Showing 16 results for:

JPMorgan Chase

Popular topics

All results

Editorial Note: Opinions and thoughts are the author’s own and not those of AFROTECH™. Billionaire business leaders turned against President Donald Trump as he implemented sweeping tariffs with other countries, which have amounted to billions of dollars lost. Many of the billionaires who have pushed back against the Trump tariffs have also endorsed him for the 2024 presidential election. One of those billionaires, Bill Ackman, warned against tariffs, likening them to an “economic nuclear war” in a post on X (formerly known as Twitter). He also claimed that the tariffs weren’t what he voted for, despite Trump speaking on tariffs early on in the election. How Will Tariffs Affect The American Consumer? Unwarranted tariffs will not only decimate our economy but also hurt our already fragile standing on the world stage. In retaliation, China has raised tariffs on American goods to 125%. Most business leaders, economic experts, and other world leaders are confused over Trump’s misguided...

COVID-19 spurred a seismic shift in buying behavior and fast-tracked years of change in the way companies across all sectors and regions do business. U.S. Commerce Department data reveals that consumer spending through non-store channels grew more than 30% in November 2020 when compared to November 2019 — the second-highest rate of any month since the agency began publishing data in 1992. In parallel, U.S. retailers experienced a boost of $152 billion in e-commerce sales in 2020. As consumers overwhelmingly shifted their spending toward online channels during the pandemic, business owners had to pivot more quickly than they ever imagined. At the same time, Black business owners found themselves disproportionately affected by pandemic-linked business impacts. A recent study conducted by the JPMorgan Chase Institute found that Black-owned businesses often experience lower revenues, smaller profit margins and more limited access to cash. Between February and April 2020, more than...

Historically Black Colleges and University (HBCU) students make the world go round! According to a press release, JPMorgan Chase & Co has partnered with the United Negro College Fund (UNCF) to create the J.P. Morgan Chase Wealth Management HBCU Scholarship. The move is intended to provide support for the Black community by providing them with the resources to achieve business, career, educational and personal financial success. “Systemic racism is a tragic part of America’s history,” said Jamie Dimon, the banking giant’s chairman, and CEO in a press release. “We can do more and do better to break down systems that have propagated racism and widespread economic inequality, especially for Black and Latinx people. It’s long past time that society addresses racial inequities in a more tangible, meaningful way.” Available to students who will be full-time college sophomores in the Fall 2021 semester, the scholarship opportunity is for students who are interested in the financial planning...

You could soon learn how to fly high thanks to United! The airline is the only major U.S. airline to own its own flight school and now the United Aviate Academy plans to train 5,000 new pilots by 2030 with at least 50% being women or people of color. According to PR Newswire, scholarship commitments from both United and JPMorgan Chase are on a mission to ensure that eligible applicants will not be turned away for financial reasons. “Over the next decade, United will train 5,000 pilots who will be guaranteed a job with United, after they complete the requirements of the Aviate program — and our plan is for half of them to be women and people of color,” said United CEO Scott Kirby in an official news release . “We’re excited that JPMorgan Chase has agreed to support our work to diversify our pilot ranks and create new opportunities for thousands of women and people of color who want to pursue a career in aviation.” View this post on Instagram A post shared by United (@united)...

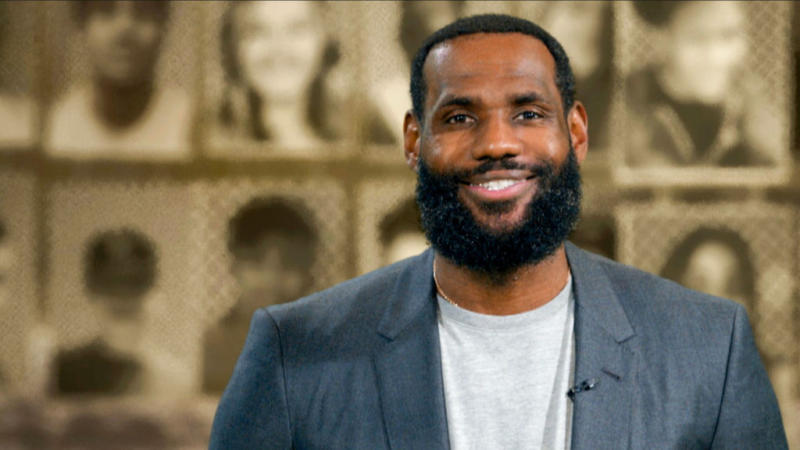

LeBron James gives back to his community continuously. Following the establishment of I Promise School, I Promise Village transitional housing, and other off-court initiatives, the LeBron James Family Foundation is now opening House Three Thirty, reports TIME. Announced this week, House Three Thirty is a 60,000-square-foot venue that will offer financial literacy advice, job training, and a variety of other services that the entire Akron community can utilize. “House 330 is going to be a sanctuary for our families,” said James of the venue — that will also include a dining space, coffee bar, private card room, and a museum dedicated to the NBA champion. “It’s going to be a place where all our families can grow and learn. This will be a hub for everything possible our families will need.” In addition to cool recreational amenities, students and families can receive training in areas like plumbing, heating and cooling, food service, merchandising, accounting, and event planning. The...

JPMorgan Chase & Co. is expanding its senior leadership team and adding more diversity in the process. According to a news release, the financial services giant named veteran executive Reggie Chambers as its new head of Investor Relations this week. He will replace JPMorgan Chase executive, Jason Scott, effective Jan. 1, 2021. Scott, who has led the company’s Investor Relations team since 2016, will be taking on a new role at JPMorgan Chase as head of Global Technology Finance. According to Black Enterprise, Chambers currently serves as the firm’s Chief Administrative Officer for Chase Consumer Banking where he oversees all branch innovation and operations for the Consumer Bank. This includes managing branch real estate, ATMs, branch innovation labs, and many other things. In his new role, he will report to JPMorgan Chase CFO Jennifer Piepszak while leading a team of employees responsible for maintaining relationships with investors and analysts, an announcement shares ....

New Voices Foundation is launching the New Voices Banking Bootcamp, a business banking educational program in partnership with JPMorgan Chase’s Advancing Black Pathways initiative, announced PRNewswire . According to the press release, the bootcamp is designed “to help women of color entrepreneurs establish strong business banking relationships and expand their access to capital.” Considering that entrepreneurs of color still struggle to raise venture funds and resources for business growth, this opportunity will help fill the gap through financial education. View this post on Instagram We are proud to announce the launch of our New Voices Banking Bootcamp sponsored by JPMorgan Chase & Co.’s Advancing Black Pathways! Over the course of three sessions in December 2020, this virtual Banking Bootcamp will provide 15 women of color entrepreneurs access to JPMorgan Chase & Co.’s bankers for programming on key topics, including establishing strong business banking relationships,...

JPMorgan Chase & Co. announced this week a $30 billion plan to advance racial equity and help remedy the country’s racial wealth gap over the next five years, as it relates mainly to underserved Black and Latinx communities, CNBC reports . According to CNBC , the bank’s pledge includes a combination of loans, investments, and philanthropy efforts that is expected to stretch beyond its normal course of business. The banking institution shared that barriers within the U.S.’ financial structures has generated profound racial inequalities that have been especially apparent amid the COVID-19 pandemic. JPMorgan Chase’s new commitment arrives to help drive more inclusive measures for the economy’s recovery efforts and eliminate systemic racism. “Systemic racism is a tragic part of America’s history,” said Jamie Dimon — Chairman and CEO, MDIs JPMorgan Chase & Co. — in a press statement . “We can do more and do better to break down systems that have propagated racism and widespread economic...

Magic Johnson’s EquiTrust Life Insurance company has teamed up with Carver Federal Savings Bank and MBE Partners to provide $225 million in Paycheck Protection Program (PPP) loans to minority and women-owned businesses, according to Black Enterprise . This is in addition to the combined $100 million in PPP loans that the corporations have provided during the coronavirus, bringing the total to $25 million in funds. These loans are for all nonprofits, religious organizations, minority, and women-owned businesses that were left out of the Small Business Administration funding. “These businesses are a vital part of our economy and essential to the economic growth necessary for recovery from the pandemic. We have a responsibility to ensure an equitable distribution of federally backed capital to minority-owned small businesses,” Chair of EquiTrust Life Insurance, Earvin “Magic” Johnson, said. The coronavirus pandemic has had a tremendous impact on business owners, especially those that...

This week, the Atlanta Hawks Basketball team and Chase Bank, of JPMorgan Chase, announced a partnership that will enrich the Atlanta area. The joint venture will provide financial initiatives for Atlanta’s many residents and offer resources for underserved communities. While the financial terms of the sponsorship have not been made available, the benefits to the Atlanta community are invaluable. Chase will partner with local nonprofits to provide community members with financial workshops and panels featuring Hawk legends, as well as offer small businesses opportunities for economic growth. In addition, Chase will stimulate Atlanta’s growing economy over the next three years by adding approximately 30 retail branches in the Atlanta area and generating 150 jobs for residents. Chase card members will receive early-purchase options for Atlanta Hawk games, and the team will prominently present Chase signage in its State Farm Arena. Nearly 500,000 people now reside in the Atlanta area ,...

JPMorgan Chase is teaming up with two Black-owned banks for the U.S. Department of Treasury’s Financial Agent Mentor-Protégé Program. The Harbor Bank of Maryland and Liberty Bank and Trust Co. will be mentored by JPMorgan to help the banks gain customers, create new business strategies, and accelerate growth within the company. The partnership comes at a time when Black-owned banks are struggling to stay alive facing operational and regulatory costs that are common strains for small banks. There are currently only 19 Black-owned banks in major cities across the country. With JPMorgan’s help, Harbor Bank of Maryland and Liberty Bank will have the chance to strengthen their presence and help their respective Black communities. Eva Robinson, Head of Treasury Services Public Sector Sales for North America, JPMorgan, said in a press release: “We’re excited about the opportunity to help black-owned community banks expand their capabilities through this program. This initiative is...

JPMorgan Chase will no longer fund private prisons. A spokesperson for the bank informed Reuters of the decision earlier this week. Immigration activists are applauding JP Morgan’s decision. Private prisons have served as detention centers for immigrants since the government’s increased effort to detain undocumented immigrants. According to the New York Times , two of the country’s largest private prison companies — CoreCivic and GEO Group — borrowed almost $2 billion from banks, JP Morgan Chase being one them. The Times also reports that 9 percent of the country’s prison population are in private prisons, and three-quarters of immigrant detainees are housed in private prisons. Last year, activists protested outside of JP Morgan CEO Jamie Dimon’s apartment, highlighting issues with private prisons. Similar protests have taken place for years and many financial analysts and activists have long questioned the ethics and profitability of private prisons. Changing government policies...

A new tech-focused organization created a program aimed at helping underrepresented entrepreneurs leverage the latest business technology to simplify their workflow and focus on growth. The Cincinnati-based NITRO! Bootcamp is designed to “power up” small owned businesses through business technology training including cloud storage, creative services, project management, and accounting. The training—made possible with a $100,000 grant from J.P. Morgan Chase & Co., Cintrifuse —is slated to take place during a one-day boot camp on February 23, 2019. “Startups or small businesses are so focused on running their business that they’re not even using some of the best technology out there,” said Maurice Coffey, a Procter & Gamble Co. executive who’s helping with Cintrifuse initiatives to WCPO Cincinnati. “We want to make them more efficient and enable them to expand their business reach.” Participants in the NITRO! Bootcamp , will get access to free tech-enabled products curated to help...

Uber drivers are earning less than half of what they made five years ago, while other sectors are doubling their earnings, according to a recent report from Recode. A study by JPMorgan Chase Institute showed that there was a 53 percent decline in earnings for transportation workers — which include ride-sharing drivers and delivery drivers for other gig economy jobs — between 2013 and 2017. The study distinguished gig economy jobs by transportation, non-transport work, and selling and leasing. JPMorgan Chase Institute looked at more than 39 million Chase checking accounts and tracked payments through 128 online platforms. The leasing sector, which includes Airbnb, saw the largest increase in earnings over the three-year span with 69 percent growth. The non-transport work and selling sectors experienced 1.9 and 9.4 percent increases, respectively. Photo: JPMorgan Chase Institute The average earnings for transportation workers dropped from $1,469 to $783. Leasing sector workers saw...