Today’s basketball style is faster and less physical than those in the 1980s and 1990s. There is also an influx of three-point scoring and attempts, which can be credited to the talent and prowess of four-time NBA champion Steph Curry. But before the world had discussions about Curry being a vital part of the current NBA style, Michael Jordan was the man everyone talked about as the game-changing phenom.

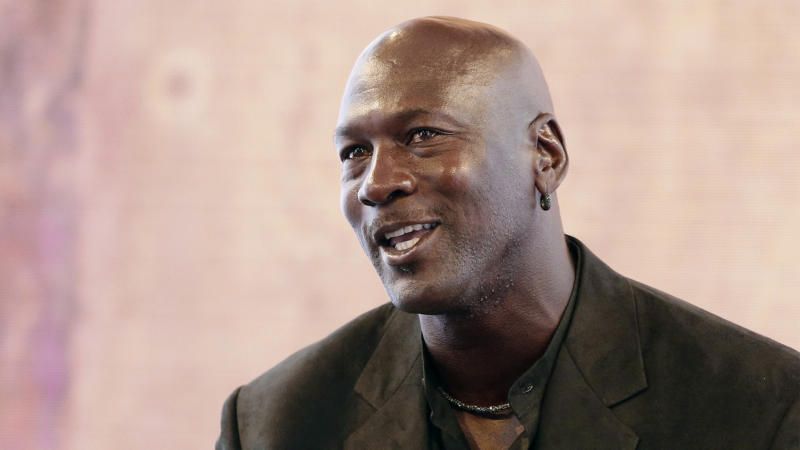

No matter where you land on the sports GOAT conversation, you’d be hard-pressed to find anyone who would deny Michael Jordan’s impact on the game of basketball. The billionaire athlete averaged 30.1 points, 6.2 rebounds, and 5.3 assists throughout his career. Jordan is a former Rookie of the Year recipient, five-time league MVP, and six-time NBA Finals winner.

However, Jordan’s first NBA championship win against the Los Angeles Lakers in 1991 started what the world now knows as the Jock Tax.

According to Joseph Pompliano, the Jock Tax was allegedly implemented as a revenge tactic after Jordan and the Bulls defeated Magic Johnson and the Lakers in the 1991 Finals.

Based on the events that led up to the implementation of the tax, the City of Los Angeles called Jordan’s accountant to reveal they were implementing a non-resident income tax on visiting athletes.

This meant that even though Jordan did not live in the State of California, he was required to pay taxes in that state.

Illinois legislation countered with a similar move and passed a bill coined as Michael Jordan’s revenge.

Based on a news post from Bloomberg Tax, the Jock Tax is “based on the amount of time a player contributed to ‘income-related work’ in any state that administers an income tax.”

Since the creation of such a tax, professional athletes across all sports genres must pay the Jock Tax.

Florida, Nevada, Texas, Washington, and Tennessee are the only states with sports franchises that do not collect the Jock Tax.