People are often surprised that a degree in finance is not a requirement for working at a financial services company. Instead, there is room for many different skill sets, and the industry has the capacity to welcome Black professionals from unique backgrounds.

A lack of diversity in the workplace continues to be an issue as diverse talent pools can be challenging to identify. However, some companies are looking to change the demographics of the financial services industry, including Fidelity Investments, which is committed to evolving its recruiting practices, enhancing the onboarding of diverse talent and providing development programs for underrepresented communities to help advance its diversity and inclusion efforts.

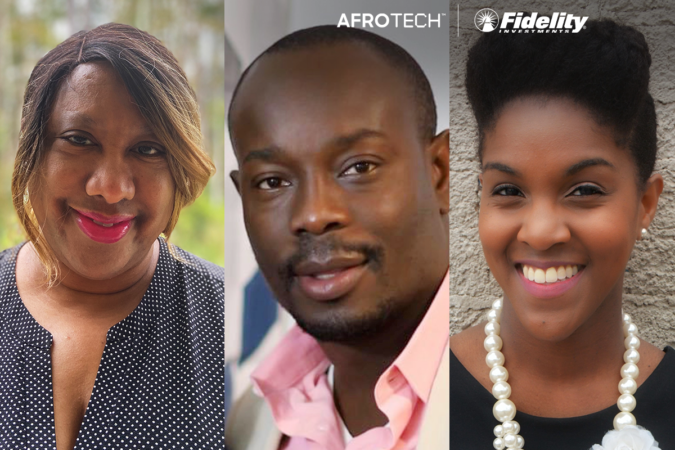

Today we’re sharing advice from three Black employees at Fidelity on how to create dynamic career paths as Black professionals in financial services.

Introducing:

Cherie, Senior Service Manager, Jacksonville, FL

Paulson, Financial Consultant, Nashua, NH

Sharnese, Senior Manager of Government Relations & Public Affairs, Jacksonville, FL

Together, they’ve curated a list of tips for those curious about working in financial services.

10 Things to Keep in Mind to Develop a Career in Financial Services

1. Call upon your life experiences. Do not lose sight of the value that your life experiences (good/bad/indifferent) can bring to your job. Your experiences may mirror those of the customers you are supporting, which can translate into empathy and solutions. Do not underestimate the value of what you have had to persevere; because in that, there is opportunity for you to bring value to both the company and its customers.

2. Build relationships with people who are not like you. While it is beneficial to find a sense of belonging through a community of others who look like you or share a similar background, it is equally important to build relationships with people who are not like you. You will grow and benefit from appreciating the differences of others. Find opportunities to mentor and reverse mentor, join employee resource groups, volunteer, and network across the company.

3. Be a trailblazer. Do not let a lack of diversity prevent you from getting your job done and knowing you have a seat at the table. Cherie offers, “Be a trailblazer who can open doors for others. While you may be the only Black person in a meeting, be confident that you have the skills to contribute to your team’s mission.”

4. Find a mentor or internship in financial services. If you are a student or grad student, an internship is a great way to learn more about the financial services industry. If you are unable to obtain an internship, finding a mentor or a community of finance professionals can help you understand the industry and the skills you will need to succeed.

5. Seek out financial services firms that commit to hearing diverse perspectives. Financial firms come in all shapes and sizes, and it’s important to know the background and culture of an organization that you are considering working for. There is no perfect company, but there are companies that have demonstrated a commitment to the recruitment and advancement of people of color. Seek out those organizations and, when possible, interview current employees to get their perspective.

6. Don’t rule out a career in financial services, even if you don’t have a background in finance. Fidelity hires individuals from a wide range of backgrounds, including those with liberal arts and technology backgrounds. Feel confident that you can come into the industry and add tremendous value with a non-finance background. Sharnese, Senior Manager of Government Relations and Public Affairs, is a great example as she has a B.A. in English and a M.A. in Sociology. “There are so many roles to explore in the industry that welcomes all kinds of experiences and backgrounds.”

7. If you’re looking to work in finance, understand licensing requirements. Most roles in finance require some form of licensing, but those outside of the industry often may not know where to start. Some firms, including Fidelity, are starting to create voucher programs that allow potential candidates to study for required licenses prior to interviewing with their firm. Those interested should ensure that the firm they are going to work for has a robust program in place to support candidates through the licensing journey.

8. Be curious, teachable, and tenacious. Always be open to learning, as it can lead to other opportunities. Paulson started working at Fidelity five years ago and has already served in multiple roles across the company, including client services and marketing. Sharnese offers, “Work hard, connect with people, and be willing to learn. When you do that, you’ll succeed.”

9. Find a way to incorporate your passion and seek out communities of support. The more you can bring in your passions, the more you will be excited about your career. Cherie shares, “I’ve always leaned into supporting diverse ways of thinking and am proud to have been the founder of my region’s Aspire Chapter which is an Employee Resource Group (ERG) at Fidelity that supports Black and Latinx employees.” Paulson agrees, “Job satisfaction comes with doing what you love.”

10. Focus on a healthy life-work balance. Give both life and work the attention that it deserves. Paulson reflects, “It is important, especially now during the pandemic, to find a balance between life and work and protect your mental health to avoid burnout. This way you are able to bring your best self to work.”

——

As you can see, many roads run through financial services, which is all the more reason why different experiences and backgrounds are needed in the industry. Whether you have a finance degree or not, there’s a role to play for anyone looking to launch a career in financial services.

What is most important is to stay hungry and to be teachable and open to learning. Or as Sharnese explains, “Don’t be intimidated. I think that some people perceive the financial services industry as an unattainable path. But the reality is, getting into the industry can be a very realistic goal and can provide great opportunities for learning and growth, regardless of what phase your career is in.”

Learn more about open roles at Fidelity here.