If you’re even on social media on a part-time basis, you’ve heard the term “digital currency.” Everyone can recount at least one story of receiving an Instagram DM, or comment, from someone promising to make them millions of dollars from just a few hours of work thanks to a mysterious, and previously unknown, secret from “Forex.”

The nebulous nature of the concept of digital currency makes it easy for people to take advantage of others, to fall victim to scams, or even just to not have even a passing understanding of what’s going on.

But since knowledge is power, we’ve decided to take you through a crash course on digital currency. What is it? What is it not? What are some of the biggest myths about it? And finally, what should you know about it when making future money decisions?

Digital Currency: The Basics

As its name implies, digital currency is — in a nutshell — non-physical fiat.

Authentication of such non-physical currency is done using blockchain technology, which is really a fancy way of saying “end-to-end encryption that’s secure on both sides of the transaction.”

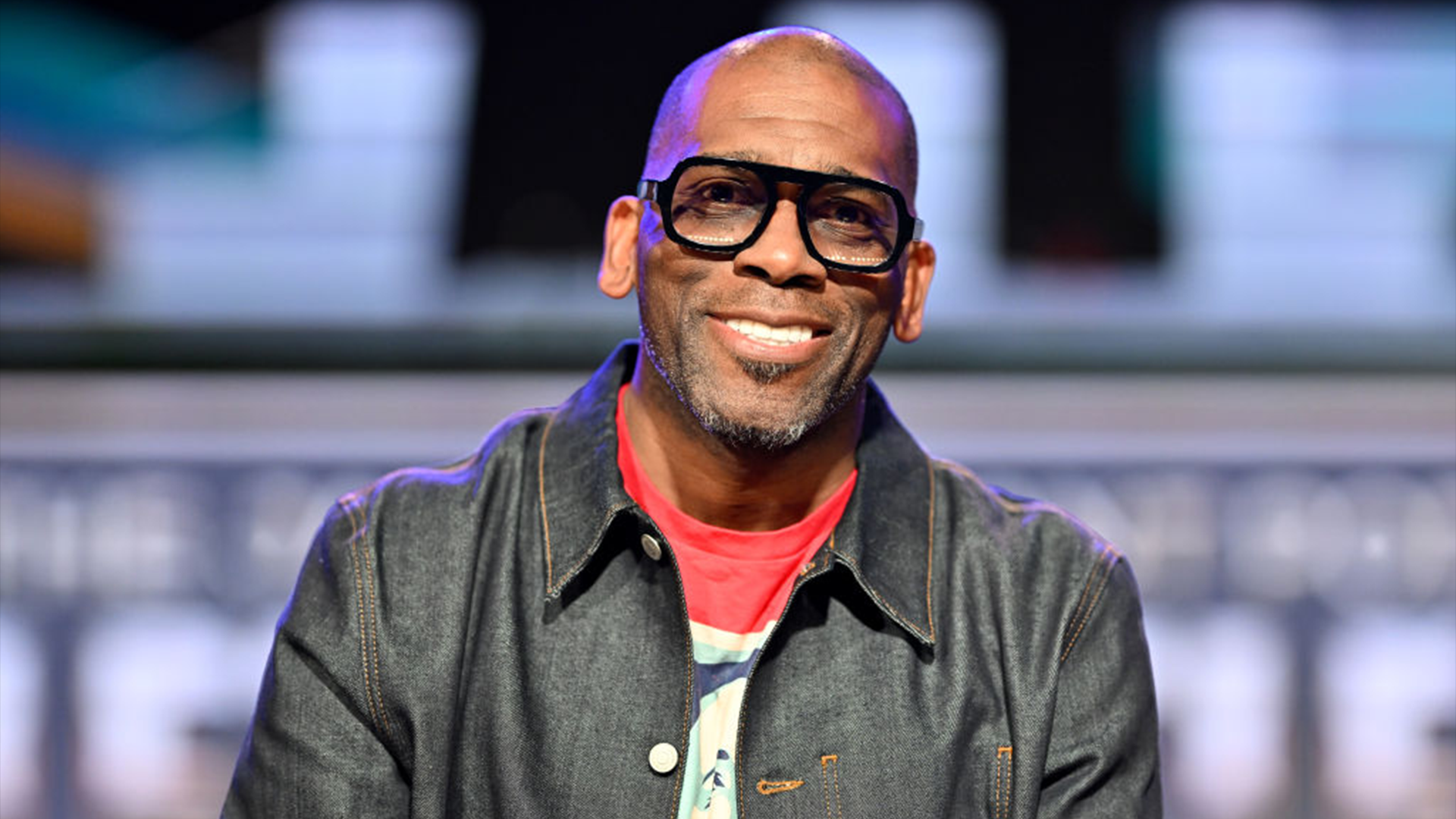

Bettinna of BettyMedia broke down what digital currency will mean for future transactions.

“Let’s start with the difference between the terms ‘fungible,’ and ‘non-fungible,’” she told AfroTech. “Fungible refers to any assets or goods that can be interchangeable with another individual asset or goods that are the same value or it can be the same type. For example, let’s take a $1 bill — whether it’s been printed in 1980 or 2020, you can exchange it for four quarters, or ten dimes, or 100 pennies. But a non-fungible is, really, a fancy way of saying that something is one of a kind.”

So whereas physical fiats can be forged, non-physical fiats cannot. This means that digital currency payments of all kinds are “real,” and non-fungible.

This means that there’s little if any chance of transactional fraud when used correctly.

Common Digital Currency Misconceptions, Debunked

Now that you understand what digital currencies are, in a nutshell, we can get into debunking some of the more popular myths about it, once and for all.

Myth No. 1: They’re An Easy Way To Make Money

As was mentioned, we’ve all received those Instagram DMs and comments promising us untold fortunes if we trust a random person that we’ve never met before with tens of thousands of dollars to invest in “Forex.”

And while most people can see things like that as the malarkey that it is, the only reason it exists in the first place is that people mistakenly believe that they can make tens of thousands of dollars, instantly, with digital currency.

It’s true that there are some investors who have seen tremendous gains by investing in Bitcoin (one of many digital currencies out there). But there are just as many — if not more — people who have seen tremendous losses by investing in Bitcoin, because — to put it simply — Bitcoin is very volatile, market-wise, right now.

Oh, and just so you know: “Forex” is short for “foreign exchange,” and it involves trading one currency — the US Dollar, in this case — for another (in this case, Bitcoin). Investopedia cautions that the only entities that truly get rich off of Forex trading are hedge funds, which have tens of millions of dollars behind them. Most people, however, not only lose money, they literally lose everything they own.

As with any other investment, discernment is key, and it’s imperative to consult with a trusted financial advisor before investing in anything, let alone such a volatile investment as a digital currency. And, not that it needs to be said, but just in case: don’t trust the random guy who slides in your Instagram DMs about the “opportunity.”

Myth No. 2: All Digital Currencies Are The Same

Another common misconception about digital currency is that they’re all the same — if you have Bitcoin, it’s just as good as having Ethereum, and so on.

But that would be like saying having $100 US Dollars and 100 Euros are the same thing — in other words, no, not all digital currencies are the same.

Bitcoin, the most common digital currency, is basically considered the “cash of the Internet.” It can be used in many online transactions to do everything from booking hotel rooms to paying an outside consultant for his services. Ethereum, meanwhile, is mostly used in contract negotiations, and the ever-embattled Ripple is used in place of SWIFT for international monies and securities transfers.

If someone doesn’t understand those basic differences in digital currency, yet still tries to pitch you their “investing” services, there’s a good chance they’re going to make you lose your proverbial shirt.

Myth No. 3: Digital Currencies Aren’t Real

There are many things about digital currencies that people are confused about, but for some reason, there’s a pervasive — and erroneous — belief that they aren’t real.

Much of this misconception has to do with the fact that digital currency isn’t tangible — it’s not like a dollar bill, or a check, or a coin. But saying digital currency isn’t real simply because you can’t physically touch it is like saying email isn’t real because, unlike letters, you can’t physically touch them.

That said, digital currency — unlike a more tangible currency, like gold or silver — is very volatile. While this may change as it becomes more common in the market, it’s best to err on the side of caution when it comes to investing in them.