For those struggling to make ends meet this holiday season, Zirtue is here to help.

As previously reported by AfroTech, the world’s leading relationship-based lending app has always aimed to drive financial inclusion, and today that mission remains the same. With the launch of their Alternative Payment Solution for businesses, companies will be able to utilize the platform as a payment option for customers allowing them to pay bills directly through the platform.

With a mission to drive financial inclusion, one relationship at a time, our vision at Zirtue is to prove that friends and family are the largest banks in the world,” said Dennis Cail, CEO and Co-founder of Zirtue, in an official email-exclusive with AfroTech. “Ultimately, we aim to be the modern-day solution for people to access needed funds through relationship-based loans, avoiding payment defaults and predatory lenders, while keeping their personal and creditor relationships intact. We believe this hand-up approach in lieu of a hand-out is the true essence of financial equity and inclusion.”

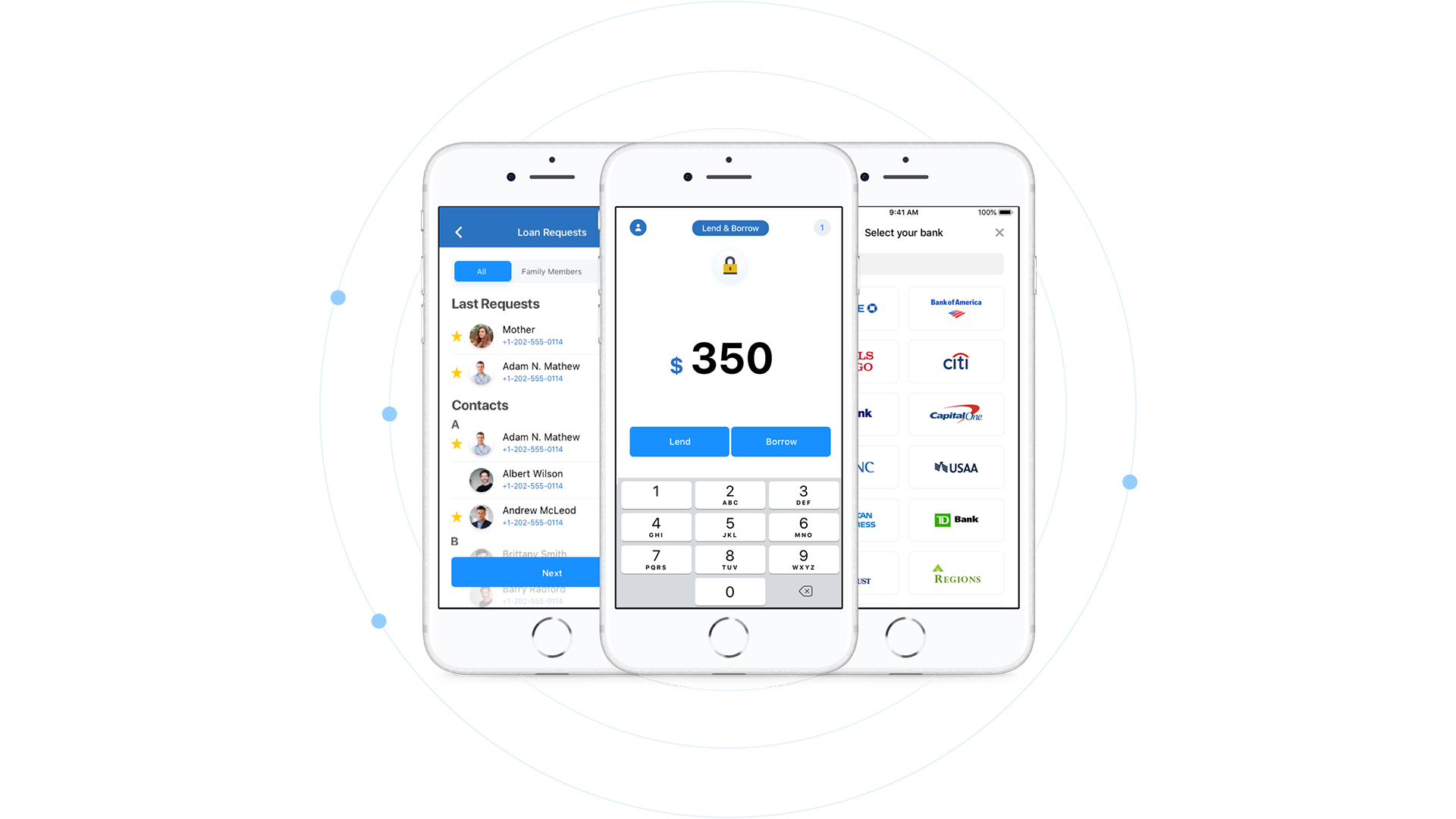

Zirtue has always simplified loans between friends, family, and trusted relationships by taking informal promises and transforming them into structured agreements while automating the repayment process.

How It Works

Businesses that use Zirtue’s Alternative Payment Solution businesses will give their customers access to low or no interest rates and the ability to obtain a loan without an impact on their credit scores.

It’s a win-win situation for both companies and customers as that they can continue to collect timely payment while keeping consumers out of high-interest debt situations.

“Zirtue’s Alternative Payment Solution provides a new level of convenience for those who are low income and struggling to pay their bills,” Cail said. “Very few events amplify or put more of a strain on this issue for people of color and underserved communities than the holiday season. Just like the holidays, Zirtue is all about relationships and showing people they are more than their credit score, more than their zip code and that there is another on-ramp to financial inclusion and responsibility.”

Pain Points

When it comes to the company’s partnerships, Zirtue is able to alleviate two major pain points.

The first is a person’s financial lifeline to pay bills and the second is a company struggling with bad debts.

Through the use of its Alternative Payment Solution, individuals with past-due accounts can request loans from friends or family members to resolve their bills directly through the technology provided by Zirtue which is currently pending a patent.