Preparation for life after death, though daunting, is essential.

This can take root in several forms, including a will or trust. A thorough understanding of the differences between the two is paramount to making the right decision for the beneficiaries who will seize control of the mentioned assets.

Unfortunately, among Black families, these estate planning options aren’t always discussed. Consumer Reports says 61% of white families and 67% of English-speaking Asians don’t have a will. In contrast, 77% of Black people and 82% of Hispanic people do not have a will, according to their statistics.

According to a report from Cerulli, by 2045 up to $84.4 trillion will be transferred from households to heirs or donated to charities.

This means a significant source of generational wealth is being missed by Black families.

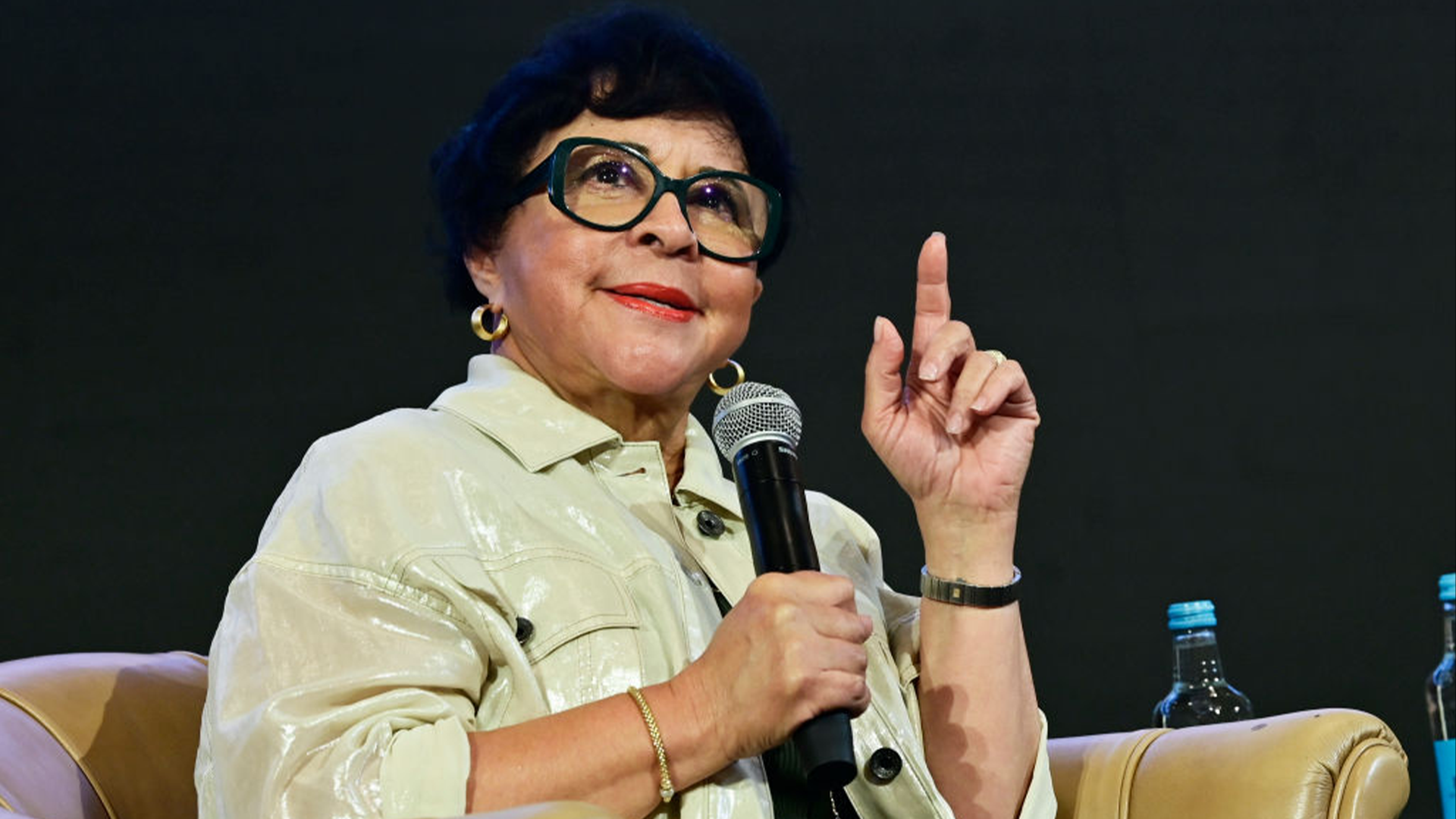

“We have been conditioned to think we’re always going to be around,” Tessa Edison, the founder of ASSET Management Consulting who holds over two decades of experience in the real estate industry, told AfroTech in an exclusive interview. “If we don’t want to have those hard conversations, then we’re not going to take the steps that we need to take to protect ourselves. So, I think that’s part of the issue in our community, but I think that by forcing the conversations to happen more, it is going to free us.”

Celebrities Who Passed Without A Will

The issue of estate planning is not merely overlooked by average households. We have seen this with celebrities who have generated millions.

As AfroTech previously highlighted, Prince died without a will, and he left behind an estate valued at $156.4 million, according to Billboard.

A six-year legal battle ensued and led to a verdict from the First Judicial District of Minnesota to split the estate evenly between Prince Legacy LLC and Prince Oat Holdings LLC.

Other celebrities who have had their estates disputed in court include Aretha Franklin, James Brown, and Chadwick Boseman. The “Black Panther” star lost over a third of his estate due to legal fees and the government, according to Hands Law Firm. What’s more, the firm also noted Boseman’s family could have been left with nothing if they weren’t protected by California’s intestacy laws, which give the probate court the authority to choose who receives their loved one’s assets.

It was decided that the value of Boseman’s estate, after considering legal fees, would be $2.3 million. The money was divided evenly between his wife, Taylor Simone Ledward, and his parents, Leroy and Carolyn Boseman, per Monroe County Lawyers.

Without legal proof of how one’s estate should be split, the result could be a lengthy court case. This would come with filing and attorney fees, which would likely be paid by the estate.

The creation of a trust can speed up the court’s decision, ultimately saving your estate and heirs more money. In addition, a trust also makes a compelling case for generational wealth building and protecting your assets.

Edison argues that creating a trust has more legal protections than writing a will alone.

“A will to me is like a wishlist,” Edison said. “A trust is a document that could be held up in court so nobody has to figure it out for you. It protects the wealth you generated to pass on.”

She added, “A trust is solid because they wrote it when they were alive. They did it with an attorney, it can hold up. Your assets being your property insurance, bank accounts, 401ks, it’s the personal representative’s fiduciary responsibility to follow whatever is in place and written at the time of death. So, as a personal representative, I can say, ‘I followed the will,’ but there’s nothing really that can honestly force me to follow the will. A trust, you’re forced to follow it because it starts attaching to things.“

Revocable Trust

There are two options to consider: revocable or irrevocable trust.

By definition, a revocable trust allows a person to maintain control over their assets during their lifetime, according to Burner Law. It can also be modified unless the person has died. Going this route means your family members will avoid the probate process, and your assets will continue to be managed “without interruption,” per Trust & Will. On the other hand, there is no tax advantage or asset protection, and you will need to regularly update the trust.

“I want everything that I worked hard for to pass on to my only child, and the best way to do that is through a living trust, a revocable trust so that you can make updates to it as you go,” Edison explained. “The first step was really digging deep and figuring out what really were my assets. Obviously, we know a real estate portfolio is an immediate asset, but we have to dig deeper like bank accounts, life insurance policies, things that are paid off. These are your assets category building up. A lot of those assets have liability attached to them as well. So you have to add those up. What are the liabilities? Mortgages that need to be paid if I pass along? Whatever needs to be paid so that these things can be kept and passed on to my son.”

Irrevocable Trust

On the other hand, an irrevocable trust has its own lists of pros and cons, according to Trust & Will. This type of trust cannot be modified or amended once signed. The benefits of this route include that items and assets listed will not add to the estate’s value. In addition, they can be protected from creditors and legal opponents.

You should ultimately sit down with an estate attorney to determine what is the most suitable route for your circumstances.

Notes for estate planning: Consider $150–$600 for a simple will and $1,500–$3,000 for advanced documents such as trusts and power of attorneys, per Contracts Counsel.

“Getting an estate attorney is a couple thousand dollars, and people are afraid to do that because it’s expensive, but death costs even more than that,” Edison told AfroTech. “I don’t think people even realize how much it costs to bury people. That could easily be $20,000. So, to me it’s worth the investment.”

Know Your Net Worth

Furthermore, it is important to be aware of your net worth. CNN Money states an individual with a net worth of at least $100,000, and “a substantial amount of assets in real estate,” should look to establish a trust.

Disclaimer: This statistic should not discourage those with a net worth of under six figures from looking into a trust.

“As a community, that’s the first exercise that we need to do is really figuring out what our net worth is,” Edison expressed. “That way you can do an inventory of your assets and an inventory of your liabilities. So, the conversation goes away from mourning death and loss, and it converts to planning, protection, generational wealth. It turns the tables on that dinner conversation.”