All results

Tiffany James is ensuring financial literacy will be accessible to Black women. As AfroTech previously told you, the 27-year-old is the founder of Modern Blk Girl (MBG). The digital platform was created to ensure minority women have a safe space to be themselves and learn about the stock market. For James creating MBG stemmed from her Caribbean upbringing in which financial literacy was nonexistent. It was not until the age of 21 that James became more conscious of how stocks could transform her ways of living. In fact, after investing in various stocks including Tesla she turned $10,000 into two million within three years. “If I had the knowledge I have now about financial literacy when I was younger, a lot of things could have been different for me. One experience that I went through is not having money for simple things like high school prom, senior trip, and a cap and gown but if I knew I could invest in Apple my junior or senior year I would have been fine,” James told...

While it may be faster for African businesses to trade goods with other partners outside of the continent, it also makes them more dependent on exports and prevents new markets from being created. To combat this, Ghanaian-based company Jetstream is proposing its own solution. Jetstream — which operates as a vertical broker between the fragmented and often-hidden segments of cross-border supply chains in Africa — uses technology in order to simplify the process of moving cargo across borders, per its company website. Today, its mission has become focused on “white labeling the systems built internally to manage shipments and financing for customers,” according to TechCrunch, and the startup just closed a $3 million seed round to continue this work. The outlet reports that the funding round included both local and international investors as participants, such as Alitheia IDF, Golden Palm Investments, 4DX Ventures, Lightspeed Venture Partners, Asia Pacific Land, Breyer Labs and MSA...

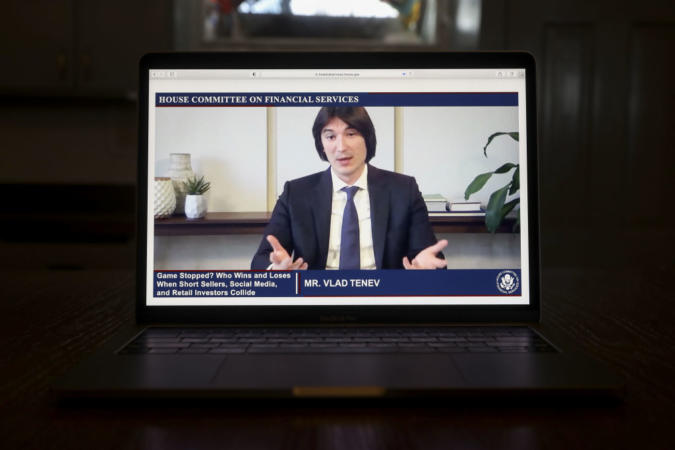

“Just answer yes or no,” California Rep. Maxine Waters repeatedly said in a recent hearing, “I’m reclaiming my time.” This was Waters’ mood the entire time she questioned Robinhood CEO Vlad Tenev during the “Game Stopped? Who Wins and Loses When Short Sellers, Social Media, and Retail Investors Collide,” virtual hearing on Thursday, Feb. 18. Tenev and a group of other CEOs and financial experts were called to testify before the U.S. House Committee on Financial Services following the events of the stock market frenzy on Jan. 25. That frenzy came after the Reddit group of young day-to-day traders called WallStreetBets caught wind of hedge fund short sellers in GameStop last month. When WallStreetBets shared its findings on Reddit, retail investors began grabbing GameStop stock up, driving its share price through the rough, and ultimately costing some hedge funds millions of dollars. Check out what Black millennials had to say about this debacle. Despite this being absolutely legal,...

According to the Selig Center for Economic Growth , the Black buying power was $1.4 trillion in 2019. However, that figure doesn’t translate into dollars that are put back or stay circulating continuously within Black communities versus others–causing a true generational economic crisis. But many are finding more ways to teach Black people financial literacy, investing, and for Tiffany James , her prized bull is the stock market and helping Black girls and women get their generational coins up. The global stock market is $85 trillion , which the United States market represents 40% of the overall figure. Unfortunately, the Federal Reserve reported that only 33.5% of Black households, hold any stocks versus white households which are at 61%. However, ModernBlkGirl was created to be a catalyst in shrinking the wealth gap by teaching stock market literacy–disproving that it was made for white men in wrinkly suits. James sat down with AfroTech to explain why now is the best time to learn...

Looking for new investment opportunities, have some disposable cash, and possess a healthy risk tolerance? Well, currency and currency derivatives trading may be a good fit for you. Investors, large and small, trade currencies and derivatives in a massive global marketplace known as the foreign exchange market (also known as forex or FX). To understand forex and the opportunities it may present for you, you need first to understand a bit about currency trading. Currency Trading Say you travel to Japan and need to pay for your food, hotel, and other items while there. You’ll need to exchange your dollars for Japanese yen at a ratio known as the exchange rate. Exchange rates change relative to one another due to central bank manipulation of interest rates, deficits in a country’s current accounts, national debt, and a host of other factors. Institutions and individual investors speculate on the variations in currency prices by buying (or selling) a currency pair — in this case,...

It’s never too early to learn the trades of the stock market, and this teen expert is living proof. Christon “The Truth” Jones — a 13-year-old investor and stock market prodigy — is a model example of what it means to invest in your future. He recently amassed $18,000 in just three days teaching adults how to get involved in stocks. View this post on Instagram A post shared by The Truth Jones (@thetruth2024) He was able to reach this goal after 36 people signed up for his online course on how to invest in the stock market, according to Black Business. His original goal was to teach 200 people and earn a profit of $100,000 total, but he was still satisfied with the rewarding outcome. “It was not even half, but it was still something,” said Jones, as reported by Black Business . “My mother encourages me to never limit myself so I am proud I made an effort. I’m disappointed the ads were rejected but I’m grateful I didn’t give up and utilized the resources I had.” Jones, according to...