All results

President Trump is back on his trade war wave — and this time, it’s rolling straight through the auto industry. With a fresh round of 25% tariffs on cars and auto parts set to take effect on April 3, people from the auto industry, from C-suites to dealership floors, are bracing for the impact. The administration says it’s about protecting national security and strengthening the U.S. manufacturing base. But if you’re thinking about buying a car this year, or if your job has anything to do with auto production, here’s the truth: You may be paying more, waiting longer, and dealing with fewer options. And that’s just the beginning. Why The White House Is Saying This Is Necessary According to an official statement from the White House, these tariffs on cars are aimed at keeping America safe. The administration is emphasizing that too many imports are “undermining” the “domestic industrial base” and weakening the U.S. supply chain. The idea is to hit foreign-made cars and parts with a 25%...

A portion of Notorious B.I.G.’s estate will now be handled by Primary Wave. As AFROTECH™ previously told you, a deal rumored to be in the “eight figures” was in the works between Notorious B.I.G.’s estate and the music publisher and involved half his publishing and master rights, including his rights to name, image, voice, and “other identifiable characteristics.” Notorious B.I.G.’s estate had been primarily run by his mother, Voletta Wallace, who was instrumental in securing stake from Bad Boy Records. Christopher Wallace, otherwise known as Biggie Smalls or Notorious B.I.G., had been one of the first artists to sign to the label owned by Sean “Diddy” Combs. Bad Boy Records had 50% stake in his songwriting catalog, Variety mentions. Voletta was able to increase the estate’s stake to 85% after arguing it was doing the heavy lifting in securing deals to license and monetize Notorious B.I.G.’s music. She then secured the remaining 15% stake in 2020. “Securing control of my son’s...

The crypto market is surging following a major regulatory shift. According to CNBC, XRP jumped 10% to $2.49 after Ripple CEO Brad Garlinghouse announced that the U.S. Securities and Exchange Commission (SEC) has dropped its case against the company. This decision marks the end of a four-year legal battle that has shaped the industry’s regulatory landscape and fueled speculation about a broader shift in the SEC’s approach. Ripple’s Long-Awaited Victory Speaking at the Digital Assets Summit in New York, Garlinghouse reflected on the drawn-out legal fight, calling it a painful yet necessary battle for the industry. “It’s been almost four years and about three months since the SEC originally sued us, certainly a painful journey in lots of ways,” Garlinghouse said. “I really deeply believed that we were going to be on the right side of the law and on the right side of history.” The SEC sued Ripple in 2020, alleging that the company sold XRP as an unregistered security. Ripple scored a...

If you missed out on your 2021 stimulus payment, there’s still time to claim what you’re owed. According to USA Today, the Internal Revenue Service (IRS) is giving eligible taxpayers another chance to receive up to $1,400 through the Recovery Rebate Credit. Are You Eligible For The Stimulus Payment? You may qualify for this Economic Impact Payment (EIP) if you: Filed a 2021 tax return but did not claim the Recovery Rebate Credit. Have not yet filed your 2021 tax return but do so before April 15, 2025. To check if you’re eligible, review your 2021 tax return. If the Recovery Rebate Credit section is blank or marked $0, you could still receive your payment. Filing before the deadline ensures you receive not only this credit but also any additional refund you may be entitled to. How To Claim Your Stimulus Money For those who already filed their 2021 tax return but didn’t claim the credit, there’s nothing else to do — the IRS began automatically distributing stimulus payments in...

For generations, the idea of retirement was wrapped in images of palm trees, golf courses, and pastel-colored condos lining the Florida coast. But for today’s retirees, those images are changing. The decision of where to retire is no longer just about sunshine and tax incentives; it’s about affordability, quality of life, and long-term stability. Instead of heading south, many retirees are opting for places like the Midwest, trading palm trees for pine forests, ocean waves for mountain peaks, and high insurance rates for financial security. And this shift isn’t random. For decades, Florida has been synonymous with retirement. The Sunshine State’s warm climate, tax advantages, and retirement-friendly communities made it the ultimate destination for older Americans. However, recent trends suggest that the tides are turning. A new study from Mirador Living, titled “Retirement Expectations vs. Reality: Factors that Impact Retirement Decisions,” reveals a surprising shift in where...

NBA star Jimmy Butler has brewed his love for coffee into a storefront in Miami, FL’s Design District. After teasing the concept for some time, the Miami Heat star officially opened his first BigFace Coffee shop on Dec. 5, 2024, according to Axios. The café boasts a chic interior design, a selection of merchandise including hats and jerseys, and an outdoor courtyard featuring ample seating. “This is a dream of mine,” Butler said at the grand opening, CBS News reported . “I get to come in here, chill out, meet people, vibe out, and become friends. Coffee is life. It’s how I start my mornings, watching my daughter play while I enjoy a cappuccino. For me, that’s the quintessential coffee experience.” View this post on Instagram A post shared by La Marzocco USA (@lamarzocco.usa) Besides Butler, other basketball figures at the grand opening included Carmelo Anthony , Heat center Kevin Love, and former NBA guard Brandon Jennings, according to Axios. DJ Khaled and French footballer...

Nearly 630,000 Fortnite players were reportedly “tricked” into making purchases through the game and will receive a refund. According to a press release, the Federal Trade Commission (FTC) has reportedly accused Fortnite developer Epic Games of leading gamers to make “unwanted purchases” by carrying out tactics through its game button configuration. “For example, players could be charged while attempting to wake the game from sleep mode, while the game was in a loading screen, or by pressing an adjacent button while attempting simply to preview an item,” the press release from the FTC read. It had also been brought to light that Epic Games had allowed minors to accumulate charges without parental approval and blocked gamers who filed disputes of unauthorized charges, preventing them from obtaining items they had purchased. For these reasons, the company received an order from the FTC to refund players in December 2022 who had been subjected to these “unlawful billing practices.” The...

The Forbes Union has walked out after publishing the company’s annual “30 Under 30” list. The list’s Class of 2025 features individuals across industries such as sports, entertainment, energy and green tech, artificial intelligence, food and drink, venture capital, marketing and advertising, science, and gaming, among others. Boston Celtics player Jayson Tatum, country artist Shaboozey , actress Ryan Destiny, Miss EmpowHer founder Caitlyn Kumi, and Foundry Technologies founder Jared Quincy Davis are some of the individuals listed. View this post on Instagram A post shared by Forbes (@forbes) A total of 600 individuals are featured, collectively contributing $3.6 billion in funding and amassing over 300 million followers across social media, Forbes states. Unsurprisingly, the list generates significant buzz and excitement among readers. It’s precisely for these reasons that editorial staffers made a calculated decision to stage a walkout, drawing attention to a three-year-long...

Content creators are taking over. Entertainment is entering a new era as attention shifts away from traditional cable TV, streaming platforms like Netflix, Prime Video, and Peacock, and even movie theaters. More people are seeking fresh, innovative ways to engage their time and dollars. And the creators are certainly delivering with engaging content that circulates the web and is also attracting countless celebrities and companies who are looking to capitalize in a new territory. Forbes notes the creator economy is currently valued at $250 billion, and that number is projected to nearly double by 2027. Three top Black creators are not just participating in this revolution — they’re leading it. Kai Cenat Kai Cenat currently holds the crown as Twitch’s most-subscribed streamer, as AFROTECH™ previously reported. The New Yorker, who once lived in a shelter, recently concluded his month-long November 2024 “Mafiathon 2.” Users tuned in to his 24/7 Twitch livestream throughout the month,...

24-year-old actress Yara Shahidi felt protected when she entered the entertainment industry. At just 6 weeks old, she landed a photo shoot gig for a life insurance company, and by 6 years old, she had her first movie audition. In an interview with SoFi, led by Vivian Tu of Your Rich BFF, the actress reflected on her experience, noting that she was able to enjoy acting as a craft rather than as a means to support her family — a privilege she acknowledges isn’t always afforded to child stars. “My parents were able to set it up so that we had either family members or people that were helping us that were on set with another brother that were looking after me where they were able to dip out and do things for themselves,” she told SoFi. “So it was under that environment where I was able to have a fulfilling career at a young age and even be in my 20s, and say I’m happy I started that young. But it was so particular to being under those set of circumstances, which allowed me to enjoy...

Keke Palmer has no regrets about being the breadwinner for her family. As previously reported by AFROTECH™, Palmer earned her first $1 million at just 12 years old as a child actress . At that time, her parents, Sharon and Larry, also hired a business manager to help oversee her finances. “They wanted me to know that they weren’t the ones controlling my money. They had heard these stories, and my mom said ‘I don’t want money to come in between me and my child,'” Palmer said on the “Club Shay Shay” podcast. Her parents would remain her backbone as she found her footing in Hollywood. Her early acting footprint included roles in “Barbershop 2: Back in Business”, “Akeelah and the Bee,” and “Jump In!” In 2008, she landed her own show on Nickelodeon with “True Jackson, VP” and her “life was changed after that,” she told People. “I was happy my family, we came to California for me to pursue my dreams I got my own show, right. H oney, my parents at their best made $40,000 a year growing...

Playing the long game paid off for Lady London. While speaking with Revolt CEO Detavio Samuels on “The Blackprint” podcast, the Bronx, NY-born artist spoke candidly about her journey into securing revenue through brand partnerships. It all began by considering the brands she often used and researching what she needed to build relationships and land opportunities. “I started YouTubing things like how are people reaching out to brands and figuring out like who’s their key point? Who handles talent? Who handles like brand partnerships within this thing? Reaching out to them with emails, forming a deck. Get your one-sheet or your EPK (Electronic Press Kit),” she explained on the podcast. Key metrics she flagged that help individuals determine their brand value included follower count, the number of females and males interacting with content, and the top five target areas. Lady London added, “Show all the things that make you a person on one thing, and send it off to brands and say,...

Angel Reese plans to retire her mother. Reese, born in Randallstown, MD, on May 6, 2002, to Michael Reese and Angel Webb Reese, has grown into an influential athlete, already making her mark in the WNBA by holding the record for most single-season rebounds — before being surpassed by A’ja Wilson. Reese’s athletic genes come from her parents , both of whom played basketball in college. Her mother, Angel Webb Reese, played for the University of Maryland, Baltimore County (UMBC) and was inducted into its Athletics Hall of Fame, notes Today. She also had a professional career in Luxembourg. Michael Reese played at Boston College and Loyola University (Maryland) before competing overseas in Luxembourg, Austria, and Portugal, mentions USA Basketball. “My whole family played basketball. My aunts played basketball, my brother plays basketball, my grandparents played basketball. So, it kind of was like, ‘You’re gonna do this,’” Reese told Just Women’s Sports. Unsurprisingly, Reese picked up...

Khaby Lame is letting the numbers do the talking. As AFROTECH™ previously reported, Lame, now one of the most-followed creators , was once a factory worker in Chivasso, Italy. “I was really poor,” he said on a panel during Forbes Creator Upfronts in partnership with Walmart Creator on Oct. 29, 2024. Lame was later fired from his job, returned to live with his family, and decided to not look back. Instead, he chose to bank on what was once merely a hobby — TikTok — during the onset of COVID-19. “When I started making videos, people told me to get a proper job,” he mentioned to Forbes in 2023. “But I continued to make videos because that’s what I like doing, even though no one was watching them.” It would ultimately become a money machine because he stood out for reacting to memes and viral videos without saying a word. “It’s my face and my expressions which make people laugh,” he told The New York Times in 2021. View this post on Instagram A post shared by Khabane Lame (@khaby00)...

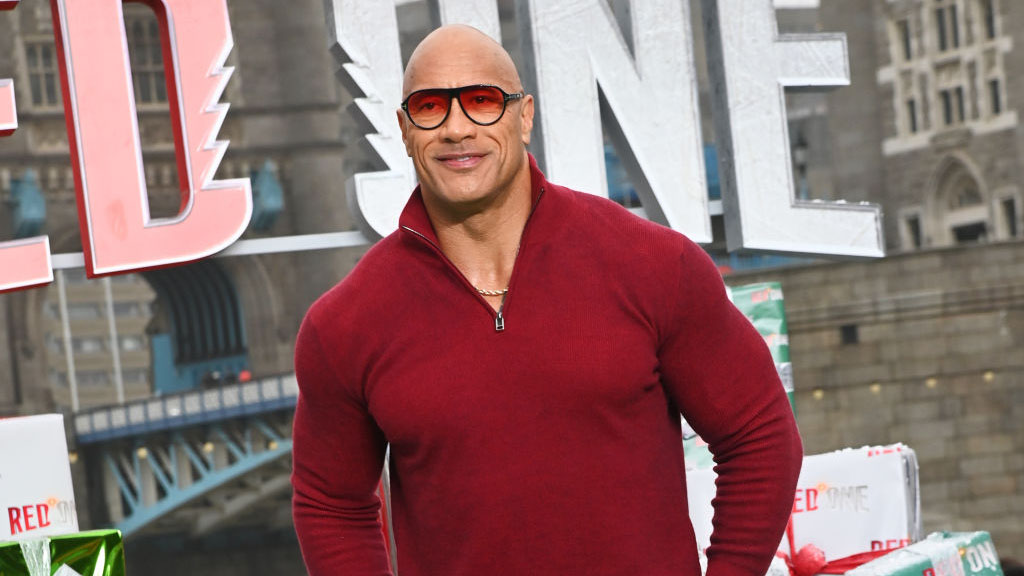

Dwayne Johnson decided to fire his agents because he saw the bigger picture. Johnson first put his name on the map as a professional wrestler, inspired by his father, Rocky Johnson, who had a legendary resume within the sport and was honored as a WWE Hall of Famer. “I think I’m going to like professional wrestling,” Johnson remembered, according to a conversation with GQ. “So we fought. [My dad] didn’t want me to get into it. And then I wound up having the career that I had. And he was proud. But he also wrestled with a lot of my success, and I know that as his son.” Johnson would later find a commonality between wrestling and acting. He revealed to GQ that he pivoted attention towards Hollywood, understanding that he could still reach the masses as an actor. “When I got into the business of Hollywood and moviemaking, it’s like, ‘Okay, well, what kind of movies do I want to make? I want to make movies that hopefully are good, that don’t suck. But also reach as many people as...