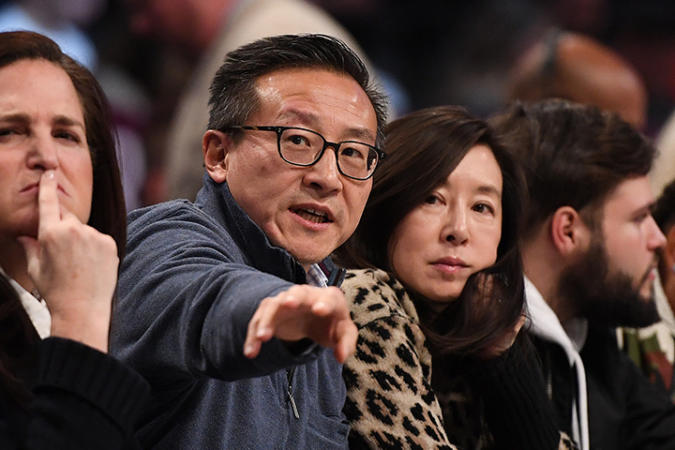

Brooklyn Nets owners Joe Tsai and Clara Wu Tsai are trying something ground-breaking that’ll change the game for Black business-owners looking for financial assistance.

According to CNBC, as part of their $50 million commitment to help minority communities, the sports owners have launched “EXCELerate,” a $2.5 million Black business loan program to help those affected by the COVID-19 pandemic. Funds for the program will come from the Tsai foundation’s Social Justice Fund — which was started last year to help resolve economic inequities in Black communities.

“We know that there is no social justice without economic opportunity,” Tsai said in a statement, “which is why we are so excited to launch the Brooklyn EXCELerate Loan Program aimed at elevating Brooklyn’s BIPOC [Black, indigenous, and other people of color] business owners post-pandemic and doing our small part to overcome barriers this community faces in accessing capital.”

What’s unique about the program is that instead of using credit scores as criteria like traditional loans do, EXCELerate will evaluate applicants’ eligibility based on “character” and good references to help them secure funding. Loans a part of the program will now help those individuals with credit scores of 620 or below.

According to a survey conducted by Credit Sesame, roughly 54 percent of Black Americans reported having no credit or a poor to fair credit score. The credit system was initially created as a blind evaluation, but has since proven to be a burden for many Black and brown people who aren’t able to qualify for bank loans.

“Literally, if you need to get a loan, you need to have a good credit score, you need to have collateral and/or you need to have a guarantor,” Gregg Bishop — EXCELerate program’s executive director — told the New York Daily News. “We have stats that show (that) almost half of Black Americans have a credit score that’s under 620, and that means that it automatically excludes them from the traditional capital market.”

EXCELerate will offer two types of loans — a “rapid recovery” loan that provides immediate funds of up to $15,000 with no interest attached and a “restart” loan that helps business owners who were forced to temporarily close or reduce business hours during the pandemic — CNBC reports. Social organizations TruFund Financial and Brooklyn Alliance Capital will both be overseeing the loans.

In order to be considered for these loans, applicants will need “local community members” as references, and won’t be subject to “require neither collateral or [a] guarantor.”

For more information about EXCELerate, click here.