Showing 768 results for:

minority

Popular topics

All results

NFL Commissioner Roger Goodell says the league has no intention of updating its stance on DEI in the wake of Donald Trump’s return to office. President Trump retracted diversity, equity, and inclusion (DEI) efforts soon after taking office on Jan. 20, 2025. As a result of his early action, federal employees in DEI roles were placed on paid leave as “the agency takes steps to close/end all DEIA initiatives, offices and programs,” AFROTECH™ previously reported. Prior to and since Trump’s appointment, major companies, such as Target, Walmart, Meta, and Amazon, have severed their ties to DEI commitments. Others, such as JPMorgan Chase, Costco, Apple, and seemingly the NFL, are making it clear they will remain steadfast in their commitment to DEI. “We didn’t get into this because it was a trend,” NFL Commissioner Roger Goodell said in December 2024. “And we’re not getting out of it because it’s a trend. We’re in it because it makes the NFL better. And what it is, is to make sure that...

Former NBA teammates and Hall of Famers Tracy McGrady and Vinca Carter have invested in the Buffalo Bill’s organization, which is currently valued at $4.2 billion, per Forbes. According to a post shared on the team’s official Instagram account, the Bills announced 10 limited partners to join the franchise, marking the first time the team has added limited partners. According to ABC News, the group was approved on Dec. 11, 2024, by owners Terry and Kim Pegula, who purchased the team for $1.4 billion in 2014 and will retain a 79% stake. The Buffalo Bills’ ownership group now includes three former Black professional athletes: McGrady, Carter, and former U.S. Men’s National Team soccer player Jozy Altidore. View this post on Instagram A post shared by Buffalo Bills (@buffalobills) Check out the breakdown below. McGrady McGrady is no stranger to the world of business. After retiring from the league in 2013 with $130 million in career earnings, he expanded his portfolio into real estate,...

Concerns about the future have intensified as Donald Trump prepares to be sworn in as the 47th U.S. president. The Washington Post reports minority- and women-owned businesses have looming concerns over contracts, citing a potential loss of $70 billion in annual contracts amid legal disputes affecting government programs for “disadvantaged” firms. Within the Black community, legal issues were prevalent amid Fearless Fund’s ongoing litigation, which has now been settled. As AFROTECH™ previously reported, the firm, led by founding partner Arian Simone, was sued by Edward Blum and his American Alliance for Equal Rights group in August 2023 over its Strivers Grant program. The $20,000 grant backed by JPMorgan Chase & Co. and Mastercard had been aimed at small businesses primarily owned by Black women, and the activist group accused the investment firm of “explicit racial exclusion.” The group had already been victorious in the Supreme Court over race-based affirmative action policies....

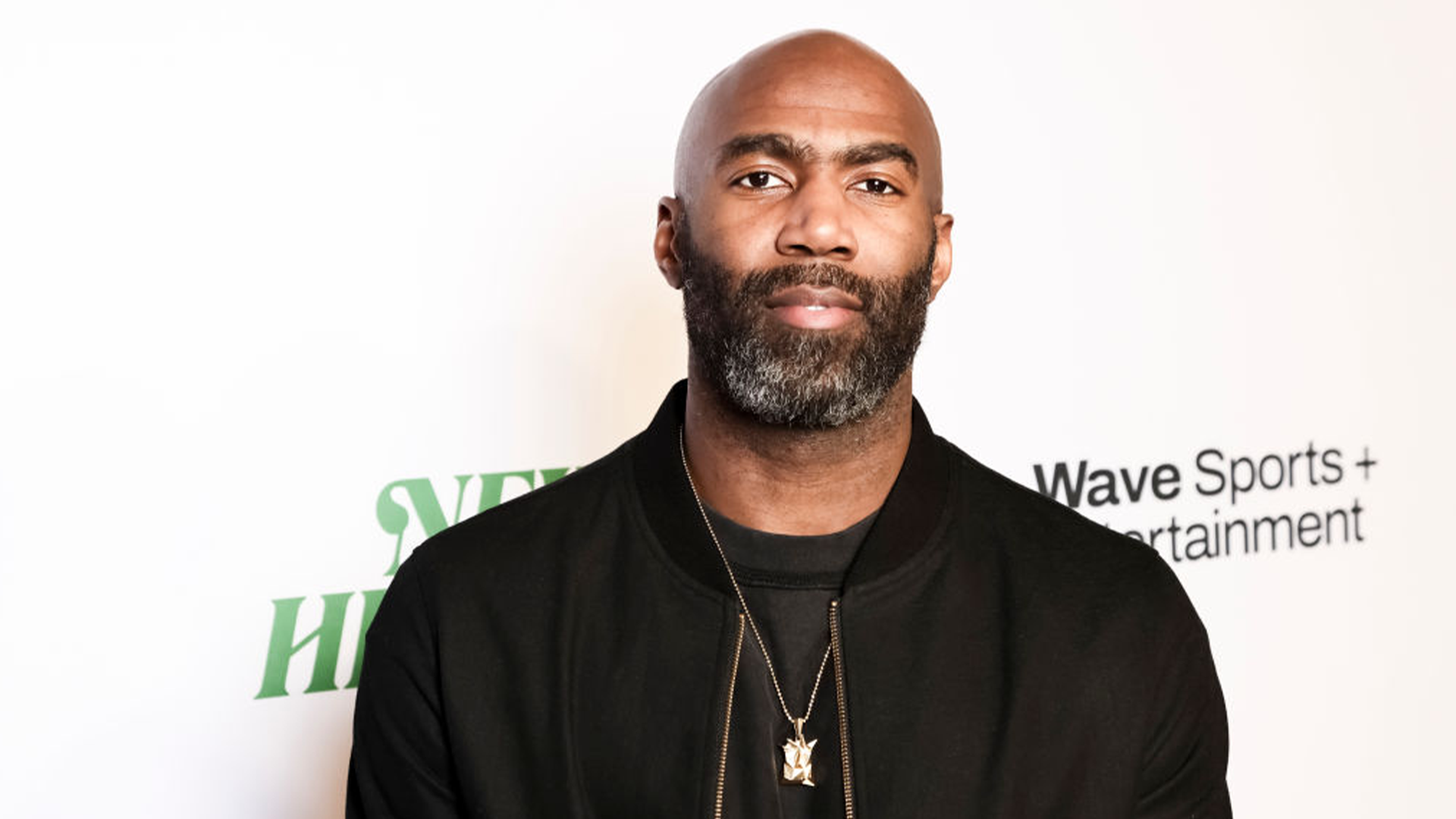

When Malcolm Jenkins secured stake in England’s Burnley FC, he made history in the process. Sports Illustrated reported the three-time Pro Bowl safety became an investor — through Malcolm INC and Disrupt Sports Partners — in the Burnley, Lancashire-based professional team within the English Premier League (EPL) back in 2021. He joined the new ownership group, ALK Capital. Jenkins, playing for the New Orleans Saints at the time, saw the opportunity as a perfect alignment to values that have been central to his business portfolio, noted a press release. He pointed to the club’s “tenacity, work ethic, good sportsmanship and efficient operational infrastructure.” His decision was finalized following a visit to the team’s Turf Moor stadium in England before watching the team, nicknamed “The Clarets,” play against Manchester City. “I think the club’s doing a great job with some of the updates around the stadium and to see the vision of where they want to go in creating a venue that’s not...

Following PowerSchool Holdings Inc.’s multi-billion-dollar acquisition, Vista Equity Partners has retained its minority stake in the company. According to a press release, PowerSchool Holdings Inc., which operates as a cloud-based K-12 education software, was acquired by Bain Capital through a transaction that was valued at an estimated $5.6 billion, with the company paying $22.80 per share in cash. Bain Capital plans to build on PowerSchool’s successful track record, with its software impacting 60 million students and 18,000 customers across more than 90 countries. “PowerSchool is aligned, throughout its entire organization, to its mission to personalize education and improve learning outcomes,” David Humphrey, a partner at Bain Capital, said . “We’ve had the privilege of seeing the leadership team’s dedication to this mission through a world-class product innovation engine.” Bain Capital Partner Max de Groen added, “We are thrilled to support PowerSchool’s mission and growth as it...

History is being made in the 2024-2025 NFL season. Diverse Representation shares on Instagram that the current season, which kicks off Thursday, Sept. 5, 2024, reportedly has the most Black team minority owners in league history. The list is filled with various trailblazers across entertainment, sports, and business, which you can find below. Venus And Serena Williams Kicking things off are trailblazers Venus and Serena Williams, who made history as the first Black women to become minority owners in the NFL. As AFROTECH™ previously told you, they became minority owners in 2009 when the team was reportedly worth $1.02 billion, per Statista. “I am honored to be a partner in the Miami Dolphins franchise and thankful to owner Stephen Ross for allowing Serena and I to be part of Miami Dolphins history,” Venus said at the time, according to People. Serena added, “I am so excited to be part of such a renowned organization. Having spent so much of my childhood in the area, being involved...

Kevin Durant has struck gold overseas. Olympic Victory The athlete is fresh off a USA Basketball Men’s National Team victory at the 2024 Olympics, taking home a gold medal alongside teammates, including LeBron James and Stephen Curry, and leading against France in a 98-87 upset, according to USA Today. View this post on Instagram A post shared by USA Basketball (@usabasketball) Durant now has four Olympic gold medals, according to his Team USA profile. “My goal every time I put this jersey on was to represent my country, my state, my street, my family name, and it help put the game forward,” Durant said, per USA Today. “And since I’ve been here, we’ve done that. We built off the Dream Team in ’92, and we carried that torch and that was the main goal.” Investing In Paris Saint-Germain Besides focusing on the victory lap on the court, Durant also looked to do the same in the business world through his sports, media, and entertainment company Boardroom, which he founded in 2019...

Black-owned Nile Capital Group Holdings has acquired a stake in a leading global investment firm. According to a news release, Nile Capital, a “sector-focused, operationally-oriented private equity firm,” along with ABS Global Investments, has bought the remaining 23% minority interest in ABS from Evercore Inc. ABC will maintain majority ownership while Nile Capital signs on as a strategic investor. Nile Capital was founded by Melvin Lindsey (managing partner); Richard Pell (chief information officer and partner); and Hien Gerbereux (partner). “As investors look for a differentiated source of non-correlated alpha, ABS has provided unique solutions to meet its customers’ needs for over two decades,” Lindsey said in a news release. “Under Laurence and Gui’s leadership, ABS has built a culture of excellence driven by a focus on innovation, talent development, and a commitment to customer success. We look forward to joining forces with the ABS team to build on the strong momentum and...

Tim Howard, a former U.S. Men’s National Team (USMNT) goalkeeper, now has ownership in a soccer league. ESPN reports Howard joined Houston Dynamo FC’s ownership group on July 16, 2024. By default, Howard now also becomes a minority investor in the National Women’s Soccer League’s Houston Dash. “We are proud to welcome Tim Howard to our ownership group at the Houston Dash and Houston Dynamo,” Dynamo majority owner Ted Segal said in a news release, according to ESPN. “His wealth of experience across soccer, both as a player at the highest levels and subsequently as a sporting director and media analyst, will be invaluable within ownership as we continue to build a competitive and successful organization. Moreover, Tim’s commitment to using his unique platform to positively impact communities in need aligns with the values of our organization.” Howard’s new position as an investor comes after his 2024 induction into the National Soccer Hall of Fame. The honor recognizes his 121 caps...

A new shared space has opened in Newark, NJ, to support minority-owned businesses. According to Tap into Newark, Equal Space, a 50,000-square-foot, multi-floor, space opened its doors to entrepreneurs on May 14, 2024. A s co-founder and CEO, Citi Medina leads the concept, which was 10 years in the making, Blavity reports. The Brooklyn, NY, native who moved to Newark observed there was not a safe shared space for talent of color. So, alongside his co-founder and COO, Ralphie Roman, they turned their attention towards creating a solution and birthed Equal Space in 2014, which had previously opened a 16,000-square-foot shared space and incubator ES89. The location includes meeting spaces, an event area, and content creation suites, its website mentions. Now, the Newark area will receive further support through the new downtown ES550 Tech & Innovation Campus at 550 Broad St., which boasts spaces for single founders and teams, “state-of-the-art event spaces” for 300 people, and a fully...

East Chop Capital has closed its funding and will deploy capital to Black investors. According to a press release provided to AFROTECH™, the private equity firm’s founders and HBCU graduates Calvin L. Butts Jr. and Carrington Carter have closed an $11 million fund, which draws equity investments from 93 limited partnerships, including Liberty Financial Services. This brings East Chop Capital’s total raise to $15 million. As previously reported by AFROTECH™, $4 million in 2021 had been raised to support its presence in the global vacation market, which is projected to reach $132.7 billion in 2033, as reported by Future Market Insight. East Chop Capital is poised to achieve a 25% return, taking into consideration the fees or expenses involved in overseeing the fund. With additional capital at its disposal, East Chop Capital is poised to amplify its efforts in the initial round, with plans already set in motion to invest in Florida and Texas. “Fund II is about scale and pattern...

Dwyane Wade is working to diversify the wine industry. The former basketball athlete is accomplishing this as the founder of his own wine brand, Wade Cellars, established in 2014, and as a University of California (UC Davis), Davis board member. According to a news release, Wade joined the school’s Executive Leadership Board for the Department of Viticulture and Enology in 2021. At the time of appointment, David Block , a professor and chair of the viticulture and enology department, shared in a statement: “All of our new board leaders have really unique skills to help the department achieve our strategic goals. They bring excellent communication skills, a passion for diversifying the industry and making sure students receive a great education and fulfilling career, and a passion for wine. Past and current members will help us to reach even a higher level of teaching, research and continuing education for the industry.” Wade’s participation was to serve as a doorway for expanding...

The Biden-Harris Administration is directing millions of dollars toward entrepreneurs located in North Carolina. On Friday, March 1, Vice President Kamala Harris visited Durham, NC, to shed light on a $92 million plan to invest in historically underserved small businesses and entrepreneurs, according to Technician, North Carolina State University’s student newspaper. Harris was greeted by Gov. Roy Cooper during an event at the city’s historic Black Wall Street, in which she revealed 10 North Carolina women- and minority-led venture capital firms will be given $32 million in federal funds. The financial commitment will be provided through the U.S. Treasury Department’s State Small Business Credit Initiative (SSBCI), and awardees include Nex Cubed (Founders Fund); RevTech Labs (majority female and Latina-owned entrepreneurship center and accelerator); LaVert Ventures (woman-owned AgTech fund); and Latimer Ventures (early-stage venture capital fund). The investment will trigger an...

Mastercard has purchased stake in MTN Group’s fintech division, Africa’s largest mobile network operator. In August 2023, TechCrunch reported Mastercard was looking to invest in MTN Group. Six months after the initial announcement, both parties have moved forward with an agreement during a time when MTN Group is looking to expand its reach in the fintech space, according to ITWeb. The move would be timely for MTN Group as it was searching for investors after parting ways with the carrier’s main telecom business. The outlet also notes Mastercard is looking to accelerate MTN Group’s technology and infrastructure and establish greater financial inclusion in the continent. MTN Group had reached over 290 million subscribers by the end of June 2023, and its transaction volume had reached $8.3 billion in the first half of 2023. “This commercial relationship is a key enabler for the acceleration of our fintech business’ payments and remittance services,” the company said, per ITWeb. “MTN...