Showing 2 results for:

VC Firms

Popular topics

All results

A step has been taken toward more transparency in the VC space. On Oct. 8, 2023, California Governor Gavin Newsom signed Senate Bill 54, a law that mandates VC firms to release annual reports regarding the number of diverse founders they’re investing in — making it the inaugural law focused on increasing diversity in VC funding in the U.S. — TechCrunch reports.

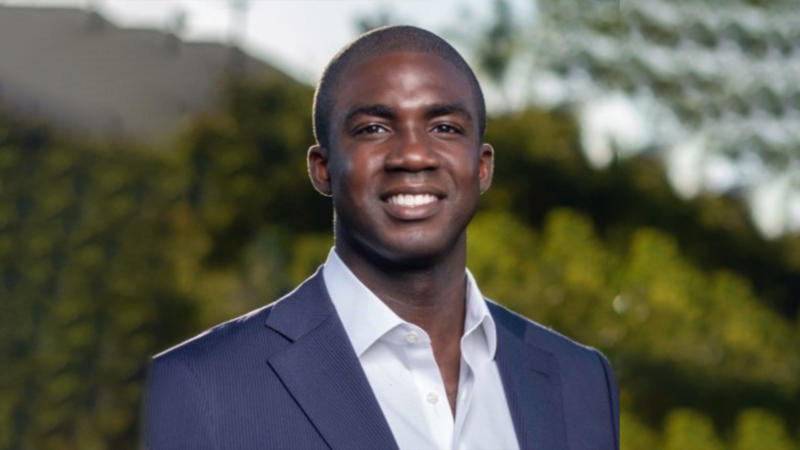

When it comes to venture capital, it’s important to have people in the space who reflect the Black-owned businesses and founders they’re looking to help serve. This commitment to serving underserved communities is vital because it allows firms like Clearlake Capital and New Enterprise Associates to use their funds for buying minority stakes in investment firms which in turn equips them with the capital they need to grow. Today, the market wants to use these same partnerships to expand into newer firms specifically with founders from diverse backgrounds. Moves like this are designed for those firms seeking early-stage capital in order to build the necessary infrastructure for winning large pensions and endowments. Wilshire Lane Capital — an early-stage capital firm led by Adam Demuyakor — announced that the company would sell a minority interest to Nile Capital Group this past Friday (August 13). Nile Capital Group is a firm that stakes general partnerships. Demuyakor is a...