All results

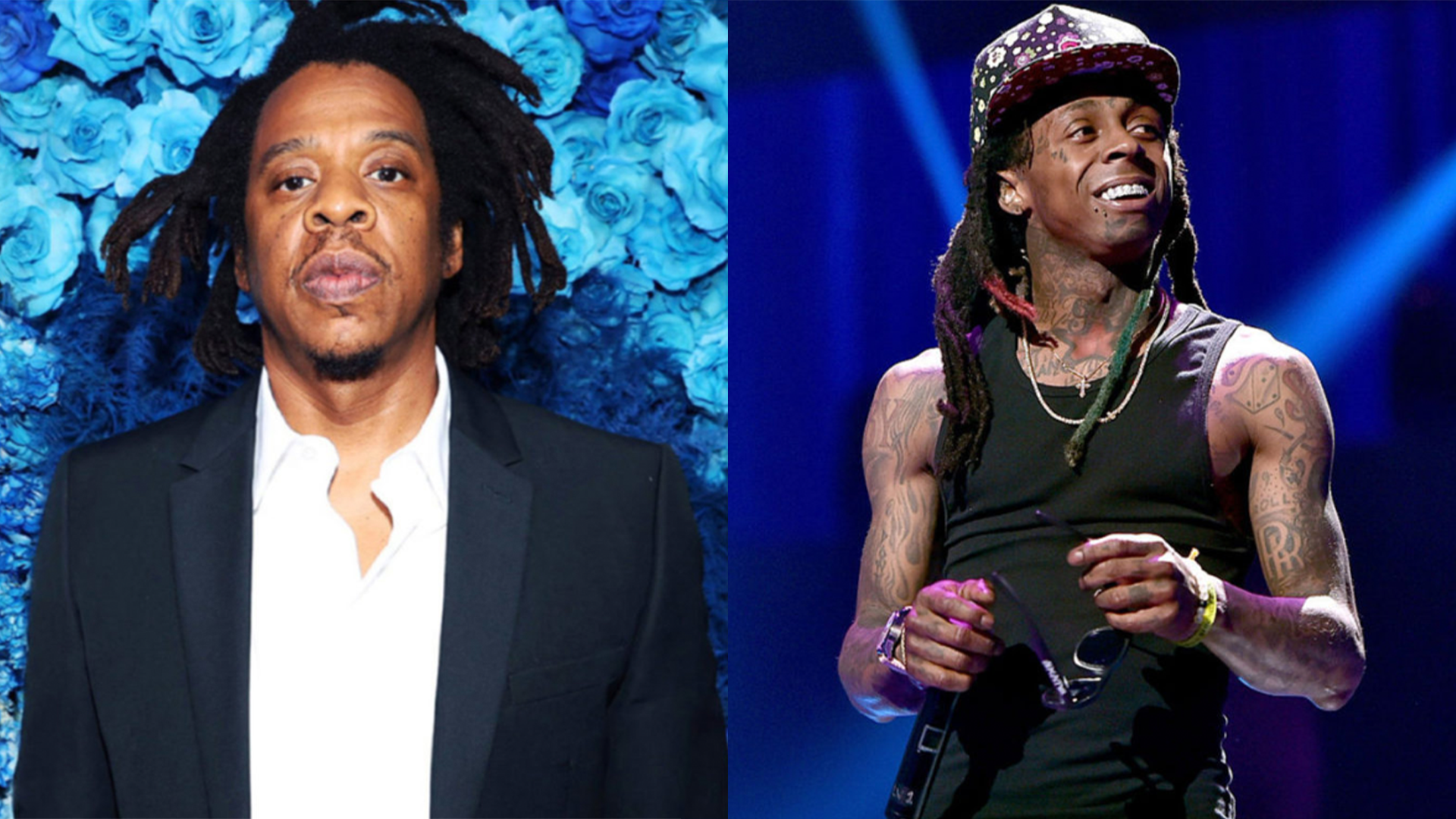

At one point in Hip-Hop history, fans were divided on who was the best rapper in the game. While many iconic MCs have come and are present, the mid-2000s served as a time when Lil Wayne made it clear that he believed he was the best rapper alive. The “best” status is relative to individual preferences, but it did not stop the Louisiana-born rapper from making a claim and even writing a song highlighting the sentiment. Lil Wayne officially hit the music scene in the mid-1990s as a member of the Hot Boys with fellow band members – Juvenile, B.G., and Turk. The four rappers produced hits like “I Need a Hot Girl” and “Rock Ice.” Wayne would launch a solo career in 1999 with his debut album, “The Block is Hot.” However, it wouldn’t be until 2004 that the then 22-year-old rapper would gain increased popularity with the release of “The Carter,” which turned into a series of albums, catapulting the rapper into Hip-Hop superstardom. In 2012, he would take the Billboard title as the male...

IRS issues are actually a lot more common than you think. According to Jackson Hewitt, statistics show that people are more likely than not to run afoul of the taxman. Each year, nearly 30 million taxpayers will receive some sort of penalty from the IRS for failing to file their taxes correctly. As of 2019, more than 20 million people owe taxes to the IRS but cannot pay them. And millions of people, each year, either under-report their taxes or make a math error on their taxes — which, of course, results in more penalties and fees. If there’s one thing the IRS is going to do, it’s get the money that you owe them! In this regard, too, celebrities are just like us when it comes to IRS issues. We’ve all heard at least one story of one celebrity who has been slapped with a gobsmackingly large tax bill. And while many of these issues can be resolved with a good attorney and a reasonable proposal to the omnipresent government agency, it can still be distressing when a tax lien comes to...

Steve Harvey may be one of the wealthiest men in entertainment today — but it wasn’t always that way. In an interview with Earn Your Leisure, he recounted how he got into some trouble with the IRS — to the tune of over $20 million. “My accountant died, and an accountant that worked for him called my lawyer and said, ‘we have a problem,'” he said in the interview. “She had found on the floor all my tax forms for 7 years, signed with the checks stapled to them.” He continued: “They were cashing the checks, keeping the money, and not turning in the tax forms…. They didn’t cash it, they took the money out [of] the account that matched the exact number. ” Steve Harvey on How he owed IRS $22 Million and how it was stolen from him in the span of 7 Years 😬💸 pic.twitter.com/e2VCTNOv1S — raphousetv (@raphousetv2) March 16, 2022 In a separate report from Yahoo, Steve Harvey also detailed the incident. “My old tax accountant, who passed, had done some, let’s say, not so smart things,” Steve...

In 2016, the world lost an icon through singer and songwriter Prince Rogers Nelson. Now, Complex reports that an agreement on the value and administrator of his estate has been made about six years following the untimely passing of the superstar. A decision on the estate’s value was made by the Internal Revenue Service (IRS) and Comerica Bank & Trust due to the fact that there was no will left behind by the singer. The Minneapolis native’s estate is valued at $156.4 million and will now be evenly distributed among music company, Primary Wave, and the late singer’s three oldest heirs.

Filing taxes can be a major pain, especially with many services charging hundreds of dollars. You might be wondering why the Internal Revenue Service doesn’t just make their own program to help, but it’s complicated. In 2002, the IRS made an agreement with tax software companies — like H&R Block and TurboTax — known as the Free File Program . This agreement let Americans making under $66,000 per year access tax software companies’ systems for free. However, the IRS agreed to not make its own competing software. A controversial provision to the Taxpayer First Act would’ve made that agreement permanent by making it illegal for the IRS to develop their own software . Now, it seems that won’t be a part of the bill, according to Gizmodo . It’s not hard to see why the tax industry would want to ban the IRS from creating its own free, online system. Nobody is going to dish out hundreds of dollars to a third-party if you can file directly through the government. Although this decision...