Access to resources is one of the most significant barriers to entry for Black entrepreneurs. Whether it is a lack of funding or a gap in training, Black business owners have often found it challenging to tap into the same level of success–at the same rate– as some of their racial counterparts.

Northwestern Mutual, a leading financial services company which has been helping people and businesses achieve financial security for more than 160 years, acknowledges this systemic challenge and is committed to investment opportunities that will help reduce the racial wealth gap. One program the company has stood up, its Black Founder Accelerator program, furthers its commitment to championing diversity, equity and inclusion.

Based on recent research, Black founders receive less than two percent of venture capital funds. Northwestern Mutual is stepping in and offering each eligible entrepreneur a $100,000 investment and inclusion in a 12-week intensive program. As part of the accelerator, the intensive program allows each startup founder to access individualized coaching and mentorship from top industry leaders directly.

This commitment to the Black business community is one of several components that make up Northwestern Mutual’s Sustained Action for Racial Equity initiative. This work underscores the firm’s commitment to combating racism, prejudice and social injustice.

“As we witness the remarkable achievements of each cohort, we are reminded that programs like these are essential in fostering a more inclusive entrepreneurial ecosystem,” said Abim Kolawole, chief audit executive at Northwestern Mutual and executive sponsor of the company’s Sustained Action for Racial Equity (SARE) initiative. “We hope that the success of these founders will inspire future generations of Black entrepreneurs to pursue their dreams.”

In partnership with gener8tor, a nationally ranked startup accelerator, The Black Founder Accelerator program has a robust programming model, allowing participants to scale their businesses and increase diversity in the tech industry.

Programs like this are game-changing for these founders; their success opens the door and creates new hope for possibilities for uncharted achievement.

“This program’s success is an honest reflection of our company’s unwavering support to create a more diverse industry by helping founders who would struggle to find this kind of support propel their businesses forward,” said Craig Schedler, managing director of Northwestern Mutual Future Ventures. “We are confident that this next cohort of bright entrepreneurs will use the resources provided in this program to become leaders in their respective sectors.”

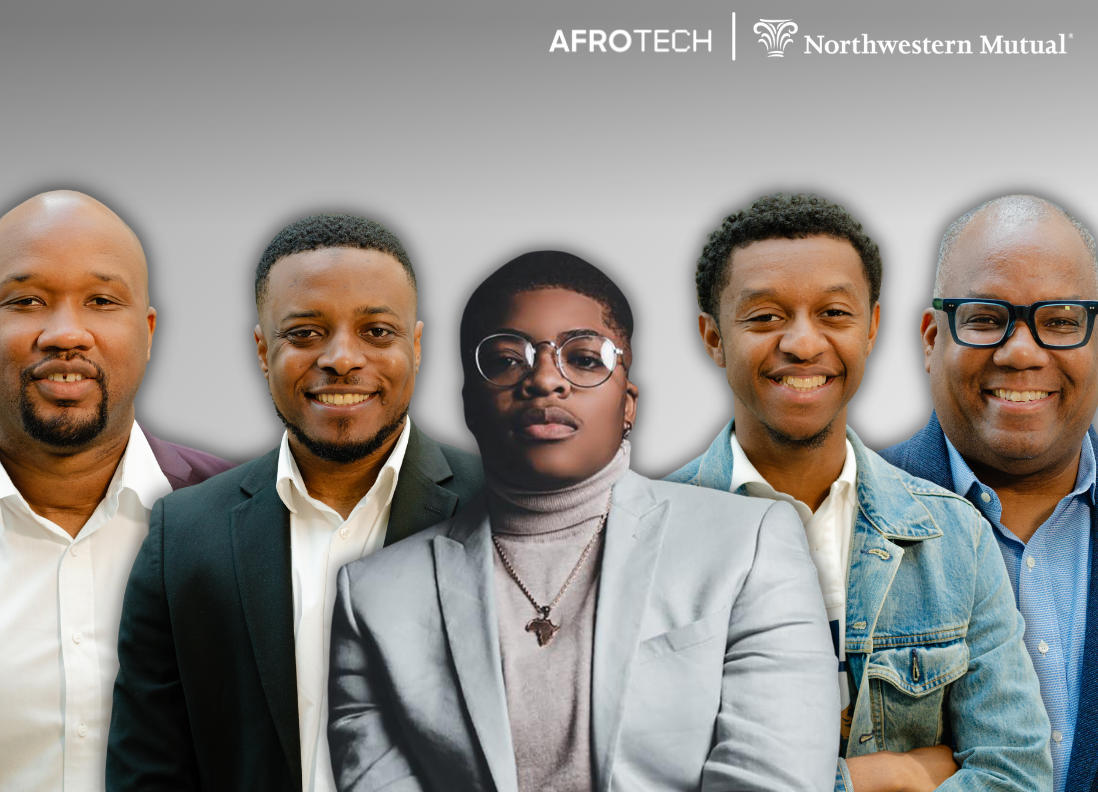

The current cohort members in the acceleration program reflect Northwestern Mutual Future Ventures’ critical strategic focus areas, including fintech, insurtech, digital health and data analytics. The latest cohort, which was just announced, includes:

Kingsley Ezeani: Co-founder and CEO | cashex.app

CashEx (Boston) takes away the financial stress of immigrants during their migration journey by guiding them through building credit and establishing a U.S. bank account.

Kahlil Byrd: Founder and CEO | shur.co

Shur (New York) promotes economic freedom and generational wealth by helping student loan borrowers eliminate early mistakes, build financial plans, and adopt an understanding of credit. Shur also provides student loan repayment interruption insurance.

Matthew Parker: Founder and CEO | moderntax.io

ModernTax (San Francisco) simplifies underwriting by providing companies with on-demand tax and financial information on their customers for a better understanding of a company’s financial health.

Ashton Keys: Founder and CEO | athlytic.io

Athlytic (Detroit) bridges the gap between brands and student-athletes by providing a seamless connection for name, image, and likeness campaigns through data-driven insights and expert recommendations to pair brands with the perfect athletes for ROI-driven endorsement campaigns.

Jannae Gammage: Founder and CEO | tryforesight.io

Foresignt (Kansas City, Mo.) leverages natural language processing and machine learning algorithms to assess credit risk, fraud, and bias. This allows traditional banking services to safely open doors for underserved consumers and drive impact at scale.

Northwestern Mutual’s work to narrow the racial wealth gap doesn’t stop here. On October 26, 2023, the company is hosting Gather Against the Gap, a one-day event in partnership with Northwestern University Kellogg School of Management to bring together business leaders, academics and experts in the field to have a conversation on how to best standup programs, initiatives and funding to reduce the racial wealth gap and sustain action for racial equity.

Click here to learn more about Northwestern Mutual’s commitment to advancing equity and inclusion.