After Missing Out On Investing In Facebook, Airbnb, And Google, Serena Williams Went On To Invest In 16 Billion-Dollar Companies

Samantha Dorisca is a Houston-based journalist and photographer whose mission is to impact communities through the gift of storytelling using the written word or visual media. She completed her B.A at The University of Texas at Austin and is pursuing a M.A at The University of Memphis. Her work can be found on platforms such as Houstonia Magazine, Girls' Life Magazine, and Blacque Magazine. Samantha mainly reports on tech, trends, and entrepreneurship.

Discover more of what matters to you

Explore more

Industry leaders Nancy Twine and James D. White share invaluable insights to help you accelerate your career. Both were featured as speakers at AFROTECH™’s Board Readiness Summit, which was held virtually from 10 a.m. ET to noon ET on March 25, 2025. The event offered keen insights on securing a board seat. Twine’s panel was moderated by Avary Bradford, founder and consultant at The Hive Consulting Co. White’s panel was moderated by Salah Goss, Mastercard’s head of social impact for North America at the Mastercard Center for Inclusive Growth. Twine’s Panel Insights Twine and White reflected on their paths to securing their first board positions. Twine, who currently serves on the boards of Room to Grow and Cosmetic Executive Women, spoke first, detailing her transition to Vera Bradley, where she served from June 2021 to June 2023, according to LinkedIn. This opportunity came nearly eight years after she founded Briogeo Hair Care—a clean, natural hair care brand designed for all hair...

LeBron James paid it forward to his mother when he signed a lucrative contract with Nike. The Akron, OH , athlete was drafted to the NBA in 2003 as a No. 1 overall pick, according to Basketball Reference. In his rookie year with the Cleveland Cavaliers, he caught the attention of Nike, Adidas, and even Reebok, which would have amounted to a $10 million shoe deal. As AFROTECH™ previously reported, James ultimately rejected the Reebok deal since it came with the condition of being unable to speak with other companies. “Me and my mom were living in an apartment—section 8 housing in Akron. I’m going back. I don’t have sh-t, whatever, and my mom looked at me. She said, ‘Son, trust your gut. If they’re offering you this, then who knows what the other companies may offer you.’ She’s super composed. She’s like, ‘We ain’t got sh-t already, so it’s not like it changes our life in this moment. Maybe in the future, but I want you to trust your gut and do what you think is right,’” James said on...

Tisha Thompson is among the 2% of female founders who have successfully secured funding. Thompson launched LYS Beauty in 2021, a clean color cosmetics brand designed to serve a diverse range of skin tones and types, according to its website. Her journey in the beauty industry began during college when she worked as a makeup artist to support her education while studying accounting, Fortune reports. After earning her degree, she secured an accounting role at PÜR Cosmetics, where she quickly advanced through the ranks, eventually becoming VP of Marketing and Innovation. “During my tenure there, I wore a lot of hats, similar to what I do now as a startup founder. I helped to innovate clean beauty product development, supported brand management and marketing, and also oversaw finance and operations,” she told the outlet. Now, Thompson is successfully leading her own business and has stacked on wins since. This includes making history as the first Black-owned clean makeup brand to launch...

The Walt Disney Company and its ABC television network have joined the list of media companies the Federal Communications Commission (FCC) is investigating for their diversity, equity, and inclusion (DEI) practices. On Thursday, March 27, 2025, FCC Chair Brendan Carr announced concerns that Disney and ABC might be “promoting invidious forms of DEI discrimination” and said the agency’s Enforcement Bureau would examine whether any of their past or current policies violated any equal employment opportunity regulations, according to NPR. “Numerous reports indicate that Disney’s leadership went all in on invidious forms of DEI discrimination a few years ago and apparently did so in a manner that infected many aspects of your company’s decisions,” Carr wrote in a letter to Disney CEO Robert Iger. The inquiry follows Disney’s reduction of diversity efforts , including the termination of some initiatives and changes in the language used to describe DEI. “We are reviewing the Federal...

Let’s be honest—when it comes to beauty, Black women have always been the standard, even if the industry has been slow to give credit where it’s due. But while some are still playing catch-up, Danessa Myricks Beauty has already rewritten the rules—and ensured we’re front and center in the narrative. From melting down drugstore makeup in her kitchen to landing on Sephora shelves across the globe, Danessa Myricks didn’t wait for anyone’s permission. She built her own table—and now the world’s pulling up a seat. From “Accidental Artist” to Beauty Powerhouse Myricks didn’t come from a legacy of wealth or beauty school credentials. She came with hustle, vision, and a deep belief that makeup should be for everyone. According to her Closers 2025 Time Magazine feature, after getting laid off from a publishing gig, she took a chance on creativity and started doing makeup—teaching herself through trial, error, and audacity. Her early kits? Straight-up DIY magic. Melting down products to...

Editorial Note: Opinions and thoughts are the author’s own and not those of AFROTECH™. In the 2024 presidential election , it was reported that voter turnout among Gen-Z voters dropped significantly compared to 2020. There was also a significant uptick in younger voters who supported President Donald Trump, according to the Guardian . Overall, Gen Z appears to be leaning slightly more conservative than their Millennial counterparts, a shift largely attributed to the influence of social media and its impact on shaping political perspectives. Social media’s prevalence in our daily lives has only gotten worse over the years. People now spend the majority of their time online, doom-scrolling. Younger generations are less likely to get their news from sources other than social media. They watch YouTube videos instead of regular television and don’t listen to the radio in the same way previous generations did. Videos targeted towards young men are laced with misogynistic messaging and the...

Dale Carnegie’s How to Win Friends and Influence People is one of the most influential self-improvement books of all time. First published in 1936, the book remains widely read today, offering timeless advice on communication, leadership , and building meaningful relationships. The book teaches practical strategies for improving social interactions, gaining influence, and fostering genuine connections—skills that are valuable in both personal and professional life. This summary explores the key principles and lessons from Carnegie’s book, breaking down the strategies that have helped people around the world build stronger relationships and succeed in business , leadership, and everyday interactions. The Core Idea Of The Book Carnegie’s philosophy centers around understanding human nature and using that knowledge to create positive interactions. The book argues that people respond best to appreciation, encouragement, and genuine interest rather than criticism or manipulation....

Ice-T has officially opened a cannabis dispensary in his home state. As AFROTECH™ previously told you, the Jersey City Cannabis Control Board (CCB) approved his adult-use cannabis dispensary application in partnership with The Medicine Woman — owned by married couple Charis Burrett and her husband, Luke Burrett — in 2022. “We want everyone to have access to safe cannabis. You are the first application who have said something about the price point. I commend you on that,” CCB member Stacey Flanagan stated . Fast-forward to 2025, and the dispensary has officially touched down in Jersey City, NJ. The Medicine Woman Jersey City held its official soft opening on Thursday, March 27. It will host its grand opening on Saturday, April 19th, and Sunday, April 20th, 2025, according to a press release shared with AFROTECH™. This also marks its first location outside of California. View this post on Instagram A post shared by ICEMFT (@icet) “We’re thrilled to be officially opening the doors of...

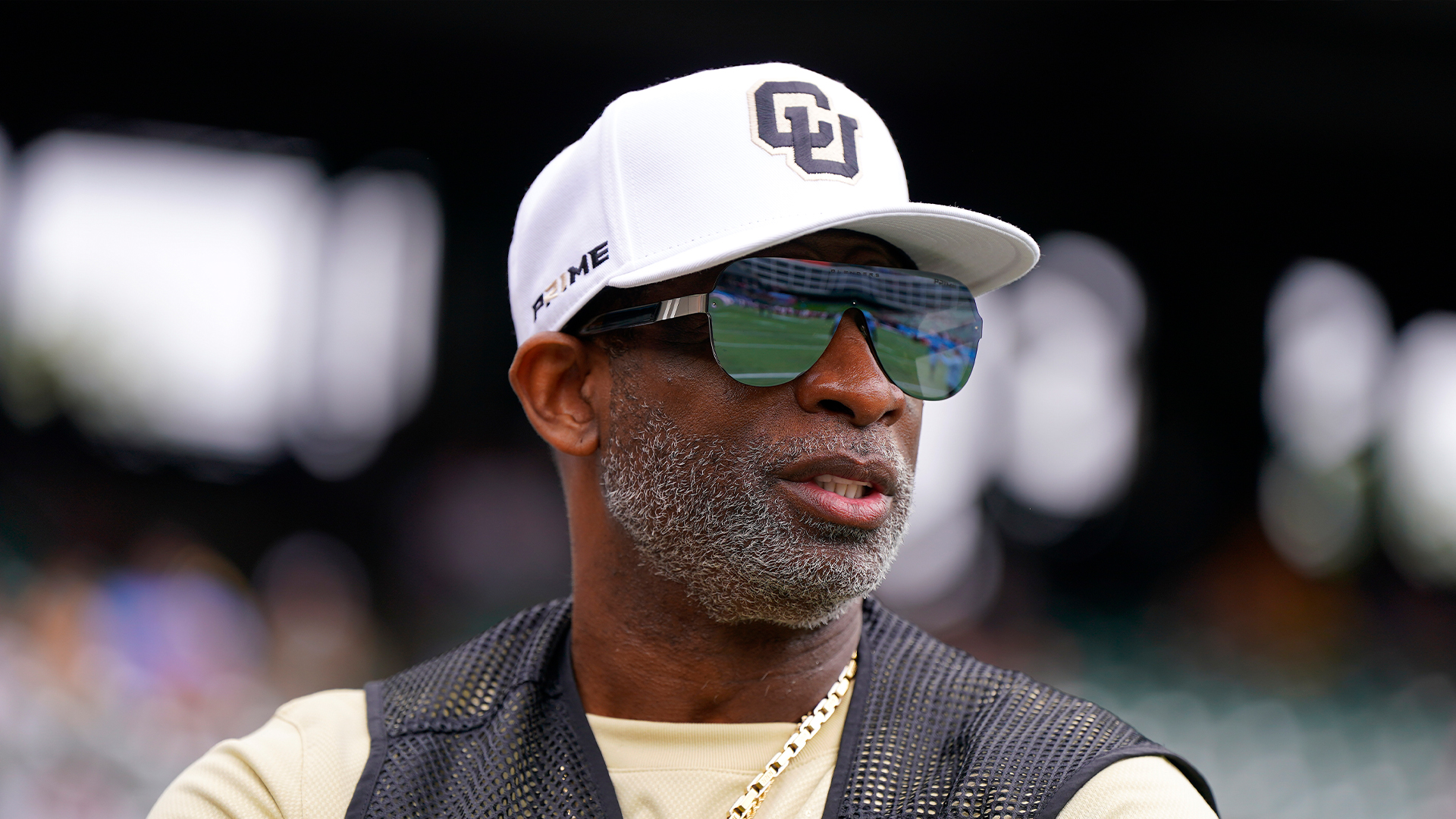

The Deion Sanders contract extension is officially signed, sealed, and worth a staggering $54 million. The University of Colorado has locked in “Coach Prime” for five more years, reportedly placing him as the No. 4 highest-paid college football coach in the nation, Sports Illustrated reported. Following two seasons of massive impact both on and off the field, Sanders’ new deal cements Colorado’s commitment to his leadership and vision. The updated Deion Sanders contract will pay him $10 million annually in 2025 and 2026, increase to $11 million in 2027 and 2028, and rise to $12 million in 2029. Deion Sanders’ Contract Extension Reflects Colorado’s Investment In The Program’s Future According to CBS Sports, Sanders was previously ranked 38th in coaching salaries with an annual income of $5.7 million. Now, his $10.8 million average yearly salary puts him in fourth place, according to DNVR reporter Scott Procter, per SI. He’s listed behind the University of Georgia’s Kirby Smart at No....

Black Economic Alliance Entrepreneurs Fund has reached the halfway point of its funding goal. The fund was launched by the Black Economic Alliance Foundation, which is led by Executive Vice President Alaina Beverly, to create generational wealth for the Black community, working alongside public, private, and social sectors to accomplish this goal, its website notes. Samantha Tweedy is CEO of the coalition behind this effort, Black Economic Alliance, which is made up of “business leaders and aligned advocates.” In 2021, the Washington, DC-based foundation established the Black Economic Alliance Entrepreneurs Fund LP to further its mission and has since onboarded venture capitalist Melissa Bradley, to lead its investment strategy, according to The Business Journals. Bradley was previously recognized as a AFROTECH™ Future 50 Dynamic Investor and founded 1863 Ventures, which provided business development programs, coaching, mentorship, and access to capital primarily for new...

After spending significant dollars in DEI efforts, the University of Michigan has closed two offices tied to equity and inclusion. The Detroit Free Press reports that the public research university has spent nearly $250 million on diversity, equity, and inclusion (DEI) efforts in recent years. However, the university has now decided to dismantle its Office of Diversity, Equity, and Inclusion (ODEI) and the Office for Health Equity and Inclusion (OHEI).” “Student-facing services in ODEI will shift to other offices focused on student access and opportunity,” the school said in a statement on its website, according to the outlet. The statement also read: “The DEI 2.0 Strategic Plan, the umbrella strategy for schools, colleges and units, will be discontinued, along with DEI 2.0 unit plans, related programming, progress reporting, training and funding. Individual leads, who have supported DEI efforts in schools, colleges and units, will refocus their full effort on their core...

The 18th annual Disney Dreamer’s Academy is underway. It will bring together a diverse group of high school students from across the country for a transformational mentoring program at Walt Disney World Resort. On Thursday, March 27, 2025, “Abbott Elementary” star Tyler James Williams — joining the fun as this year’s “DREAMbassador” — helped welcome 100 high school students who are shaping the future in fields like science, technology, engineering, and mathematics (STEM) to Orlando, FL. The day featured a parade at Magic Kingdom, where Williams served as the honorary grand marshal. After the parade, Williams shared that he was particularly excited to attend storytelling sessions, noting that he’s a storyteller “first and foremost.” When asked by AFROTECH™ about the impact of AI-generated content and streaming platforms on the future of storytelling, Williams said he believes technology will always play a significant role. “I think technology will always play a role,” Williams told...

Despite major record labels suing it for its AI technology, Timbaland is standing beside Suno, the music creation program. As AFROTECH™ previously told you, Timbaland aligned himself with the artificial intelligence (AI) music creation tool Suno in October 2024, taking on the title of its strategic advisor. He had already been an avid user of the platform for several months. “You can put out great songs in minutes,” he said during an interview with Rolling Stone. “I always wanted to do what Quincy Jones did with Michael Jackson’s ‘Thriller’ when he was [almost] 50. So my ‘Thriller,’ to me, is this tool. God presented this tool to me. I probably made a thousand beats in three months, and a lot of them—not all—are bangers and from every genre you can possibly think of. I just did four K-pop songs this morning!” Timbaland’s embrace of AI is not new. While speaking at the AFROTECH™ Conference in November 2023, during a panel titled “From Producer to Founder: A Conversation with...

President Trump is back on his trade war wave — and this time, it’s rolling straight through the auto industry. With a fresh round of 25% tariffs on cars and auto parts set to take effect on April 3, people from the auto industry, from C-suites to dealership floors, are bracing for the impact. The administration says it’s about protecting national security and strengthening the U.S. manufacturing base. But if you’re thinking about buying a car this year, or if your job has anything to do with auto production, here’s the truth: You may be paying more, waiting longer, and dealing with fewer options. And that’s just the beginning. Why The White House Is Saying This Is Necessary According to an official statement from the White House, these tariffs on cars are aimed at keeping America safe. The administration is emphasizing that too many imports are “undermining” the “domestic industrial base” and weakening the U.S. supply chain. The idea is to hit foreign-made cars and parts with a 25%...

Events

conference

Multi-city event series empowers corporate executives, investors & tech moguls