Black Americans were short-changed amidst a promising time for refinancing home loans.

According to Bloomberg’s analysis of federal mortgage data, Wells Fargo rejected nearly half of Black applicants who were looking to refinance their homes. Worsening matters, the banking giant approved applications for more lower-income white applications than the highest-earning Black applicants.

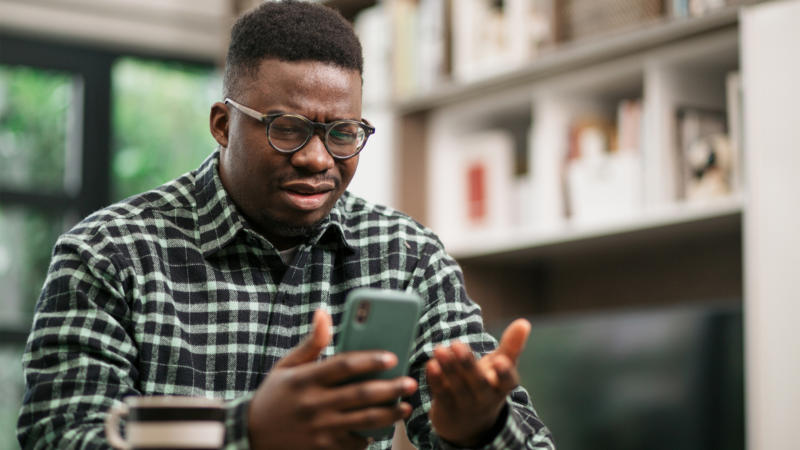

Engineer Mauise Ricard III experienced Wells Fargo’s rejection firsthand after paying $560.43 to refinance his home in the suburbs of Atlanta. Richard was married to a doctor and had a credit score boasting over 800. The loan officer affirmed he could qualify for a fast-track appraisal. Yet, what should have been a clear green light turned into a string of issues.

Bloomberg reports, Richard’s former home was in a predominantly Black neighborhood and he was told by the loan officer “perhaps the area is not eligible” for fast-track appraisal. Later, the loan officer told Richard his rate would increase by 4.5 percent, and eventually, Wells Fargo chose to reject the application.

“They kept moving the needle,” Ricard says, according to Bloomberg. “They didn’t want to move forward for whatever reason.”

Richard’s reality is just one of many. According to Bloomberg, only 47 percent of Black owners were approved for a refinancing application in comparison to 72 percent of white owners in 2020. In addition, Wells Fargo was the leading contender for rejecting Black applicants in comparison to other bank giants.

Wells Fargo Will Push For 250,000 New Black Home Buyers

Wells Fargo did not refute Bloomberg’s 2020 report and they claim to be more intentional in comparison to other lenders, stating all applicants are treated equally. Instead, the bank said the issue was caused by “additional, legitimate, credit-related factors.” Regardless of Wells Fargo’s stance, it is clear that there need to be changes made.

Head of Wells Fargo Home Lending Kristy Fercho states the company will help those in Black communities who feel wary in regards to discriminatory practices by a lender.

On the other hand, Wells Fargo distributed $50 million to 13 Black-owned banks in 2021 to increase Black home buyers, which they hope reaches 250,000 by 2027. Wells Fargo is also considering rental payments as a deciding factor for its lending practices.

“We have to get creative as an industry around how do we level the playing field and create some equity,” Fercho says, according to Bloomberg.