Auntie. Unc. These nicknames came out of nowhere, and they’re not coming from your actual nephews and nieces. Birthdays are flying by, but you still feel the same age as prior years. Weird times.

You may already know that starting a retirement plan early on means you’ll be ahead of the game, but it just seems like retirement is so far away. According to recent data from the Federal Reserve’s 2022 Survey of Consumer Finances, 45.6% of families are not investing for retirement. Whether you’re in the 54.4% who do have a retirement plan or not, the birthdays are going to continue regardless.

Or, maybe you’re one of the few who decided to start trying to figure out the retirement savings “magic number” to strive for while Gen Z and Gen A have already assumed you get senior discount breakfasts and an AARP magazine subscription.

Can You Survive On Social Security Benefits While Working?

Instead of worrying about gray hair on your head (or other places) and wrinkles, it’s time to actually understand that “magic number” so you can comfortably retire, especially with Social Security reportedly doing a nosedive by 2037. The Social Security Administration (SSA) currently provides benefits to more than 50 million seniors and those with disabilities via payroll taxes from over 150 million workers and their employers. After the reserves are exhausted a decade from now, continuing taxes are expected to pay 76% of scheduled benefits instead of 100%.

According to the SSA, financial planners are generally in agreement that retirees will need about 70%-80% of preretirement earnings to be financially comfortable. So would it be easier to try to qualify for Social Security now while you’re still working? Not really.

If you are under full retirement age for the entire year, the Social Security Administration deducts $1 from your benefit payments for every $2 you earn above the annual limit ($22,320 this year). But once you reach full retirement age, they take only $1 from your benefits for every $3 you earn ($59,520 this year) until the official month you’re at full retirement age. For example, if your birthdate is in November, you may see the $1-for-$2 earnings deduction from January to October. By November, your earnings are no longer reduced, no matter how much you earn.

However, anyone who has earned an income of $168,600 or more does not contribute to Social Security, as of March of this year. Interestingly, higher-income earners can still collect Social Security for all those years that they were not wealthy though. So if you’re one of those six-digit earners or millionaires by retirement age, you can still collect Social Security.

For The Non-Millionaires, What’s The Retirement Savings “Magic Number” To Strive To?

According to Fidelity, working adults should aim to save at least one time their salary by the age of 30, three times by the age of 40, six times by the age of 50, eight times by the age of 60, and 10x by age 67 and up.

For example, let’s say you have earned $40K in your 30s. You should have an extra $40K in your savings account (or an assortment of investments, including savings bonds, stocks and CDs).

- In your 40s, if you earned that same annual income, you should have saved $120K.

- In your 50s, if you earned that same annual income, you should have saved $240K.

- In your 60s, if you earned that same annual income, you should have saved $320K.

- At age 67 and onward, you should have earned $400K.

If these amounts seem completely out of your reach at your current age, try planning on a day-to-day basis with a retirement calculator.

Calculate all the following:

- Your current age

- Your pre-tax income

- Your current amount already set aside for retirement

- Your immediate future monthly contribution toward retirement

- Your monthly budget in retirement (Take some time with this one to calculate things you can slow down buying, such as public transportation costs for a 9-to-5 job versus your mortgage payments if your home isn’t paid off.)

- Any additional retirement income coming your way (ex. a trust set aside by your grandparent, rent if you’re a long-term landlord, affiliate marketing or stock marketing earnings)

Knowing where your current financial health is will help you learn what you need to do in order to get to your ideal retirement savings, even if Social Security is not an option (or lowers to the guesstimated 76%).

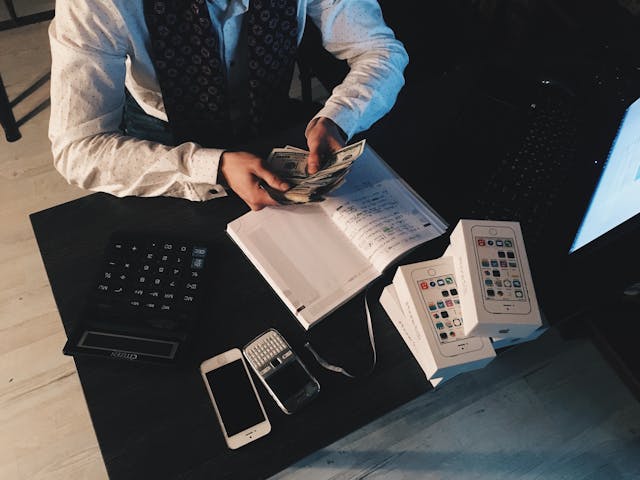

While you’re brainstorming on retirement savings, this is also a good time to look at successful startups, profitable ways to earn money in your specialty area. You may want to explore other ways to make residual income so you don’t feel like you can never retire. Maybe your current job cannot realistically get you to the retirement amount you need. But having a handle on the retirement savings “magic number” to strive for is a clear way to make adjustments where needed.

If you need to get a financial planner involved or start setting a stricter budget, that may help too. Do whatever works best for you while still being able to afford your day-to-day life at your “auntie/unc” stage too.