Showing 211 results for:

fintech

Popular topics

All results

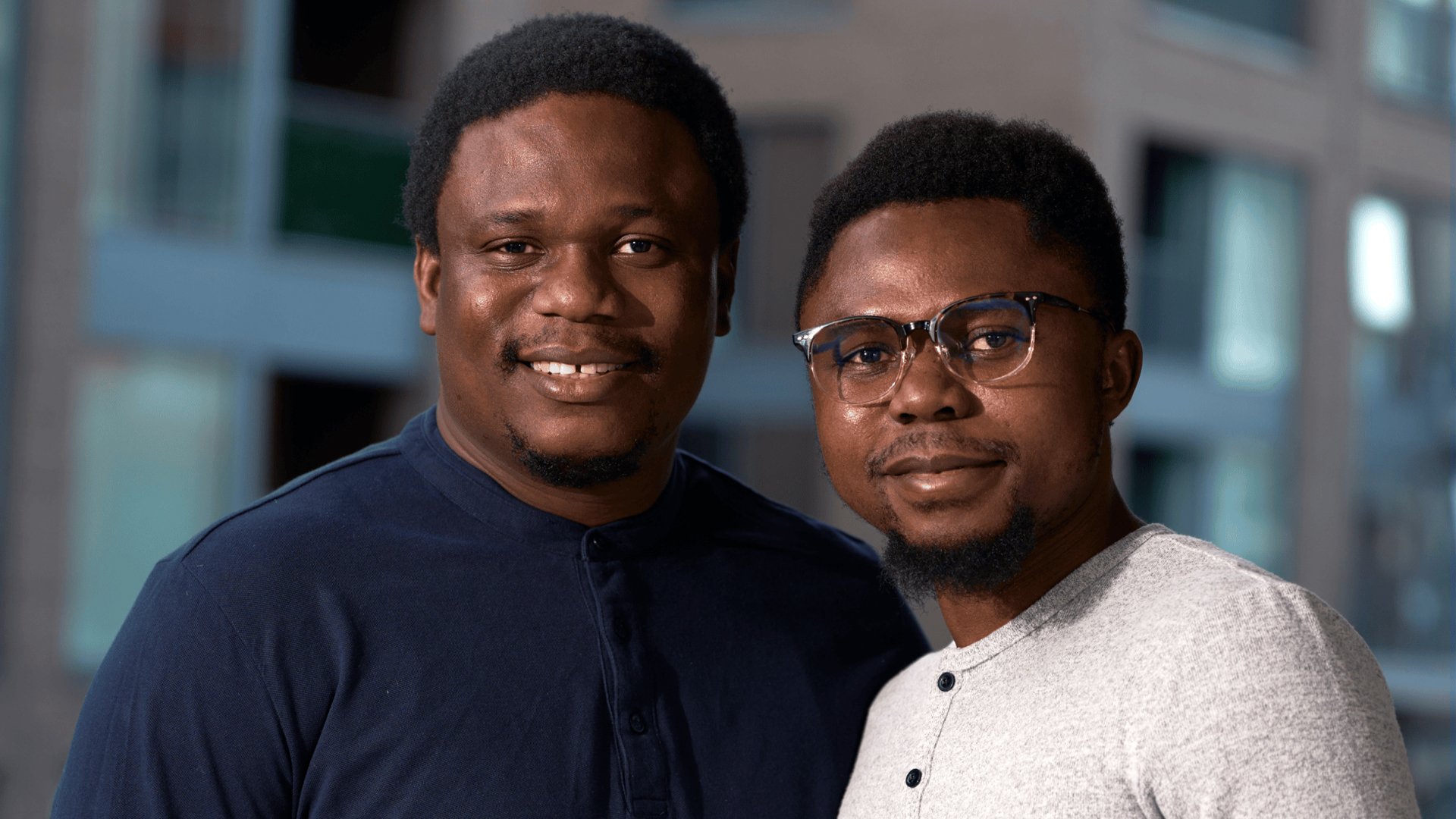

Tosin Eniolorunda and Felix Ike are reportedly behind Africa’s fastest-growing fintech company. According to a press release shared with AFROTECH™, the founders lead Moniepoint, which initially launched under the name TeamApt in 2015. The company has since become a trusted provider of financial solutions, reaching millions of entrepreneurs across Africa and processing over 800 million transactions a month, with those having a monthly total value of more than $17 billion. Moniepoint offers a free personal banking app that allows customers to benefit from a “debit card that always works,” Eniolorunda said in a YouTube video. In addition to banking accounts, the company offers loans, expense cards, instant payouts, and accounting and bookkeeping solutions, its website lists. Photo Credit: Moniepoint Moniepoint’s business model has made it Africa’s fastest-growing fintech in both 2023 and 2024, per the press release. It is now poised for further growth following a $110 million equity...

Ismail Ahmed, who is behind the first Black-founded fintech company to reach unicorn status in the U.K., has secured additional funding, Bloomberg reports. In 2009, Ahmed launched Zepz, formerly WorldRemit, and was inspired by the high transaction fees from sending his loved ones money to East Africa. The venture also followed his experience working on a transfer project as part of the United Nations Development Programme, which led him to discover corruption in the UN’s Somalia remittance programme, The Guardian mentions. “My boss said if I went and submitted the dossier, I would never be able to work in remittances again, and I took that threat very seriously. I lost my job to uncover the fraud,” he told the outlet. While working through the legal case, Ahmed decided to attend London Business School, a move that would provide him with the blueprint for the company — originally called AfricaRemit. Furthermore, he would receive a financial award for his mistreatment as a result of...

Keyeriah Miles walked away from a career in fintech to empower women golfers. Inception Keyeriah currently leads Ladies Who Golf, a company created alongside her mother, Lashonda. An interest in sports had always been ingrained in the family. In fact, Keyeriah had been playing golf for the past four years, and her brother was involved in golf, track, and football, while Lashonda had launched an adult softball team in the early 2000s alongside her sister, called Lady Majestics. “We had that team probably for about maybe about six years… but the other funny thing was our colors. My initial colors for that softball team was green, navy blue and white, which is now the exact same colors for Ladies Who Golf,” Lashonda told AFROTECH™ in an interview. Keyeriah added, “And we didn’t realize that until after we implemented the blue, and she was like, ‘These are Lady Majestics’ colors.’ I completely forgot that she even had that team, and it didn’t ring a bell until we implemented the blue…...

Waza has raised $8 million to improve the financial technology sector in Africa. TechCrunch mentions that emerging economies tend to buy more from other countries than they sell, leading to an increase in demand for U.S. dollars to trade internationally. Combined with limited supply, trading can be more expensive. The outlet also notes that Africa’s lack of technological solutions worsens the issue. Thus, Waza’s efforts are timely for Africa because it exists to ensure Africa-based companies and traders can have liquidity and more seamless B2B payments using U.S. dollars, euros, and Great Britain pounds, per the company website. Within its first month of operations, the company’s payment volume reached $280,000, according to TechCrunch. In May 2024, those numbers had dramatically increased, with $70 million in monthly payment volume equating to $700 million in annualized transaction volume, Co-Founder and CEO Maxwell Obi confirmed to TechCrunch. “Cross-border payments in the context...

Morgan State University is receiving extended financial backing from a leading company that works to “build breakthrough crypto solutions.” On May 14, the National FinTech Center at the Baltimore, MD-based HBCU announced it had been awarded a three-year $1,050,000 grant from Ripple. The new funding will go toward advancing the center’s blockchain and fintech research, education, programming, faculty and student technical projects, ecosystem development, operational support, educational workshops, blockchain clubs, and a fintech solution incubator, per a news release. “This generous $1,050,000 grant is not just an investment; it’s a catalyst that propels our ability to innovate, collaborate, and prepare our students to be at the forefront of the FinTech revolution,” said Ali Emdad, Ph.D., f ounding director of the National Center for the Study of Blockchain and FinTech. “The ongoing partnership with Ripple stands as a beacon, illuminating the path toward a transformative educational...

Canza Finance’s co-founders are leaning into Web3 to financially empower the African continent. Pascal Ntsama IV and Oyedeji Oluwoye are looking to create “the world’s largest non-institutional-based financial system” through the creation of Canza Finance, the company website mentions. They both share distinct journeys on how they arrived to the company’s inception. For Chief Technology Officer Oluwoye — born in Nigeria, Africa, and raised in Sydney, Australia, before moving to the United States at 14 — he began taking various CompTIA Certifications, early-career data analytics certification, during his senior year of high school. After graduation, he headed to the Alabama Agricultural and Mechanical University to obtain a Bachelor of Science degree in computer science. While in college, he was able to secure a position with Adtran, a networking and telecommunications company based in the U.S., as a co-op engineer. He then transitioned to work at AT&T as a senior specialist-network...

Chris Paul has entered into a partnership that considers the financial futures of the youth. Goalsetter, a fintech company founded by Tanya Van Court, has shared results from a study it conducted with Ivy League university students revealing a significant lack of understanding when it comes to personal finances. When surveying 1,065 undergraduate students from Harvard University, Stanford University, and the University of Pennsylvania, t he study revealed that the students answered on average only 51% of its financial education questions correctly. The questions were at the high school standard, and the percentage of acuity decreased even further when looking at only underclassmen, with scores of 48%. Furthermore, only 13% of students who took the quiz scored above a C-. To create better outcomes, Goalsetter is committed to targeting financial initiatives towards the youth, and the company is strengthening its efforts through a partnership with NBA player Chris Paul, Oakland Fund...

A Lagos, Nigeria-founded mobility fintech has secured a historic investment. TechCrunch reports that Moove has announced a $100 million Series B funding round led by Uber — marking the rideshare company’s first investment in Africa. Now, Moove’s valuation is $750 million. “ Today’s announcement marks a significant milestone for us,” Moove Founder Ladi Delano shared in a press release. “When we founded Moove in 2020, we were motivated to solve the acute shortage of vehicle financing that over two million African mobility entrepreneurs faced.” He continued, “This validation from Uber and others stands as a testament to the fact that what was once a dream is now a palpable reality. This infusion of capital is set to amplify the immensely positive impact our products have in the lives of our customers on a much broader spectrum. I would like to extend my heartfelt gratitude to our dedicated team of Moovers for their relentless effort and commitment, which has been pivotal in reaching...

Mastercard has purchased stake in MTN Group’s fintech division, Africa’s largest mobile network operator. In August 2023, TechCrunch reported Mastercard was looking to invest in MTN Group. Six months after the initial announcement, both parties have moved forward with an agreement during a time when MTN Group is looking to expand its reach in the fintech space, according to ITWeb. The move would be timely for MTN Group as it was searching for investors after parting ways with the carrier’s main telecom business. The outlet also notes Mastercard is looking to accelerate MTN Group’s technology and infrastructure and establish greater financial inclusion in the continent. MTN Group had reached over 290 million subscribers by the end of June 2023, and its transaction volume had reached $8.3 billion in the first half of 2023. “This commercial relationship is a key enabler for the acceleration of our fintech business’ payments and remittance services,” the company said, per ITWeb. “MTN...