The financial struggles and needs facing Black and brown Americans have significantly increased in the wake of COVID-19. Outside of health concerns, financial shocks have altered life and our economy as we know it.

In an April survey conducted by the Pew Research Center, 73 percent of Black adults and 70 percent of Hispanic adults said they did not have emergency funds to cover three months of expenses. In turn, it made it even more difficult to pay their monthly bills.

To help alleviate the financial burdens of Black and brown Americans, Black-owned fintech company MoCaFi has announced the launch of an upgraded banking platform with “features and services designed to address financial inequality in Black, Hispanic, and historically disenfranchised communities,” a press release said.

MoCaFi — which stands for Mobility Capital Finance, Inc. — serves American residents who exist between the economic margins as either unbanked or underbanked.

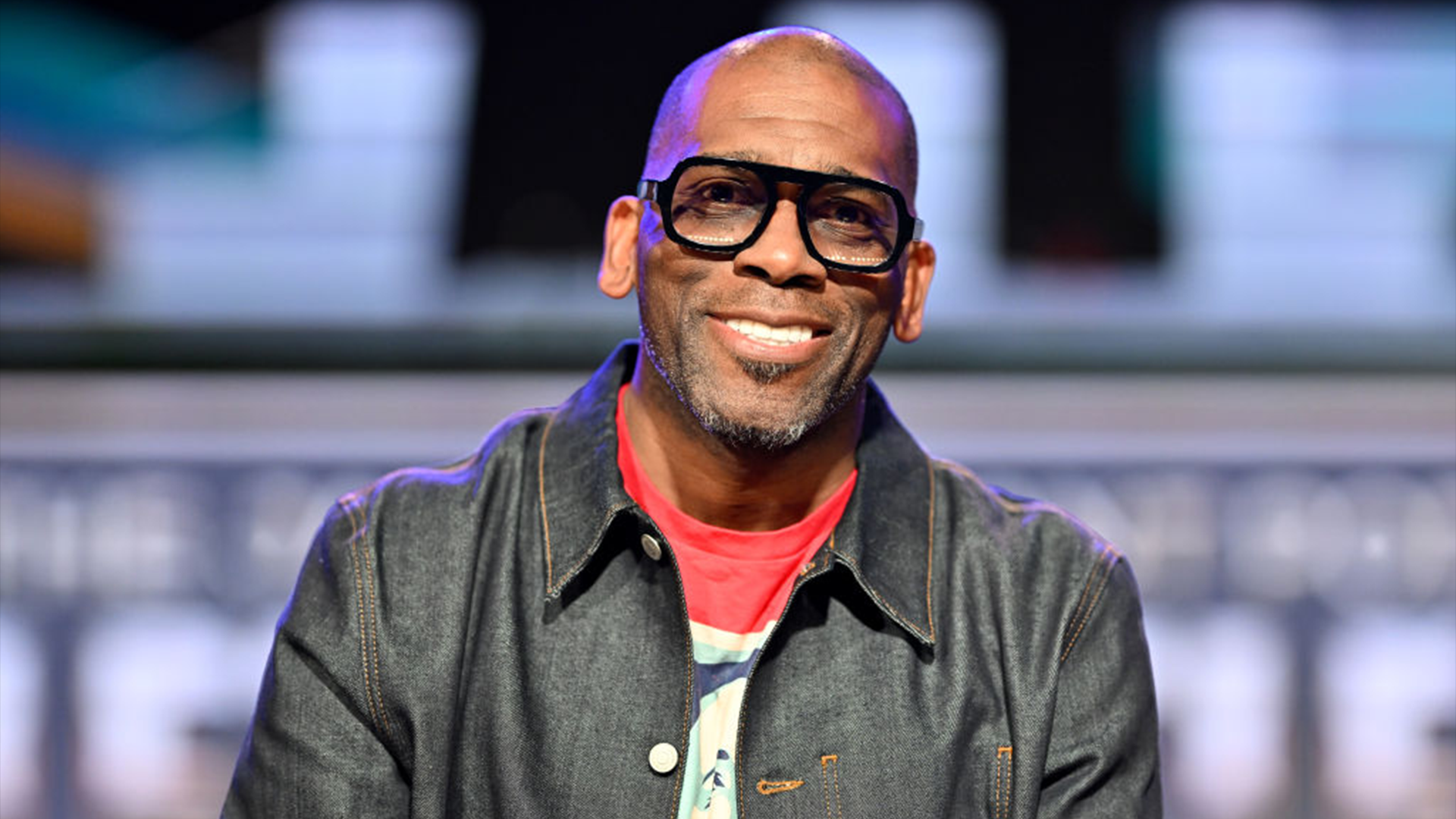

Founder and CEO Wole Coaxum said in a press statement:

“MoCaFi is revolutionizing financial services for communities of color in the United States. While the nation has not had a chance to fully assess the economic impact of the pandemic, we do know that many Americans, especially those in communities of color, have experienced job loss and depletion of emergency resources and savings. As the nation tries to reestablish itself, many of those affected by the economic shift will have to re-examine the ways in which their financial needs are met. We already know that Blacks and Hispanics spend at least 50% more on banking services than their white counterparts. MoCaFi is addressing structural failures in our financial system by reimagining services that ensure that all Americans have access to safe, secure, affordable, and convenient products and services.”

In addition to the new upgrade, MoCaFi also introduced the MoCaFi Mobility Debit Mastercard which provides access to no-charge ATM withdrawals and options on how to load funds. The debit card also includes Tap & Go® contactless payments, mobile wallet functionality, and advanced security features such as Mastercard ID Theft Protection™, according to a press release.

MoCaFi is both a catalyst for improved banking for disenfranchised communities in the U.S. and creating a vision for what true financial support looks like.

“MoCaFi is disrupting a space and is taking it so many steps further than just banking,” said Will Roundtree, Investor and Credit Strategist in a statement. “I am proud to be able to say that I get to partner with someone whose vision for communities is being actively made possible by Wole’s [Coaxum] genius in this space.”

For more information on MoCaFi, visit their website.