Showing 1059 results for:

credit

Popular topics

All results

Raleigh, NC -based St. Augustine University (SAU) has lost its appeal for accreditation and will enter a 90-day arbitration process. According to WTVD-11, SAU has been on probation with the Southern Association of Colleges and Schools Commission on Colleges (SACSCOC) for two years. In December 2023, the SACSCOC Board of Trustees voted to remove SAU from membership due to financial and governance issues. After a successful appeal, it was reinstated in July 2024 and remained effective through the end of the year. However, on Thursday, March 6, 2025, the Historically Black College and University announced that the appeal to keep its accreditation had ultimately been denied, per WDTV-11. The university stated that the 90-day arbitration process would ensure that all students graduating by May 2025 receive degrees from an accredited institution. “We have made substantial progress and are confident that our strengthened financial position and governance will ensure a positive outcome,”...

Lesa Milan, star of “The Real Housewives of Dubai,” credits Beyoncé as an inspiration for her fashion business success. In 2016, Milan launched her fashion brand Mina Roe, catering to pregnant women because she felt there was a lack of trendy maternity items on the market, notes WWD. “I love that Rihanna was out there with her bump, being sexy and bold because that’s what Mina Roe has always been about — celebrating your pregnancy rather than hiding it,” she told the outlet in 2022 . “You can still add that fashion twist and your own personal style to your bump. I think that’s the hole that we filled with Mina Roe.” View this post on Instagram A post shared by MINA ROE (@minaroe) Milan had ambitious goals for her brand from the start, launching it with the support of just one female employee. In an interview with radio station Hot 97, she shared how she initially reached out to entrepreneurs and celebrities, hoping they would wear Mina Roe. Ultimately, her breakthrough came through...

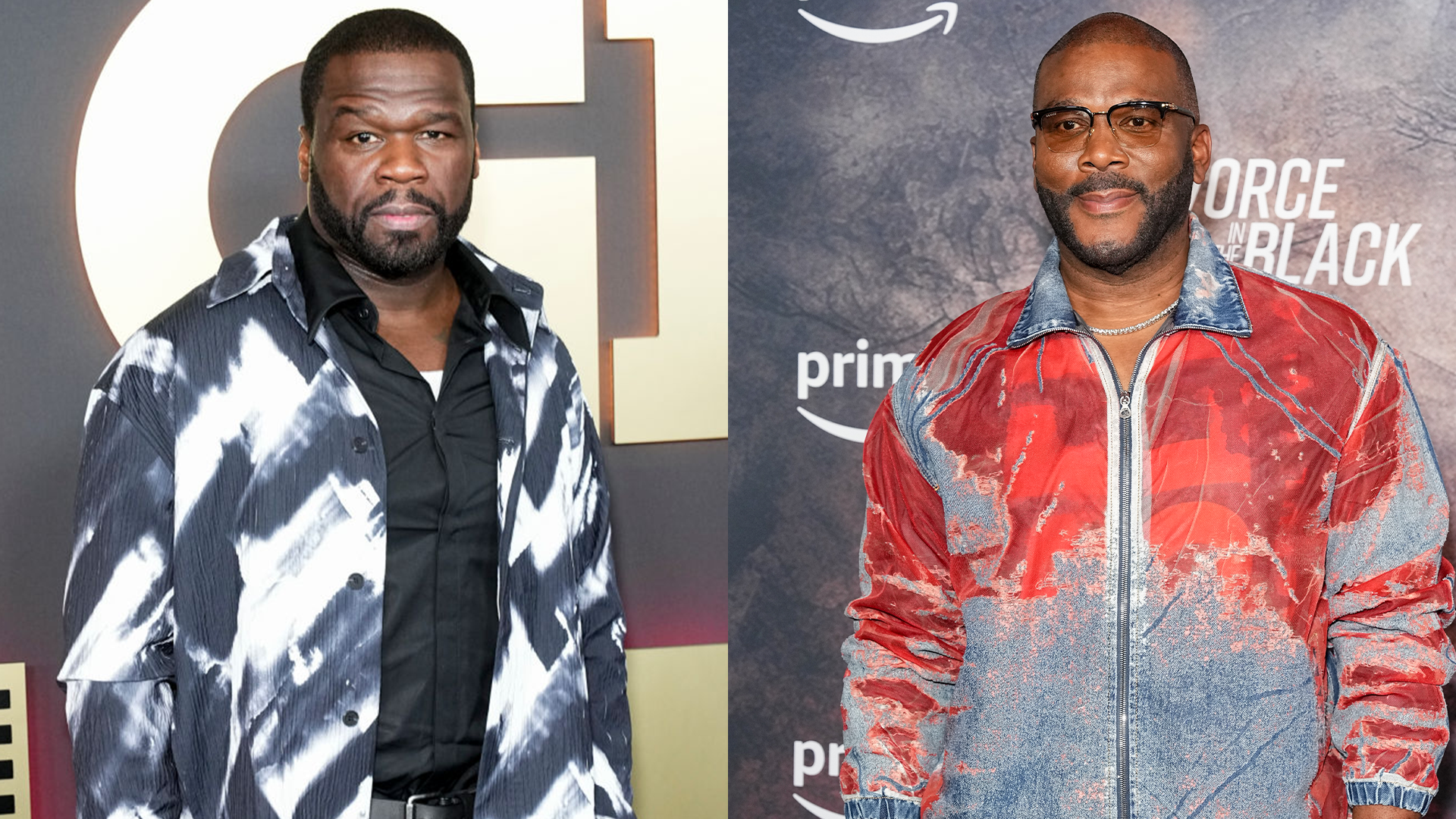

50 Cent has recently received technology advice from fellow studio owner Tyler Perry. In 2008, Perry, a self-made billionaire , made history when he opened the first major Black-owned film studio. The 330-acre studio, located at a former Confederate Army base in Atlanta, GA, features 12 sound stages that are available to rent. These are accompanied by various staged sets, such as baseball fields, a chapel, a bank, a county jail, a coffee shop, an oval office, and a theatre, among others, as AFROTECH™ previously mentioned. It’s no surprise that Perry’s recent projects, including “The Six Triple Eight,” “Beauty in Black,” and “All the Queen’s Men,” have been filmed at this groundbreaking facility. View this post on Instagram A post shared by Tyler Perry Studios (@tylerperrystudios) In 2024, Tyler Perry has been offering words of wisdom to rapper and entrepreneur 50 Cent, whose television empire continues to thrive. Since launching G-Unit Studios in Shreveport, LA, in April of this...

James Harden hit the jackpot thanks to an investment decision influenced by the late Kobe Bryant. During an interview on the “Earn Your Leisure” podcast, the basketball star revealed that Bryant suggested creating a pool of money dedicated to investments, including sports drink company BodyArmor. As previously reported by AFROTECH™ , Bryant had invested $6 million in BodyArmor back in 2014. “Kobe basically was like ‘W e going to put a stash of $5 million and then any like business opportunities — it might be as little as $200,000, it might be $500,000 just depending on what, you know, what investment it is. But we going to put a pot together and we just going to invest our money,’ rest in peace before he passed away,” Harden explained to “Earn Your Leisure” hosts Rashad Bilal and Troy Millings. “ But BodyArmor was the beginning of that, and we seen how it is.” While it is unclear what Harden’s direct contributions were, the investment into BodyArmor was a smart move. In 2021,...

Mathew Knowles was inspired to invest in a sports team due to a former Destiny’s Child member. On Saturday, Oct. 12, 2024, Knowles graced the Main Stage during the Building Wealth Today for Tomorrow (BWTT) Financial Empowerment Summit at the UIC Forum in Chicago, IL. The event promoted wealth-building among the Black community through workshops moderated by local financial experts and insightful discussions from panelists, including Keke Palmer, Larenz Tate, and Knowles, among others. Photo Credit: Building Wealth Today for Tomorrow “Building Wealth Today for Tomorrow is the largest financial education program of its kind,” Chicago’s City Treasurer Melissa Conyears Ervin explained in a statement shared with AFROTECH™ . “It brings together experts and leaders from businesses, community organizations, and city, state, and federal agencies to lead workshops and discussions that help Chicagoans build a more financially secure future.” Knowles shared insights into his family history —...

Investment firm partners Monique Idlett-Mosley and Erica Duignan Minnihan are level-headed in their approach to allocating capital to companies. Forming Reign Ventures The duo lead Reign Ventures, an early-stage investment fund targeting consumer technology and software startups led by women and minorities. Both founders, who met more than a decade ago during an executive MBA program, bring distinct experiences to their roles, which fall on opposite ends of the spectrum. Idlett-Mosley, co-founder and managing partner, brings 20 years of experience spanning entertainment, marketing, press, and entrepreneurship, and previously worked as CEO for Mosley Brands and Mosley Music Group. Minnihan, co-founder and general partner, has collected 15 years of experience as an investor and advisor. She began her career in investment banking with roles at Citigroup, Credit Suisse, and Cantor Fitzgerald. She later transitioned to venture capital as managing director at DreamIt Ventures, executive...

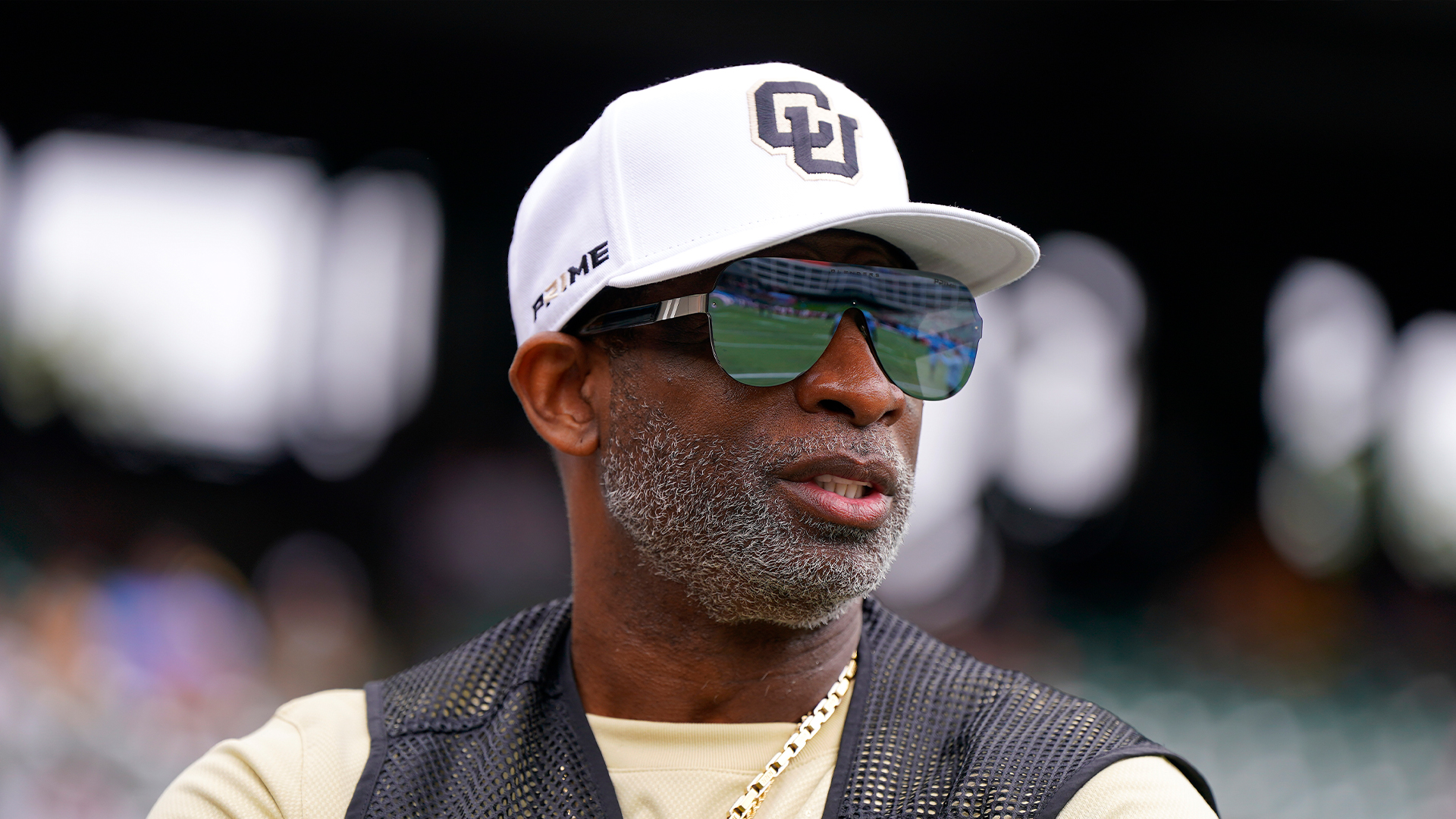

Deion Sanders cares about the financial future of his players. Sanders, the head coach of the University of Colorado’s Buffaloes Football, brought forward eight players who are parents during a meeting held Aug. 25, 2024, per The New York Times. “Want y’all to know, ain’t like you’re in trouble,” Sanders said, according to Sports Illustrated. “You ain’t done nothing wrong. Matter of fact, you did something right. And a child is not a mistake. A child is an opportunity to mature you, grow you, advance you, and give you some skills. Y’all know how I am about fathering.” He added, “You know I would not hire a coach unless he’s a great father. I don’t hire a coach that’s a deadbeat, I don’t hire a coach that’s not taking care of his responsibilities. I would never hire a man that he says he’s going to look after y’all but he won’t look after his. That don’t make sense to me.” After affirming the players, he shared, alongside the school’s name, image, and likeness (NIL) collective 5430...

Dwyane Wade has revealed who influenced his decision to invest in the WNBA. In 2023, the former NBA player, who was born in the “Windy City” and has three national championships to his name, decided to become an investor in the Chicago Sky when the team was valued at $85 million, a news release mentions. It was not revealed what size stake Wade purchased. The team is now worth $95 million, according to Sports Illustrated. Reflecting on Wade’s participation as an investor, Nadia Rawlinson, co-owner and operating chairman of the Chicago Sky commented,” Not only has Dwyane been an extraordinary talent on the court during his career, but even more so in his business and philanthropic endeavors after. We care a lot about the culture that we’ve built, and we want people around us that have the same outlook and values as we do, and he is definitely one of those people.” She added, “Dwyane is very much someone who can help us achieve those goals and even take them to another level. There...

What was supposed to be a big moment in one photographer’s life has turned into a tale of survivor’s remorse after he claims that Nike tricked him out of credit for a photo he captured of Michael Jordan that would go on to become the logo for the company’s Jordan Brand. In a new short documentary, “Jumpman,” Jacobus “Co” Rentmeester accuses the leading athletic company of copying his work to create the Jordan Brand logo that has graced a plethora of sneakers and clothing products for decades. Originally shot during a photo shoot commissioned by Life magazine for the 1984 U.S. Olympic team, Jordan was instructed to perform a grand jeté, which is “a classical ballet move where a dancer jumps and spreads their legs wide,” Fortune magazine reports. Today, the Jordan Brand is worth $6 billion. However, Rentmeester’s disdain comes from what he believes was negligence on Nike’s part to properly credit and compensate him for the role his photo may have played in inspiring the logo. View...

Former University of North Carolina (UNC) basketball player Armando Bacot is investing his earnings from name, image, and likeness (NIL) deals. During an interview on the “Run Your Race” podcast, Bacot said he earned “life-changing” money — more than $2 million — during his time at the university. He even opted to stay for a fifth season to reap the full benefits. Per On3, his deals have included Wingstop, Intuit TurboTax, and Topps. “That speaks on the brand of Carolina. If I didn’t go to Carolina, doing deals with TurboTax, all those people, they wouldn’t do it with me… If you go to Carolina, you handle business, you go out there and play, somewhat be marketable… it pays,” he explained. “I could never say a bad word about Carolina and everything ’cause I got life-changing money. I’m from Richmond. I got life-changing money in college just off playing basketball.” Bacot emphasized his gratitude to UNC, crediting his success to the college. He believes he would not have landed...

A conversation with Beyoncé inspired Megan Thee Stallion’s latest business venture. Launching A Tequila Brand In April 2024, Megan Thee Stallion, the rapper born Megan Jovon Ruth Pete, announced plans to launch her own tequila brand during Adweek’s Social Media Week (SMW). She will be part of the $2.5 trillion spirits industry, which will reportedly reach $5.7 trillion by 2032, per Fortune Business Insights. During Adweek’s SMW, Megan Thee Stallion also revealed that she was working on bringing new music. “I create the things that I want to see. I don’t create things for other people to like them,” she said, per Essence. “I create the music I want to hear, I go and do my own thing and stay true to me.” In May 2024, the “Savage” rapper embarked on the Hot Girl Summer arena tour featuring GloRilla. During the tour’s visit to Chicago, IL, Megan Thee Stallion gave fans an exclusive first taste of her tequila brand, per a May 19 Instagram post. She has yet to reveal other details about...

GloRilla had to take control of her spending after her first hit single took off. In 2022, the Memphis, TN-born artist, born Gloria Hallelujah Woods, found success with the release of her single “F.N.F. (Let’s Go),” produced by Hitkidd. ”It didn’t take the song long to blow up. It blew up in like three days,” she said during an interview on “The Shop” podcast. “So, I was just traveling the world like two days after I dropped that song ‘cause all the labels were calling me everywhere. So yeah, my life changed, changed right after I dropped that song.” Her newfound fame came with some learning curves, such as keeping her spending habits in check. During the interview, she notes that she shifted her mindset with spending when rap-artist-turned-music-executive Yo Gotti intervened and suggested she hire an accountant. “My first year I blew up, this was before I got an accountant. I was just spending money, and I’m like, ‘Okay, I’m getting it. I’m making it but I’m spending it too,'” she...

Hollywood Hair Bar Founder and CEO Tiffany Rose Dean hopes her story inspires Black woman entrepreneurs to chase their dreams on their terms. According to Hollywood Hair Bar’s website, the former celebrity fashion stylist created the haircare company to help people grow their hair with products made from natural ingredients. View this post on Instagram A post shared by Hollywood Hair Bar (@hollywoodhairbar) During Dean’s appearance on the “Earn Your Leisure” podcast, hosted by Rashad Bilal and Troy Millings, she recalled studying online marketing from 2008 to 2018 before officially launching her business. The entrepreneur also shared that she put in the work to get traffic to Hollywood Hair Bar’s website and ensured advertisements on the social media platform Facebook had all the data necessary to reach the target audience. After collaborating with a marketing agency, Dean says she saw more revenue come in. She claims on the podcast that the company went from making $50,000 a month...

Notable names in sports and music have gathered to make credit building more accessible to the masses. According to a press release shared with AFROTECH™, Tinashe, Quavo, Chris Paul, and Marshawn Lynch are among the investors who participated in Altro’s latest strategic funding round totaling $4 million. The round brings the credit-building and financial literacy platform’s total funding to $22 million. Altro, formerly known as Perch, was founded in 2019 by Michael Broughton. It allows users to strengthen their credit scores through “everyday payment and subscriptions” such as Netflix, Spotify, Amazon Prime, Starz, and more. Additionally, the company offers educational resources even to its baseline free membership model. Resources include Altro’s Convo, consisting of brief audio episodes discussing various cultural and financial subjects, and in-person and virtual networking events and opportunities. Prior, Altro was available in 10 U.S. states. In light of the star-studded round,...

Failure was never an option for filmmaker Tyler Perry. In conversation with Soledad O’Brien during a fireside chat hosted by QuickBooks and Mailchimp, Perry emphasized the importance of not frowning upon small beginnings. In his early days as a hungry creative in Atlanta, GA, he was homeless and living in his car, as AFROTECH mentioned previously. However, Perry never lost faith, and he credits hope as his constant driver toward success. “What I would say to anyone if it is your dream and it is your hope, it is that thing that you wake up with, and you go to bed with it, and you can’t shake it no matter what, that’s something that’s bigger than you… I was homeless,” Perry explained to O’Brien. He continued, “My mother said, ‘Leave them plays alone’…You ain’t never going make it.’ And this woman loved me with all of her heart, but she knew how difficult it was for me. But if it is your dream and that thing wakes you up and keeps reminding you, do not stop, don’t stop. I’m sitting...