Two days ago, I minted my first NFT. I’ve been increasingly enamored with the idea of both, collecting digital art, and the concept and implications of smart contracts over this past year. After doing a ton of research over the last couple of months, I decided I wasn’t going to really learn by sitting on the sidelines, I needed to get in. Either I was going to buy some NFTs, or I was going to make some. I could even do both!

What kept me apprehensive about buying NFTs was the hype surrounding some of the ones we’ve all probably heard of, CryptoPunks and Bored Ape Yacht Club. While learning, I found it difficult to decipher signal from noise as I both explored what I wanted to invest in, and learned how to actually buy something I wanted. I knew the Punks and Apes had value, but they were also tens of thousands and hundreds of thousands of dollars to secure. There were cool things I found in price ranges I didn’t mind investing in, but being a newbie, I didn’t feel comfortable yet that I was making a good move buying something obscure. And, you might think that securing your first NFT is as simple as finding the one you want and swiping your AMEX to get it as you would on Amazon, but you’d be wrong. There are layers to making transactions in the world of crypto, and it’s very easy to make expensive mistakes. Simply moving your money from one pocket to another can cost you.

All in all, I didn’t struggle with understanding that the art hand in hand with the tech had value and big implications, but I understand why some people do have that challenge and internal questioning. And, we’ll talk about that another time. What I wanted to accomplish was getting my hands dirty so I could fully appreciate what digital art would and could mean to both me as a creator and my fellow community of creators and as a collector and consumer who likes nice things.

What I found in my study is so much more than just a community of dope creators with their work on display in exchange for ETH, but also an underlying technology that, I believe, will revolutionize agreements between people – the bedrock of functioning, or malfunctioning society.

But I digress, this post is about making your first NFT, so I’ll do my best to stick to the scope.

Some preliminary work we’ll need to perform today is the establishing of terminology. Definitions, if you will.

Here are a few words and short phrases that are probably not in your daily lexicon, but will be, need to be, if you’re to understand creating (and even purchasing) an NFT.

NFT. What is an NFT?

To define NFT, let’s first define what Non-Fungible means.

“Non-fungible” basically means that the thing is unique and it can’t be replaced with something else. For example, a $1 bill is fungible — you could trade your $1 bill for my $1 bill, and you’ll have the same thing. You could even have a $5 dollar bill, and trade it for my 5 – $1 bills and also have the same thing.

But, the one-of-one Basquiat Untitled (Boxer), created in 1982 is non-fungible. If you have that, and I trade it for the Mona Lisa, I’d have something completely different.

So, effectively, to be non-fungible means its a one-of-one.

So, let’s add the ‘T’ back in to non-fungible. Now, we have a Non-Fungible Token.

Here’s where people get things a bit confused. The token is code. It’s metadata. It’s a deed, like a deed to a house. The token isn’t the house, like the deed isn’t the house, but the deed is the documentation that I own the house. The token is the documentation, or code in this case, that I own said jpeg, mp3, mp4 video file, gif, whatever other digital asset. The digital asset isn’t the token – the token is the proof that I own the digital asset. This is a very important concept, and one I hope you grasp.

We’ve already had experiences in our lives with non-fungible assets, even though we didn’t see them from this perspective. If you record a voice memo on your iPhone, that is a digital asset. I can send you a voice memo from my phone, and you send me one from yours, and they are not, and will never be the same. They are one-of-ones. They are non-fungible.

The moment we decide to place those mp3’s onto the blockchain, however, you tokenize the asset and it then can take advantage of this new opportunity, a marketability of ownership and value.

Minting an NFT

Before I get too deep into explaining this concept, I need to remind you that the art itself (or the voice memo, the mp4, or the jpeg itself) is just that, a digital file – a non-fungible digital asset. The NFT’ing of this asset is when this digital asset becomes represented by a token on the Ethereum blockchain.

The token is not the art. The token represents the art on the blockchain.

To ‘mint’ an NFT simply means assigning a non-fungible token on the Ethereum blockchain to your digital file. Once an NFT is created, it cannot be changed, altered, or tampered-with. It’s done. (I could go off script here, but I won’t because then, we’d be out of scope with this post).

This is an important concept, because, as I said, the token is not the art, the token represents the art on the blockchain, then where is the art? It could be many places, any place, actually, where you can store a digital file. If you store files on AWS, Bluehost, or a server in your bedroom, the original, non-fungible art or digital file could reside there. The person who owns it, however, could be someone you’ve never met. (Again, there’s so much here that I’m compelled to go off-script, but I will control myself).

The most native way to store digital files for the purposes of tokenization as an NFT, however, is to store them on what’s called an IPFS, The InterPlanetary File System, which, in laymen’s terms is a decentralized server, which holds files in the ether.

Crypto Exchange

Let’s use Coinbase, as it’s arguably the most popular. A crypto exchange is an online marketplace where you can buy, sell and trade cryptocurrency. There are several of these online and ones you can download as apps, and I won’t go through them all. For the purposes of this post, we’ll stick with Coinbase, one of the most, if not the most, widely used.

Digital Wallet

A digital wallet is a software-based system that stores your coins. Using your wallet, you can make transactions (like making payments as it stores your coins, and you gain access to services, as it stores your passwords).

Gas Fees

Erase the idea in your head of automobiles. Gas fees, in the world of Ethereum, is the fee you pay for the usage of the network. Making transactions on the blockchain uses computational power. That computational power costs money (someone has to pay the electric bill). Gas fees are the fee you pay when you perform transactions. We’re going to talk a lot about this concept, but this is all you need to know for now.

Ok, so now that we’ve established some foundational language, let’s mint our first NFT.

The first, thing we have to have is, duh, a digital asset. So, you might have a song you’d like to place on the blockchain, or a piece of art you created in Illustrator or Photoshop, or maybe a poem you wrote and saved as a gif.

None of this conversation matters if you don’t have some digital asset you want to share with the world. I won’t spend a lot of time here since, while having an asset is critical to this idea, it’s obvious, and there are other necessary steps more worthy of our time.

It is important, necessary, and required, you first have a digital wallet. There’s no need in having a digital wallet if you don’t have any coins. And yes, you’ll need some coins (remember, gas fees!).

The first thing you’ll need to do is setup an account on Coinbase. You could use other crypto exchanges, but this is the one we’ll use in this session. To setup your Coinbase account, you’ll need all the same kind of information you need to setup any other online account, an email address, unique username, password and etc., but you’ll also need to serve up a photo of your Driver’s License or some other State ID. From the Coinbase website, the reason behind requiring this documentation is:

To prevent fraud and to make any account-related changes, Coinbase will ask you to verify your identity from time-to-time. We also ask you to verify your identity to ensure no one but you changes your payment information.

So, be ready with your ID on hand when setting up your account.

The next thing you’ll need is your banking info. In order to by some ETH, you’ll need to have access to an online account to connect to your Coinbase to swap out the currencies.

So, you’re a genius. You got this far without much of a headache, right? Well, this was the easy stuff. It gets a little more complex here now, but I promise, it gets simpler again shortly.

This is the part I got hung up on for like a week.

The Exchange vs the Wallet

There was a lot of unlearning I had to do in order to be birthed into the world of Web3. There were a lot of norms I was used to and had taken for granted that are not native, or at least not at face-value native, to how we perform in our analog world.

This concept of a digital wallet took me a second. I assumed once I had some money in my Coinbase account that I was golden. I could go and make some purchases. But, Coinbase is just an exchange. You don’t buy things from the Coinbase app. You need a digital wallet to do that. Which, after I got over the momentary state of confusion, started to make sense. If I have a bank account, that doesn’t mean I make buy some Yeezy’s on the Confirmed app using my bank account. No, I use my credit card, or debit card – which is backed either by my creditworthiness or my bank balance. You get the point. The exchange is just where I convert my dollars to the cryptocurrency of my choice, be it Ethereum, Bitcoin, Dogecoin, Shiba or whatever, and the wallet is where I buy stuff in a marketplace. Like, an NFT marketplace.

With this conversation, we’re talking about minting NFTs, not buying them. But, so far in our steps, we’re still doing the work to perform either task. You still have to have a wallet to mint NFTs. Again, your wallet is also the holder of your coins and your passwords!

Moving coins over to your wallet.

The process of moving my coins from the exchange to my wallet, again, being new to the game, caused me some heartache. But before I describe the heartache, I’ll tell you about my wallet.

There are 2 wallets I hold. One is a MetaMask wallet, and I also have a Coinbase Wallet. (Coinbase is not only a marketplace, the company also has a wallet to go alongside the marketplace service).

Once you have some coins in your marketplace account, you’ll need to move some over to your wallet in order to continue the process of minting your first NFT.

This was my first experience with the dreaded gas fees.

I mentioned before that you get charged gas fees whenever you make a transaction on the Ethereum blockchain, remember? I also mentioned that at this point, I’d already purchased some ETH. So, why is now, moving money from my Coinbase account to my wallet, the first brush I’ve had with gas fees? Wouldn’t I have had to pay gas fees to get my first coins in the marketplace? Yes, but no.

I could go off the deep end, here, but I won’t. We’ll give you enough information to understand the core concepts without bogging you down in details and minutiae.

When you buy crypto from a marketplace, that marketplace already has the ETH. So, having $1,000 in your Coinbase marketplace account is effectively like having a $1,000 IOU from Coinbase. You really don’t own the ETH. When you go to move it over to your wallet, however, you’re taking control of the ETH and placing it in your, digital, hands. So, because you first simply had an IOU from the marketplace, you didn’t have to pay any gas fees because you really didn’t have the ETH. You had the promise of ETH.

So, platforms can get hacked, and it’ll matter to you because they’re storing your ETH, or your promised ETH. If its in your wallet, however, you risk losing it if you lose your keys, or your keys get stolen. You’re in control. (Going deeper into that isn’t in scope with this post, so I’ll leave that at that).

So, this is where I came to pay my first real toll, in the form of gas fees. Moving money from my Coinbase marketplace account, to, in this case, my Coinbase wallet.

Since I’m truly taking ownership of my ETH instead of having Coinbase, the marketplace, being a custodian for my ETH, I’m placing a recorded transaction onto the blockchain. Therefore, that requires computational power, and I must pay.

Gas prices, like the gas prices we’re used to – the ones that involve automobiles, fluctuate. And, they fluctuate based on the demand for computational power. The volume of network activity. Since Ethereum is in more demand than ever, gas prices have been higher than they’ve been in months and years recently. They’re incredibly high at the moment. So much so, that the rates make some investments no longer feasible and even ruin the value and possibility of future returns.

So, let’s say you’re comfy with paying the incredibly high fees to move your ETH (you baller, you) and you make the move. (NOTE: I’m going to use some very simple numbers going forward as an example. Actual numbers in these real life instances vary second to second, but my goal here is for you to understand the concepts. Giving you simple numbers helps me communicate the ideas.) You had $1,000 in ETH in your Coinbase (marketplace) account, and now you have $920 in ETH in your Coinbase wallet, after paying gas fees.

Here’s a peek at everything you have so far:

- A digital, non-fungible asset (a piece of art, or an mp3 of a song)

- A Coinbase marketplace account

- A Coinbase wallet, with some ETH in it

The next thing you’ll need to mint your NFT is an account on an NFT marketplace. For this example, I’ll use the most popular NFT marketplace, OpenSea. (There are others, like Rarible, Foundation, Mintable, and more, however).

To setup an account on OpenSea to mint our piece of art, we’re going to need to use the other utility of our wallet. Remember, a wallet can perform more tasks than spending coins. It can also serve as our password trapper-keeper.

In order to create our OpenSea account, we’ll need to connect OpenSea, by clicking the ‘Create’ button at the top of their webpage, to our wallet. This will require a bit of authentication which we don’t have to get into here, but I found it to be quite user-friendly and uncumbersome. If you’ve made it this far, should get through this process with no issue.

Guess what – now that you’ve created your Wallet and moved some ETH into it, you’ve made it past much of the heavy lifting! Most people don’t make it this far, so, cheers!

Now, after having connected your wallet, you should see that you have an OpenSea account now. You’ll be able to click into your profile on OpenSea, upload a profile picture, add a bio, your social handles, and more. But, let’s skip all that and get back to minting our first NFT.

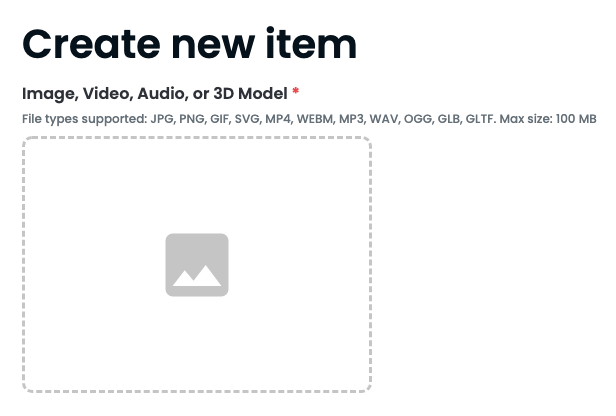

The reason OpenSea is the big dog in this NFT marketplace space is they make it super easy to mint NFTs. What you’re going to do is, simply, click ‘Create’ at the top of the page in the navbar, and start creating your item.

OpenSea allows you to upload a number of filetypes, such as JPG, PNG, GIF, SVG, MP4, WEBM, MP3, WAV, OGG, GLB, GLTF. with a max size of 100 MB. This is pretty cool, and creators have a lot of options for work they’re able to share with the world!

Most of this page is self-explanatory, but the one thing, and among the last things to note here is the benefit of NFTs, as opposed to the pre NFT world of art, related to the creators reward for her creation.

Historically, and still in many if not all analog instances, say you create a painting and you’re lucky enough to find a buyer at some community art show who you sell the piece to for $10,000. You won, right? For many artists, selling anything at that number is a victory.

But let’s put a real world twist on this that’s happened time after time.

You sold that piece at that community art fair for $10k. 2 years later, the person, let’s call him Sal, has garnered a lot of interest in that piece as he throws these remarkable dinner parties at his home in Utah. A purveyor fine art loves the piece, and buys it from Sal for $100,000. Sal made $90k on his investment. You, the creator of the work, realize none of that secondary sale value. That purveyor lists it in a Christie’s auction and it sells for $600,000. Again, you see none of that cash, and that $10k you were so excited about is starting to feel like a raw deal. With today’s technology, it is.

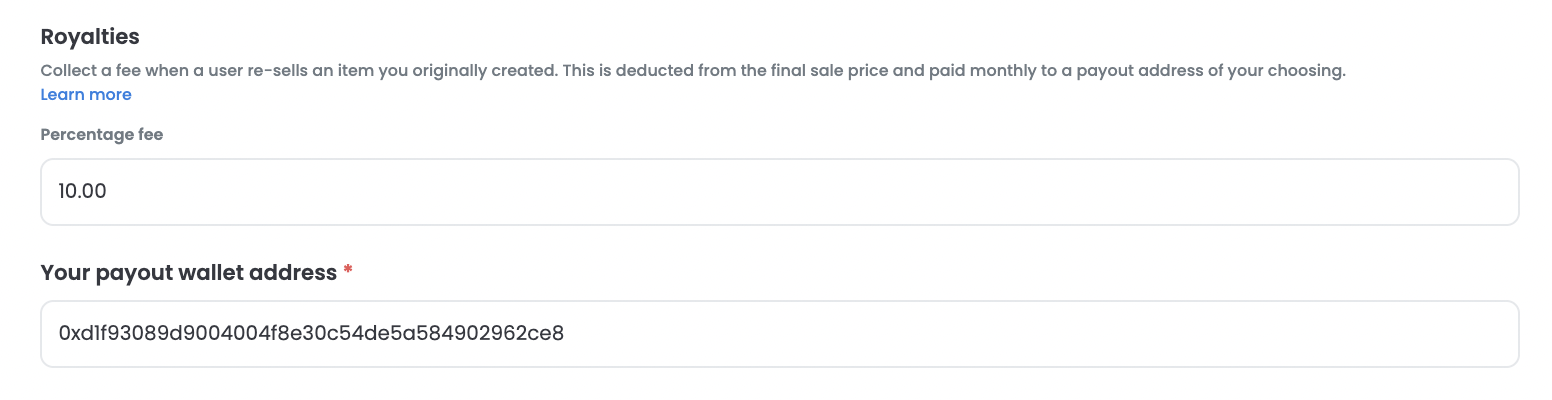

With an NFT, and on the same page we’re looking at on OpenSea, you can create a royalty that gets solidified into your art. Up to 10%, in fact.

So, what does this mean, based on our example?

Baked into the smart contract, which is simply the settings we’re creating on this page we’re looking at on OpenSea, we’re baking into our NFT a set of rules that governs all transactions going forward about our NFT.

So, let’s play it out again as an NFT.

You’re at the community art fair, and Sal walks up, he’s like “Nice piece, kid. How much?”. You muster up the courage, take a big gulp, and say $15,000. You and Sal haggle, and you settle on $10k. You feel like million dollars because you sold a piece for 5-figures that you created at home in your drawers.

Sal has his dinner party at his home in Utah and the purveyor shows up – loves the piece. He buys it from Sal for $100,000. This time, you’re not mad though, because, baked into the NFT is a smart contract that outlines a 10% royalty. So you made your initial $10k, and now that Sal is out there selling again, you made 10% on his sale to the purveyor, and you cashed in another $10k as you earned 10% of his $100,000 sale. Now, you’re at $20k total.

The purveyor, being a friend of Christie’s auction house, lists the piece, and it goes for $600,000. Your 10% royalty, never goes away. Its unchangeable, unmodifyable, and baked in. What did you just earn? $60,000. In total, you’re up $80,000 and didn’t have to do anything else, besides mint your NFT and it went to work.

Finally

Obviously, there will be millions of NFTs created as the awareness grows over time, and not all will have this outcome. That’s not important. What is important is that now we have the opportunity for it to happen. Jean-Michel Basquiat didn’t. Gordon Parks didn’t. You do.

In the future, we’ll get more into smart contracts, DAOs, and other implications of NFTs like what it might mean for health insurance, home sales, and more. But, my goal with this post is to pique your interest in the future we can all take advantage of now and benefit from for generations to come.

What will you create?