With the help of financial innovations, the road to financial freedom is becoming more accessible for Black people and communities of color, and Qoins is a fintech startup helping to lead the way in continuing the streak of progress.

Since its launch, Qoins’ mission has focused on helping their users pay off their debt and put money into their savings. Qoins’ strides in the financial wellness space have seen continued success and the app recently reached its latest milestone of paying over $20 million in consumer debt, according to a press release provided to AfroTech.

“People of color, we tend to get the short end of the stick when it comes to interest rates,” co-founder Nate Washington tells AfroTech. “I can go into a whole spiel about how the credit score system is against us. For us, being able to see that impact and continue to get those testimonials where people tell us, ‘Hey, you really helped me pay off my student loans or my credit card and now I can actually do something that I’ve wanted to do for a long time,’ — it’s just humbling, and that’s one of the things that keeps us going for sure.”

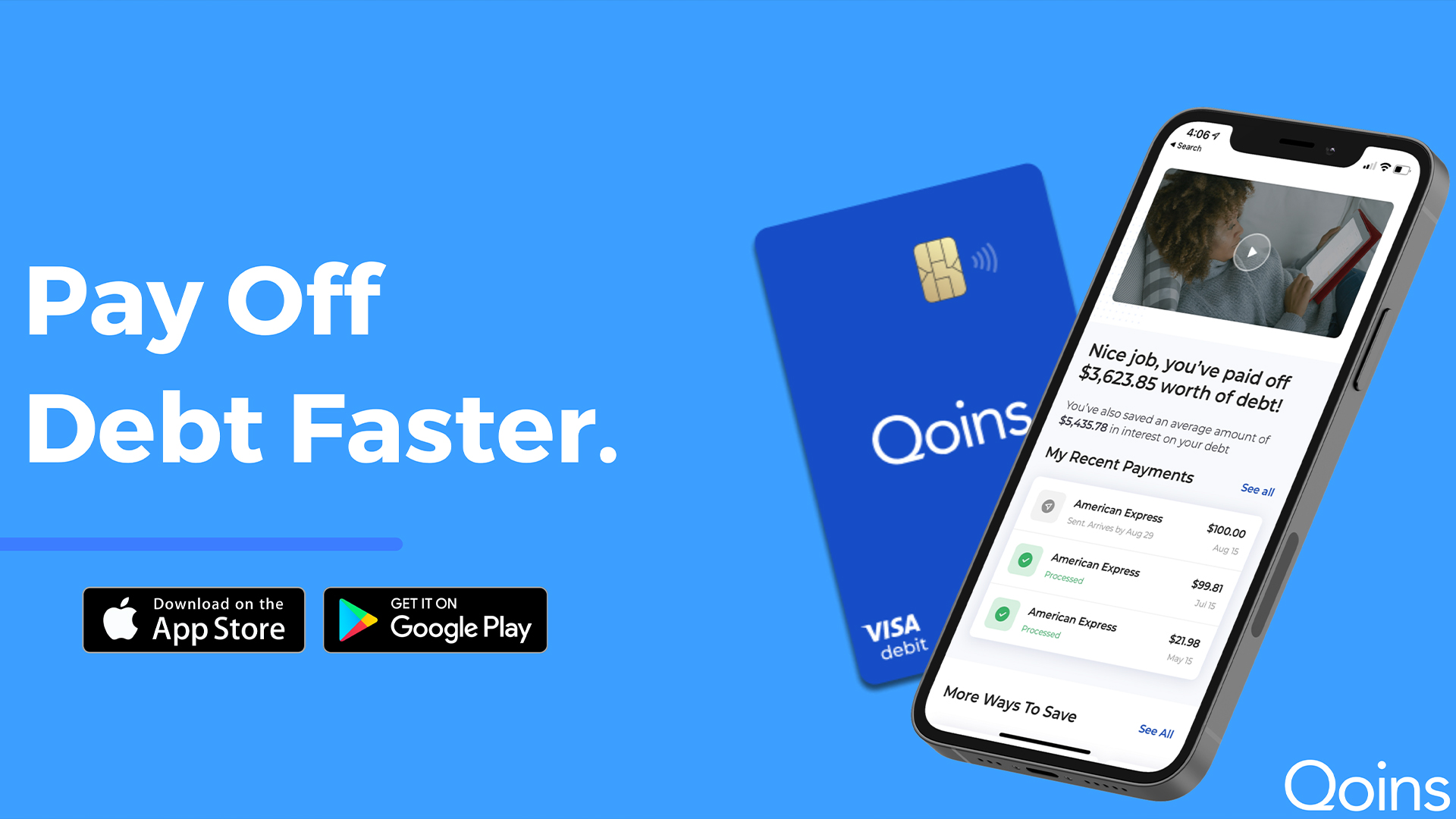

Qoins Card

Through the relationships built by Washington and fellow co-founder Christian Zimmerman, the app has seen an influx of customer testimonials. While being amped by customer satisfaction, Qoins has turned from what initially was a tool to help customers pay off their debt, to transforming itself into creating even more methods to help users stay on track toward their financial goals.

As previously reported by AfroTech, Qoins’ first debit card, Qoins Card, is currently in the works — with the help of their $1.5 million funding round earlier this year — and is described as “the debit card that pays off your debt faster.”

As the debit card is set to launch before the end of 2021, its purpose is to not only focus on instant debt payments, but also to build a merchants reward network — where merchants help pay down on consumer debt — through customers’ everyday purchases.

“An extension of our overall mission is to create new ways to save for our customers,” Zimmerman tells AfroTech. “We also believe that every business has a corporate social responsibility to its customers. That’s why we believe that the network of merchants and retailers will want to work with a product like ours to help its customers achieve their financial goals, such as becoming debt free.”

Republic Campaign

While pushing Qoins Card’s rollout, Qoins recently launched a crowdinvesting campaign with Republic — a private investing platform — that will help with the debit card’s funding and open the door “for common investors to join in the mission of eliminating debt and building wealth” by becoming startup investors and owners in Qoins, according to Qoins’ press release.

“[The campaign] is truly rooted in our overall mission to help bridge the gap between financial health and financial wealth,” Zimmerman shares. “Many typically never get the chance to invest like others do and also have ownership of something they believe in. We felt it was important to bring our customers along for the ride to also help spark the opportunity for future wealth creation.”

Qoins' Vision For The Near Future

As the online platform continues to cross off milestones on consumer debt, Qoins plans to expand into credit more in the near future, as well as provide more specific recommendations for customers to successfully embark on their financial journey.

“I think we’re definitely headed in the right direction with a lot of the things that we have in the works,” Washington says. “And beyond that, just continuing to become a household name for debt repayment, improving finances, etc. Maybe one day we’ll look into some international expansion, but that’s in the future.”