Showing 25 results for:

generational wealth

Popular topics

All results

Farmer, Patrick Brown, has reclaimed the land once owned by his great-great-grandfather, who was also enslaved there. Currently, Patrick serves as the director of farmer inclusion for the social justice nonprofit Nature for Justice, reports Bitter Southerner. He is responsible for ensuring that $1.7 million in funding is allocated to farmers of color in North Carolina by 2029. Brown also serves on the board of the Eva Clayton Rural Food Institute, an organization established to combat food inequities. Patrick’s passion for farming is rooted in his upbringing. At the age of 9, he was already working on his family’s farm in North Carolina, helping to load tobacco. “It would take us about nine hours to fill up two barns,” he told the outlet. His father, Arthur, played a key role in igniting his interest in farming. He passed down stories of their family’s four-generation legacy in agriculture. “He was educating me,” Patrick explained, according to Bitter Southerner. “He would say,...

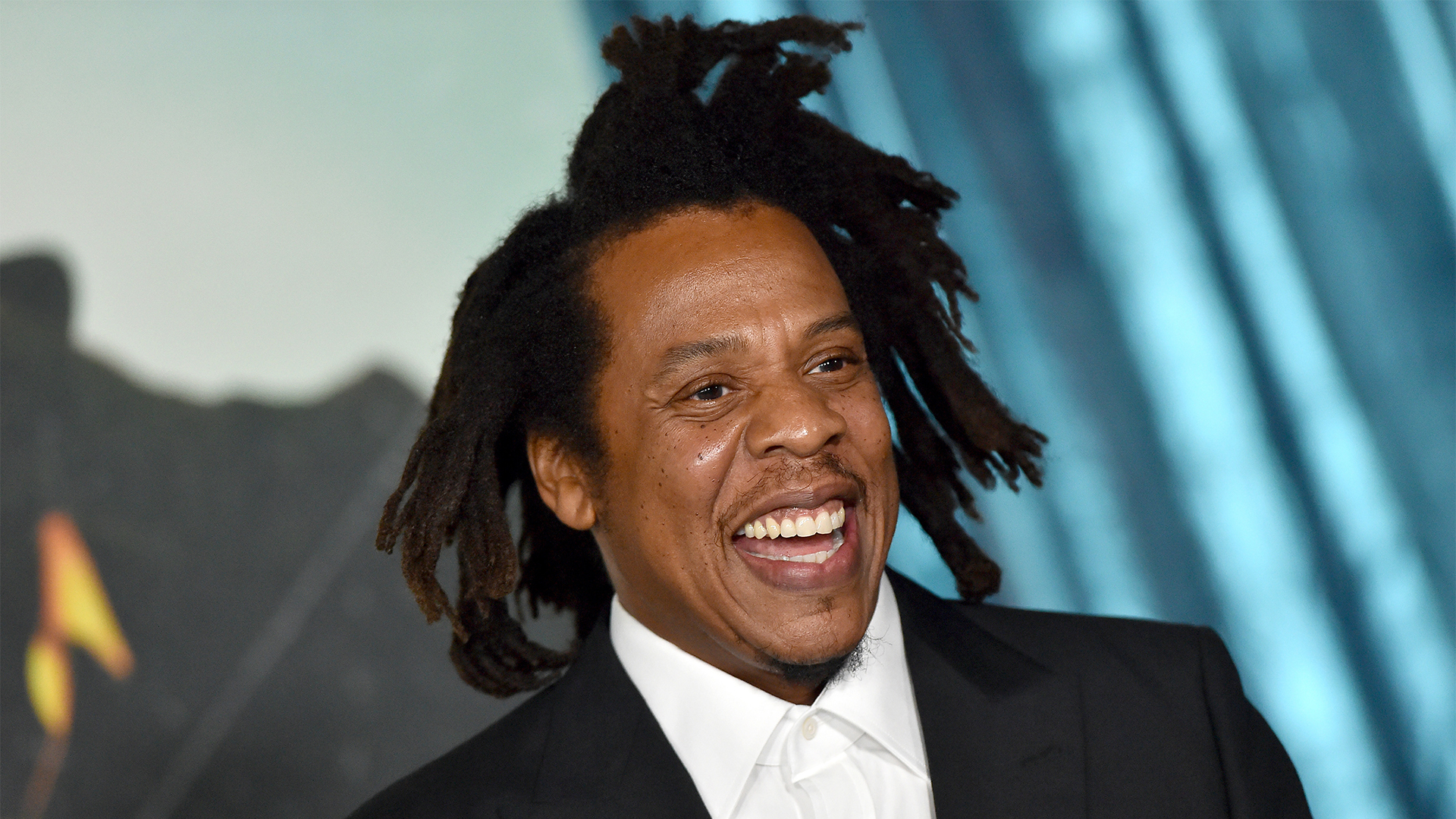

A new financial education program is making its way to Historically Black Colleges and Universities (HBCUs) with the help of Jay-Z. According to a news release shared with AFROTECH™, the Shawn Carter Foundation, with support from Toyota Motor North America, is launching the Champions for Financial Legacy (CFFL) program in time for Spring 2025. To start, the program will benefit students at Lincoln University, Norfolk State University, and Virginia State University, offering a financial curriculum structured around real-world applications. “We are excited to see our partnership with the Shawn Carter Foundation evolve to include this innovative initiative,” said Monica Womack, general manager of diversity & inclusion and community engagement at Toyota, per the release. “One that not only provides resources to HBCU students but also reaches the heart of the community, through advocacy for financial literacy.” The curriculum, developed in collaboration with the Coalition for Equity and...

In any sports competition, coaches go into each game with a specific strategy. From determining who will be a part of the starting lineup to tricking plays to throw the opponent off, every game is built with tools to ensure the team’s success. But what happens when the tried-and-true approach to the game no longer works? For the more traditional and antiquated coaches, they will more than likely stick to the routine, hoping everything will work itself out. However, for those who desire to see change on the fields or courts, the coach will implement a new strategy and approach aimed at getting the results they’ve planned for. The same can be paralleled in the world of tech. Although the industry is experiencing challenging times due to the current job climate, the field still suffers from diversity. According to a 2023 McKinsey Institute for Black Economic Mobility report, Black people represent 12% of the United States workforce, while only 8% hold tech jobs. The people at...

No matter the debate, Sean “Jay-Z” Carter will go down as one of the most influential rappers of all time. While Carter is mainly known today for his business moves, his long-standing music catalog put him on the map. From topics about his upbringing to the cultural nuances of his community, Jay-Z is no stranger to communicating the times and providing classic bops along the way. At this stage in his career, his business acumen and his music have consistently collided. The billionaire gives listeners consistent insight into how he thinks financially and how getting to the bag is more than just a notion. One of the shining examples of this concept is on his last solo project, “4:44.” While some saw it as a response to Beyonce’s “Lemonade,” others tapped into the financial gems he dropped throughout the album. AfroTech previously reported that fellow rapper Bow Wow noted the 2017 album as a piece of financial wisdom, providing him with an improved financial mindset. But the...

The start of a new year comes with the usual examination of goals and aspirations. People are typically focused on a few areas that include fitness, relationships, and wealth – with the latter generally finding its way toward the top of people’s “new year, new me” lists. And this perspective is in line with cultural norms. With songs like “Money” by Cardi B or the ’90s hit “It’s All About The Benjamins” by the Bad Boy Records crew, the world keeps the idea of wealth accumulation on the brain. But how exactly does one go about getting to the bag to reach their dreams? Social media makes it easy to tap into information from people who market themselves as financial gurus and entrepreneurial experts. But with so many people in the mix and sometimes little proof, it can be hard to know whom to trust and what advice should be implemented. It is at the intersection of financial research where AfroTech enters the chat. We gathered information and tips from some of today’s trusted voices to...

After working for the late Michael Jackson, Faheem Muhammad and Michael Amir’s acquired knowledge over the years served as a launching pad to help underserved communities. “Mr. Jackson was always mission-driven. Everything he did had a purpose, which was to do what he could to make the world a better place,” Amir told AfroTech in an email interview. In the past, Muhammad worked for Jackson as head of security and Amir worked as the icon’s chief of staff. Now, the duo has found their contribution to fostering a more improved society by forging a business partnership alongside other close friends to create Oasis, a real estate investment , and development company. Oasis has a focus on the South Side of Chicago, as they saw a clear pathway to revisit the demographics they often saw in dire need during their upbringing.

Damian Lillard is making sure his family is set for life. The NBA star signed a two-year extension with the Portland Trail Blazers totaling $122 million back in July. “I have and will always go hard for mine. Thankful for the @trailblazers having faith in me and showing this type of commitment … and also allowing me to take care of generations of my family,” Lillard wrote on Instagram. View this post on Instagram A post shared by Damian Lillard (@damianlillard)

A Black dollar is a powerful tool. From the popularity of fashion items in culture to the work to overcome systemic barriers, the Black community works in various ways to build, accumulate, and maintain wealth. But in the words of Langston Hughes, “Life for me ain’t been no crystal stair.” Black people have not always had the luxury or ease of access to the tools and resources necessary to build wealth. Because of the historical and present systems that impact the ability to build wealth, there is a lack of trust in traditional banking systems. This lack of confidence has caused many Black people to be considered “unbanked,” ultimately leading to a significant disparity in financial equity. The folks at Wells Fargo have taken particular notice of this disparity. As a part of its Banking Inclusion Initiative, the bank partnered with Black-led fintech startup MoCaFi to help alleviate the financial barriers for BIPOC community members. AfroTech had the opportunity to speak with the CEO...

Tiffany Haddish has remained candid about the highs and lows of her life’s trajectory. The comedian had her first big break on the 2006 comedic show “ Who’s Got Jokes?” She later made several appearances in movies and television shows, including Tyler Perry’s “If Loving You Is Wrong” and “The Carmichael Show.” However, Haddish became an even more well-known name after her sensational and award-winning lead role as “Dina” in the 2017 box office hit “Girls Trip.”

This past weekend, I got to celebrate my daughter’s birthday. When she was born 17 years ago on May 31, it never occurred to me that her connection to such a dark day in our country’s history would later serve as a beacon of light for building our family’s legacy and make her a driving force in my own career trajectory years later. Known as the Tulsa Massacre, the events of May 31, 1921, arguably encompass the most devastating atrocities of injustice we as Black Americans have endured in this nation’s history, shaping the future of our families for generations to come. It is on this day that a symbol of economic hope and success for Black communities in the United States came to an end when within hours, a white mob turned three square miles of a vibrant Black community into ashes, with more than 300 Black people killed and over 1,000 homes and businesses looted and set on fire. The Tulsa Massacre would set in a wave of fear and a warning for Black communities across the country for...

AfroTech Executive is still making its rounds, continuing to fuel leaders with the resources needed to not only succeed but smash ceilings, move the needle, and make room for generations to come. Before it makes its way to Los Angeles, CA, it stopped in D.C. for a sold-out event, where the room was filled with corporate executives, founders, and investors in an effort to cultivate connections and also build community. What’s more, spotlighting opportunities to cultivate Black wealth was the main course of the day on May 19, 2022, where panels included The Power Of The Black Dollar and Cultivating Capital In A Black Tomorrow. Plus, we ended the night with something sweet as DJ 5’9 set the vibes for a Networking Reception. Photo Credit: Jemal Countess

When discussing trailblazers in the fintech space, Tanya Van Court is a name that is expected to come up in conversation. The Goalsetter founder has been working tirelessly as a leader to not only spread knowledge of the importance of financial literacy but also backing initiatives that directly support Black and brown communities. As previously reported by AfroTech, Goalsetter and Robert F. Smith launched One Stock. One Future. — an initiative to spearhead financial freedom for the next generation of Black and LatinX Americans. With the success behind her platform, Van Court is also no stranger to the whirlwind of a journey that attaining financial wellness can bring. After seeing her own fair share of how the lack of financial education can leave a devastating impact, she’s a believer that there’s still room to turn in the right direction toward the ultimate goal of financial freedom. “There is no shame in realizing that perhaps you aren’t as well equipped as you thought you were,...