This article was originally published on 07/25/2019

2018 was a record year for the amount of venture capital pumped into startups. Over $130 billion went to several lucky founders — the highest since the dot com era — setting them and their companies on a potential pathway to success.

For many people, this number sparks a lot of optimism. More VC dollars means more companies are funded, which means more people have a shot at launching their idea. For Black and brown founders, seeing this large, obnoxious amount of VC funding can be a stark reminder of how much of it they’re not getting.

According to a recent study, over the past 5 years, 77 percent of founders backed by VCs have been white and the teams receiving that money have been made up of mostly white men. Black founders made up just one percent of the companies receiving cash from VCs and for Black women, the picture is even bleaker. According to data from ProjectDiane, Black women founders have only received .0006 percent of total tech funding since 2009. Think about how deep that disparity is. Of the thousands of companies receiving what seems like endless mountains of cash, not even a full percent are run by Black women.

The lack of funding for minority owned startups is one of tech’s most pressing issues, and in 2015 the founders of Harlem Capital decided to do something about it.

Founded by Henri Pierre-Jacques, Jarrid Tingle, Brandon Bryant, and John Henry — Harlem Capital is on a mission to change the face of what a successful, well-funded founder looks like. The company has committed to funding over 1,000 minority-owned startups over the next 20 years. A lofty goal, yes, but one Henry says is more than doable given the sheer amount of innovation coming from communities of color. He says the funding gap is wide, but that’s only one part of a complicated equation that Harlem Capital is trying to solve.

“When you peel the curtain back even further you start to realize that the reason that there is few funded founders, is because there is even fewer diverse fund managers. The folks that are deploying the capital are overwhelmingly white males.”

Henry points to a groundbreaking study by Harvard University’s Paul Gompers that outlines just how homogenous the VC industry is. Gompers’ research shows what a lot of founders trying to raise money already know: That most VC firms are full of white men that went to liberal arts colleges. Plus, those dollars go to people who look like them and have similar backgrounds, which Henry says supports the unconscious bias.

“I just believe, honestly, that people do what they know and historically capital has existed in a handful of networks with folks who have gone to a handful of schools, and so its not uncommon to invest in people who have come up in similar networks as you, have worked at similar jobs, have gone to similar schools.”

Henry also says there’s just not a lot of data to go on when it comes to venture capital, so that leads to a lot of pattern matching and reliance on what has worked in the past.

“It’s not like these companies have like, ten years worth of history. In a lot of cases, they’re upstarts, they’ve been around less than a year, sometimes a year or two. And so because there’s less data to go on, it’s a lot more subjective by nature.”

Venture capital is growing at an accelerated rate. That $130 billion number we mentioned earlier? That’s about a $46 billion increase from just the previous year. Henry says that people at firms like Harlem Capital are a lot more in tune with the ideas of the future and the people coming up with them.

“I just feel like if we’re smart and can stay focused, we can make some really interesting bets across the next decade on the companies and entrepreneurs of the future.”

Henry says venture capital comes with its own set of risks, but putting his faith in minority-owned companies is something he’s more than willing to bet on.

“Look the failure rate is going to be similar, you’re going to have zeros, you’re going to have companies that exit and you may lose a little bit of money or only make a little bit of money. But once you fundamentally have the belief that this job can be done by anyone, then its a matter of who is going to be taking these bets?”

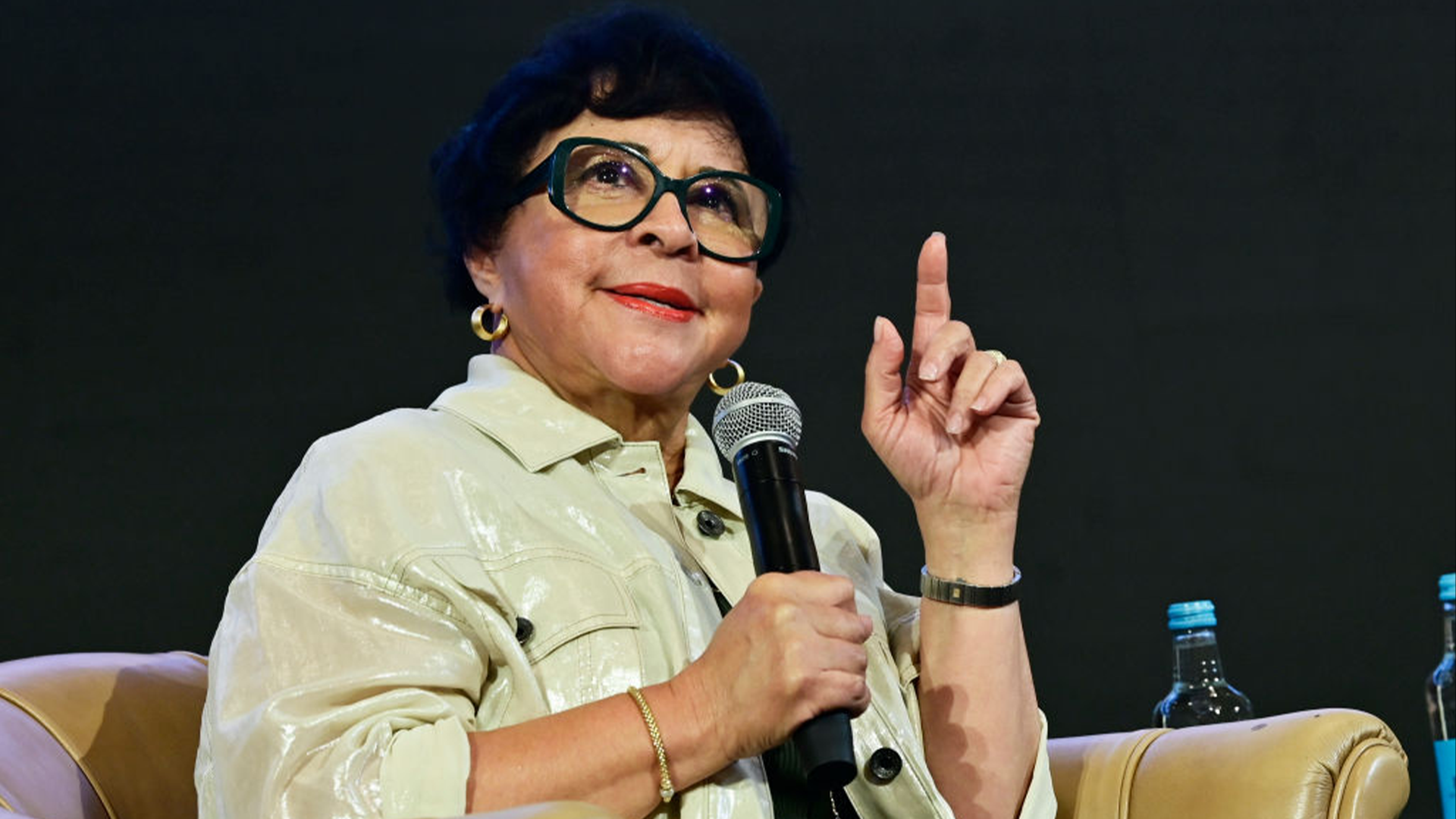

AfroTech caught up with Henry to talk about the funding gap for minority founders, why it exists and what can be done to close it.

This interview has been lightly edited for length and clarity.

Black people drive a significant portion of the culture across the world. People make money from our ideas, the music we listen to, and the way we talk to each other as a community. We’re the reason why a lot of these corporations are making the money they are. So why is everyone getting paid but us?

For us, we view the most powerful way to combat the whole thing is to grow equity. If I could sum up everything that we’re after and what this mission is about, it’s about equity. When you become a student of the game and you start looking and you’re like, “Well, how was this wealth so grossly distributed the way it has been?” it comes down to lack of ownership. A lack of equity in our homes, a lack of equity in the real estate in our communities, a lack of equity at the policy table, a lack of equity in the companies of today. The reason corporate equity is so important is because we’ve grown into such an industrialized and capitalistic state, which by the way, I’m a die-hard capitalist and I believe in capitalism as an equalizer, but at the same time, these companies have amassed so much power. They’re largely propagating the world’s views—what’s acceptable, what’s not, what everyone uses.

2019 has been the record year for IPOs, a record number of companies have gone public and have created so much wealth and I’d be willing to bet that just a fraction of that made its way to communities of color. As a venture investor I know, just given the amount of capital that’s in the venture ecosystem now, that there’s going to be another wave of IPOs. How can I make sure that that liquidity and those monies are going back to our communities. All of that value creation is only possible to get into through venture capital and that’s why that asset class in particular is very important because we are determining the companies that will dominate the future.

We know about the work Harlem Capital is doing to help founders get funding, but why is it so important, in general, to change the narrative around what a well-funded founder looks like?

Not only are we changing the narrative on what a VC-funded founder looks like. We’re changing the narrative on what investors look like. I really do honestly believe that this is a generational opportunity. I really do think we are on the ground stages of doing something special and if we do this right and if we focus on the narrative and the mission, then maybe 20 years from now people will look back on this movement and at firms like ours and say “wow they changed the entire script and visual for what people think of when they think of investors.” I believe that once that visual is out there and it’s mainstream, we’ll have kids who say “Yo I want to be a boss, I want to own land and business and equity.”

So I think one thing your firm and firms like yours have shown us is that innovation goes beyond what we’re seeing in Silicon Valley. Where do you think our next big wave of innovation is going to come from? Atlanta? Texas?

I think as more capital flows to these other ecosystems that increases the likelihood with which game changing companies can come out of these markets. I wouldn’t go as far as to negate the very powerful network effects that exist in the valley, they have an incredible amount of capital, they have a lot great founders and tech talent, but the byproduct though is that it’s gotten a bit homogenous. That’s not to say that more innovation will not continue to come out of Silicon Valley, but I fundamentally don’t think that’s the only place it can come from. What’s going on in Detroit is absolutely incredible, Cleveland is on the come up, Omaha is on the come up, the Lehigh Valley in Pennsylvania is having a manufacturing re-renaissance because of the e-commerce boom. There’s so many hubs across the country that are starting to lean into their specialties and what makes them different. I think once cities stop trying to imitate Silicon Valley and start trying to double down on their DNA, I think that’s when you’ll have a lot more winners.

There are obviously a lot of risks that come with venture capital. Do you all think about that a lot with the work you’re doing? Investing in this many companies is a really lofty goal and comes with its own set of chance.

To me, the greatest risk that exists is not doing something about this equity gap. It will not fix itself. The net worth of the typical Black family is expected to be negative in 2050, we are trending negatively. Yea, it’s risky to start a fund and go after this and be lofty, it’s even riskier if no one fundamentally believes that this gap should not exist. For me, this is the most powerful thing I could be doing with my life and the thought that I wouldn’t be doing this because I was afraid for my personal well-being or my own financial welfare, all those concerns pale in comparison to the amount of impact we could have on a national level.

Editors Note: Harlem Capital is an investor for Blavity, the company that owns AfroTech.