Showing 31 results for:

small businesses

Popular topics

All results

The Russell Innovation Center for Entrepreneurs (RICE), dedicated to expanding opportunities for Black entrepreneurs in Atlanta, GA, and beyond, has received a $2 million donation from The Arthur M. Blank Family Foundation. According to a news release, Blank’s donation will help the center move forward with RICE 2.0, a hub for innovation, collaboration, and economic empowerment that will provide essential resources for Black business founders, including small business grants, expanded programming, and mentorship opportunities. “This investment reflects our chairman’s entrepreneurial journey and his commitment to giving back to Atlanta, a city that has given him so much,” Blank Foundation President Fay Twersky said. “RICE’s extraordinary work supporting entrepreneurs creates pathways to economic mobility and opportunity. By investing in entrepreneurs at all stages, we’re fostering collective thriving where individual success strengthens entire communities.” In 1978, Arthur Blank...

Vice President Kamala Harris proposed a substantial increase in the tax deduction for startup expenses, raising the allowable deduction for new small businesses from $5,000 to $50,000. The Democratic presidential nominee announced the proposal during a speech in New Hampshire on Sept. 4 as part of her broader economic plan to make tax filing “cheaper and easier” for businesses, Forbes reported . “As President, one of my highest priorities will be to strengthen America’s small businesses,” Harris said, according to CBS News . “We’re going to help more small businesses, and innovators get off the ground.” New startups could either use the full $50,000 deduction in one year or spread it across multiple years as they become profitable. They also have the option to use the $5,000 deduction and spread the remaining startup costs over 15 years. The proposal aims to ease the financial burden of starting a business, covering costs such as advertising, employee training, consultant and...

Comcast RISE is staying true to its acronym of “representation, investment, strength, and empowerment.” Congratulations to the TechTown alumni in Detroit, Hamtramck and Highland Park who were each awarded a $10,000 grant from the #ComcastRISE Investment Fund! 👏 View the full list of #Detroit grantees and learn more about the program: https://t.co/SawuLMQdqP pic.twitter.com/kjoq4BPmxE — TechTown Detroit (@techtowndetroit) July 29, 2022

The NAACP, VistaPrint, and the Boston Celtics Shamrock Foundation announced the second cohort of recipients from the Power Forward Small Business Grant. This shared commitment of $1 million was designed to create a lasting impact through the economic empowerment of Black-owned small businesses across New England. Featuring grants of $25,000 and the opportunity to be featured on national co-branded platforms, recipients also receive design and marketing assistance customized to their specific needs. The second group of grant recipients consists of 13 small businesses from the Boston metropolitan area, Western Massachusetts, Rhode Island, and Connecticut representing a variety of industries including health and wellness, fashion, food service, journalism, and consulting, among others. Recipients of the Power Forward Small Business Grant were notified with a mix of surprise in-person and virtual visits from Celtics players Aaron Nesmith and Grant Williams; Head Coach, Ime Udoka,...

Kevin Hart can now add “Shark” to his ever-growing resumé. Yahoo reports that the actor, comedian, and businessman on the rise appeared on the Jan. 7 episode of “Shark Tank,” the hit ABC series that gives once-in-a-lifetime opportunities to small businesses looking for an investor to grow their businesses. The outlet confirms that Hart was filling in for longtime Sharks Daymond John and Robert Herjavec. He also endured some ribbing from fellow Shark Kevin O’Leary, who claimed that Kevin Hart was a “rookie” when it came to investing. (Despite O’Leary’s snark, Hart is far from a “rookie” when it comes to investing. According to Crunchbase, he’s made 10 investments as an individual investor, and he’s also a brand partner with Fabletics Men). Ignorant jokes aside, Hart explained on the show that he created HartBeat Ventures — an investment offshoot of his HartBeat Productions — to create what he called “financial inclusion” opportunities. HartBeat Ventures has already partnered with...

Meta is remaining committed to uplifting and supporting Black-owned businesses. In the first-ever Meta Elevate HBCU Hackathon, the company had an event that allowed computer science and engineering students to get hands-on experience working side by side with Meta engineers and employees as they take care of real-world problems faced by Black-owned businesses. “Black-owned small businesses have been disproportionately affected by the pandemic with higher closure rates and lost sales,” said Irene Walker, Meta Elevate Program Director, in an interview with AfroTech. “In an effort to help solve the problems these businesses are facing, we’re excited to kick off the Meta Elevate HBCU Hackathon. We’re excited to partner with HBCUs to provide an opportunity for students to join us in creating solutions to support Black-owned small businesses.”

A$AP Ferg is giving back to the unsung heroes of New York City by spotlighting local mom-and-pop corner stores. According to Variety, the Hip-Hop star took note of how the COVID-19 pandemic was affecting the plight of the city’s independent corner stores, so he teamed up with Snapple to develop a merchandise line and raise money for them. Funds raised from the partnership will reportedly go toward the Bodega and Small Business Group (BSBG) — a Hispanic organization that helps support small business and bodega owners located in New York. “As a native New Yorker on the pulse of music and art, A$AP Ferg was the perfect creator to collaborate with on this initiative,” Katie Webb — Keurig Dr Pepper’s vice president of brand marketing — shared with Variety. “It’s an authentic partnership that gives back to Snapple’s roots and highlights the enduring culture of New York City.” In addition to raising money, BroBible reports that Ferg also worked alongside Snapple and director Shomi Patwary...

Visa is piloting its Tap to Phone technology in Washington, D.C., with hopes of aiding in the close of the digital divide for small Black-owned businesses and communities. This is the first time the multinational financial services corporation is bringing its new tech to the U.S. after piloting it in 30 other countries, Visa shared in a press release. Visa is also looking to provide resources and education through Visa Street Teams , an initiative it created to digitally-enable 50 million small businesses. Following this launch in D.C., Visa will be taking its tech to Atlanta, Chicago, Detroit, Los Angeles and Miami as part of its small business revitalization initiative. “The way we shop and pay has forever changed. During the pandemic, tapping to pay and contactless checkout became more commonplace – and are now expected,“ Mary Kay Bowman, Visa’s global head of buyer, seller, core and platform products, said in a press release. “With our technology, networking and community...

TD Bank is rolling out a new initiative to further support Black and brown business owners in America. Today, the national bank announced the establishment of its new $100 million equity fund to provide financial resources to small minority-owned businesses. This comes as part of its continued commitment to address racial inequities and support underserved communities of color. TD Bank’s equity fund allows Specialized Small Business Investment Companies (SSBICs) — which provide financial assistance to disadvantaged or minority-owned businesses — and Community Development Financial Institutions (CDFIs) — known for helping Black and Latinx-owned businesses secure financing — to offer up small business loans and technical assistance to ensure that these businesses have the tools they need to scale effectively. “We hope that our investment in these SSBICs and CDFIs serves as a means of making access to capital more equitable for minority small business owners. But our support doesn’t...

Tennis icon and business-owner Serena Williams has pledged her support for the Opportunity Fund by committing to donate a portion of the proceeds from her Serena Williams Jewelry Unstoppable collection to benefit its Small Business Relief Fund — which directly supports Black small-business owners. A press release reports that Williams will continue this commitment through the month of February. “This February, we’re honoring Black History Month by donating a portion of proceeds from every purchase to Opportunity Fund’s Small Business Relief Fund that provides support directly to Black small-business owners,” an Instagram caption reads. As the nation’s leading nonprofit business lender, the Opportunity Fund has made it its mission to support “diverse, resilient entrepreneurs through these challenging times.” By offering up microloans to Black small business-owners, the Opportunity Fund is able to help build their credit and grow. View this post on Instagram A post shared by...

Last year, small Black-owned and minority-owned businesses were reported as being denied access to PPP funding to help keep their businesses afloat. In an effort to change that, Black-run website BlackBusiness.com and a reputable community lender have partnered together to launch PPPLoans.com — a new initiative to specifically help more Black-owned businesses apply for and qualify for these business funds, Black Enterprise reports. According to Black News, the Paycheck Protection Program has officially reopened with more than $280 billion in funding, and will initially only be available to community financial institutions that offer this capital access to small businesses in underserved and underprivileged communities. Several initiatives have already been put in place to ensure Black and other minority business owners get a fair chance to secure these loans who couldn’t during the previous rounds of PPP lending or weren’t able to apply. In addition to launching this platform,...

Founders Valentine Osakwe and Zerryn Gines took advantage of free resources made available through the tech company coalition, Tech For Black Founders (T4BF) initiative . Now, they’re paying it forward to save small businesses. According to Forbes , Osakwe, 26, and Gines, 21, recently launched a mobile version of Peep Connect , a customer insight and analytics platform for small businesses that they founded in January. https://www.instagram.com/p/CEprH1ppwdT/ To overcome the financial setbacks they faced after the pandemic hit, the duo sought free technology and services by T4BF, whom they credit for the launch of their new business venture. “Just for an analytics feature, we were looking at paying a couple thousand dollars a month,” Gines said. “Now Foursquare is providing us tools, free for a year. It put us in a position to be six to eight months ahead of where we would have been without them.” Executives and founders of Amplitude, Branch, Braze, mParticle, Radar, and other tech...

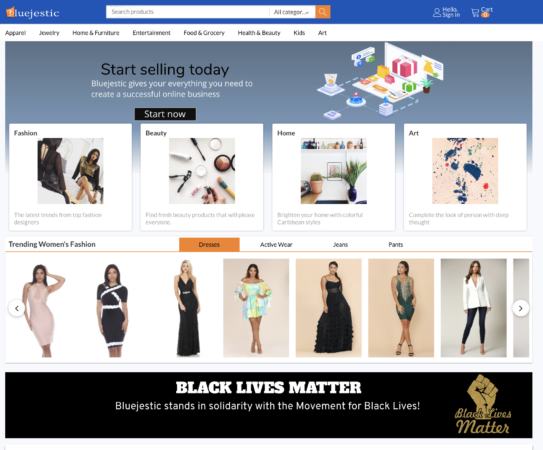

2020 and COVID-19 have brought on an unexpected wave of challenges for small businesses with shutdowns, social distancing rules, and other pandemic-related instances hitting companies hard. As more businesses adopt new ways to reach consumers, a new e-commerce marketplace has surfaced to help provide a larger platform for companies across various industries. Bluejestic — a Black-owned selling platform for small/mid-sized U.S., Caribbean, and Central American businesses — launched last month to give businesses the opportunity to showcase their retail products and expand their markets, Black News reports . “What we are doing is leveraging technology to create economic growth for businesses in the U.S as well as the Caribbean who are in a more dire need for a centralized marketplace,” Jude Plaisir, founder of Bluejestic, stated in a press release . “This is very much a mission-driven effort.” As we continue to feel the grueling effects of COVID-19, many businesses are still struggling...

COVID-19 has brought on a number of financial challenges that yielded economic consequences. In an effort to absolve minority-owned small businesses of their financial burdens brought on by the pandemic, Hennessy has launched Unfinished Business , a recovery fund to aid in getting them the resources needed to get back on their feet, according to a press release . “Built for community by community, Unfinished Business is an extension of our legacy supporting multicultural consumers and underscores our ‘Never stop. Never settle.’ ethos,” said Giles Woodyer , Senior Vice President, Hennessy US. “We want to do all that we can to help the small businesses survive the current crisis and pledge resources for the long term; as long as they have unfinished business to settle, so do we.” The fund will donate to small business entrepreneurs and continuously replenish funds so donations are more than a one-time occasion. “Hennessy has always valued the spirit of resilience and this is what...

From entrepreneurs and small minority-owned businesses to Black and brown communities, low-income and financially-excluded individuals in America deal with many social and economic disadvantages that make it difficult to seek out loans. According to Forbes , minority-owned firms are much less likely to be approved for small business loans than white-owned firms, which speaks volumes considering minority-owned establishments lead a significant portion of the nation’s businesses. A 2017 report from the FDIC stated that 6.5 percent of U.S. households were unbanked and 18.7 percent were underbanked. Of those unbanked households, more than half cited not having enough money to keep in an account. In an effort to solve these issues, Kiva and SoLo Funds have partnered together to offer these populations of people affordable loan products for personal and business lending. Both companies have supported thousands of Americans through their communities of lenders, according to Kiva’s blog ,...