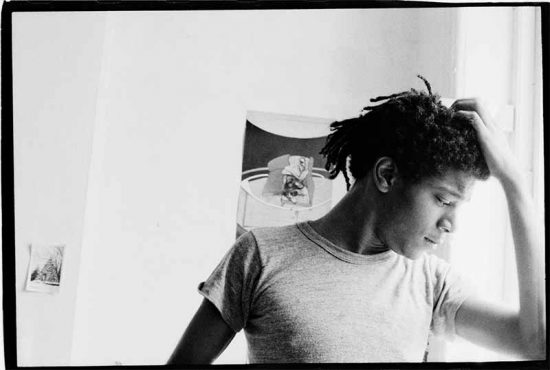

Terzel Ron understands that if nothing else, the entertainment industry is volatile.

So, after he graduated from New York University in 2018, he spent nine months looking for a job — only to finally land a job as a production assistant at ViacomCBS. Thanks to that job, he was able to pay off $5,000 in student loans — but according to CNBC, he wanted more.

In 2021, he got a job at a “large television network” where he makes $110,000 per year. Terzel Ron subsequently got a second part-time job, where he makes an additional $40,000 per year, for a grand total of $150,000 per year.

And, he says, it was imperative to save — and invest — as much of it as he could.

“I invest most of what I make and try to forget the amount of money in my accounts. Jobs come and go, and when they go, the only thing left to show for it is the amount of money you have saved and invested from it,” he said to the outlet.

What’s more, Terzel Ron said he works a lot, too. He told CNBC that he works seven days a week between his two jobs — from 9 a.m. to 11 p.m. Monday through Friday, and from 2 p.m. to 9 p.m. on weekends.

All this, he said, was part of his larger quest to become a millionaire before the age of 30.

Here's A Quick Breakdown of How Terzel Ron Saves His Money

CNBC reports that Terzel Ron is “very frugal” with his money. The only things he and his girlfriend “splurge” on are occasional trips from Los Angeles to New York, and the occasional restaurant meal.

Everything else goes either to expenses or investments.

Additionally, Ron and his girlfriend take turns on what they cover in terms of expenses. For example, one month, he’ll pay the Internet bill while his girlfriend pays the electric and the cable; the next month, they’ll switch it around.

Investments

“Most of Ron’s monthly income goes into investments, with roughly $5,000 per month split between a SEP IRA, a brokerage account, and cryptocurrencies,” reports CNBC. “He also has a Roth IRA, but no longer puts money into it because his annual income is above the limit to contribute. He has over $70,000 saved between investments and cash, with about two-thirds of that tied up in a variety of cryptocurrencies, including Ethereum.”

Looking to the Future

With all this money tied up in investments, it’s hard to believe that Terzel Ron has other investment goals he wishes to achieve. Yet, that’s exactly what he has. Ron told CNBC that in the very near future, he’d like to buy a home of his own (he’s aiming to do that this year), and eventually invest in some other properties for investment purposes.