Minnesota just got its first Black-owned bank, and it’s nestled in the twin cities.

Specifically located in Minneapolis, Detroit-based First Independence Bank opened its first location outside of Michigan and the new site is the first of two that will be in Minneapolis.

New Location. New Opportunities.

The current location opened on April 26 in southeast Minneapolis, and a second branch is scheduled to open sometime in June 2022, according to Finurah News.

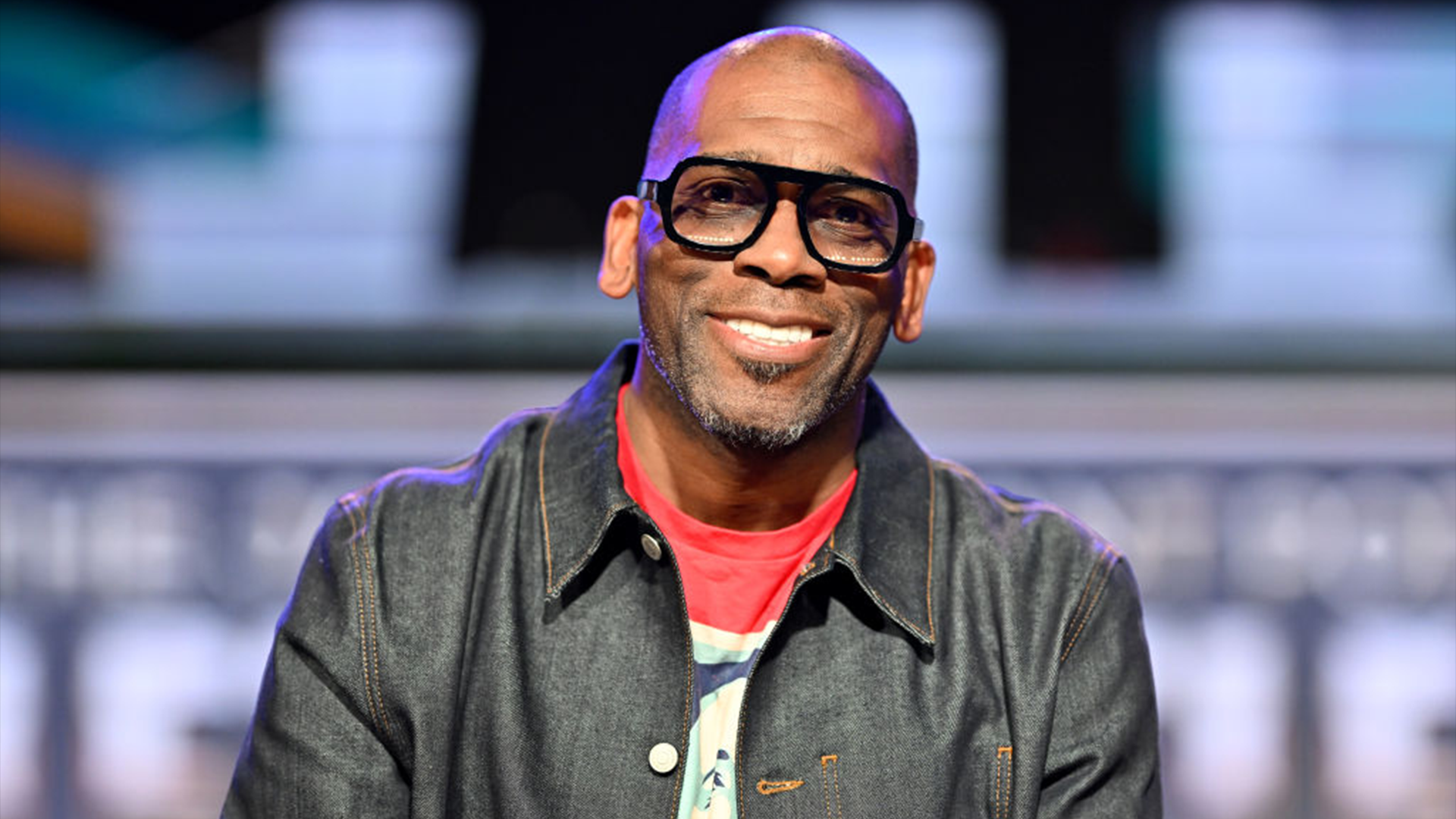

Damon Jenkins, a Minneapolis native, will head up the new First Independence branch slated on the city’s southeast side.

“I grew up on the south side; I am product of that,” Damon Jenkins, senior vice president and Twin Cities regional market president of First Independence Bank, told local Minnesota news channel – KSTP. “Selfishly, I wanted to be in a seat of influence to help people who look like me.”

“This is a real opportunity to really say how do we think different. It really gives us a chance to serve different and really bring access to communities that have been cut out of banking, but cut out of resources for some time,” Jenkins explained.

Community First

Founded in 1864, First Independence is the seventh-largest Black-owned bank in the United States. First Independence successfully applied for FDCI approval to expand and leveraged the assistance of five major financial institutions — Bremer Bank, Huntington Bank, Bank of America, U.S. Bank, and Wells Fargo.

“That’s what makes this such a historic thing because it’s not the flavor of the day,” Jenkins said. “If it’s an opportunity to think different, let’s look at that. If it’s an opportunity to bank different, let’s look at that because that’s the true way we’re going to give people access and power their potential so they can tap into this journey of generational wealth as well.”

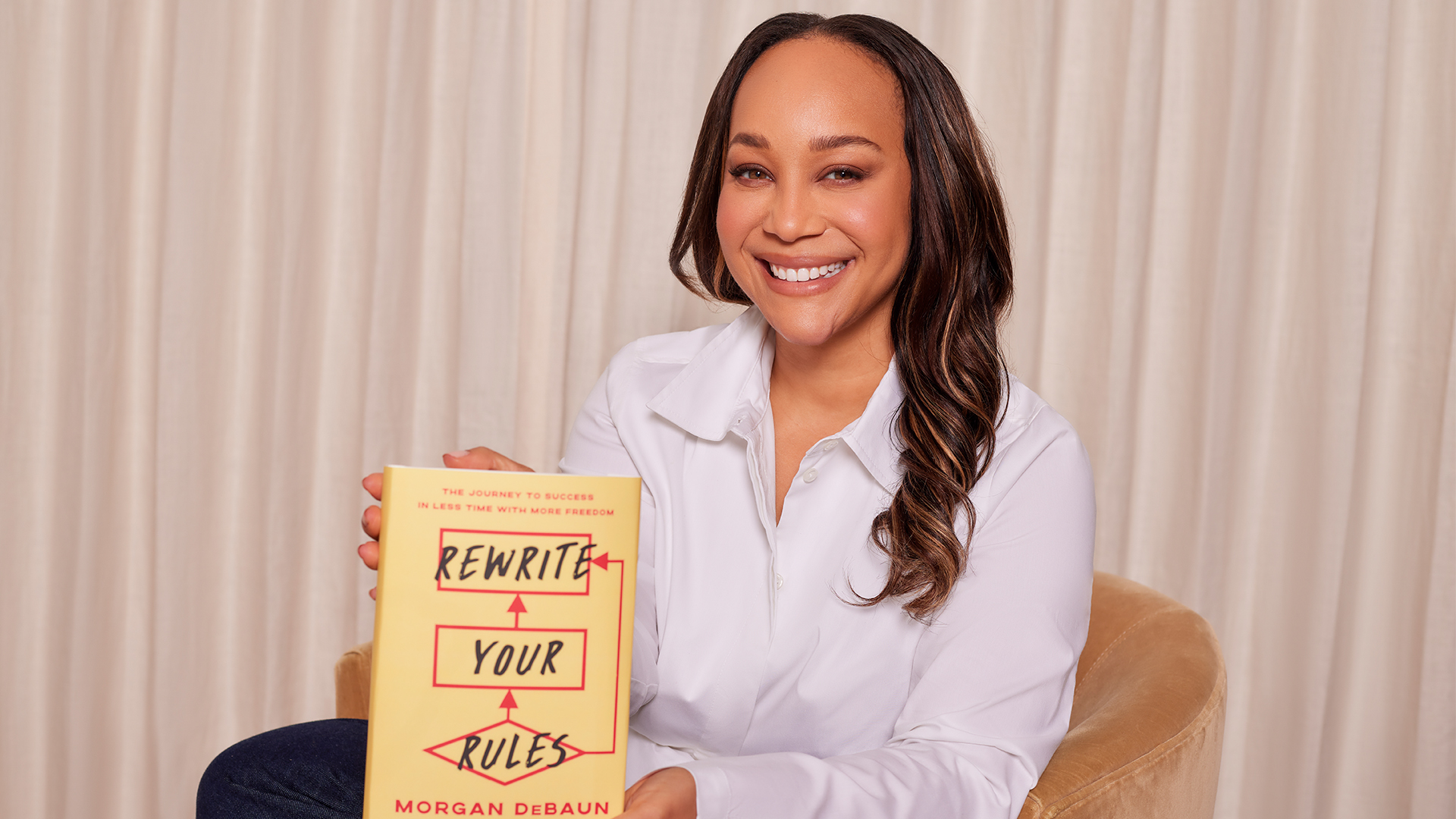

First Independence will partner with local businesses and nonprofit organizations to offer free financial literacy training and credit repair services as part of its ongoing programming.

The bank partners with local businesses and non-profits to provide complimentary financial literacy training and credit restoration services.