Despite the news that loan relief with extremely low interest is on the way, it’s unclear if it’ll be enough to save entrepreneurs hit hard by COVID-19. A new LendingTree survey of more than 1,200 small business owners found that 71% worry they’ll never recover from the downturn.

Business owners are holding on by a thread as more governors join the long list of states closing non-essential businesses. Nearly half of small business owners have temporarily closed their businesses, our survey found. They have also laid off workers or reduced their hours and sought funding, often unsuccessfully, to stay afloat.

Key findings

-

- 71% of small business owners are worried their business will never recoup the losses associated with the COVID-19 pandemic.

- Business owners in the accommodation/food service and retail trade sectors are among the most likely to fear for their company’s future.

- Nearly half — 47% — of small business owners surveyed have taken on debt to keep their business afloat during the pandemic. An additional 34% attempted to seek financing but were not approved.

- 8 in 10 small business owners have “no idea” where to get emergency funding for their business right now.

- 69% of small business owners do not have enough cash on hand to sustain their business for the next 90 days.

How business owners are responding to the pandemic

As of April 2, 38 states had shelter-in-place mandates or similar orders in effect, directing residents to only leave their homes for necessities. The Centers for Disease Control and Prevention has also recommended the cancellation of gatherings of more than 10 people. Although these measures are taken with public health and safety in mind, they put small businesses in a vulnerable position.

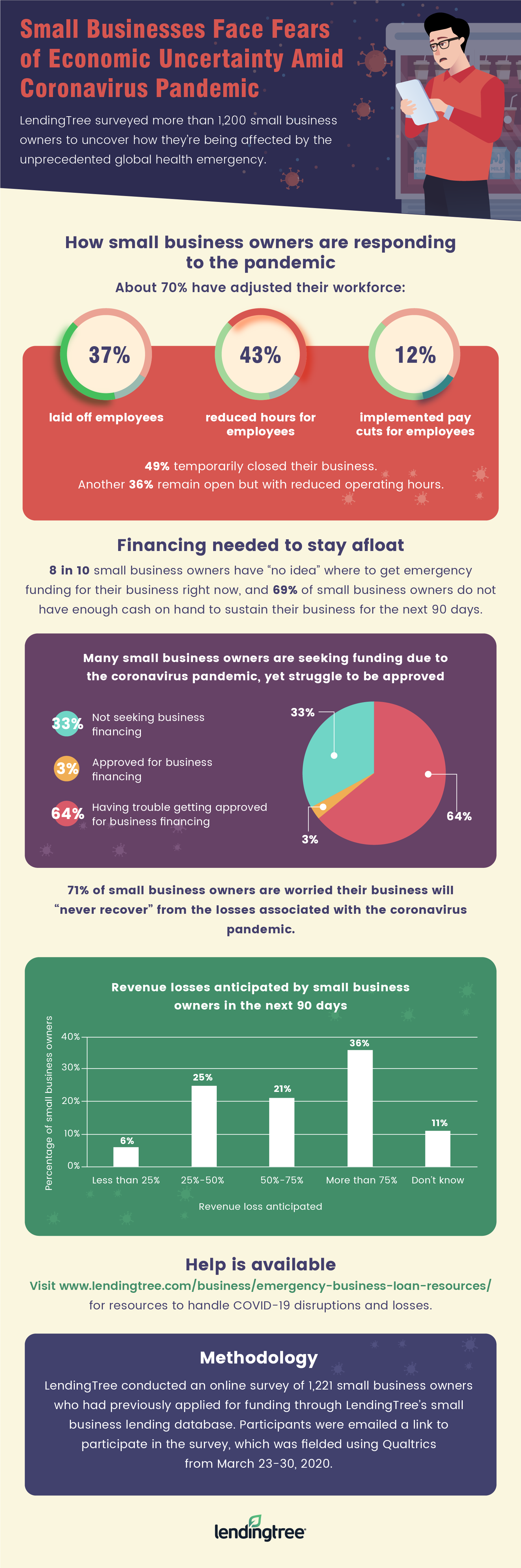

At the time of our survey, 49% of small business owners had temporarily closed their business. Another 36% remained open, but with reduced hours. Of those who closed, more than three-quarters were legally required to do so.

About 70% of small business owners adjusted their workforce to cope with the pandemic:

-

- 37% laid off employees

- 43% reduced hours for employees

- 12% implemented pay cuts for employees

Some small businesses may be able to adapt to the regulations, depending on the industry in which they operate. For instance, many restaurants and food establishments across the nation are open for takeout and delivery. Still, the loss of dine-in customers results in lower wages or lost income for servers.

Fears for the future

Major companies in the U.S. are losing millions in revenue as the outbreak worsens, and small businesses are facing comparable losses on a smaller scale. About 47 million people could lose their jobs, sending the unemployment rate past 32% by the end of the second quarter, according to the Federal Reserve Bank of St. Louis.

Among our survey respondents, 57% of small business owners expect to lose at least half of their revenue in the next 90 days as a result of COVID-19. And more than one-third — 36% — anticipate losing more than 75% of revenue.

Emergency savings won’t provide much relief for many entrepreneurs, as 69% of small business owners say they don’t have enough cash on hand to sustain their operation for the next three months.

When business becomes personal

Entrepreneurs are dealing with additional economic uncertainty and stress at home. Of married business owners, 56% said their spouse or partner does not have a stable job.

When it comes to personal bills, 60% of survey respondents are “very worried” about their ability to keep up with payments, while an additional 28% are “somewhat worried.”

Small business owners also keep their employees top of mind, as more than one-third are “extremely worried” about their employees’ personal financial situations and another 27% are “very worried.”

Many small business owners taking on debt — when they can

To keep the doors open during the pandemic, many small business owners have turned to some form of financing. Nearly half — 47% — have taken on debt to offset the COVID-19 crisis, and another 34% applied for business financing but were not approved.

As of March 30, small business owners have turned to the following funding options:

-

- 39% have taken on credit card debt

- 17% have taken out a business loan

- 12% have taken out a personal loan

- 12% have taken on another type of debt

Unfortunately, eight in 10 business owners have “no idea” where to get emergency business funding right now. Of those who do know where to find financing, 64% are seeking funds for reasons directly related to the coronavirus pandemic but are having trouble getting approved. More than half — 59% — would use funds to cover payroll. However, just 3% of the small business owners we surveyed were approved for financing.

How business loan underwriting has changed

When underwriting business loans, lenders typically look for proof that a business is equipped to repay debt. Lenders may analyze cash flow history and projections, as well as financial statements like a balance sheet. As long as businesses are closed or experiencing a slowdown, they may not be able to provide the crucial financial information lenders need to approve the business for financing.

In the midst of the crisis, some lenders have also tightened their standards by altering their eligibility requirements. For example, OnDeck, an online business lender, increased its time in business requirement to three years from one year, and raised its minimum annual revenue to $250,000 from $100,000.

Where to find emergency funding for small business

Congress stepped in to help small business owners stuck in this very quandary, needing more funding just as many private lenders cut off the flow of loans. In addition to existing emergency business loan programs, the U.S. Small Business Administration expanded its popular 7(a) lending program and its disaster loans program to help small business owners struggling as a result of COVID-19.

SBA COVID-19 disaster loans: Businesses affected by coronavirus can apply for an Economic Injury Disaster Loan from the SBA to cover fixed debts, payroll costs, accounts payable and other business expenses. EIDLs are available up to $2 million with interest rates capped at 3.75% for small businesses.

- EIDL applicants could receive a $10,000 loan advance that would not need to be repaid. The advance could provide faster access to capital while waiting for the SBA to process an EIDL loan application.

SBA Paycheck Protection Program loans: Paycheck Protection Program (PPP) loans are designed to encourage business owners to keep employees on the payroll. PPP loans are available up to $10 million and any portion of the loan used to cover payroll costs may be forgiven. For any portion of the loan that isn’t covered, interest rates are capped at 1%.

A number of companies and organizations have set aside funds to help small businesses during the coronavirus crisis, and many local and state programs are also providing financial support. Check out our resource page for small businesses and CARES Act explainer for those looking for assistance to cope with the COVID-19 pandemic.

Methodology

LendingTree conducted an online survey of 1,221 small business owners who had previously applied for funding through LendingTree’s small business lending database. Participants were emailed a link to participate in the survey, which was fielded using Qualtrics from March 24-30, 2020.

Editorial Note: This piece originally appeared on LendingTree.