When it comes to venture capital, it’s important to have people in the space who reflect the Black-owned businesses and founders they’re looking to help serve.

This commitment to serving underserved communities is vital because it allows firms like Clearlake Capital and New Enterprise Associates to use their funds for buying minority stakes in investment firms which in turn equips them with the capital they need to grow. Today, the market wants to use these same partnerships to expand into newer firms specifically with founders from diverse backgrounds.

Moves like this are designed for those firms seeking early-stage capital in order to build the necessary infrastructure for winning large pensions and endowments.

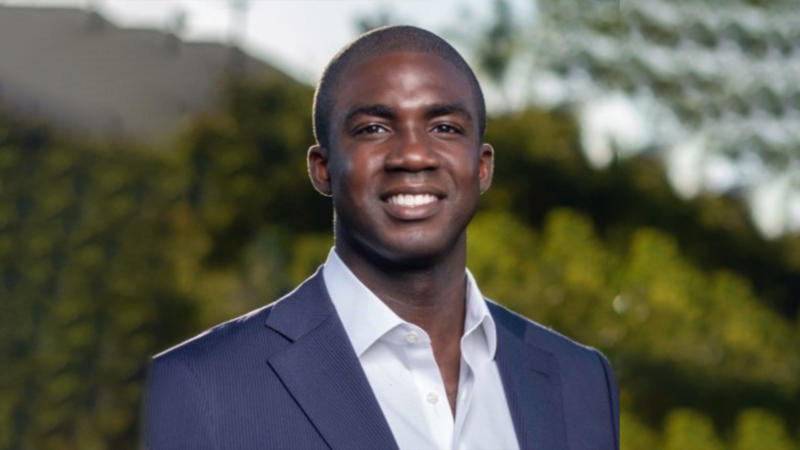

Wilshire Lane Capital — an early-stage capital firm led by Adam Demuyakor — announced that the company would sell a minority interest to Nile Capital Group this past Friday (August 13). Nile Capital Group is a firm that stakes general partnerships.

Demuyakor is a 32-year-old venture capitalist with experience in working at blue-chip firms, Andreessen Horowitz and Fifth Wall Ventures, founded by Willshire Lane in 2019 with a goal to invest in early-stage real estate technology companies. These are companies currently growing rapidly thanks to landlords who are repurposing retail and office assets into logistics, residential and self-storage space.

Fast-forward to today, Demuyakor uses his business connections to continue to drive diversity in the venture capitalist space. After meeting with billionaire, Feliciano, who co-heads Clearlake Capital, one of the private equity industry’s fastest-growing firms with $38 billion in assets under management, Demuyakor was inspired to begin institutionalizing Wilshire Lane. He then went on to work with the team to spearhead the company’s operations, distribution, and marketing strategies.

Today, Nile Capital has taken a minority position within Wilshire Lane.

“It’s a match made in heaven,” said Demuyakor in an interview with Forbes. “This will be instrumental in Wilshire Lane taking that next step and being able to raise more capital for the exciting property technology space. For me, now moving into building an institutional-focused firm, it’s helpful to have people around the table who have done it before.”

On the other hand, Nile Capital sees this as a chance for a huge leap in the real estate technology investing niche space.

“We are in a pretty dramatic shift in how people think about real estate,” said Lindsey. “With property-technology, as companies transition from being asset-heavy real estate owners to using data and technology to become more asset-light, there is a tremendous value being created. It’s why we think Wilshire Lane Capital is in such an exciting space.”

As the venture capitalist space continues to work to evolve, partnerships like this are vital to moving the diversity needle forward.