blavity

Want to read more?

Articles

Feeling cute? Using that exact caption for your Instagram photo because you can’t come up with anything else? Well, two HBCU grads have the answer for such a cyber woe with the Caption Any Photo app. The app came to fruition after co-founder JaBre’ Jennings eventually came up with the idea for a class project and created a mock-up of the app. After the app was completed, he and his business partner Juwon Nicholson toured the country with it. “We went up and down the East Coast with it,” Jennings told Technical.ly. Both men attended the University of Maryland Eastern Shore and have certainly made their alma mater proud. UMES alumni JaBre’ Jennings & Juwan Nicholson have teamed up to create their app “Caption Any Photo”. The mobile app is designed to help users find the best photo captions for social media post. Try it for yourself! Download here: https://t.co/wrzPIHH18c #UMES #HawkPride pic.twitter.com/02eigXxnFB — UMES (@UMESNews) July 16, 2018 Caption Any Photo makes it easy to...

May 23, 2019

Rapper Nipsey Hussle’s death profiled his charitable efforts and business endeavors as key elements to the late musician’s legacy. An emotional Instagram post from longtime friend and business associate David Gross revealed Hussle planned to expand his businesses past South Los Angeles and open a resort and casino in Las Vegas in 2020. Gross penned the tribute to his late friend Tuesday, and several photos of the two accompanied the caption that detailed their intentions to open The Virgin Las Vegas. “We always planned to tell the story behind these pictures but didn’t get the chance to because we were busy executing on the next idea, and each successive opportunity got bigger and bigger,” a portion of Gross’ remarks read. View this post on Instagram A post shared by David Gross (@david.a.gross) Per his statement, Gross and Nip were slated to become partial owners of the hotel, which The Star Advisor writes is scheduled to open in November 2020. “This is the meeting a couple months...

Apr 17, 2019

Detroit high school senior Michael Love is trying to pick a college and has a bevy of choices. Love applied to about 50 colleges and received acceptance letters from 41 institutions, reports WXYZ. As the acceptances rolled in, so did scholarship offers: the Cornerstone Health and Technology student has amassed more than $300,000 in scholarship money. Love’s mom, Micole Ewing, was initially wary of her son applying to so many schools. “I thought he was crazy when he told me he was applying to so many schools,” said Ewing. She changed her outlook as her son kept receiving good news, however. “Every time I open up a letter I jumped up and down, we praised God and everything. I’m super proud of him,” she said. Love struggled at the beginning of high school but was determined to succeed despite discouraging comments from naysayers. “I got told a lot when I was younger I couldn’t do this, I couldn’t do that,” Love said. “So I just wanted to show people I’m better than what they think I...

Mar 15, 2019

Alfred E. Nickson went from growing up on welfare in the rough inner cities of Miami to becoming one of the youngest millionaires in network marketing in the United States. Determined to make a better life for himself and his family, Nickson began his entrepreneurial journey in network marketing at the young age of 19. Within three short years, he became a six figure earner and one of the top sales professionals in his company before building his own brand of nearly 100,000 followers. He specializes in a range of financial services including, but not limited to, credit restoration, credit monitoring, wills and trusts, credit litigation and financial planning. He has proudly helped thousands of people restore their credit, while helping them build financial wealth. In addition to that, Alfred has found tremendous success working as a seven-figure success coach for the last six years, coaching people through workshops and seminars on how to make the most out of their current financial...

Mar 6, 2019

Giphy has released a collection of GIFs designed by some of the internet’s most creative Black artists . Artists like Tenbeete Solomon, Aurélia Durand, Edinah Chewe and others are contributing to Giphy’s ongoing dedication to diversity. Their work will be in a partnership with women’s lifestyle Refinery29’s Unbothered’s Instagram, where they will create GIFs that depict Black life and culture. “Giphy allows me to create work I truly believe in, especially covering themes like celebrating people of color and empowering women,” Solomon told Refinery29. This new initiative aims at inspiring other companies to hire Black creatives to produce diverse images. Durand told the fashion and lifestyle site she struggled with being proud of her “Afro heritage,” but she used art to help her break that feeling and empower herself. “Art has helped me to embrace myself and connect with others; I feel empowered when I see that people can relate and see a part of themselves in my visuals,” she said....

Mar 5, 2019

Massachusetts Institute of Technology (MIT) graduates Shawna Davis and Tiffany Mickel have put a twist on traditional playing cards by printing pictures of history-making black women on their faces. Say goodbye to your typical two through 10, jack, queen, king and ace. Instead, players can find the faces of Michelle Obama, Rosa Parks, Harriet Tubman, Madam C. J. Walker, Nina Simone and more. “Cards are a staple in Black households, but we don’t have our own kings and queens on our decks,” Davis said of the duo’s inspiration. “We wanted to create a movement that empowers the African American community of the greatness, [through learning] our past culture and history, and helping players realize the endless possibilities and potential of just being born into the Black culture.” Each woman on the Heiritage playing cards has a story that coincides with their card’s corresponding number. Bessie Coleman, for example, is displayed on the eighth card, which pays homage to the eight-meter...

Mar 4, 2019

NASA announced plans to rename a facility after legendary mathematician Katherine Johnson paying tribute to her lasting impact on space exploration. In a February 22 ceremony, Johnson, a West Virginia native, was presented with a building on the NASA complex in honor of her illustrious career. The Katherine Johnson Independent Verification and Validation (IV&V) Facility will serve as a building dedicated to safety programs. ABC News reports the facility houses NASA’s highest-profile missions “by assuring that mission software performs correctly.” For 30 years, Johnson’s calculations were used for some of the most fundamental missions in the early days of NASA. She calculated the trajectories for Alan Shepard’s Freedom 7 mission in 1961, John Glenn’s Friendship 7 mission in 1962 and multiple Apollo missions before the use of computers. She was deemed a “human computer” whose story became subject of the 2016 film Hidden Figures. NASA Administrator Jim Bridenstine showered her with...

Feb 26, 2019

In 1965, Dr. Martin Luther King, Jr. joined the community of Selma, AL to lead the Selma-to-Montgomery March that would change voting rights history forever. His Nobel Lecture the year before suggests why King, if alive today, might address innovation inequality as the civil rights issue of our era. “In spite of spectacular strides in science and technology, and still unlimited ones to come, something basic is missing. There is a sort of poverty of the spirit which stands in glaring contrast to our scientific and technological abundance. The richer we have become materially, the poorer we have become morally and spiritually.” – Dr. Martin Luther King, Jr., Nobel Lecture, 1964 There is perhaps no greater example of this wealth and moral gap than Silicon Valley, where at the same time it radiates as a global symbol of technological advancement and wealth creation, it is the center of moral criticisms and a deficit of values. Within Silicon Valley tech companies, unfair treatment is...

Jan 22, 2019

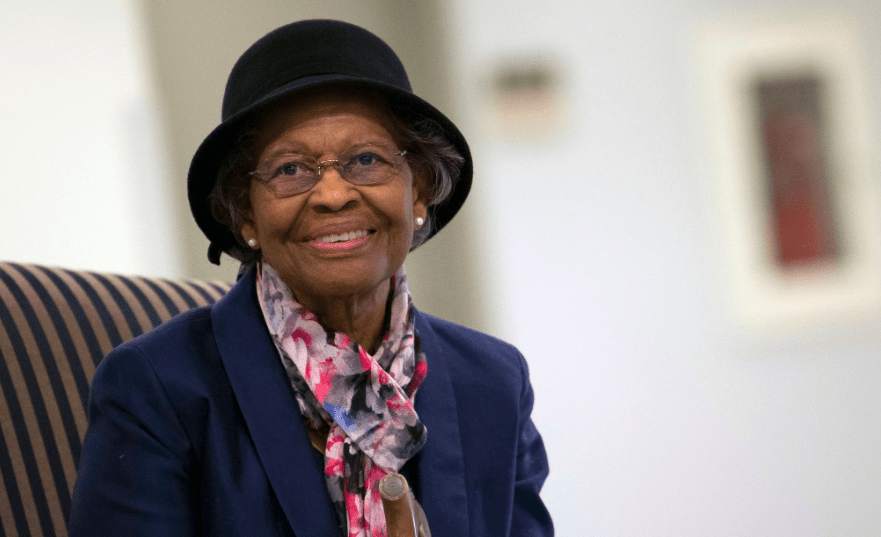

A “hidden figure” in the development of GPS technology has officially been honored for her work. Mathematician Dr. Gladys West was recognized for doing the computing responsible for creating the Geographical Positioning System, more commonly referred to as the GPS. On December 6, the 87-year-old woman was inducted into the Air Force Space and Missile Pioneers Hall of Fame by the United States Air Force during a ceremony at the Pentagon. The Alpha Kappa Alpha Sorority member, born in Dinwiddie County, Virginia, earned a full scholarship to Virginia State University after graduating high school at the top of her class. Gwen James, her sorority sister, told The Associated Press she discovered her longtime friend’s achievements when she was compiling a bio for senior members of the group. “GPS has changed the lives of everyone forever,” James said. “There is not a segment of this global society — military, auto industry, cell phone industry, social media, parents, NASA, etc. — that does...

Dec 19, 2018

There's something magical and bizarre happening in the development of the African Diaspora. I don't think a lot of people see, nor understand, that the Caribbean, Latin America and Africa are becoming the epicenters of a new revolution in technology that’s quickly and dramatically changing the status quo of inequality and under-representation. My wife and I had the pleasure and honor to attend and participate in Tech Beach Retreat 2018 in Montego Bay, Jamaica. Tech Beach was founded by Kyle Maloney and Kirk-Anthony Hamilton, two entrepreneurs with a vision to connect and empower Caribbean entrepreneurs, engineers and executives across a range of backgrounds to explore and create solutions to improve country and citizen. The caliber of the attendees and participants has attracted the attention of major tech companies like Twitter, LinkedIn, Google, Instagram and a number of VCs and financial service firms and government conglomerates. Kirk-Anthony comments, “Tech Beach is modeled on...

Dec 11, 2018

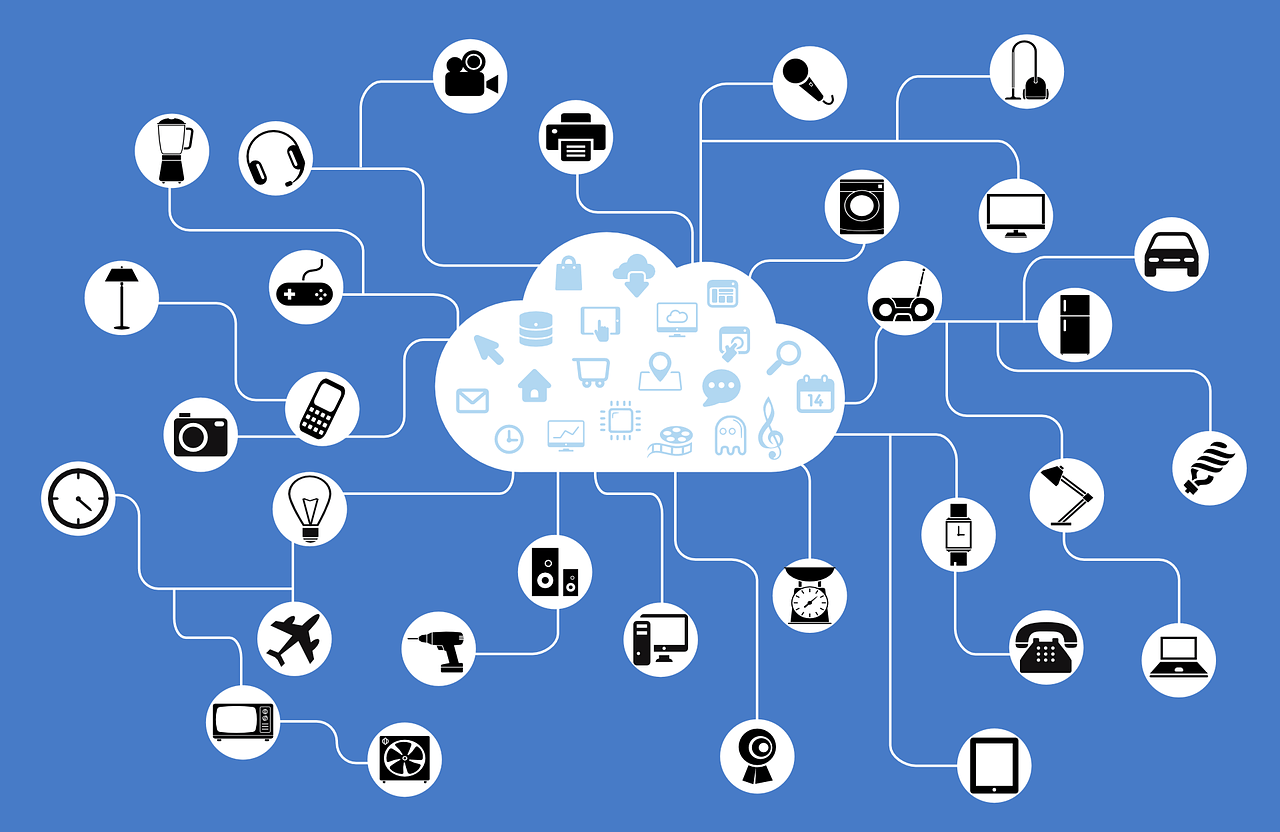

For many of us, the internet plays a central role in our lives. From shopping for food and clothing, to entertaining ourselves and even ordering a taxi, it's hard to imagine life without the internet. As technology continues to develop, this dependency is likely to grow, with the internet expanding beyond the web, and into everyday objects, as well. This is the "Internet of Things" (IoT), using networks to link objects so they can send and receive data. This technological development, alongside AI, is designed to increase automation, producing greater efficiency and convenience for us in our working and personal lives. This technology is predicted to have a huge impact, but what does this mean economically? Does automation mean fewer jobs? Simply put, on paper, automation leads to job losses. Already, machines have replaced human labor in manufacturing industries, and the development of AI means that numerous jobs will be performed by machines in the future , with one study...

Dec 4, 2018

This story originally appeared on Shadow and Act , a property of Blavity Inc. Playwright Marcus Gardley’s award-winning historical play The House That Will Not Stand is on its way to becoming a film. MWM Studios is the company behind the adaptation of the play to film, according to Deadline, and Gardley, who has also written for shows like Showtime’s hit The Chi , will write the script. The plot is something that hasn’t been explored a lot in Hollywood — free Black women living in 1800s New Orleans. As the article states, The House That Will Not Stand , a historical dramedy, is vaguely inspired by The House of Bernarda Alba by Carcia Lorca and is set in Faubourg Treme in 1813. The main characters are free Black Creole women who fought against racism and became millionaires through plaçage, or the practice of common-law marriages between white men and Black women, biracial women of color, or Native American women). The play, which premiered at the New York Theatre Workshop this year...

Dec 4, 2018

November 29 is the final National Day of Action in the fight to restore Obama-era net neutrality rules. To mark the day, we've put together everything you need to know about the issue. What Is Net Neutrality? As of right now, internet users across the United States can all visit the same websites and use the same digital services at the same speed (as long as the proper physical infrastructure is in place). Internet service providers like AT&T and Verizon can't make you pay more for access to certain websites and can't throttle your internet speed as they see fit. This is Obama-era net neutrality: these gatekeepers must be neutral parties, allowing users to fairly access the whole of the (legal) internet. What's With The National Day Of Action? The Trump administration opposes the Obama-era rules, and wants to end government oversight of internet service providers. As USA Today reports , the FCC, which sets policy for service providers, repealed rules against throttling and...

Dec 1, 2018

Rage and tears followed the murder of Nia Wilson, an 18-year old Black woman from Oakland, who was killed while exiting a Bay Area Rapid Transit (BART) train one Sunday evening in July. These were appropriate reactions in the wake of such a tragedy, especially from community members incensed by the seemingly relentless targeted killing of Black people across the nation by police and racist vigilantes. But there were inappropriate responses as well. Among the worst of these came from BART authorities that responded with a proposal for widely expanding transit surveillance. One BART policymaker went as far as to call for the widespread use of facial recognition technology. Let’s be clear: expanded surveillance and facial recognition technology are not the solution. Would these technologies have prevented Nia Wilson’s murder? No. Instead of preventing race-based hate crimes, expanded surveillance will just put more people of color at risk, adding insult to injury, salt to an open...

Nov 28, 2018

A group of internet trolls are threatening to report sex workers to the IRS. It all began on Sunday when the hashtag #ThotAudit began to circulate on Twitter thanks to blogger Daryush Valizadeh, according to Newsweek. Valizadeh claimed the movement was started by a Facebook user known as David Wu. The #ThotAudit movement calls on men to report women who make money from social media accounts used to send sexual videos and pictures to the IRS, arguing that the women are dodging taxes. The man who started #ThotAudit is named David Wu. He has cemented his place in Valhalla. Godspeed to you, young man. https://t.co/BUNhdsESyh — Roosh (@rooshv) November 25, 2018 If you report a thot to the IRS and they collect taxes from her, you can receive up to 30% of that amount. There is actually a financial incentive to defeating thottery. pic.twitter.com/3BxAldTpFC — Roosh (@rooshv) November 24, 2018 The hashtag caught on with right-wing trolls, misogynists and incels, or involuntarily celibate...

Nov 27, 2018