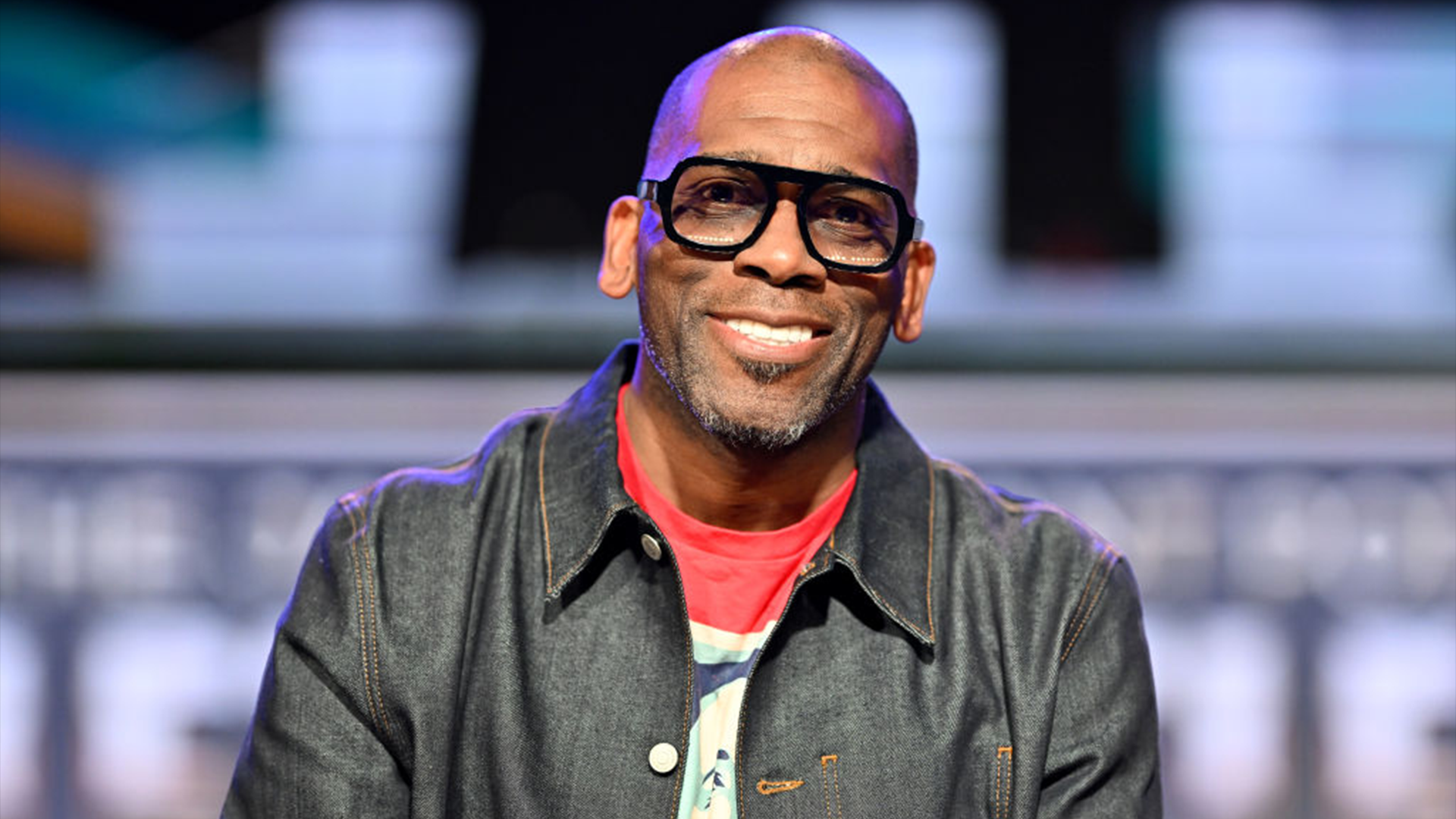

NBA All-Star-turned-entrepreneurial investor Chris Webber has upped the ante once again. This time, he’s teamed up with JW Asset Management to launch a cannabis impact fund worth up to $100 million.

In a press release announcement, it was revealed that the private equity cannabis fund will invest in companies led by entrepreneurs of color pursuing careers in the cannabis sector.

“As our country moves closer to federal legalization, I believe it is more important than ever to empower the next generation of cannabis leaders in a tangible way,” said Chris Webber, in the press release statement. “I’m thrilled to team up with Jason [Wild, CEO of JW Asset Management] on this endeavor — he’s a visionary in this industry and understands the urgency of supporting minority business leaders in this space. For far too long, minorities have been excessively punished and incarcerated for cannabis while others profited. Working with JW, we will equip underrepresented entrepreneurs with the financial resources and industry knowledge to build businesses and thrive.”

Chris Webber couldn’t have picked a better partner to launch the cannabis impact fund. In addition to having a $2 billion asset war chest, JW Asset Management is led by Jason Wild, who is a registered pharmacist and the chairman of Arbor Pharmaceuticals and TerrAscend Corp. Webber, himself, is a longtime cannabis and CBD advocate.