BLCK VC, a nonprofit organization committed to enhancing the presence of Black investors in the venture capital (VC) industry, has recently released its annual edition of the State of Black Venture Report in partnership with Silicon Valley Bank.

The report, released on Feb. 22, sheds light on the current state of the Black venture ecosystem, analyzing various trends in leadership and representation within the industry.

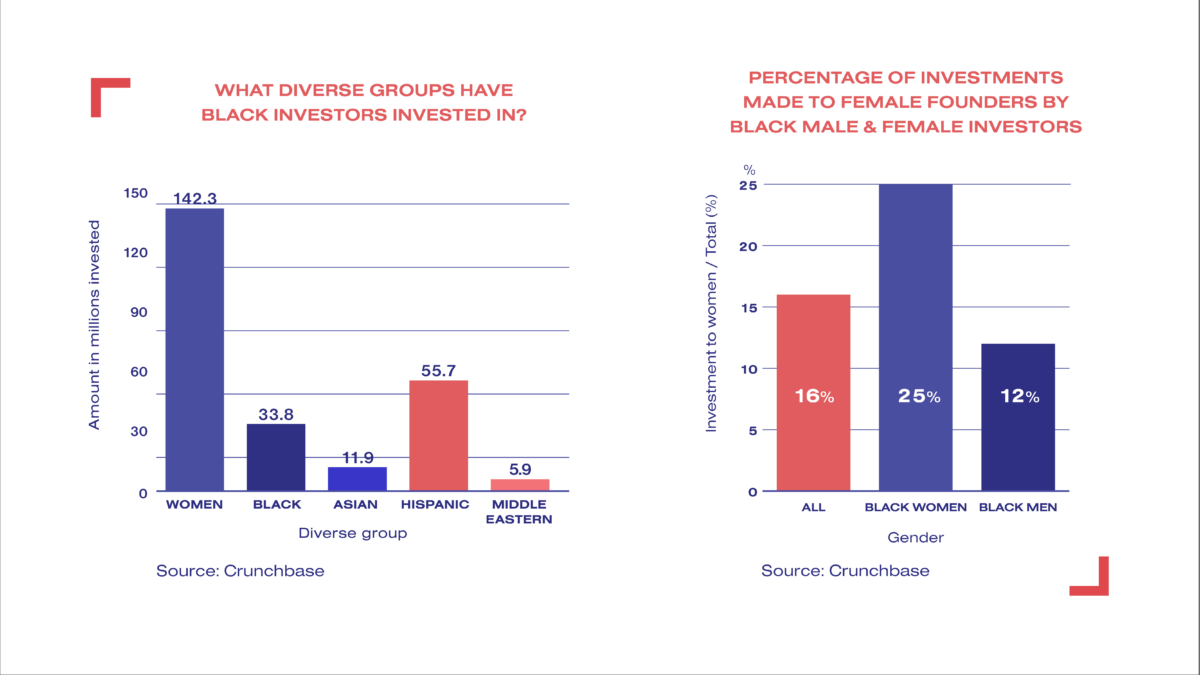

According to a study conducted by Accenture, and shared by BLCK VC, Black investors exhibit a higher tendency to invest in Black founders.

The Crunchbase data obtained by BLCK VC, which had a sample pool of 113 Black investors, also mentioned that women and Latinx founders are more likely to receive funding from Black investors.

Furthermore, BLCK VC’s 2022 report showed Black investors left their firms or launched their own funds to achieve partner status at an increasing rate.

However, in its 2023 report, it decided to “look at these trends across varied career paths of Black investors to offer a more nuanced picture of the existing barriers.”

That said, within the past year, 57.5 percent of the sample has been promoted from analyst and associate positions while 42.5 percent have not, signaling a “positive trend” for those at the junior level.

“It is crucial to acknowledge that most investors in our sample have yet to be promoted within their firms at all. This suggests that Black investors often leave their firms in search of advancement, underscoring the need for clear career advancement paths and leadership development opportunities for Black investors within

venture firms,” BLCK VC’s report reads.

It’s clear that there’s much more work to do to alleviate the current difficulties that minority entrepreneurs face in the venture ecosystem.

An associate at March Capital believes the best way to help diverse junior investors thrive is by providing mentorship.

“The venture industry has done a decent job of providing initiatives and support to senior-level Black investors, but I believe there should be an equal initiative to bring in diverse, junior investors, and then provide a very specific and very clear pathway to promotion for them so that they can grow within an organization,” Maya Matthews said, according to the report.

The report notes that 72.4 percent of Black junior-level investors are mentored by Black investors. However, to accelerate growth, it is important to ensure support expands beyond just Black investors.

“Mentorship is critical because venture is ultimately an apprenticeship business,” Adam Kiki-Charles, a senior associate at Equity Alliance, said in a statement. “There’s stuff you can learn on your own, but a lot of education comes through experience, and the one thing that can help accelerate growth, particularly when it’s experiential, is being able to lean on other people who’ve been there already. So there’s obviously some aspects of this job that you only learn by doing, but having someone to save you from pitfalls and who can break down the rationale behind decisions, I think, is really valuable.”