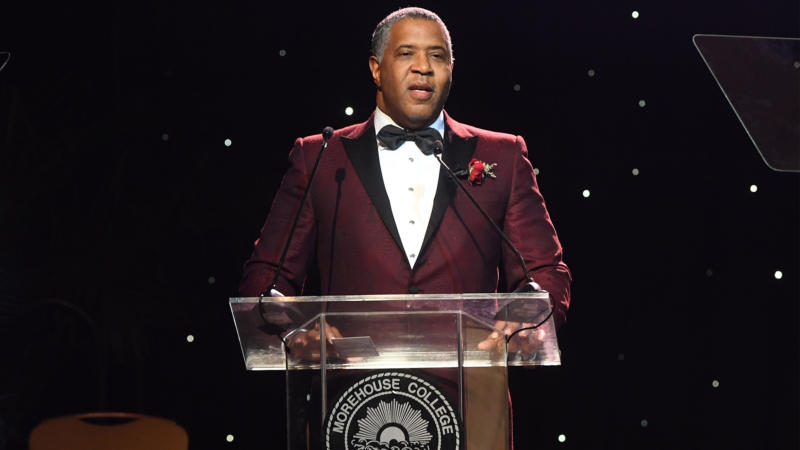

Robert F. Smith’s global investment firm continues to reach new heights.

Back in December 2021, Vista Equity Partners had around $93 billion in assets under management, according to a press release. Now, less than two years later, the firm has hit over $100 billion.

On Aug. 8, Smith shared the announcement on LinkedIn to not only celebrate the milestone but also give thanks to those who have been a part of the nearly 23-year journey. Since launching, the company has built an extensive portfolio and invested in the likes of STATS, Ping Identity, Jio, and more, as previously shared by AfroTech.

“Since Vista was founded over two decades ago, we’ve expanded to 650+ team members operating around the world, built a comprehensive library of enterprise software best practices and much more,” Smith wrote in the LinkedIn post. “We’ve also been committed to supporting the communities in which we live and work, creating opportunities for individuals who have traditionally been underrepresented.”

He continued, “As we look to the future, the values Vista has honed over the years will remain its North Star: a commitment to continuous improvement, a culture of inclusion and an unwavering belief that every role is critical for our collective success. Cheers to many more years and to all who made this possible.”

The celebration follows one of Vista Equity Partners’ lucrative moves.

As previously reported by AfroTech, the firm sold Apptio, a Seattle, WA-based software company, to IBM for $4.6 billion. The sale doubled Vista Equity Partners’ revenue after acquiring Apptio back in 2019 — marking a return of 142% on the $1.9 billion investment. Additionally, it was reported that IBM shared “it will use cash on hand to fund the deal, which it expects to complete in the second half of 2023.”