Showing 4 results for:

Business Loans

Popular topics

All results

Launching a business is no easy feat. For as much as social media gurus love to talk about how everyone should have a hustle or launch their own business, the reality is often far different. While coming up with an idea can be hard enough, the truth is that most businesses will fail long before they reach the five-year operation milestone. Real barriers like funding a startup business as one tries to shift it from a labor of love to a profitable venture make that grim statistic a reality. In the beginning, most business owners are entirely self-funded. And while this can give one a sense of accomplishment, it also means that there can be lean times. Eventually, startups are going to need a cash infusion which is where the business loans come in. Understanding The Basics Of Startup Business Loans While business loans might seem like mysterious products, they are not much different than any other kind of financial loan offering. Simply put, a financial institution fronts a business...

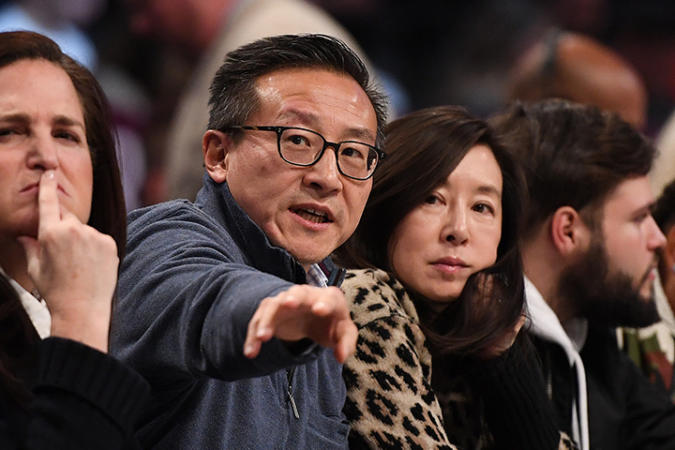

Brooklyn Nets owners Joe Tsai and Clara Wu Tsai are trying something ground-breaking that’ll change the game for Black business-owners looking for financial assistance. According to CNBC, as part of their $50 million commitment to help minority communities, the sports owners have launched “EXCELerate,” a $2.5 million Black business loan program to help those affected by the COVID-19 pandemic. Funds for the program will come from the Tsai foundation’s Social Justice Fund — which was started last year to help resolve economic inequities in Black communities. “We know that there is no social justice without economic opportunity,” Tsai said in a statement, “which is why we are so excited to launch the Brooklyn EXCELerate Loan Program aimed at elevating Brooklyn’s BIPOC [Black, indigenous, and other people of color] business owners post-pandemic and doing our small part to overcome barriers this community faces in accessing capital.” What’s unique about the program is that instead of...

Launching a company is difficult, and limited funding is the most common barrier to entry to the startup world. Do you have a great idea, but you’re trying to figure out how to fund it? Are you already running a startup, but cash is running out fast? Here are some ways to raise capital for your startup: Save Money Saving money isn’t easy, but it’s the most straightforward way to raise funds for your business. If you’re still working a regular full-time job, commit to saving a part of your current salary to help fund your dreams. Review your monthly expenses and eliminate unnecessary expenses like subscriptions and expensive lunches. If you live with roommates or a significant other, consider sharing expenses to reduce cost per person. This might include shopping in bulk, sharing an Amazon Prime account (or any subscription for that matter), and taking advantage of family memberships at the gym. If you’re already committed to your startup on a full-time basis, you should be auditing...

Holiday shoppers and wintry weather could have a positive or negative effect on businesses, depending on the industry. Retailers, for example, could experience a rush of customer traffic during the holidays, while business could slow down for weather-affected companies, like oil well drillers who can’t work when the ground freezes. Because the winter months can put a strain on small businesses of all kinds, it is a prime time of year to secure financing. Seasonal business loans could make it easier to keep up with the demands of the holiday season, or help you cover regular expenses if business slows down. Before you find your business in a tight spot, keep reading to find out how you can obtain a seasonal business loan or other types of holiday financing. In this guide, we’ll cover: Types of seasonal business loans Business line of credit Accounts receivable financing Inventory financing When to apply for holiday financing Is seasonal financing right for your business? Types of...