Showing 11 results for:

Harlem capital

Popular topics

All results

The winner for the Invesco QQQ Legacy Classic Startup Pitch Competition has been announced.

Feb 4, 2023

Created to support the startup economy, Pariti will continue its efforts with the help of recent funding totaling $2.85 million. The seed round was led by diversity-focused fund Harlem Capital, which secured $134 million earlier this year. Better Ventures, Accelerated Ventures, Diverse Angels, AVG Basecamp, and New General Market Partners participated in the round. “We’re thrilled to be working with Harlem Capital,” said co-founder and CEO Yacob Berhane of Harlem’s participation, according to TechCrunch. “Their focus on data, process and supporting underserved ecosystems aligns perfectly with our mission and makes them an amazing partner for us to build with.”

Dec 6, 2021

Harlem Capital, a diversity -focused venture capital firm, led a $3.7 million seed round for Singuli, according a press release provided to AfroTech. Founded in 2019 by Benjamin Kelly and Thierry Bertin-Mahieux, Singuli created an AI-powered platform that allows retailers to use consumer behavior to better inform inventory decisions. This seed round is the first major funding deal the company has closed, which includes participation from High Alpha Capital, AVG Basecamp Fund, existing investors Interlace Ventures and LAUNCH, as well as angel investors Paul Goodman and Darwish Gani. The fresh funding also includes a previously unannounced $700,000 pre-seed round. “Our mission is to provide commerce brands of all sizes with state of the art tools to make optimal inventory decisions,” Singuli co-founder and CEO Benjamin Kelly told AfroTech. “This is a gnarly space and there are lots of tricky problems.” Kelly was inspired to launch Singuli with Bertin-Mahieux after working as a data...

Jul 28, 2021

Diversity-focused venture capital firm, Harlem Capital has just announced the close of its Harlem Capital Partners Venture Fund II Limited Partners (LP) — also known as Fund II — at $134 million. According to a press release reviewed by AfroTech, the new fund exceeded its original target of $100 million and went above its initial cap of $125 million as it aims to continue its mission of changing the face of entrepreneurship with diverse founders. It is also said to be the largest diversity-focused VC fund to date. Harlem Capital shares that while Fund II will maintain the firm’s focus on minority and women founders, it will also seek out early-stage investments in companies in the enterprise and consumer technology fields. “We are focused on building an institution and platform to support diverse founders for many generations. Fund II is one step closer to our mission, but we know the work and journey continues,” Harlem Capital Managing Partner Henri Pierre-Jacques shared in a...

Mar 31, 2021

The social unrest that occurred back in June inspired a lot of major corporations to step up with multi-million dollar initiatives aimed at bridging the gap between racial inequality and justice in America. Of those companies, Apple launched their own $100 million Racial Equity and Justice Initiative to help to disrupt systemic barriers for opportunity and fight against injustices faced by communities of color. The unfinished work of racial justice and equality call us all to account. Things must change, and Apple's committed to being a force for that change. Today, I'm proud to announce Apple’s Racial Equity and Justice Initiative, with a $100 million commitment. pic.twitter.com/AoYafq2xlp — Tim Cook (@tim_cook) June 11, 2020 As part of this financial pledge, Apple announced a rollout of a new set of projects designed to support the Propel Center’s learning hub for HBCUs, an Apple Developer Academy for coding and tech education for Detroit students, and venture capital funding for...

Jan 19, 2021

Back in June, PayPal made a $530 million commitment to Black and minority-owned businesses to fight racial injustice. Now, as a part of that promise, the financial giant is paying up. In a press release , Paypal announced an investment of $50 million in eight early-stage Black and Latinx-led venture capital funds: Chingona Ventures; Fearless Fund; Harlem Capital; Precursor Ventures; Slauson & Co.; VamosVentures; Zeal Capital Partners; and one additional fund. The money will be funneled to each company through PayPal venture capital arm, PayPal Ventures, which invests in startups from series A to late-stage funding. “Black and Latinx founders have been underrepresented in venture capital funding for far too long,” said president and CEO of PayPal, Dan Schulman. In addition to providing capital to minority-led VCs, PayPal Ventures is offering a three-month fellowship to a Black or Latinx graduate student each semester. In the program, the student will be mentored about business....

Oct 28, 2020

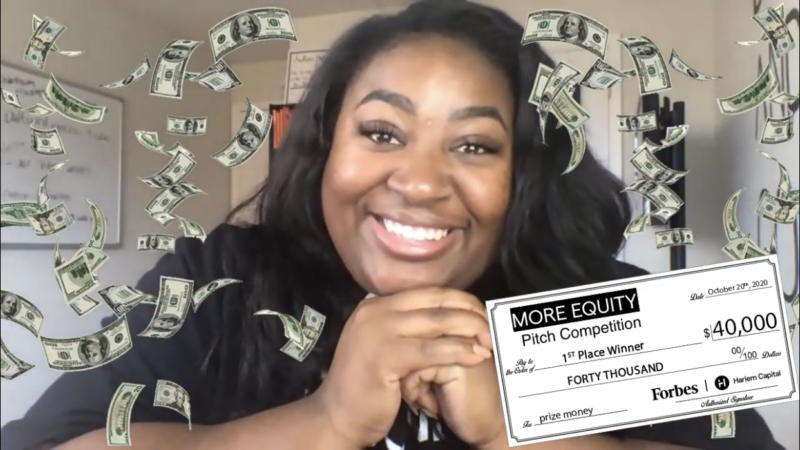

Harlem Capital — the New York-based early-stage venture capital firm — is on a mission to nurture the growing field of entrepreneurship by offering plentiful business opportunities to BIPOC and women founders. In an effort to continue their strong commitment to diverse businessmen and women in the U.S., they partnered with Forbes this year to host their first-ever MORE EQUITY Pitch Competition . View this post on Instagram A post shared by Harlem Capital (@harlemcapital) Along with the support of TPG, Grasshopper Bank, M12, Lerer Hippeau, RSM, and Techstars, Harlem Capital brought together notable investors and celebrities to help celebrate the slew of recognized founders from emerging startups at this year’s competition. To further invest in these founders’ business models, Harlem Capital nominated finalists to compete for $50,000 to have their company pitches considered by special guest judges Jewel Burks Solomon, Jenny Fielding, and Lolita Taub, with Founder Gym CEO Mandela SH...

Oct 20, 2020

Harlem Capital Partners is in search of some of the best companies led by women and diverse founders to participate in its inaugural pitch competition taking place on Wednesday, April 22, 2020. Harlem Capital is giving away $40,000 in grants to two winners. Participants will compete in two categories, Startups and Small Businesses, before pitching in front of a live audience and panel of judges. Harlem Capital Check out the eligibility criteria below. Startup Category – $30,000 grand prize At least one self-identified woman or underrepresented minority founder or co-founder Technology or technology-enabled startup Less than 3 years in operation Raised less than $400,000 in funding to date Previous accelerator experience is acceptable Preference is given to New York-based companies Small Business Category – $10,000 grand prize At least one self-identified woman or underrepresented minority founder or co-founder New York-based with priority given to Harlem-based businesses Less than 3...

Mar 3, 2020

John Henry has announced his departure from Harlem Capital after three years with the New York-based venture capital firm. Henry made the announcement yesterday via a Medium Op-Ed , and took to his Instagram to share his sentimental farewell. View this post on Instagram What an incredible journey it was to be part of @harlemcapital. Today, I announce my departure. Full medium post in bio. ? A post shared by John Henry (@johnhenrystyle) on Feb 16, 2020 at 5:36pm PST “I learned a great deal being part of this team. Made memories that will last a lifetime. Formed a special kind of bond that only partners of a like-mission will know. Put my own little touch in the firm’s DNA. And ultimately, served passionately until I contributed all I felt I was meant to,” Henry wrote in the Medium Op-Ed. Founders of Harlem Capital Henry joined Harlem Capital in 2017 working alongside managing partners, Henri Pierre-Jacques and Jarrid Tingle, as well as venture partner, Brandon Bryant . Harlem...

Feb 17, 2020

Harlem Capital, a venture fund that was established in 2015, has just celebrated a significant funding milestone. The firm, whose goal is to help minority and women entrepreneurs, has raised now over $40 million, far exceeding its initial funding goal of $25 million . Harvard Business School graduates Henri Pierre-Jacques and Jarrid Tingle founded the firm four years ago, aiming to “ change the face of entrepreneurship .” They saw a need to increase more seed funding for minority entrepreneurs in order to provide them with better traction in later-stage, more expansive funding rounds. Their ultimate goal is to invest in 1,000 founders over the next two decades . In a recent interview produced by Cheddar U , Pierre-Jacques and Brandon Bryant, venture partner, discussed Harlem Capital’s impact in addressing low percentages of female-founded venture capital investments. Pierre-Jacques indicated that while more minority women are obtaining funding, more change is needed. “ Until you can...

Dec 13, 2019

As more Black women enter the startup world, many are struggling to secure venture capital funding compared to their white male counterparts. In 2017, women received nearly 2.2 percent of the $85 billion available in venture capital funding. According to the ProjectDiane2018 report by digitalundivided, the numbers were even smaller for Black women. Black women represented .0006 percent of the $424.7 billion in total tech venture funding raised since 2009 and a majority of the funding was raised in 2017. The dismal rates at which Black women receive funding reflects a larger issue with diversity in the tech and venture capital spaces. The National Venture Capital Association (NVCA) and Deloitte released a report in 2016 that showed that Blacks accounted for 3 percent of the VC workforce and that women accounted for 45 percent. Black people only comprise 2 percent of senior positions at VC firms. “Research shows that diverse teams make better decisions and, with this baseline...

Feb 5, 2019