On average, Black workers are already earning $12,000 less than the median wage in the U.S., and there are so many other barriers in their way in regards to diversity, opportunity and stability in the workplace.

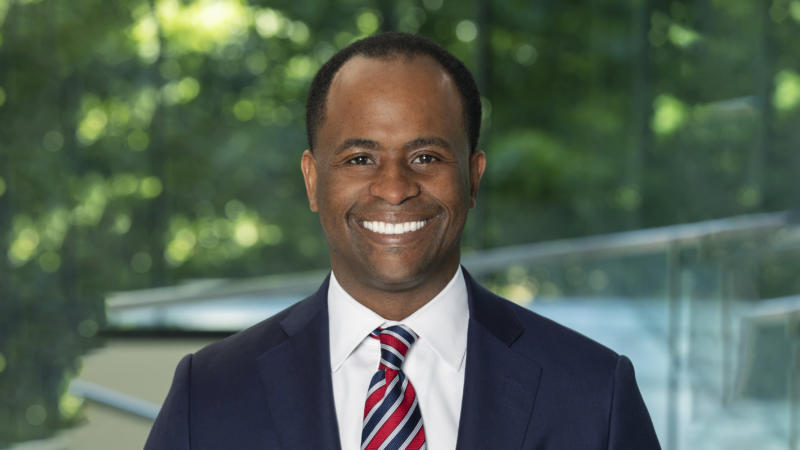

Jesse Walton, SVP of the Walton Group and a certified private wealth advisor at Morgan Stanley, has been fighting institutional inequities for over two decades. Walton is extremely passionate about helping position his clients to create generational wealth and those building blocks start with financial literacy, long-term investing and saving, he says.

“The biggest opportunity this country gives you is freedom and the fact that you can participate in the corporate structure,” Walton told AfroTech. “You can grow your wealth if you save and participate in the growth of this economy and you do that through stock ownership.”

Here’s more of Walton’s thoughts on the racial wealth gap, how the Black community can close it, and more.

Editorial Note: This piece has been edited for clarity and length.

AfroTech: Why do you think there’s this big wealth gap for the Black community?

Jesse Walton: That goes back to a time that can pre-date all of us, but it really revolves around the lack of access to capital, high-paying jobs, opportunities and education. From a financial education standpoint, oftentimes, we are also less likely to participate in buying stocks. We’ve kept out money in cash and have been a little naive about investing in the stock market. As the economy in the U.S. continues to grow, the wealth gap is getting wider because we’re not participating in investing.

AT: Black households make up less than two percent of the top one percent of the nation’s wealth distribution. What can big corporations do to better support Black professionals striving to build wealth?

JW: Companies can really participate by providing more financial education and setting up their benefit structures to ensure that employees are keeping pace with where they need to be financially before retirement, especially since most companies have dropped their pension plans. This is a tough one because you won’t know every individuals’ home situations, how much they can save and what their goals are. You can guide people and set up the structure of things, but it’s really up to the employees to stick to it and find out what they need to do to put themselves in the best position to grow their wealth, keep pace with society as it’s growing, and beat inflation.

AT: Studies show that diversity matters in the workplace. Why do employees, especially Black employees, perform better when they are a part of a diverse team?

JW: Anytime you have a diverse board or have diversity in leadership at the C-suite level, that tends to drive higher performance as a whole. I think it just comes from diversity of thought and perspective. This trickles down and creates a more comfortable working environment for employees, which leads to consistency and more long-term, better performance.

AT: In your opinion, what does Black wealth look like? What should the Black community be doing to attain this wealth?

JW: You can really start with financial literacy and education to understand what your goals and objectives are, and be able to partner with somebody in order to guide them and cover all the things that they need to cover. Unfortunately, there are some things that we don’t know much about like life insurance, the importance of having emergency cash, understanding stocks, building portfolios, and how aggressive or moderate you should be with spending.

We tend to think a little bit more short term and sometimes want to focus on bitcoin and cryptocurrency, or things that are more trading-focused instead of looking at a bigger picture down the road, like setting up a family.

These are all things that can be addressed with a financial advisor to make sure that your money is working as hard as the person is.

AT: How does your work at the Walton Group correlate with decreasing the wealth gap for the Black community?

JW: Since I’ve been able to grow my practice over the last 20 years, I’ve been focused on providing impact. We’re helping to build wealth for the Baby Boomer generation, Gen X and Millennials. I’m also having a lot of conversations around financial education for these generations to better position their kids, so there is not that financial education gap that exists today.

I’m making sure that I’m talking to and providing financial information to people who are not clients so as many people as possible have the right foundations to build on. I’m doing this work in the community as well. I do public speaking quite a bit so people understand why there is a wealth gap to eliminate it. It’s not going away on its own and the government isn’t changing the rules to play in our favor.