Neon Money Club pulled up fresh from attending the 65th Annual Grammy Awards to put us on game by merging investment education with music.

—

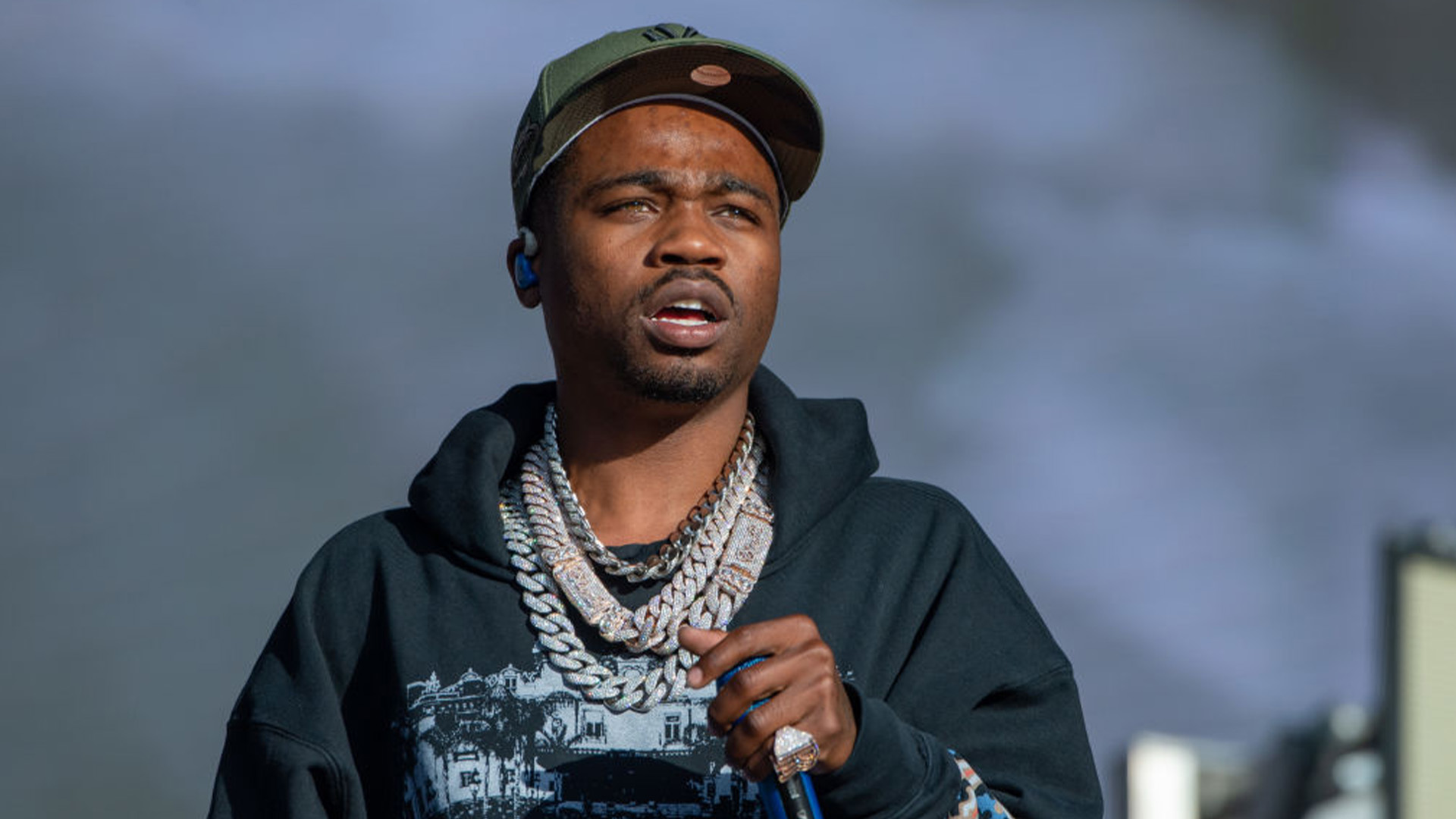

In 2020, Roddy Ricch had the most played song on Apple Music with 455 million streams. Apple Music only pays $0.01 per stream, which means Ricch made an estimated $4.5 million from Apple Music that year.

But what if the streaming service paid him in Apple stocks instead of cash? Let’s find out.

“You don’t have to be an investment professional to spot value.”

Apple’s stock price was $79 per share in 2020. Therefore, Roddy Ricch would’ve gotten 57,500 shares. That same stock is worth $152, as of this writing, which means his $4.5 million would’ve nearly doubled to $8.6 million.

If Roddy had made a similar move with Spotify, he would’ve lost money instead. But unlike Spotify, streaming isn’t Apple’s only business (iPhone, AppleTV+, Macbook, etc.), and this is where common sense analysis (a.k.a. Good Taste) is useful.

You don’t have to be an investment professional to spot value — you already have good taste. Start first by researching the companies that give you value. You can probably find 10 of them by looking around your apartment.

“Starting in 2023, we’re bringing ownership energy only.”

Whether you have bars like Roddy Ricch or are just a hardworking person who subscribes to Apple (AAPL:NASDAQ), wears Nike (NKE:NYSE), or uses MAC Cosmetics (EL:NYSE) – it’s important that we think of how we can flip ourselves from consumers of the brands we love, to owners. The buying power of Black Americans is projected to reach $1.8 trillion by 2024. Whether it’s with our dollars, our talent, or our culture — we power revenue for a ton of the companies in the U.S. Stock Market.

Just imagine if we shifted part of our buying power to owning part of the companies we already spend our time and dollars on. Starting in 2023, we’re bringing ownership energy only.

At Neon Money Club, we call that the Long Money Mindset.

—