There are many myths about Silicon Valley, but AfroTech’s Black Tech Green Money is here to get to the bottom of it.

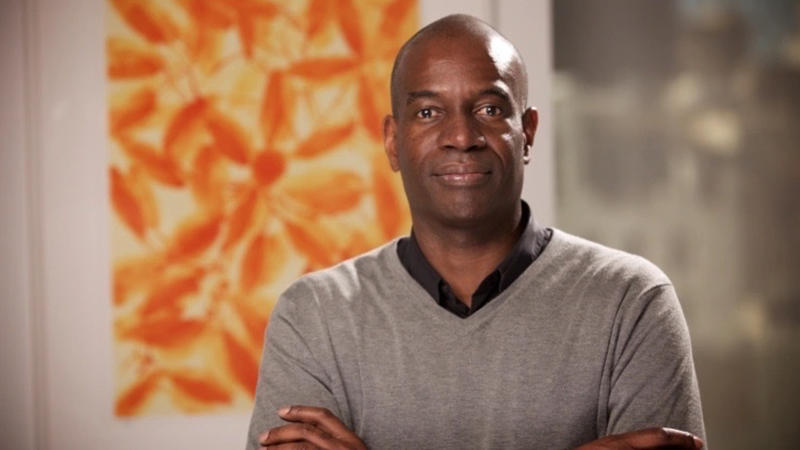

As the founding managing partner of Plexo Capital, an institutional investment firm that was incubated and spun out of Google Ventures (GV), Lo Toney knows what it means to be on both ends of the table, whether it’s being a venture capitalist (VC) or operating a startup.

“There are a lot of similarities,” he said during the episode of Black Tech Green Money (BTGM) podcast. “We think about it all the time, both in terms of how we operate and communicate the message of Plexo Capital, but also what we look for in other early-stage firms in general partnerships that we want to invest into.”

When it comes to what they’re looking for in a startup, he further explained that the market size, along with the problem that is solved, the solution and how it will fit into the overall competitive landscape are some of the key elements that encourage a VC to invest.

“Most importantly, especially at the early stage, we’d look at the team as well,” Lo Toney continued. “Lastly, in a combination of all of those things, one of the things that should surface is what is it that makes this company really unique? What’s their competitive advantage.”

For Lo Toney, running a company and investing in a company can be completely different.

“The risk is isolated into a kind of one point of fault,” he shared. “There is the company itself, the entrepreneur of the team, and the market they’re going after but basically the risk is isolated into that one investment investing as a limited partner. It’s a bit different because what I’m doing is as a limited partner, I’m basically investing into a bank account of a general partner and they’ve got a blank checkbook.”

Listen for more on how VCs raise capital, the myths of Silicon Valley, and how legislation keeps what would be Black founders from large wealth-building opportunities on the full Black Tech Green Money episode below.