Adelphi Bank, Ohio's Only Black-Owned Bank, Was Established To Dismantle Financial Inequities — Now It's Tripled Its Assets To $68.2M

Samantha Dorisca is a Houston-based journalist and photographer whose mission is to impact communities through the gift of storytelling using the written word or visual media. She completed her B.A at The University of Texas at Austin and is pursuing a M.A at The University of Memphis. Her work can be found on platforms such as Houstonia Magazine, Girls' Life Magazine, and Blacque Magazine. Samantha mainly reports on tech, trends, and entrepreneurship.

Discover more of what matters to you

Explore more

Editorial Note: Opinions and thoughts are the author’s own and not those of AFROTECH™. The turmoil over tariffs has taken center stage since President Donald Trump has started to make good on his campaign promise to Make America Great Again. His latest move is leveraging the tactic of tariffs to help bring back manufacturing jobs that he believes have been outsourced to other countries and should be available to people in the United States. However, having the goal of quickly bringing industrialization to a country has been tried elsewhere before. Mao Zedong of China, who formed the People’s Republic of China in 1949 and ran it until his death in 1976, tried what Trump is doing in the U.S. in China. It was called The Great Leap Forward and started in 1958. It aimed to change China from a country that relied on agriculture as its economic center to one that relied on industrialization instead. Similar to Donald Trump’s vision for industrialization, it included a focus on increasing...

Editorial Note: Opinions and thoughts are the author’s own and not those of AFROTECH™. Billionaire business leaders turned against President Donald Trump as he implemented sweeping tariffs with other countries, which have amounted to billions of dollars lost. Many of the billionaires who have pushed back against the Trump tariffs have also endorsed him for the 2024 presidential election. One of those billionaires, Bill Ackman, warned against tariffs, likening them to an “economic nuclear war” in a post on X (formerly known as Twitter). He also claimed that the tariffs weren’t what he voted for, despite Trump speaking on tariffs early on in the election. How Will Tariffs Affect The American Consumer? Unwarranted tariffs will not only decimate our economy but also hurt our already fragile standing on the world stage. In retaliation, China has raised tariffs on American goods to 125%. Most business leaders, economic experts, and other world leaders are confused over Trump’s misguided...

UnitedHealth Group, a longtime healthcare powerhouse, just took a brutal hit, missing earnings expectations and slashing its 2025 outlook. The company’s stock dropped rapidly Thursday morning, April 17, and it wasn’t just a blip — this was a full-on market reaction to what many are now calling a crisis moment. At the center of it all? A shaky Medicare business, a leadership shakeup, and the long shadow of a massive cyberattack. For years, UnitedHealth was considered untouchable on Wall Street. But now, the once-steady giant is showing signs of severe strain. Medicare Misfire Rattles Confidence In The Insurance Giant Investors didn’t just flinch — they ran. According to The Wall Street Journal, UnitedHealth stock tumbled about 18% in early trading, pulling other major healthcare players like Humana and CVS Health down. What happened? The company’s Medicare Advantage division, which manages benefits for older and disabled Americans, faces deeper issues than previously disclosed....

Dr. Christine Izuakor is making it easier for people in technology to forge meaningful connections. The Houston, TX, native is a cybersecurity professional with over a decade of experience leading cybersecurity functions at Fortune 100 companies. Her career journey could have looked very different had she pursued the medical field, a path favored by her Nigerian parents. However, she “failed miserably” in her attempt to become an eye doctor. Her pivot came after taking a course on encryption, which sparked her interest in cybersecurity. “I immediately switched my major and went on to earn a Ph.D. in security engineering. From there, I spent about 10 years leading different security functions at United Airlines, was a graduate cybersecurity professor, and so that’s what really kind of got me into this space and then allowed me to grow,” she told AFROTECH™ in an interview. Cyber Pop-up Today, Izuakor works part-time as an adjunct professor in cybersecurity at various schools and...

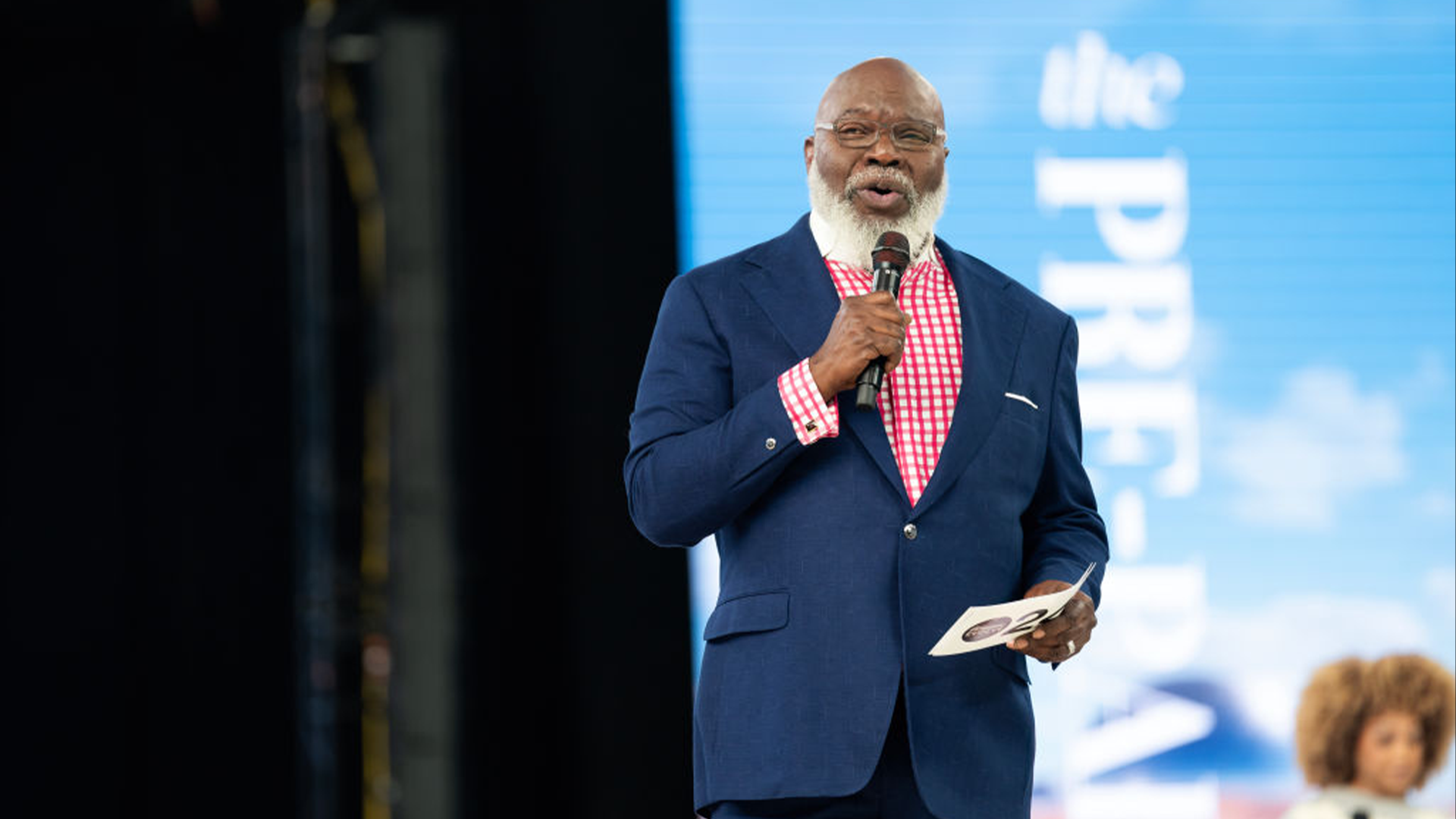

As faith leaders, entrepreneurs, and policymakers navigate the fast-shifting terrain of artificial intelligence, automation, and digital globalization, few figures have leaned into this moment with as much intentionality — or complexity — as Bishop T.D. Jakes. Known to many as a pastor, to others as a media mogul, and increasingly to investors and technologists as an ecosystem builder, Jakes is reasserting his role at the intersection of innovation, equity, and cultural capital. This is where his ongoing initiative, the Good Soil Forum, enters the chat. The conference, which has convened business owners, technologists, creatives, and investors for years, positions itself as a gathering and a long-term infrastructure. It reflects Jakes’ emphasis on sustainability, access to capital, and the kind of practical knowledge often kept behind institutional gates. What has shifted recently, however, is not the mission — but the moment. When Technology Hits Close To Home For Jakes In 2024,...

Five days of fun, networking, mentorship , and the chance to enjoy everything the most magical place on Earth has to offer — that’s what Disney’s Dreamers Academy is all about. From Wednesday, March 26, to Sunday, March 30, 2025, students from around the world traveled to the Walt Disney World Resort in Orlando, FL, to be inspired, motivated, and energized by educators, business executives, community leaders, and celebrities, including “DREAMbassador” Tyler James Williams (“Abbott Elementary”) and former NASA rocket scientist Aisha Bowe . For the 100 participants — ages 13 and 19 — such as Alexis Limary, Jayden Kelly, Christian Rutter, Iraj Shroff, Ava Powers, and Tristan Williams, getting accepted into the 18th annual Dreamers Academy was a dream come true, preparing them for future careers in science, technology, engineering, and math ( STEM ). “The opportunity to even be able to come to Disney World, expenses paid, that’s just someone’s dream. Also, to be able to become a part of...

Tax season rolls around every year, but for many it never feels any easier . The stress associated with this time of year (particularly if you’re not anticipating a huge return) can really mess up your groove. Whether you’re managing multiple income streams , juggling business responsibilities or just trying to keep up with life, things can get messy fast. Getting your taxes filed on time can feel overwhelming and like a chore. And let’s face it, when deadlines sneak up and your plate is already full, taxes typically take a back seat. No matter how busy you are, it’s worth noting that missing the filing deadline can lead to some avoidable penalties and much more unnecessary stress. If you’re not ready to file by the due date, requesting a tax extension so time is on your side again might be the next best choice. For those wondering how to take advantage of the option, there are a few things to remember . Firstly, filing an extension is a normal thing (and it is an IRS-approved...

In an era where the boundaries between technology, law, and culture constantly shift, Blake Richardson, Esq., is one of the few professionals standing firmly at the intersection. As chief legal officer at Gala Games, Gala Music, and Gala Film, Richardson navigates one of emerging tech’s most complex regulatory environments: blockchain. But her journey — from working behind the scenes at NBCUniversal, Lionsgate, and the Phoenix Suns to helping shape blockchain legal frameworks — is more than a personal evolution. It’s a case study in how legal minds are increasingly essential to the tech sector’s future. Understanding Legal Tech In The Age Of Blockchain At its core, legal tech encompasses tools that streamline how users interact with and interpret the law. From document automation and case law research to e-discovery platforms and client management systems, legal tech is transforming how firms and in-house departments operate. But as Reuters notes, it’s not just about efficiency —...

There’s no need to walk into interviews blindly anymore. There are many AI tools designed for interview prep, offering features ranging from mock interviews to personalized feedback. These platforms allow users to receive guidance from knowledgeable AI and even connect with other real people for more realistic practice. Some of these platforms are specifically designed to aid interview candidates in certain fields, like tech, but others provide personalized practice for a variety of fields . With stiff competition in a job market that’s already hard to break into, using AI for prep can help take some of the stress out of interviewing. Let’s explore 10 AI tools designed for interview prep, what they do, and which interview candidates can benefit from them the most. Interviewing.io This resource is best for those pursuing technical roles, especially software engineering . Interviewing.io offers anonymous mock interviews with engineers from top tech companies that provide detailed...

A strategic partnership has formed to empower Black leaders. AFROTECH™ and The Gathering Spot (TGS) will be teaming up to scale AFROTECH™ Insider, a membership program designed to place participants on a track of excellence in tech and business through exclusive conversations and meetups, such as fireside chats, panel discussions, cocktail hours, and personal branding privileges, including priority for speaking events such as the annual AFROTECH™ Conference and PR opportunities. By teaming up with The Gathering Spot — a private-membership club bridging the gap between community and culture — AFROTECH™ will be able to provide greater resources, relationship building, and platforms to scale organizations for the membership community, which consists of Black executives, founders, and visionaries. “The Insider program was built for the modern executive who isn’t just leading teams — they’re shaping industries,” said Morgan DeBaun, founder and CEO of Blavity Inc. “Our partnership with...

Remaining a student has led Carmelo Anthony into various industries. The former NBA player, who retired in 2023 and is a first-ballot Basketball Hall of Fame inductee, reflects on his evolution from the 19-year-old drafted in 2003 to a businessman who is now a serial investor and founder in the wine and cannabis sectors. One of Anthony’s biggest takeaways: He is no longer operating in fear. “A top lesson that I’ve learned was ‘stop being afraid,'” he recalled in an interview with AFROTECH™. “ A lot of times when you’re younger and you in these powerful roles and there’s people who are making decisions and there are people writing checks, it’s like ‘You too young to understand it,’ until you grow and until you get older, you go through it and you understand what you truly want to do.” He continued, “At 19, 20, 21, I didn’t have any type of sense of business. I knew street business, I knew street knowledge. I have foundational ethics and morals that could carry over from the streets...

PepsiCo representatives met with civil rights leaders from the National Action Network (NAN) after Reverend Al Sharpton threatened to lead a boycott over the company’s decision to scale back parts of its diversity, equity, and inclusion (DEI) initiatives . After sending a letter to the food and beverage brand on April 4, 2025, outlining details of the intended boycott, Sharpton issued a statement on Tuesday, April 15, saying that he and several members of NAN had a “constructive conversation” lasting over an hour with PepsiCo Chairman Ramon Laguarta and PepsiCo North America CEO Steven Williams. During the meeting at PepsiCo’s global headquarters in Purchase, NY, they had a chance “to discuss our grievances over reports they were rolling back nearly $500 million in DEI commitments .” “We agreed to follow up meetings within the next few days,” Sharpton wrote. “After that continued dialogue, NAN Chairman Dr. W. Franklyn Richardson and I, both former members of the company’s African...

After years of letting baristas bring their full selves to work — tattoos, flannels, colored hair, and all — Starbucks is reining things back in. Starting May 12, the coffee giant is introducing a new, streamlined look that puts the brand’s most iconic symbol — the green apron — back at center stage. The 2025 Starbucks dress code will require employees to wear solid black tops (collared, button-up, or crewneck) paired with bottoms in black, khaki, or blue denim. This shift is being framed as a branding move, part of Starbucks’ ongoing effort to create a familiar and consistent vibe in stores across North America. Each employee, known internally as a “partner,” will also receive two company-branded T-shirts at no cost, including options designed by partner networks. Why The 2025 Starbucks Dress Code Signals More Than Just A Wardrobe Change At first glance, it might look like a simple update to the dress code. But the new dress code is actually doing a lot of heavy lifting. It’s a...

Entreprenuership is a risk that Monique Rodriguez was willing to take on. Business Risks Rodriguez is the co-founder of haircare brand Mielle Organics, which she launched with the help of her husband, Melvin. She shares on the “Black Tech Green Money” podcast, hosted by AFROTECH™ Brand Manager Will Lucas, that her earliest risk in her entrepreneurship journey was walking away from a stable position as a registered nurse. Melvin also took a leap, leaving his corporate role. Together, they trusted in what they believed was a vision from God and created a blueprint that ultimately led to success. “We didn’t just leave our jobs and say, ‘Oh, we don’t have a plan in place or we don’t have income.’ We had to have a solid plan in place to map out how we were going to get some type of income to still keep our bills afloat and food in our kids’ mouth. So we had to plan that out. But it was a huge risk of the unknown, of both of us turning away from our jobs,” Rodriguez mentioned on the...

The Trump administration has rescinded a historic settlement designed to improve wastewater treatment services for residents in majority-Black communities in Lowndes County, Alabama, where inadequate infrastructure has long led to raw sewage exposure. On Friday, April 11, 2025, the U.S. Department of Justice (DOJ) announced the termination of the 2-year-old agreement made with the Alabama Department of Public Health (ADPH) under the Biden administration , describing it as an “ illegal DEI and environmental justice policy.” “The DOJ will no longer push ‘environmental justice’ as viewed through a distorting, DEI lens,” said Assistant Attorney General Harmeet K. Dhillon. “ President [Donald] Trump made it clear: Americans deserve a government committed to serving every individual with dignity and respect, and to expending taxpayer resources in accordance with the national interest, not arbitrary criteria.” On Jan. 20, 2025 — his first day back in office — Trump had signed an executive...

Events

conference

Multi-city event series empowers corporate executives, investors & tech moguls