All results

A step has been taken toward more transparency in the VC space. On Oct. 8, 2023, California Governor Gavin Newsom signed Senate Bill 54, a law that mandates VC firms to release annual reports regarding the number of diverse founders they’re investing in — making it the inaugural law focused on increasing diversity in VC funding in the U.S. — TechCrunch reports.

Black Thought is prepared to take his talents into venture capital (VC). In 1987, the rapper — whose real name is Tariq Trotter — formed The Roots band alongside Questlove in their hometown of Philadelphia, PA. According to HipHopDX, Black Thought has announced his role as a general partner at Impellent Ventures, a new fund that is centered around equity. He and the team aim to recruit and encourage other entrepreneurs as they begin their journeys to scaling and growing their new businesses. “I’ve been keeping an eye on the industry and looking for new ways to invest and diversify my portfolio,” said the 50-year-old emcee in an official statement. “I also get to see a lot of investment opportunities before anyone else does because of what my brand means to founders.” Excited to officially announce our newest partner here at Impellent… welcome @blackthought ! https://t.co/FZ0wVdzmvj — Impellent Ventures (@ImpellentVC) July 15, 2022

There’s more to diversity than meets the eye and vegan hair extension company, Rebundle is proof of that. However, what is just as important is the team that is willing to invest in the vision of Black founders, providing them with the tools needed to not only survive but also to thrive. M25 is the early-stage venture firm dedicated to supporting startups located in the Midwest, providing them with the tools needed to not only survive but thrive within an industry that was not built with them in mind. “Supporting women founders is important everywhere, regardless of the region, but I do think we have an amazing opportunity in regions like the Midwest,” said M25 VC Partner Mike Asem in an email interview with AfroTech. “As many point out that ecosystems like the Bay Area have matured whereas ecosystems like the Midwest are still emerging, maturing, etc. We have a unique opportunity to write diversity into our ecosystem’s entrepreneurial DNA better, and earlier, than more mature ones...

Equity Alliance, led by former Time Warner CEO Richard Parsons, has announced that it has closed a $28.6 million fund, which they say they will use to invest in other woman-led and minority-led funds. According to The Wall Street Journal, the “fund of funds” is aiming to provide both a professional network and a mentoring program for the funds it intends to back. “It’s easier to open doors,” Parsons said to the outlet. “What we have to figure out is how to take this favorable mentality that is existing and create mechanisms that enable us to deploy capital in a successful way, so we make a lasting change in the economic spectrum.” Equity Alliance notably invested in Esusu, a Black-owned fintech company. As AfroTech previously reported, Esusu reached a $1B valuation in January 2022, and they said they wouldn’t have been able to do it without the support of Equity Alliance. “It’s like chatting with people you know have your best interest at heart,” said Abbey Wemimo, Esusu’s...

Here’s why the traditional route isn’t always the best route! At 23-years-old, Dazayah Walker is one of the youngest female venture capitalists (VC) thanks to the impressive investment portfolio that she manages and maintains for one of Atlanta’s most prominent entertainment labels, Quality Control (QC). Founded in 2013 by Chief Executive Officer, Pierre “Pee” Thomas, and Chief Operations Officer, Kevin “Coach K” Lee, Quality Control Music is responsible for groundbreaking acts that include Migos, Lil Baby, City Girls, Lil Yachty, and a host of other trailblazers in the music industry. It has also since expanded its mission to sports with an extensive roster that includes NFL’s Alvin Kamara and D’Andre Swift.

Lendtable — a Black-led fintech startup — has raised an $18 million Series A funding round led by O1 Advisors with other participants including SoftBank’s SB Opportunity Fund , Valor Equity Partners, and the CEOs of Complex Networks and Social Finance, Inc (SoFi), Socii Capital and Streamlined Ventures. Founded in 2020 by former Dropbox product managers Mitchell Jones and Sheridan Clayborne, Lendtable offers cash advances to allow employees to take full advantage of their 401(k) match all at once without needing to use any of their own money. Once their money has been vested, the San Francisco-based startup takes a portion of the profit earned. Jones and Clayborne were inspired to solve the problem of underutilized 401(k) matching by their own families’ financial struggles. “I’m obsessed with trying to help people save and invest their money. I come from a lower-middle-income Black community in Dayton, Ohio,” Jones told AfroTech. While an undergraduate at Yale Unversity, Jones...

Last week, AfroTech reported that Byron Allen was poised to acquire Tegna in a deal worth $8 billion. Now, however, a new report reveals that the CEO of Allen Media Group has successfully raised $10 billion in a bid to acquire Tegna and engage in some debt management. Reuters is reporting that the deal Byron Allen has put together is backed by 14 banks and 10 investors, including Ares Management Corp, Fortress Investment Group, Oaktree Capital Management, and Michael Milken’s family office. “Ares is leading a $2.2 billion preferred equity investment in support of Allen’s financing package, another of the sources added. Tegna could choose a winning bidder as early as this month, the sources said,” reports the outlet. Byron Allen is said to be going up against investment firms Apollo Global Management Inc. and Standard General LP, but Allen is still poised to be the favorite winner, according to the report. However, New York Post reports that prior to Byron Allen raising the money...

The world may refuse to pay attention to Black founders, but here at AfroTech, we’re always looking for ways to help others launch that next big idea, and Maisha Leek has the same mind. During this week’s episode of Black Tech Green Money, Maisha Leek joined host Will Lucas to discuss her work at the time as a partner at Human Ventures, a New York City-based venture capital firm and startup studio. As someone who operates in her gift, Leek has a spot for helping startups work through their business strategy along with opportunities and operations. Her work has included helping corporate innovation teams build entrepreneurial and residence programs as well as identifying founders that align with their respective investment thesis. “I emphasize the ‘C’ in capitalist and just so I am clear, I care about the world, but I am a capitalist,” she explained. “I don’t like to align myself with these people because even if they’re icons of American history, they also did terrible things to...

There’s so much power that comes from building within the community, and Ita Ekpoudom knows her role in being the change the world needs. As a partner at Gingerbread Capital, it is Ekpoudom’s mission to educate, engage and elevate the next generation of successful women leaders in business. For the latest episode of AfroTech’s Black Tech Green Money, Will Lucas takes on New York to learn more about the venture capital (VC ) that emerges from the city of dreams along with input from Ekpoudom on how to become a successful venture capitalist. During the episode, Ekpoudom explained the two aspects that can lead folks on the right path to securing that dream VC role. “There’s kind of two main ways,” she explained. “You come in from finance with either an investment banking or consulting background or as an ex-operator and entrepreneur, which would then allow you to move over from the perspective of having been an operator.” She also shared the background that led her on this journey as a...

When it comes to venture capital, it’s important to have people in the space who reflect the Black-owned businesses and founders they’re looking to help serve. This commitment to serving underserved communities is vital because it allows firms like Clearlake Capital and New Enterprise Associates to use their funds for buying minority stakes in investment firms which in turn equips them with the capital they need to grow. Today, the market wants to use these same partnerships to expand into newer firms specifically with founders from diverse backgrounds. Moves like this are designed for those firms seeking early-stage capital in order to build the necessary infrastructure for winning large pensions and endowments. Wilshire Lane Capital — an early-stage capital firm led by Adam Demuyakor — announced that the company would sell a minority interest to Nile Capital Group this past Friday (August 13). Nile Capital Group is a firm that stakes general partnerships. Demuyakor is a...

Upsie, a consumer warranty startup led by Clarence Bethea, has raised $18.2 million in a Series A round led by True Ventures, according to a press release. The St. Paul, MN-based startup’s mission is to provide affordable and reliable warranties for electronic devices. Other notable Venture Capital (VC) firms and angel investors also participated in the round, including Concrete Rose VC, Avanta Ventures (CSAA Insurance Group, a AAA insurer), Kapor Capital, Samsung Next, Massive, Backstage Capital, Awesome People Ventures, Imagination Capital, Uncommon VC, Marc Belton, Daren Cotter (Founder and CEO of InboxDollars), George Azih (Founder and CEO of LeaseQuery), Richard Parsons, and several others. Upsie was born out of frustration with the expensive warranties consumers are often offered with their electronic device purchases. “Oftentimes when you walk into that big box store, they’re charging you so much money. They’re charging as high as 900% more than they should,” Bethea explained...

Diversity and inclusivity have been trending since protests against systemic racism reached fever pitch this summer. As many companies scrambled to prove their support of Black lives, other entities have continued to shutout Black creativity, ideas, and wealth. Ahead of the new year, The Startup Pill reported on Silicon Valley’s top 25 venture capital firms least likely to invest in founders of color. The information is compiled of data from The Black Founders List, which serves as a running historical record of Black founders and the investors who invested in them. The list names well-known firms that have less than five Black-led investments while boasting thousands of investments and billions in revenue. The Startup Pill says that only one percent of venture-backed companies are led by Black founders. “On a macro level, the lack of diversity in the industry is a problem because it means most of the money flows to types of founders VCs understand — businesses with white men of a...

As of Aug. 31, a total of $87.3 billion in venture capital has gone to founders so far in 2020. However, Black and Latinx founders have received just 2.6 percent of that funding. According to CNBC, a new report from Crunchbase confirms the Black founders are still struggling to raise money for their innovative ideas. Released on Oct. 7, the reports gathered data from over 970 Black and Latinx-founded companies that have raised VC funding since 2015. The report also highlights data from the nonprofit organization BLCK VC that shows 81 percent of all VC firms don’t have a single Black investor. “I think it’s pretty shocking,” Crunchbase data evangelist Gene Teare said. “Hopefully for the industry, this is a wake-up call.” Teare cites racial bias and discrimination within the venture capital space for the rejection founders experience early in the fundraising process. “That early funding is all about you as a founder, your network, and your credibility,” she said. However, with limited...

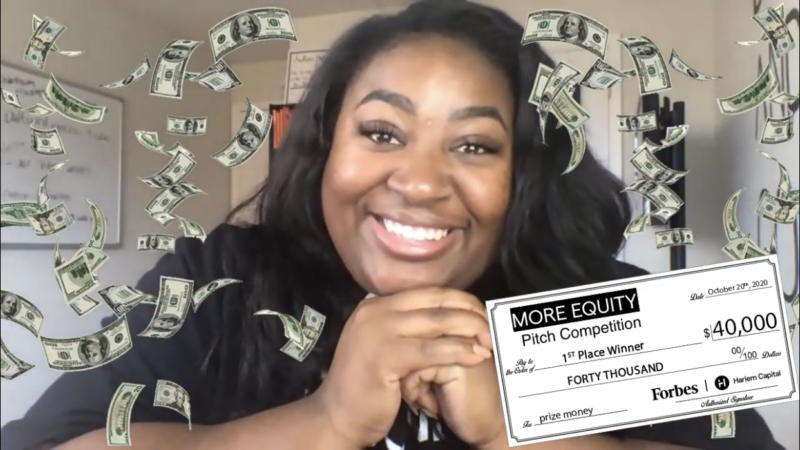

Harlem Capital — the New York-based early-stage venture capital firm — is on a mission to nurture the growing field of entrepreneurship by offering plentiful business opportunities to BIPOC and women founders. In an effort to continue their strong commitment to diverse businessmen and women in the U.S., they partnered with Forbes this year to host their first-ever MORE EQUITY Pitch Competition . View this post on Instagram A post shared by Harlem Capital (@harlemcapital) Along with the support of TPG, Grasshopper Bank, M12, Lerer Hippeau, RSM, and Techstars, Harlem Capital brought together notable investors and celebrities to help celebrate the slew of recognized founders from emerging startups at this year’s competition. To further invest in these founders’ business models, Harlem Capital nominated finalists to compete for $50,000 to have their company pitches considered by special guest judges Jewel Burks Solomon, Jenny Fielding, and Lolita Taub, with Founder Gym CEO Mandela SH...