Showing 5 results for:

Tanya Van Court

Popular topics

All results

Goalsetter is going from online to the classrooms! Founder and CEO Tanya Van Court’s financial literacy platform has joined Clayton County Public Schools (CCPS) to provide financial education, developed according to Jumpstart.org and Council for Economic Education, to high schoolers, per a press release shared with AfroTech. The partnership comes after Georgia’s financial literacy curriculum mandate for high schools, which is required by districts to implement by the 2024-2025 school year — making CCPS a year ahead. While checking off the mandate for high schools, the CCPS students are set to have access to savings and investment accounts. Over 3,300 11th and 12th are expected to start their financial freedom journey. “We are proud to establish a partnership with Goalsetter to strengthen financial literacy among our students as they continue their K-12 matriculation and become successful adults,” said Dr. Morcease J. Beasley, Superintendent/CEO of Schools, per the press release. He...

This past weekend, I got to celebrate my daughter’s birthday. When she was born 17 years ago on May 31, it never occurred to me that her connection to such a dark day in our country’s history would later serve as a beacon of light for building our family’s legacy and make her a driving force in my own career trajectory years later. Known as the Tulsa Massacre, the events of May 31, 1921, arguably encompass the most devastating atrocities of injustice we as Black Americans have endured in this nation’s history, shaping the future of our families for generations to come. It is on this day that a symbol of economic hope and success for Black communities in the United States came to an end when within hours, a white mob turned three square miles of a vibrant Black community into ashes, with more than 300 Black people killed and over 1,000 homes and businesses looted and set on fire. The Tulsa Massacre would set in a wave of fear and a warning for Black communities across the country for...

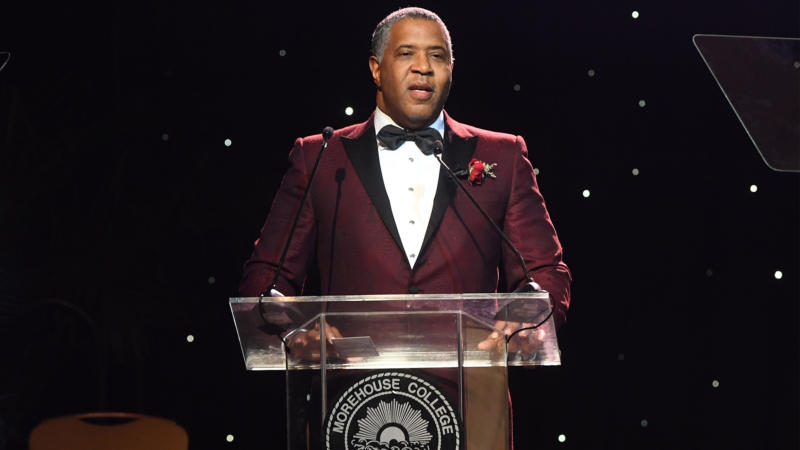

When discussing trailblazers in the fintech space, Tanya Van Court is a name that is expected to come up in conversation. The Goalsetter founder has been working tirelessly as a leader to not only spread knowledge of the importance of financial literacy but also backing initiatives that directly support Black and brown communities. As previously reported by AfroTech, Goalsetter and Robert F. Smith launched One Stock. One Future. — an initiative to spearhead financial freedom for the next generation of Black and LatinX Americans. With the success behind her platform, Van Court is also no stranger to the whirlwind of a journey that attaining financial wellness can bring. After seeing her own fair share of how the lack of financial education can leave a devastating impact, she’s a believer that there’s still room to turn in the right direction toward the ultimate goal of financial freedom. “There is no shame in realizing that perhaps you aren’t as well equipped as you thought you were,...

When underserved communities lack access to resources for financial education, their ability to focus on the idea of generational wealth is stunted before they even have a chance to take a step on its path. With the mission to give such communities a fighting opportunity to learn about smart investing and building wealth early on, Robert F. Smith and Goalsetter, a financial literacy platform founded by Tanya Van Court, announced today the launch of “One Stock. One Future.” — an initiative to spearhead financial freedom for the next generation of Black and LatinX Americans.

Financial education in the Black community is often a concept that’s not grasped until adulthood. Even then, many young adults struggle to manage their personal finances because they’ve never received a solid foundation in saving and investing. When former Nickelodeon executive and Goalsetter founder Tanya Van Court set out to create her financial literacy platform, she understood that she had a higher calling to close the wealth gap between Black and brown families in America and educate Black youth all across the country. The idea for her revolutionary platform came from her then eight-year-old daughter who asked for enough money to start an investment account for her ninth birthday. Van Court knew that if she could combine her knack for understanding the language of kids as well as her personal connection to financial education, she could create something powerful to better equip Black America’s youth to take charge of their finances. “I didn’t want to be an entrepreneur. It’s...