Combs Enterprises invested in Arc, an electric boat startup, alongside Kevin Durant and Will Smith. The stars helped the company raise $30 million in their initial funding round.

Magic Johnson — Magic Johnson Enterprises

As AfroTech previously reported, Magic Johnson has really made an impact on the world with his Magic Johnson Enterprises, which has invested in such companies as Naturade (a Black-owned natural health products company). He’s also joined the board of directors at Uncharted Power, a Black-owned energy startup company. These investments, and more, have made Johnson one of the richest athletes in the world, with a $600 million net worth, and the ability to create generational wealth for his children.

CrunchBase, meanwhile, reports that of Magic Johnson Enterprises’ eight total investments, seven of them were considered “diversity investments.” That’s the highest percentage of “diversity investments” and “Black-owned and led” investments than any other celebrity investor on this list. Companies that he’s invested in that are Black-owned and led include Skurt, ShotTracker, and Jopwell.

Will Smith — Dreamers VC

As AfroTech previously reported, Will Smith is doing something a little bit different with his venture capital fund, Dreamers VC. The fund aims to connect Japanese corporate investors with early-stage U.S. startups. The official Dreamers site showcases its portfolio with brands like Travel Bank and Mellitus.

CrunchBase, meanwhile, reports that the fund has made 33 investments total, six of which are “diversity investments.” Those diverse companies include Genome Medical, Run The World, and Node.

Carmelo Anthony — Melo7 Tech Partners

While AfroTech has recently told you about Carmelo Anthony’s burgeoning rise in the Hollywood game, CrunchBase is reporting that “Melo” is also a rising star in the venture capital world. He’s the co-founder of Melo7 Tech Partners whose aim is to “invest in and develop opportunities primarily in early-stage digital media, consumer internet, and technology ventures.” Of the 36 companies that Melo7 Tech has invested in, 12 of them were “diversity investments.” Those companies include Andela and Walker & Company.

Nas — Queensbridge Venture Partners

As AfroTech previously reported, “Nasty Nas” has made a “Nice Net Worth” of $70 million thanks in no small part to his Queensbridge Venture Partners.

According to its CrunchBase profile, Queensbridge Venture Partners has invested in more than 120 companies, and more than 30 “diversity investments.”

One of the fund’s most public investments was in Pluto TV. Back in 2019, AfroTech reported that the free TV app was acquired by Viacom for a staggering $340 million. Queensbridge has also invested in the likes of Lyft, Casper, Genius, and Dropbox.

Tiger Woods — TGR Ventures

While Tiger Woods has been getting a lot of love from AfroTech on his 10,000-deep NFT collection, he’s also the founder of TGR Ventures. Its mission, according to its website, is to “unite its namesake’s ventures in a focused mindset, a precise method, and an ongoing pursuit of mastery.”